Good Evening,

It was inevitable that the market would have some meaningful consolidation after strong run like we’ve had. At this point, there’s no reason to think that today’s selling was anything more than consolidation. That said, any time that the market drops, no matter how routine it may seem, we must raise our level of vigilance to ensure that it doesn’t turn into anything more.

The day’s trading left us with the following results: Our TSP allotment gave up -0.4988% and AMP dropped -0.5577%. For comparison the Dow lost -0.47%, the Nasdaq -0.56%, the S&P -0.45%, AT&T -0.66%, Alaska Air Group +1.10% , Facebook -0.19% and Apple +0.21%.

Wall St. falls from records, led by technology stocks

| 03/02/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6626 | 16.9381 | 28.0395 | 38.0537 | 25.8795 |

| $ Change | 0.0013 | -0.0655 | 0.1722 | 0.2720 | -0.0922 |

| % Change day | +0.01% | -0.39% | +0.62% | +0.72% | -0.36% |

| % Change week | +0.01% | -0.39% | +0.62% | +0.72% | -0.36% |

| % Change month | +0.01% | -0.39% | +0.62% | +0.72% | -0.36% |

| % Change year | +0.32% | +0.81% | +3.22% | +4.84% | +6.86% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6544 | 23.4752 | 25.589 | 27.3248 | 15.5635 |

| $ Change | 0.0107 | 0.0367 | 0.0538 | 0.0696 | 0.0442 |

| % Change day | +0.06% | +0.16% | +0.21% | +0.26% | +0.28% |

| % Change week | +0.06% | +0.16% | +0.21% | +0.26% | +0.28% |

| % Change month | +0.06% | +0.16% | +0.21% | +0.26% | +0.28% |

| % Change year | +1.17% | +2.52% | +3.16% | +3.59% | +4.04% |

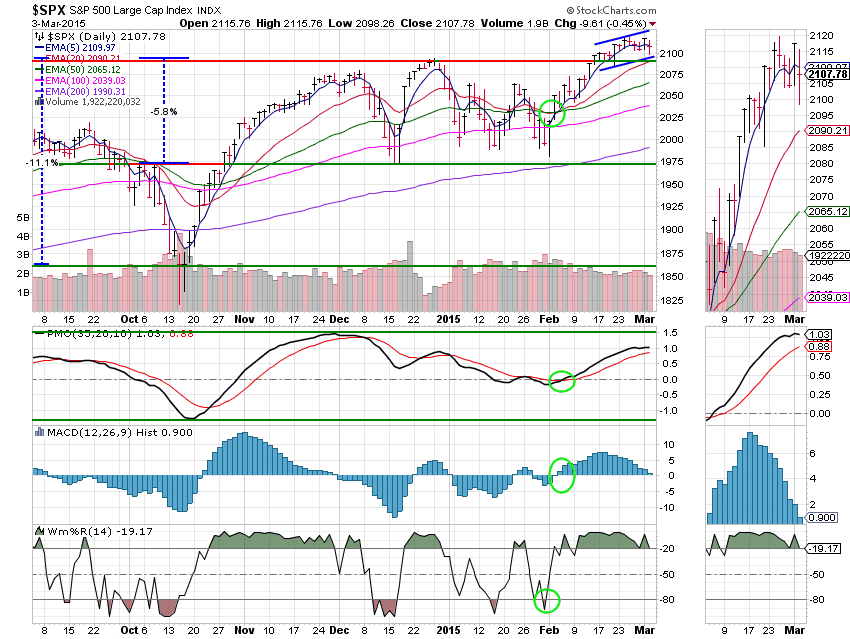

C Fund: This Fund is still a strong buy signal with all four indicators in a positive configuration. Price remains within the newly established ascending channel. The new channel is not as steep as the previous one and, as a result, is more sustainable. The PMO has fattened out and the MAC D is close to entering negative territory.