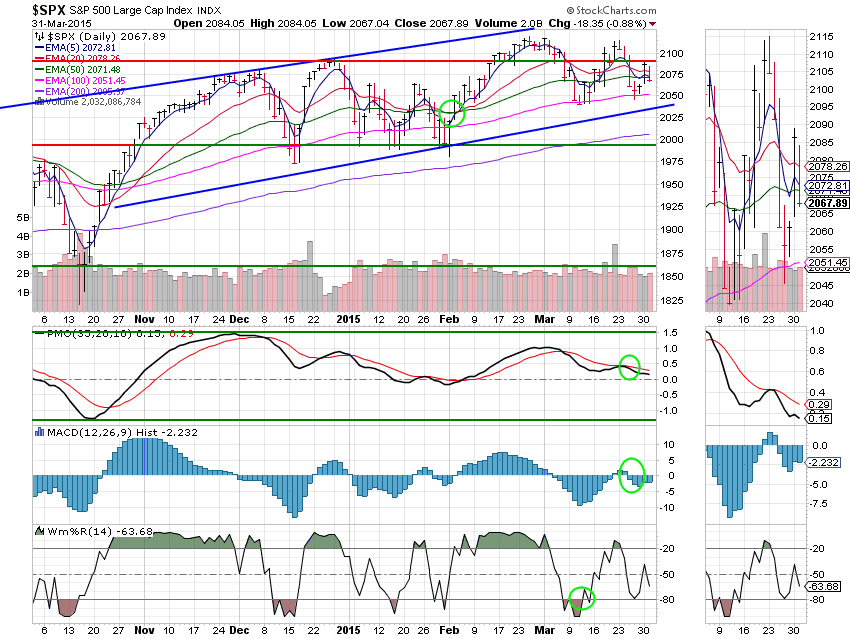

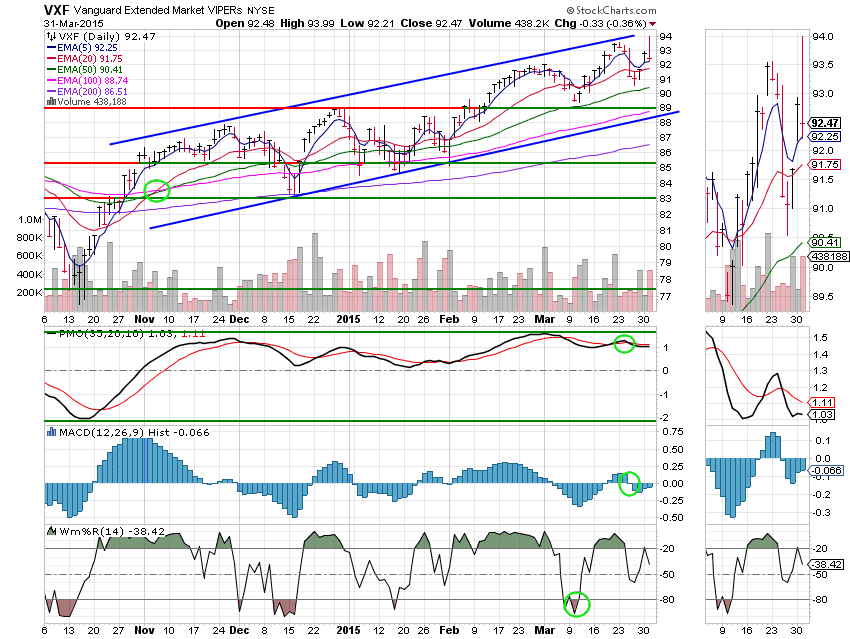

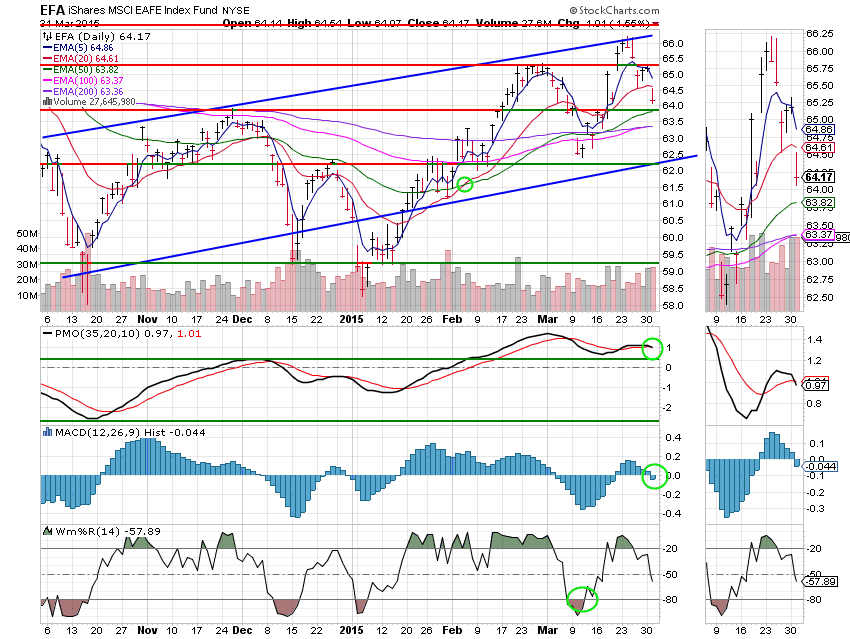

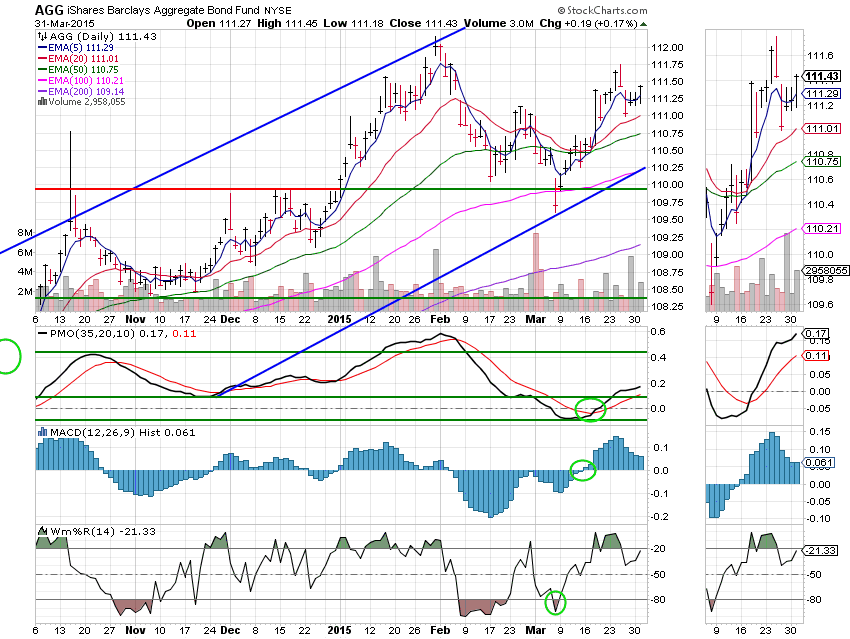

Good Evening, I thought we might see some down side today after yesterday’s window dressing but we got a little more than I anticipated. About all I can say is that the market didn’t give up all of yesterday’s gains. The negative action sealed the deal on a negative month. Seasonally speaking, we have about one more good month before things traditionally slow down and some folks start repeating that old mantra “Sell in May and go away”. Back in November and December I said that 2015 would be more choppy than 2014 and that I thought we would be fortunate if we made a profit of 5% on the year. I’m sticking with that prediction (which, by the way, is the only one that I intend to make). Either way I’ll stick to the charts and react to the action that comes! The day’s trading left us with the following results: Our TSP allotment lost -1.135% and AMP fell back -0.697%. For comparison, the Dow dropped -1.11%, the Nasdaq -0.94%, the S&P -0.88%, AT&T was -0.97%, Alaska Air -0.03%, Facebook -1.18%, and Apple closed at -1.54%. I thank God that we made it another month without being forced to sell. We lived to fight another day!

Wall St. retreats but S&P, Nasdaq post quarterly gains

| 03/30/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6837 | 17.0574 | 27.6684 | 38.4062 | 25.8994 |

| $ Change | 0.0023 | -0.0060 | 0.3367 | 0.4785 | 0.0183 |

| % Change day | +0.02% | -0.04% | +1.23% | +1.26% | +0.07% |

| % Change week | +0.02% | -0.04% | +1.23% | +1.26% | +0.07% |

| % Change month | +0.15% | +0.32% | -0.71% | +1.65% | -0.28% |

| % Change year | +0.46% | +1.52% | +1.85% | +5.81% | +6.94% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6595 | 23.4375 | 25.53 | 27.2533 | 15.5141 |

| $ Change | 0.0350 | 0.1067 | 0.1503 | 0.1869 | 0.1181 |

| % Change day | +0.20% | +0.46% | +0.59% | +0.69% | +0.77% |

| % Change week | +0.20% | +0.46% | +0.59% | +0.69% | +0.77% |

| % Change month | +0.09% | +0.00% | -0.02% | -0.01% | -0.03% |

| % Change year | +1.20% | +2.35% | +2.92% | +3.31% | +3.71% |