Good Evening,

In yesterday’s newsletter we anticipated a post FED hangover and today that’s what we got with two out of the three major indexes in the red. Today’s media excuse was the strong dollar and low oil. My charts say we are still in an uptrend and that’s really all I’m worried about……

The day’s trading gave us the following results: Our TSP allotment gave up -0.5784%, but AMP was the class of the field with a gain of +0.3519%. That is four straight gains for AMP. I’ll take consistency over wild swings any day! For comparison the Dow lost -0.65%, the Nasdaq gained +0.19%, the S&P was -0.49%, AT&T -1.16%, Alaska Air +0.56%, Facebook +2.27% and Apple slipped -0.76%. So much for Apple’s first day in the Dow…. I have no complaints; the action today was pretty much what I expected. I was definitely pleased with how dialed in that AMP is. It not only posted four successive gains, but two of the gains came on down days for the market! God is with us! Give Him Praise!!!

S&P 500 ends lower in Fed rally reversal

The day’s action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Buy. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +3.16% on the year, not including the day’s results. Here are the latest posted results:

| 03/18/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6747 | 17.0399 | 27.8322 | 38.3558 | 25.9207 |

| $ Change | 0.0008 | 0.0891 | 0.3351 | 0.3680 | 0.6524 |

| % Change day | +0.01% | +0.53% | +1.22% | +0.97% | +2.58% |

| % Change week | +0.03% | +0.70% | +2.25% | +2.07% | +3.47% |

| % Change month | +0.09% | +0.21% | -0.13% | +1.52% | -0.20% |

| % Change year | +0.40% | +1.42% | +2.45% | +5.67% | +7.03% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6623 | 23.4665 | 25.5737 | 27.3071 | 15.5496 |

| $ Change | 0.0598 | 0.1943 | 0.2681 | 0.3237 | 0.2091 |

| % Change day | +0.34% | +0.83% | +1.06% | +1.20% | +1.36% |

| % Change week | +0.56% | +1.36% | +1.73% | +1.97% | +2.23% |

| % Change month | +0.11% | +0.12% | +0.15% | +0.19% | +0.20% |

| % Change year | +1.21% | +2.48% | +3.09% | +3.52% | +3.95% |

Let’s get to the charts.

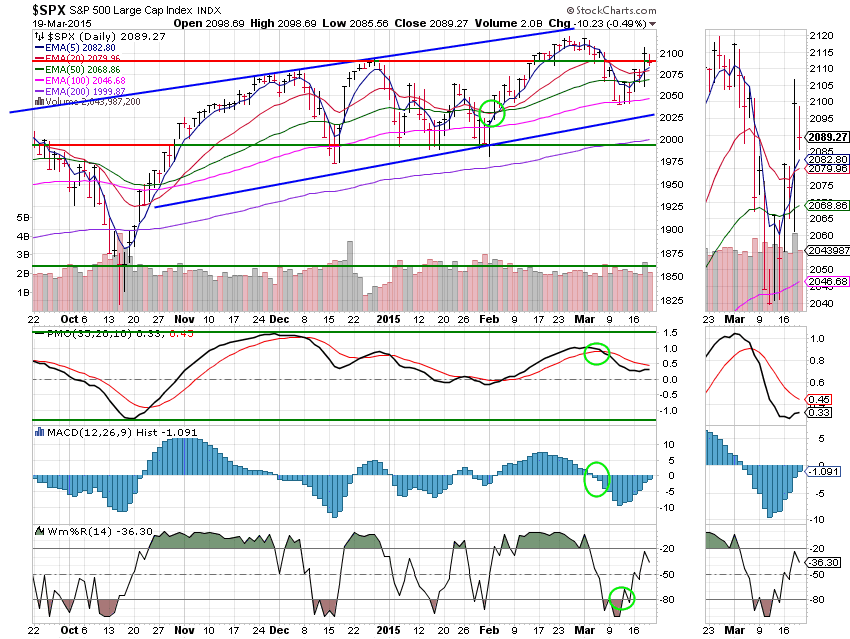

C Fund: Price gave up some ground testing and then closing right at support. It still remains in the center of the ascending channel and above its 20 EMA so no damage done here. The C Fund remains on an overall Neutral signal. All signals are annotated with green circles.

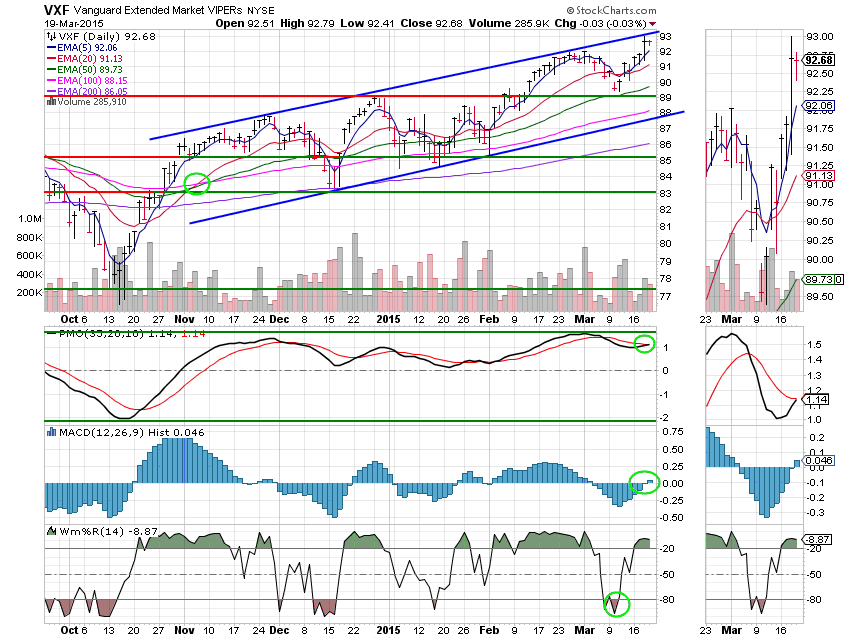

S Fund: The S Fund gave up very little ground today as small caps out performed again. As a result the MAC D and PMO generated buy signals moving the chart to on overall buy signal. The S Fund has been the strongest of our equity based charts. All signals are annotated with green circles.

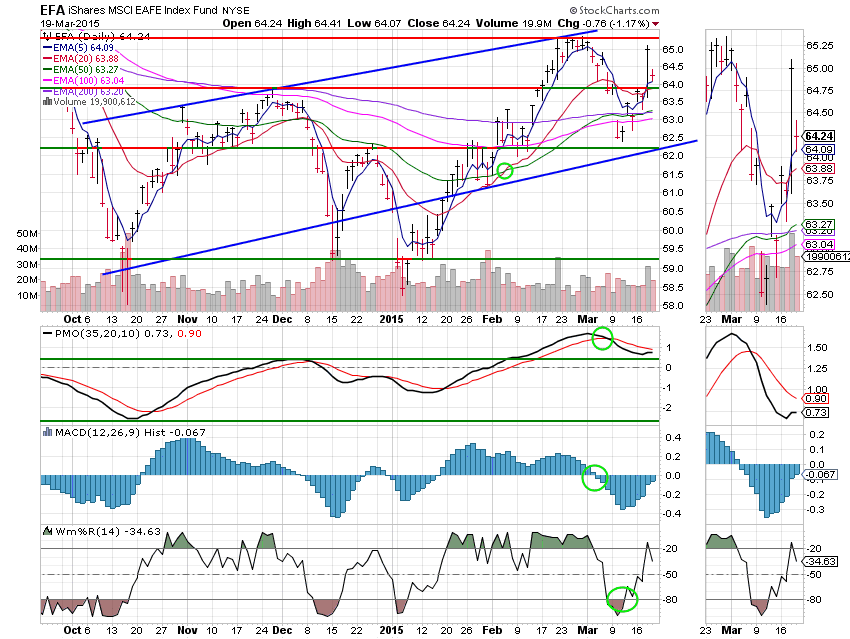

I Fund: The I Fund gave up about half of yesterday’s gain but is still in good shape with price closing above resistance and its 20 EMA. Price remains in the center of the ascending channel so no real concerns here. This chart remains on an overall Neutral signal. All signals are annotated by green circles.

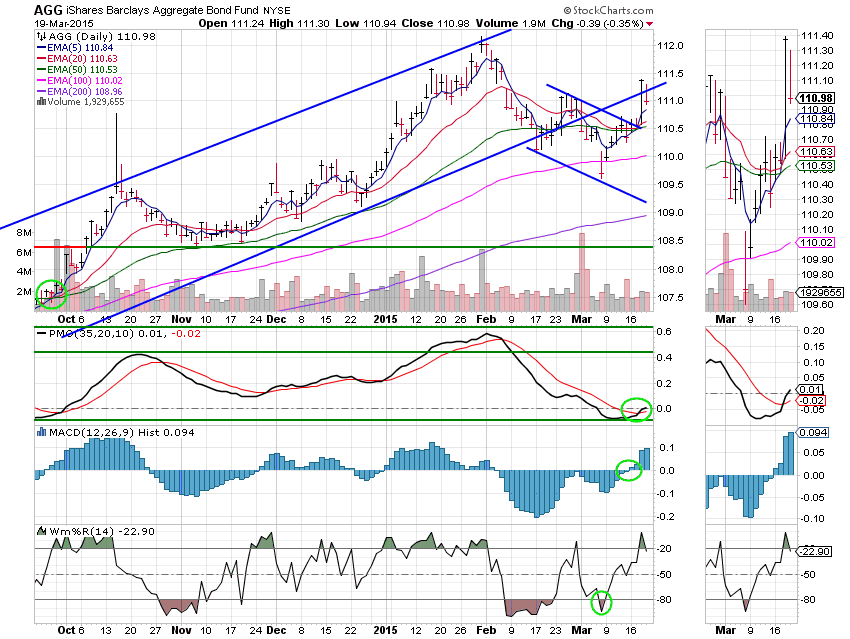

F Fund: Price gave up some ground, again dropping out of the ascending channel. However, it did close above its 20 EMA. This chart remains on a buy signal. All signals are annotated with green circles.

Today’s action could best be called back filling or consolidation after a big rally. The upward trend is still in place so we’ll watch our charts and stick with it as long as we can. Don’t forget to give God a little praise tonight as He continues to bless our group. That’s all for tonight. I I’ve got to go watch the Kentucky Wildcats win game one of the tournament. Wow, my bracket is already taking some hits. Who thought UAB would beat Iowa State?? or that Baylor would lose to Georgia State? I guess that’s the reason they play the games. Let Cinderella dance!

Have a nice evening.

Scott