Good Evening,

The market opened down and stayed down until 2:00 PM Eastern Time. At that point, the S&P was down half a point and within 60 seconds it reversed and was up a half a point. 1% in a minute, wow! The old saying “Don’t Fight The FED” definitely applied here! Those traders that were worried about the word ‘patient’ being taken out of the FED statement were left in the dust as they scrambled to add exposure. You may remember that in yesterday’s newsletter I said that I had no idea how the market would react to the FED statement no matter how it was worded and that turned out to be correct as the market rose at a torrid pace. In short, Janet Yellen presented things just as she always does with a carefully worded common sense approach. Basically she told it like it is; she noted all the concerns that the FED has about the economy from deflation to slow growth and reduced the forecast for interest rate increases for the next year. She made it clear that rate increases would be tied to such things and that they were in no hurry to substantially increase rates. In even simpler words, if and when they increase rates they will not increase fast and right now there are a lot of concerns. I love you Janet! I think I’ll make you my official adopted Aunt as I’m way too old to have a living Grandmother!

The day’s action left us with the following results: Our TSP allotment was rocking at +1.4694% and AMP added another +0.5764%. I could easily say that AMP under-performed on the day, but you have to remember that it made money yesterday when the big three were solidly in the red. I’ll take three successive gains any time I can get them! For comparison, the Dow added +1.27%, the Nasdaq +0.92%, the S&P 500 +1.22%, AT&T +2.10%, Alaska Air was off -1.21%, Face book added +1.95% and Apple +1.13%. God be praised for a great day!!!

Wall St. surges as Fed statement relieves rate worries

| 03/17/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6739 | 16.9508 | 27.4971 | 37.9878 | 25.2683 |

| $ Change | 0.0007 | 0.0224 | -0.0908 | 0.0931 | -0.0170 |

| % Change day | +0.00% | +0.13% | -0.33% | +0.25% | -0.07% |

| % Change week | +0.02% | +0.17% | +1.02% | +1.09% | +0.86% |

| % Change month | +0.09% | -0.31% | -1.33% | +0.55% | -2.71% |

| % Change year | +0.39% | +0.89% | +1.22% | +4.66% | +4.34% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6025 | 23.2722 | 25.3056 | 26.9834 | 15.3405 |

| $ Change | -0.0043 | -0.0167 | -0.0220 | -0.0250 | -0.0163 |

| % Change day | -0.02% | -0.07% | -0.09% | -0.09% | -0.11% |

| % Change week | +0.22% | +0.52% | +0.66% | +0.76% | +0.85% |

| % Change month | -0.23% | -0.71% | -0.90% | -1.00% | -1.15% |

| % Change year | +0.87% | +1.63% | +2.01% | +2.29% | +2.55% |

Let’s it the charts!

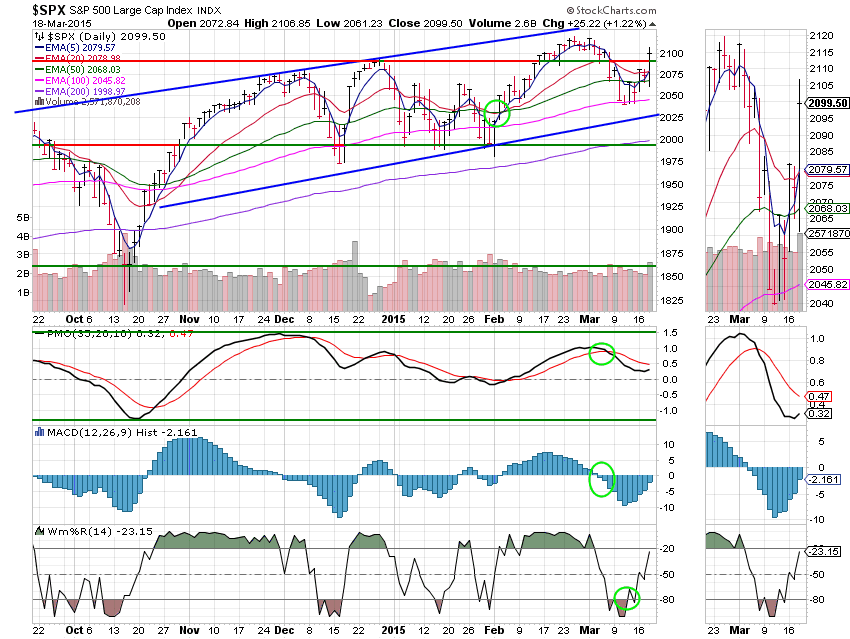

C Fund: Price broke through resistance at 2185 so that resistance now becomes support. The MAC D, PMO, and Williams %R all improved. If price can remain above resistance a buy signal may be in the not so distant future. All signals are annotated with green circles. This chart is neutral but improving.

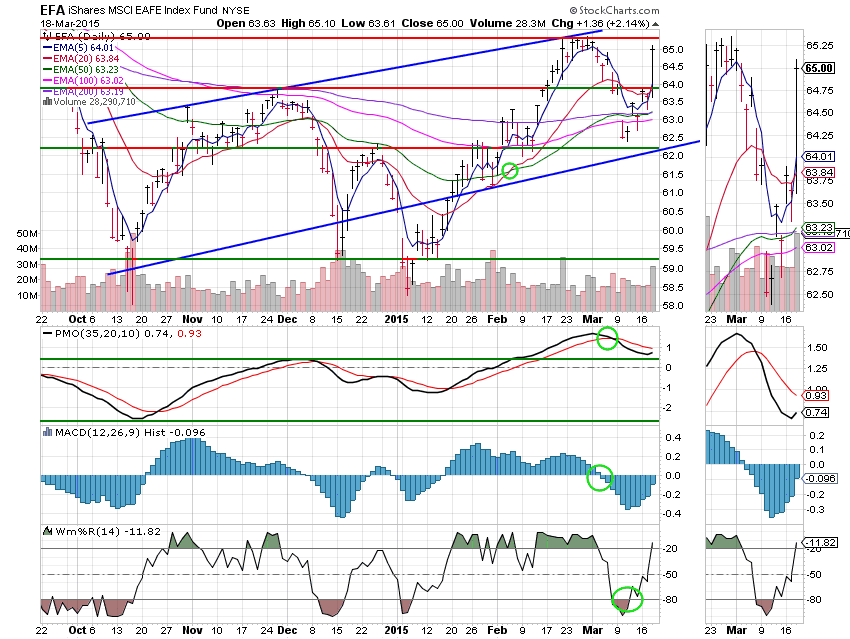

F Fund: There are no two ways about it. This is a gaudy gain for bonds. The market voted and it has voted that it thinks interest rates won’t be rising soon. Price reclaimed the old ascending channel. Given all the headwinds, I thought it would be impossible for that to happen. Nevertheless it did and powered all four indicators to buy signals generating an overall buy signal for the chart. Impressive, I’m still not investing in bonds at this time, but still impressive. All signals are annotated with green circles.