Good Evening,

The market sure seems to like higher oil and I just don’t know why. Low oil is a good thing for the overall economy. I understand that oil below $40.00 per barrel would be injurious to the energy producers but oil in the mid-forties to mid-fifties is good for everyone. I could easily embrace the fact that this is why the market went up except for the fact that the retail and consumer discretionary sectors under-performed in response to stronger oil. What gives? The media can stick with the oil thing. After all, they have to make headlines to make a living. I’m going with performance anxiety. In other words, the market is going up so everyone might as well get in or be left behind…… Stocks started off strong and, after a brief bout of weakness, headed up most of the afternoon.

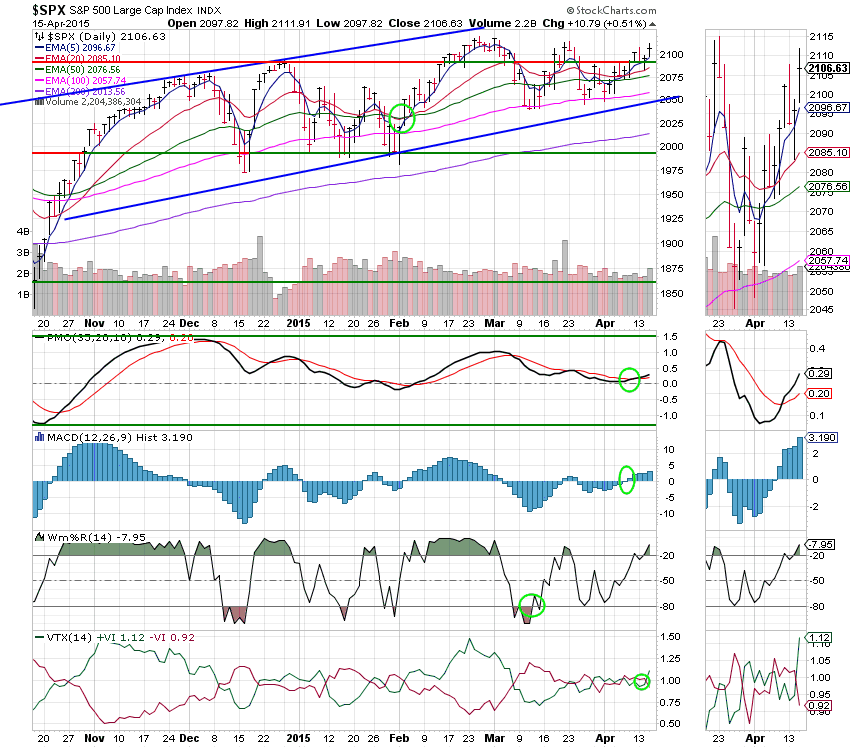

The day’s trading left us with the following results: Our TSP allotment gained +0.52%. For comparison, the Dow gained +0.42%, the Nasdaq +0.68%, and the S&P 500 closed up +0.51%. I thank God for another good day!

Wall Street ends higher as jitters about earnings and oil recede

The day’s action left us with the following signals: C-Buy,S-Buy, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allotment is now +4.27% on the year, not including the day’s results. Here are the latest posted results:

| 04/14/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.695 | 17.1375 | 27.818 | 38.6268 | 26.4521 |

| $ Change | 0.0007 | 0.0216 | 0.0456 | -0.0005 | 0.2088 |

| % Change day | +0.00% | +0.13% | +0.16% | +0.00% | +0.80% |

| % Change week | +0.02% | +0.26% | -0.29% | -0.19% | +0.43% |

| % Change month | +0.07% | +0.31% | +1.42% | +0.98% | +3.33% |

| % Change year | +0.54% | +2.00% | +2.40% | +6.42% | +9.22% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7081 | 23.5716 | 25.7111 | 27.4685 | 15.6528 |

| $ Change | 0.0125 | 0.0408 | 0.0554 | 0.0654 | 0.0428 |

| % Change day | +0.07% | +0.17% | +0.22% | +0.24% | +0.27% |

| % Change week | +0.01% | -0.01% | -0.02% | -0.03% | -0.03% |

| % Change month | +0.44% | +1.01% | +1.27% | +1.43% | +1.63% |

| % Change year | +1.47% | +2.94% | +3.65% | +4.13% | +4.64% |