Good Evening,

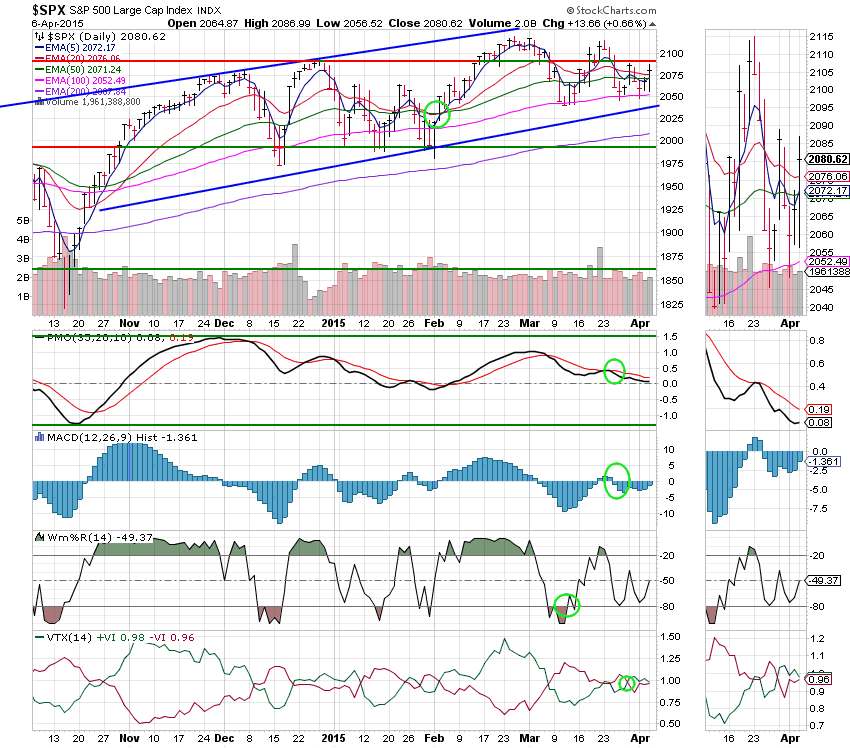

As long as there’s a little cheap FED money and interest rates stay low, it’s all good…….. You remember last week I said the way that the market would go on Monday would depend on how the market would react to the jobs report. Well, the jobs report was issued on Friday and only half the jobs that were anticipated were actually created. That is flat bad news. But, as long as interest rates stay low it’s all good… So the market did the unthinkable, as it has done so many times in past 5 years, and rallied. Like I said last week, even if you know what the news is going to be, you really can’t predict how the market will react to it. Also, in keeping with recent years’ action, once the market started up, the fear of being left behind started to set in…….

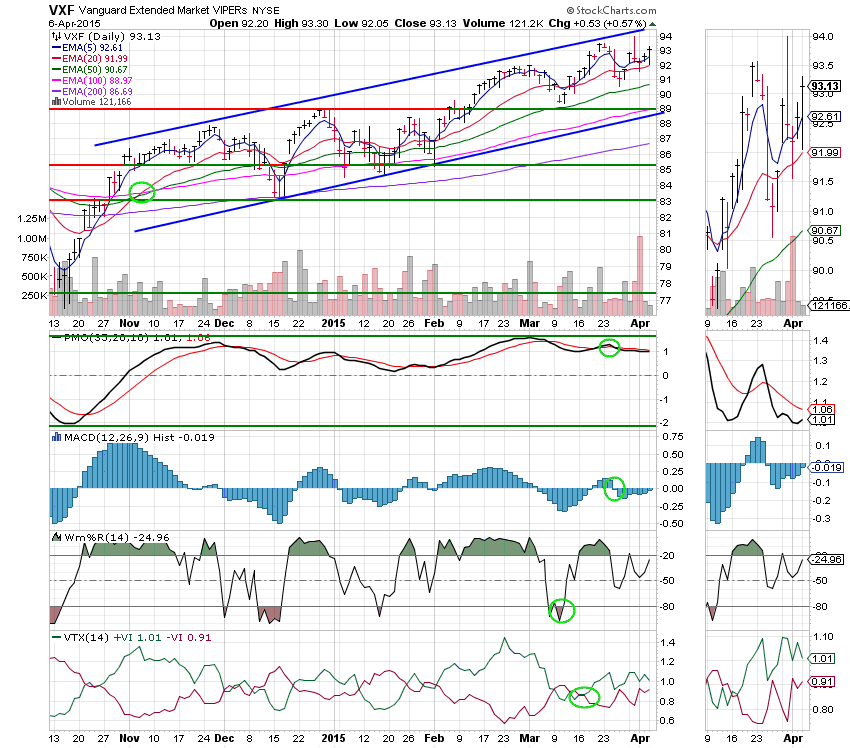

The day’s action left us with the following results: Our TSP allotment added an impressive +0.852% while AMP gained +0.289%. For comparison, the Dow was up +0.66%, the Nasdaq +0.62%, the S&P 500 +0.66%, AT&T +0.60%, Alaska Air -1.06%, Facebook +1.09% and Apple closed at +1.62%. Thank God for another good day!

Wall Street ends higher as weak data reduces rate hike worries

| 04/02/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6859 | 17.1082 | 27.4203 | 38.315 | 25.8973 |

| $ Change | 0.0007 | -0.0283 | 0.0972 | 0.1597 | 0.2623 |

| % Change day | +0.00% | -0.17% | +0.36% | +0.42% | +1.02% |

| % Change week | +0.03% | +0.26% | +0.32% | +1.02% | +0.06% |

| % Change month | +0.01% | +0.14% | -0.03% | +0.17% | +1.16% |

| % Change year | +0.47% | +1.82% | +0.94% | +5.56% | +6.93% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6443 | 23.3799 | 25.4492 | 27.1542 | 15.4504 |

| $ Change | 0.0176 | 0.0648 | 0.0910 | 0.1109 | 0.0731 |

| % Change day | +0.10% | +0.28% | +0.36% | +0.41% | +0.48% |

| % Change week | +0.11% | +0.21% | +0.27% | +0.32% | +0.35% |

| % Change month | +0.08% | +0.19% | +0.24% | +0.27% | +0.32% |

| % Change year | +1.11% | +2.10% | +2.59% | +2.94% | +3.29% |