Good Evening,

We have often talked about the news and how it relates to our investment style. It is something that we’d love to ignore entirely if we could. However, it does have its place. While we are not fundamental investors, we do believe in overlaying technical analysis with fundamentals. This uncommon marriage allows us to take the best of both worlds while hopefully avoiding the worst. At least that’s the idea. By using fundamentals we can more easily target our technical analysis. For instance if we know oil is going lower we can focus our research on the charts of stocks and funds that may benefit from low oil. The thing about fundamental investing that we seek to avoid is all the noise created by the media. More often than not, it is not the news that shapes the market, but the market that shapes the news. In other words, the news media has to explain what happened in the market so the news is tailored to the market action. It’s not like you might think in that the market might react to news that says the FED will or won’t raise rates. No, its more like the market just went up or down and now we have to explain why. Sometimes that explanation is accurate and sometimes it is not. One thing that is for sure is that it is seldom a good predictor of things to come. It is a very poor indicator on which to place your bets. The only way to accomplish that goal with any certainty is to stick to the charts and that folks, is what we do here. Bottom line, for the aforementioned reasons, take all news with a grain of salt and when it gets too noisy shut off the news and hit the charts!

Traders decided to take some profits today after a nice run yesterday. The main excuse was a strong dollar and a poor consumer sentiment survey. The day’s action left us with the following results: Our TSP allotment was -0.568% while AMP slipped back -0.351%. For comparison, the Dow dropped -0.82%, the Nasdaq -0.44%, the S&P -0.61%, AT&T -1.12%, Alaska Air Group -0.67%, Facebook -1.11%, and Apple closed at -0.69%. Praise God our TSP allotment was competitive and AMP was king of the hill. AMP has been dialed in in recent weeks and is consistently beating the senior indexes!

Wall St. resumes fall as dollar hits 12-year high

| 03/12/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6701 | 16.9336 | 27.3851 | 37.7424 | 25.1357 |

| $ Change | 0.0007 | 0.0115 | 0.3475 | 0.4960 | 0.2006 |

| % Change day | +0.00% | +0.07% | +1.29% | +1.33% | +0.80% |

| % Change week | +0.03% | +0.60% | -0.20% | +0.96% | -1.40% |

| % Change month | +0.06% | -0.41% | -1.73% | -0.10% | -3.22% |

| % Change year | +0.37% | +0.79% | +0.81% | +3.98% | +3.79% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5816 | 23.2118 | 25.222 | 26.8807 | 15.275 |

| $ Change | 0.0424 | 0.1359 | 0.1906 | 0.2347 | 0.1497 |

| % Change day | +0.24% | +0.59% | +0.76% | +0.88% | +0.99% |

| % Change week | +0.00% | -0.14% | -0.17% | -0.18% | -0.23% |

| % Change month | -0.35% | -0.97% | -1.23% | -1.37% | -1.57% |

| % Change year | +0.75% | +1.37% | +1.68% | +1.90% | +2.12% |

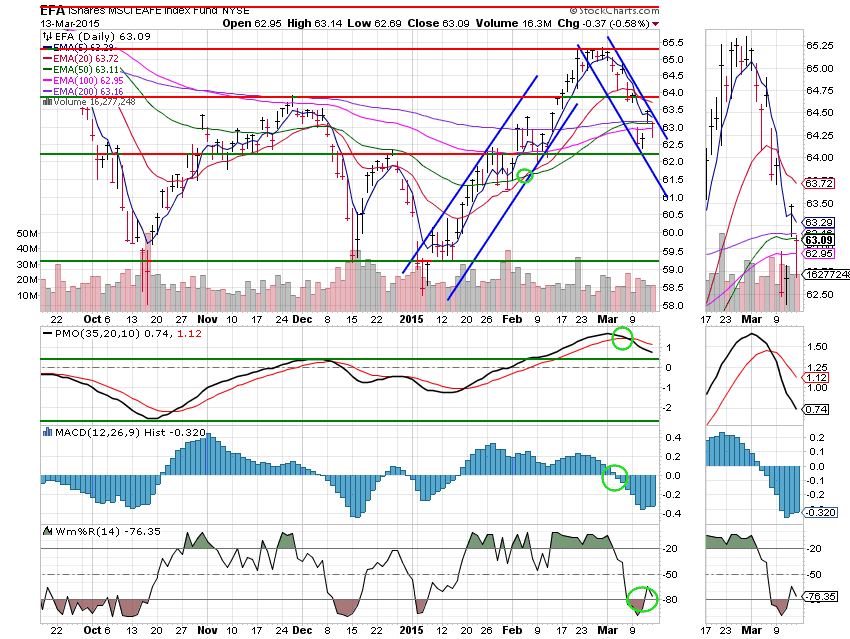

C Fund: Price dropped back below its 50 EMA but still remains within the wide ascending channel. The Williams %R has turned back down into negative territory reflecting the volatile week.

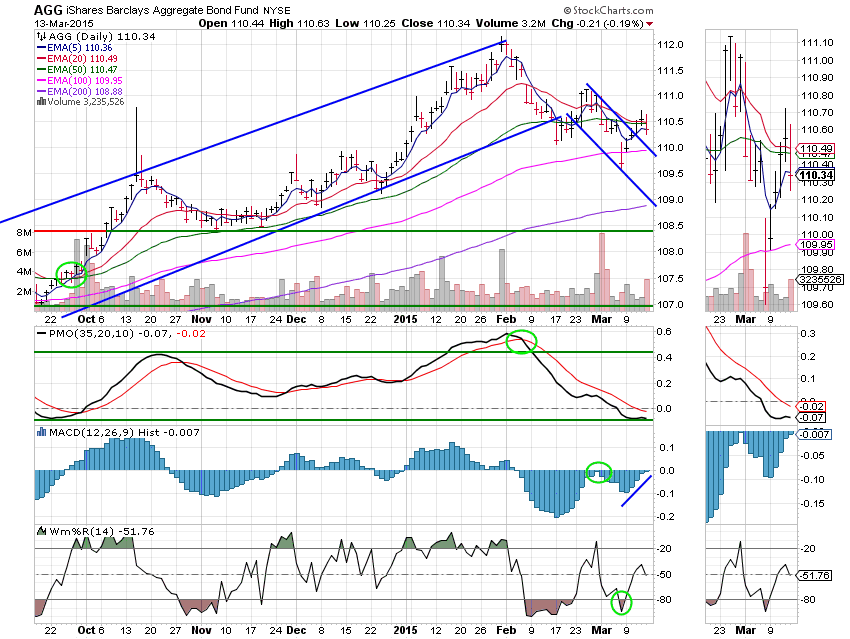

F Fund: Price dropped back below its 50 EMA but still remains above its upper descending trend line. It is most likely slowing its rate of descent. Not changing directions. The MAC D is close to crossing into positive territory and the Wms %R has turned down but remains in positive territory.