Good Evening,

The market bounced back today as we anticipated that it would. It’s always good when we don’t have too many surprises and things go according to plan. The trend is up and we’re making money, but that just isn’t enough for some folks as they keep up the negative talk. I will readily admit that I got caught up in some of that talk last year myself. I thought after all, how high can this thing really go. You see there’s a difference when you are looking after other people’s money and not just your own. There are really two reactions that money managers have. They either don’t give a flip, which I believe is most of them, or (and I liken this to myself) they agonize with every pullback. Although I have been helping people with TSP since 1998, I did not get involved with post retirement money until 2011 and quite frankly it took a while getting used to investing on the street vs investing in TSP. Yes, I had a Scott Trade account, but trading a few individual stocks of your own is not the same thing as managing post retirement money. After all, if I lost my entire Scott Trade account I would still eat right? Anyway I’ll quit chasing rabbits and get to the point. With all the pressure to call the top in 2014 and for that matter prior to 2014, many traders got away from sticking with the trend as the topping noise just became too loud to ignore. Couple that with a real anxiety over losing any of the money you manage and you have the perfect recipe for under-performance. That is what made 2014 and the months leading up to it so unique. So why did I say all this? There is a lesson to be learned and that is that if you are to be a successful trader you must stick with your system and avoid the noise. There are always going to be intellectuals out there trying to be the “one” who called the top and most of them are just plain wrong and misleading. If you listen to such talk enough, sooner or later you will cave in and short your stocks or funds when there is no good reason to do so. You’ll say to yourself, my investment fell back 3% last week, they must be right! Yes, but what did your charts say? They say the the trend is still going up and you tell yourself, but it sure doesn’t look like it. Surely they must be right, it is topping! So you sell again, and what happens? The market turns right back up just like your charts said they would. The bottom line is that you can only trust yourself, your charts, and your God. Above all, if you trust in the latter, then the former things will take care of themselves. He will guide you! However, If you try to do things yourself and listen to all this noise, if you try to accomplish things on your own, you are doomed to under-perform. I don’t care how many letters these folks may have after their names or how many you have after yours, or how much education I have, our God has more knowledge than all combined for in the 55 Chapter of Isaiah in verses 8 and 9 if says “For my thoughts are not your thoughts, neither are your ways my ways, saith the Lord. For as the heavens are higher than the earth, so are my ways higher than your ways, and my thoughts than your thoughts.” Trust in God, watch your charts and do what you know is right! That is how we went from 1998 to 2011 with only one losing year of less than two percent. I guess another more secular way to put it is “Stick with the girl you brought to the dance”. The ‘Rev Shark’ James DePorre had some comments about this subject in his morning commentary. I’ll share a few of them with you here. If you would like to know more his web site is http://www.sharkinvesting.com. Here is what he had to say:

“The bears of course believe that this time it will be different and that the Fed’s dovishness will not be a sustained driving force. They continue to look for a ‘sell the news’ reaction to the very positive Fed developments but they are ignoring the pattern that has persisted in this market for years now.

Patterns do eventually change but at this time conditions are very similar to what has been driving this market for so long. It all boils down to not fighting the Fed. The Fed has made it quite clear that economic growth is still slow, there isn’t enough improvement in unemployment and that inflation is not a concern. There simply isn’t any reason to rush into rate hikes. The removal of the word ‘patient’ was done simply to allow for greater flexibility down the road.

The best thing you can do in this market is to avoid the temptation to keep predicting a market top. It is an irresistible game for many pundits who are constantly seeking the glory of being the great intellectual that nails the exact moment that the market tops out. The problem is that there is tremendous opportunity cost to such predictions. Not only do they miss out of the gains as the trend continues but they constantly rack up losses as they are stopped out of premature shorts.”

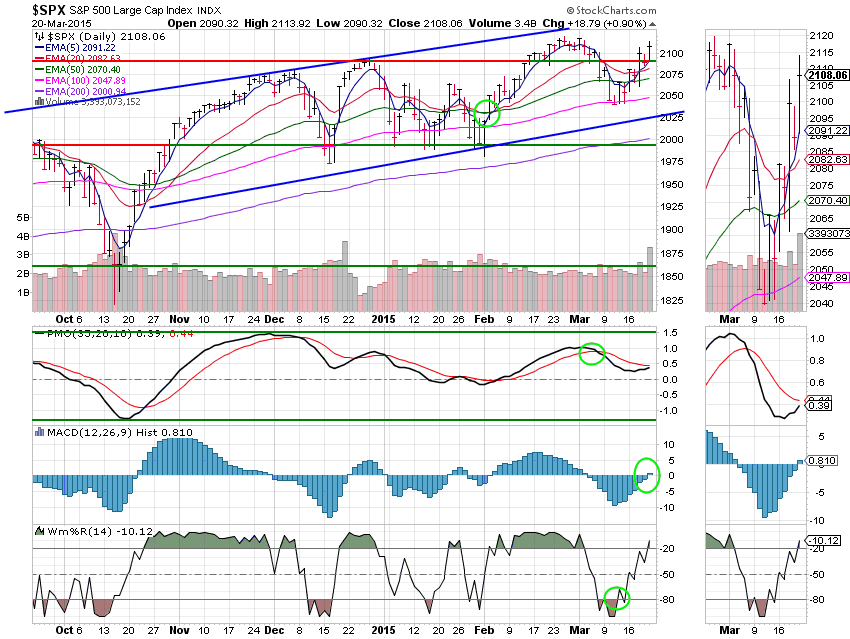

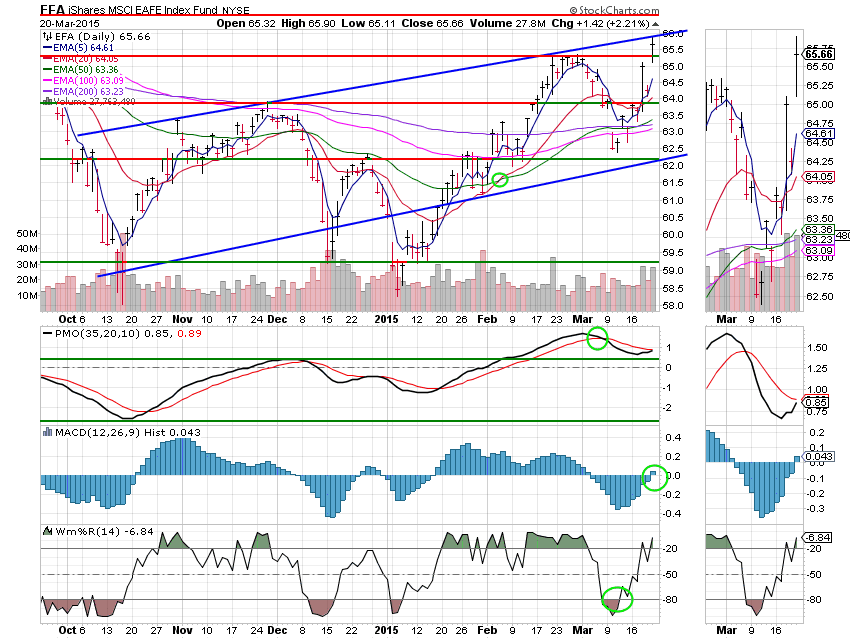

Amen Rev Shark! The day’s action left us with the following results: Our TSP allotment was rocking again today with a gain of +1.371% and AMP posted its 5th consecutive gain adding +0.6024. I’ll take 5 straight gains of any size as it’s not what you make, but what you keep that’s important and this week AMP kept it all! For comparison the Dow added +0.94%, the Nasdaq +0.68%, the S&P 500 +0.90%, AT&T +0.09%, Alaska Air +0.48%, Facebook +1.27% and Apple closed down -1.25%. God has blessed us with another good week. We are now up on the Year, the Month, and for the Week! Be sure and give Him all the praise!!!!

Wall St. rises on Nike, lower dollar; snaps three-week string of losses

| 03/19/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6754 | 17.0211 | 27.6969 | 38.3592 | 25.5533 |

| $ Change | 0.0007 | -0.0188 | -0.1353 | 0.0034 | -0.3674 |

| % Change day | +0.00% | -0.11% | -0.49% | +0.01% | -1.42% |

| % Change week | +0.03% | +0.59% | +1.76% | +2.08% | +2.00% |

| % Change month | +0.10% | +0.10% | -0.61% | +1.53% | -1.61% |

| % Change year | +0.40% | +1.31% | +1.96% | +5.68% | +5.51% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6386 | 23.3831 | 25.4598 | 27.1721 | 15.4611 |

| $ Change | -0.0237 | -0.0834 | -0.1139 | -0.1350 | -0.0885 |

| % Change day | -0.13% | -0.36% | -0.45% | -0.49% | -0.57% |

| % Change week | +0.43% | +1.00% | +1.28% | +1.47% | +1.65% |

| % Change month | -0.03% | -0.24% | -0.30% | -0.30% | -0.38% |

| % Change year | +1.08% | +2.12% | +2.63% | +3.01% | +3.36% |