Good Evening,

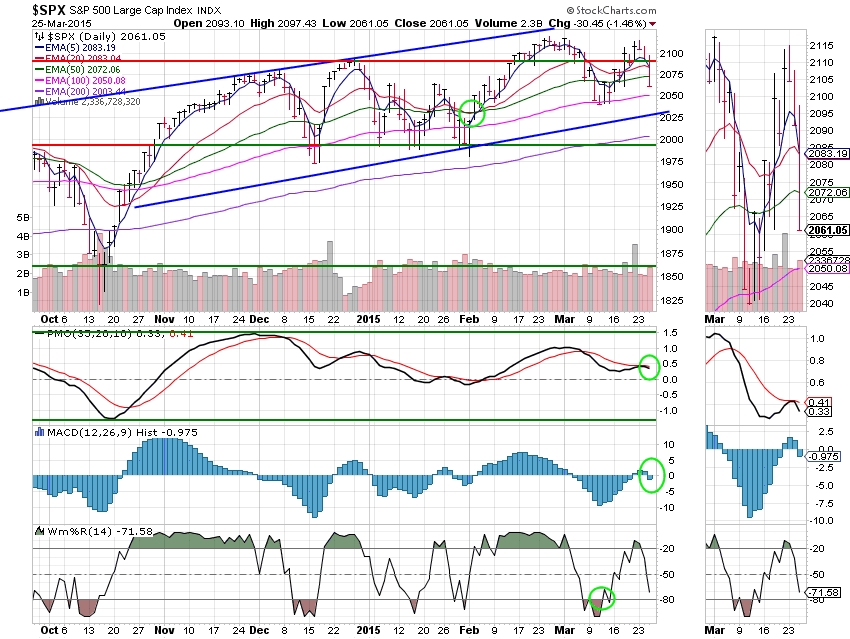

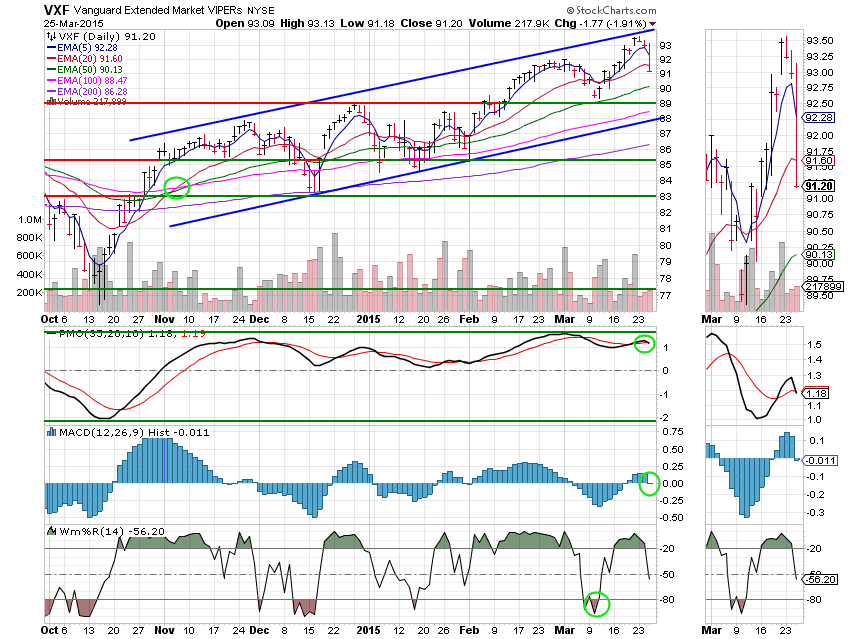

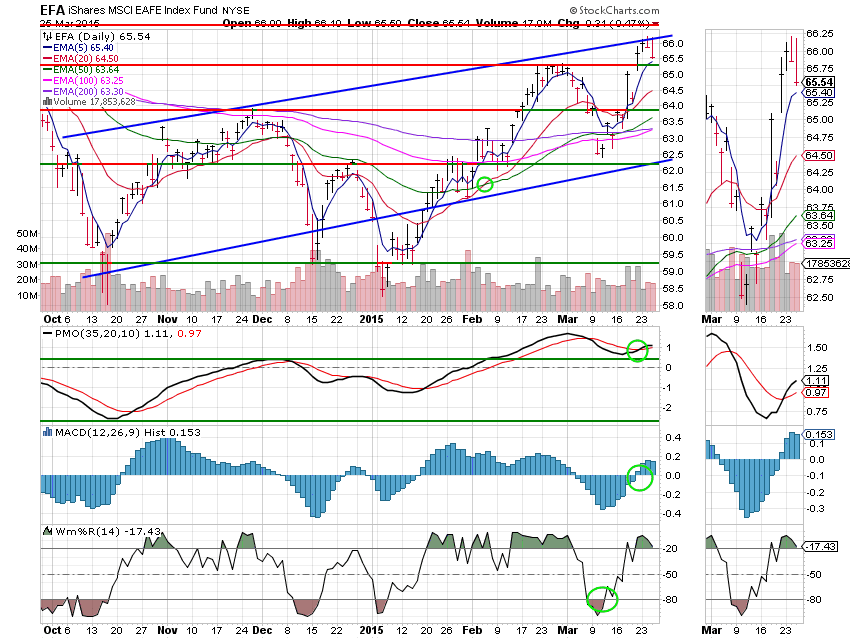

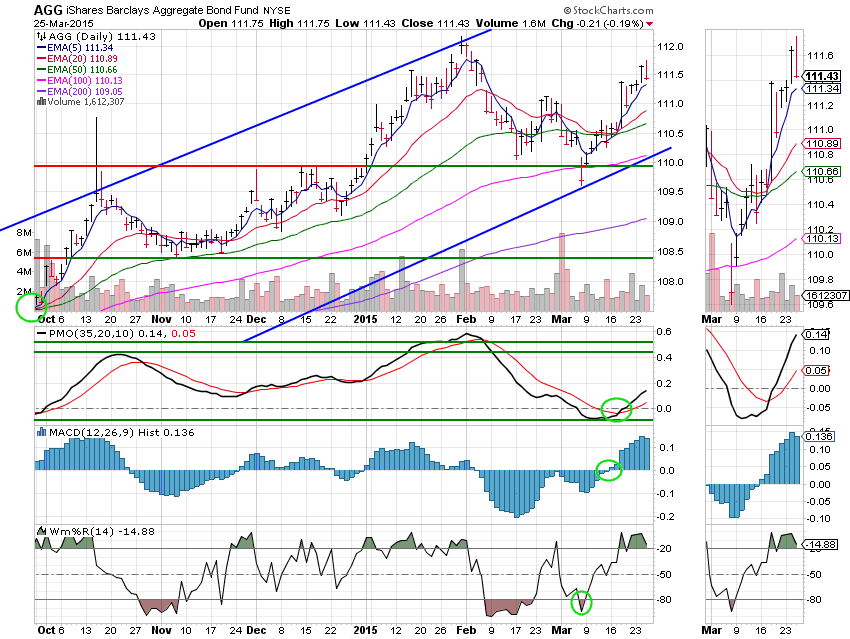

There’s no doubt about it, the numbers where ugly today. It was an absolute slaughter out there. So is this a top? Looking at the charts, it is possible that a double top could be forming. But, given the main reason for today’s decline, I think it would be a premature call just yet.

The sell off all started with the durable goods report that came out today. Economists had expected the report to show a decline of -0.1%, but instead they got a decline of 1.4% which would be terrible if there were not a good explanation for it. The explanation? We have to go back to last year to find a good example. Durable goods orders (as well as everything else) got slammed during the months of January and February in 2014. However, after the initial sell-off, the market rebounded with one of its patented v-shaped recoveries when traders realized that the poor reports were not a function of the economy but a result of the weather! Fast forward to 2015 and here we go again. Am I missing something? Did we not have record snowfall in many areas on the east coast? Perhaps they should check the durable goods orders for snowblowers! Please note my sarcasm!

Is it possible that the market was looking for an excuse to sell off anyway with the indexes near their all time highs and stock valuations high as well? Yes it is possible. Is it a sure thing? You can panic and sell everything you have and you may be right, but you’ll probably be wrong. This is where our charts are valuable. (I can hear you now – here he goes again.) We will increase our vigilance and if we see sell signals, we will sell, but if we don’t, we won’t. It’s called discipline and now’s the time you need it. When everyone else is panicking, have a plan, have a system, and stick to it!

The day’s action left us with the following results… I suggest if you are faint of heart, that you skip this part! Our TSP allotment dropped -1.253% and AMP was even worse at -2.223%. For comparison, the Dow lost -1.62%, The Nasdaq was -2.37%, the S&P 500 -1.46%, AT&T -1.36%, Alaska Air -3.55%, Facebook -2.80%, and Apple -2.61%. I’ll say it again. It was bad. Day’s like this are hard to take, but if you going to trade you will have to deal with them. It’s just a part of being in the market. I still thank God. He will guide us through this and every other sell off we have!

Wall St. drops as biotechs, semis hit Nasdaq

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Buy. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +3.63% on the year, not including the days results. Here are the latest posted results:

| 03/24/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6792 | 17.1041 | 27.7293 | 38.4695 | 26.2562 |

| $ Change | 0.0008 | 0.0335 | -0.1684 | -0.1112 | 0.0052 |

| % Change day | +0.01% | +0.20% | -0.60% | -0.29% | +0.02% |

| % Change week | +0.02% | +0.27% | -0.78% | -0.53% | +0.74% |

| % Change month | +0.12% | +0.59% | -0.50% | +1.82% | +1.10% |

| % Change year | +0.43% | +1.80% | +2.08% | +5.99% | +8.41% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6752 | 23.5019 | 25.6209 | 27.3633 | 15.587 |

| $ Change | -0.0114 | -0.0406 | -0.0576 | -0.0713 | -0.0457 |

| % Change day | -0.06% | -0.17% | -0.22% | -0.26% | -0.29% |

| % Change week | -0.04% | -0.12% | -0.17% | -0.20% | -0.22% |

| % Change month | +0.18% | +0.27% | +0.34% | +0.40% | +0.44% |

| % Change year | +1.29% | +2.63% | +3.28% | +3.73% | +4.20% |