Good Evening,

Investors pushed the market to slight gains today, ending a short string of negative days, although it was clear that they weren’t going to make any big bets ahead of tomorrow’s jobs report. Not that that the jobs report doesn’t usually have the attention of traders, but it’s even more in focus in 2015 as the Fed has made it clear in the past that the jobs report will have a large input on their decision to raise interest rates. I’m not even going to make a prediction on the market’s reaction to this one. However, I do expect that the report will fall short of expectations. As usual, we’ll see what happens and then watch our charts for the reaction.

The day’s trading left us with the following results: Our TSP allotment added +0.257% and AMP gained +0.261%. For comparison, the Dow was up +0.21%, the Nasdaq +0.32%, the S&P 500 +0.12%, AT&T +0.00%, Alaska Air Group -1.72%, Facebook +0.39% and Apple dropped -1.66%. Not a bad day for our allocations but it’s all about the jobs report tomorrow. It will definitely be a market mover. It’s just a question of what direction that move will be. Hopefully, we’ll be back in the all news is good news mode!

Wall Street closes up slightly ahead of jobs report

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +2.19% for the year not including the day’s results. Here are the latest posted results:

| 03/04/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6641 | 16.9177 | 27.7961 | 37.7641 | 25.6542 |

| $ Change | 0.0007 | 0.0050 | -0.1167 | -0.1559 | -0.1086 |

| % Change day | +0.00% | +0.03% | -0.42% | -0.41% | -0.42% |

| % Change week | +0.02% | -0.51% | -0.26% | -0.05% | -1.22% |

| % Change month | +0.02% | -0.51% | -0.26% | -0.05% | -1.22% |

| % Change year | +0.33% | +0.69% | +2.32% | +4.04% | +5.93% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6244 | 23.3732 | 25.4457 | 27.1488 | 15.4502 |

| $ Change | -0.0137 | -0.0487 | -0.0689 | -0.0851 | -0.0551 |

| % Change day | -0.08% | -0.21% | -0.27% | -0.31% | -0.36% |

| % Change week | -0.11% | -0.28% | -0.35% | -0.39% | -0.45% |

| % Change month | -0.11% | -0.28% | -0.35% | -0.39% | -0.45% |

| % Change year | +0.99% | +2.07% | +2.58% | +2.92% | +3.29% |

Lets hit the charts:

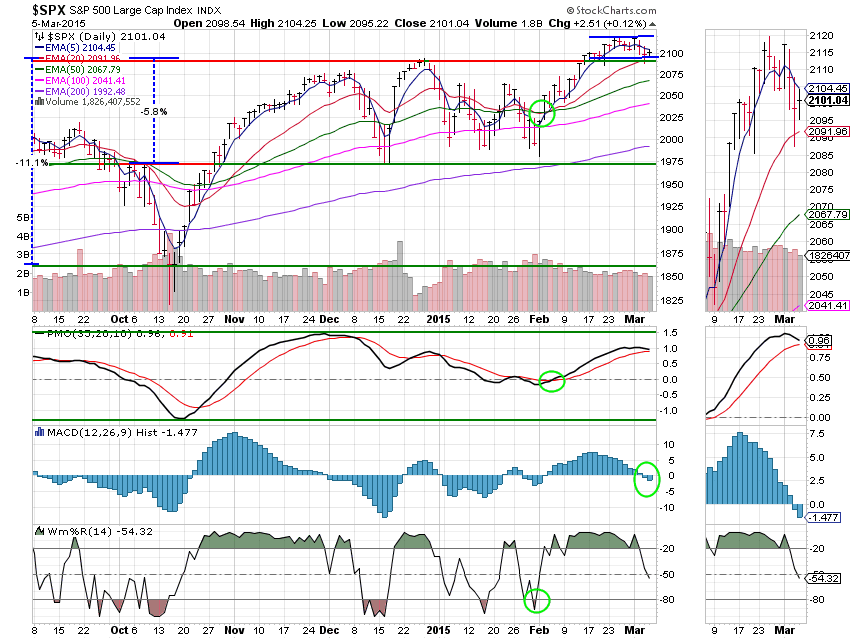

C Fund: The C Fund is still on a buy signal with three indicators in a positive configuration. Price remains within the newly established trading channel holding just above support at 2090. The PMO continues to travel down and is now threatening to pass through its 20 EMA which would result in an overall neutral signal. I have no real concerns about this chart as price is still trading above its 20 EMA and holding support. Should support be broken at 2090, I would start to become a little concerned. We’ll see which way it heads after tomorrow’s jobs report.

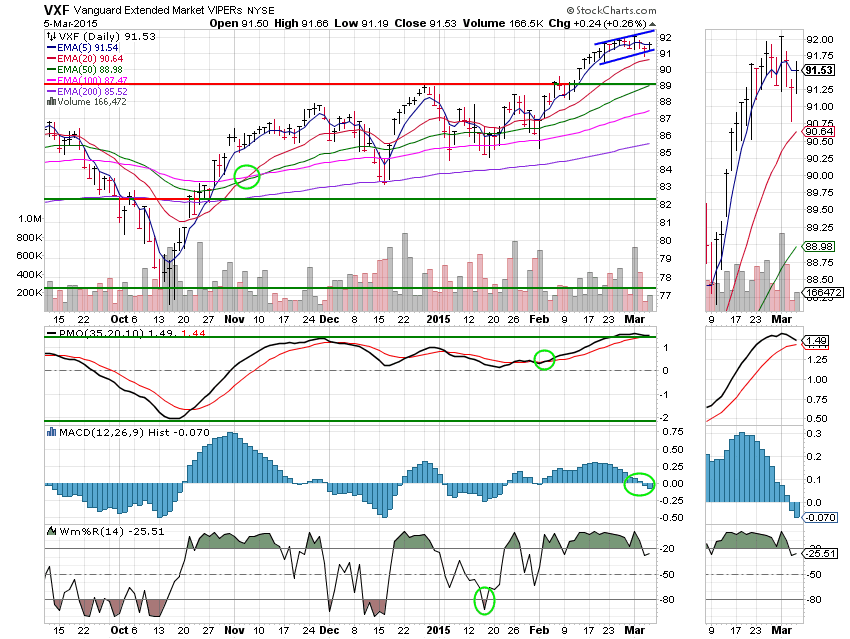

S Fund: The S Fund also remains within its established trading channel which, unlike the C Fund, is an ascending channel. At the current time, this chart is slightly stronger than the C Fund due to the fact that it is trading much higher than its support which is set at close to 89. The only negative that this fund has when comparing it to the C Fund is that its PMO is a little overbought. That said, the PMO can travel as high as +2 in overbought territory. It just hasn’t done it in a while, which is the reason that we have resistance set just above +1. The Williams %R turned back up, indicating that the ultra short trend could go up as well. We’ll see if it’s predicting some strong action tomorrow. Also like the C Fund, the S Fund remains in an overall buy signal which is being threatened by a negative PMO crossover. I’m not concerned about this fund. Even if it dips into neutral territory, it is nowhere near a sell signal.

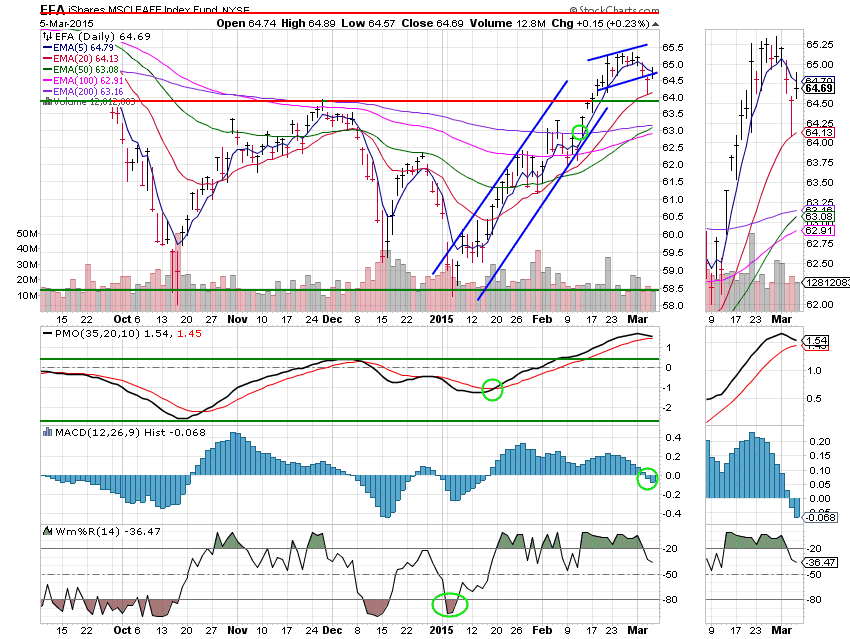

I Fund: Just as we though it might in yesterday’s analysis, price re-entered the established ascending channel and remains well above its 20 EMA. As with the C and S Funds, the PMO is threatening a negative crossover which would generate an overall neutral signal. There’s no concern here either as this chart could take some big hits before it generates a sell signal. So far it is only showing the weakness of some healthy consolidation.

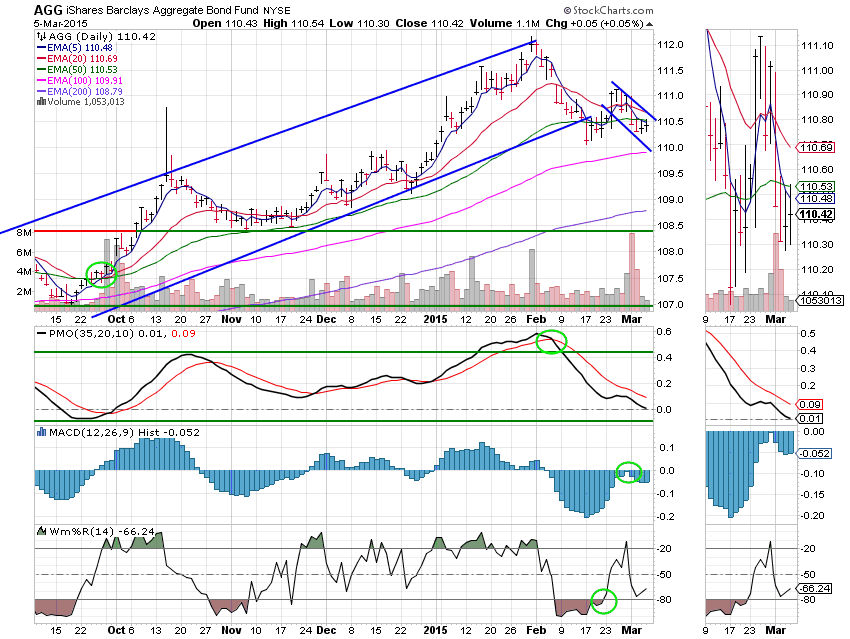

F Fund: This Fund managed another small gain today. However, the PMO is in a free fall and is threatening to cross from its neutral area into negative territory. Price remains in the newly established descending channel and is also still below its 50 EMA. The Williams %R did turn up which could indicate an ultra-short run up. Price has a lot of work to do to turn this fund around. The PMO which is a strong indicator shows no sign of slowing its descent and has a lot of room to run lower; based on that I’ll say that the current price strength is probably just a little consolidation before another break down. This chart is way too weak to put funds to work here.

Many traders have forgotten what a healthy market feels like. We’ve certainly had a few days of weakness, but it is normal in a bull market for there to be a rest before the next run. Right now, that’s what this appears to be. There will be a day when the trend will turn down. However, we’ll keep our foot on the gas until the charts tell us that a true trend change has come. May God continue to bless your trades! Have a nice evening and stay warm. It’s cold out there. I think I’ll sit in my easy chair with a heat pad as I had to shovel way too much snow!

God bless,

Scott