Good Evening,

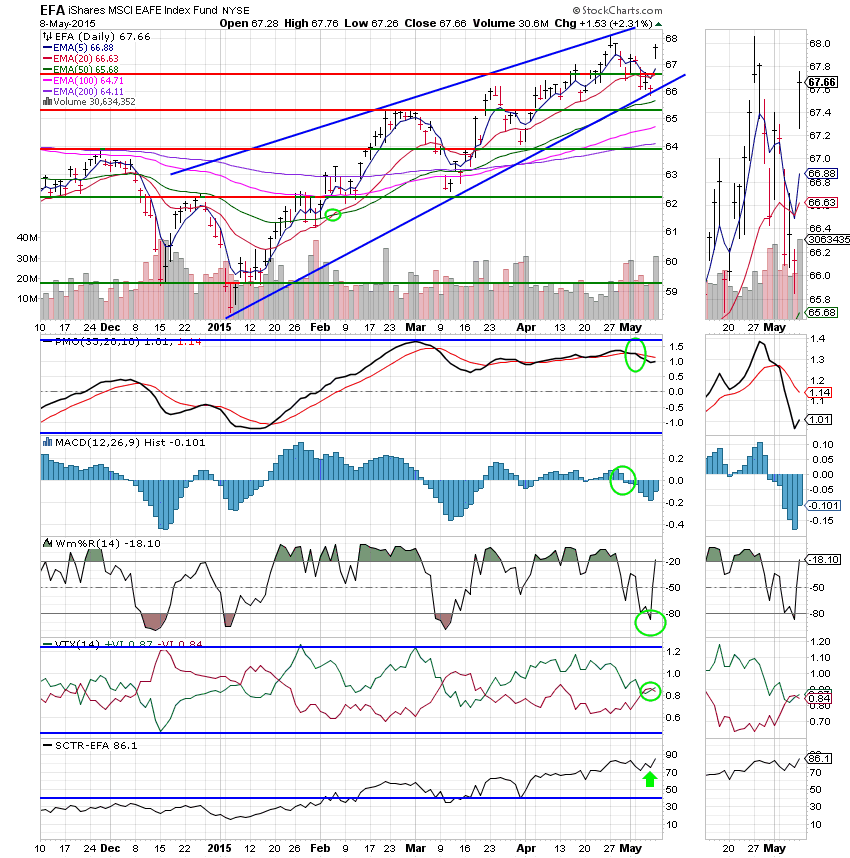

The jobs report we talked about yesterday was promptly released at 8:30 AM ET this morning and it hit the sweet spot that the market was looking for. By the time the market opened, the futures had gaped up by triple digits and that turned out to be the lows for the day. I thought there would be some profit taking this afternoon, but that simply wasn’t going to happen. The under-invested bulls were worried about being left behind. In addition, we received a lot of tail wind from the election results in the UK where David Cameron’s conservative party came out on top. Speaking of international things, we have discussed the I Fund a lot in recent blogs. There seems to be a large contingent of people who refuse to embrace its recent success. Most of them prefer the S Fund…. One thing to keep in mind about this and other investments is that just because an investment is not working today, doesn’t mean it will never work. You keep it in your tool bin for a time when you’ll need it and that time is now for the I Fund!

It’s funny how things reverse over time. I can remember around 2002 when everybody wanted to be in the I Fund and nobody wanted to be in the S Fund. The chart for the S Fund indicated that it was really starting to take off so I allocated a lot of money there. At times I even went 100/S. I had the same issues then convincing people that the S Fund was good to go that I am having now telling people that the I Fund is working. Conditions change and investments change with them! There are a lot of factors that are making the I fund desirable in 2015, but the two main ones are the recent weakening of a strong dollar added to European and Chinese Quantitative Easing. If those issues plus the charts don’t convince you then I’ll tell you the same thing I told one of my critics when we talked about the I fund this afternoon. They asked again why I was bullish on the fund. Since the charts and fundamentals didn’t convince them, I told them I was bullish on the I Fund because it was up close to 2.4% on the day. The moral of the story is go with what is working, not necessarily just with what you think should be working. Enough said!

The day’s rally left us with the following results: Our TSP allotment gained a gaudy (Hold Your Breath) +1.876% on the day! For comparison, the Dow was up +1.49%, the Nasdaq +1.17%, and the S&P 500 +1.35%. Some days you just nail it and with God’s help that’s what we did today! Give Him all the praise for He and He alone is worthy!!!!

Stocks leap as Wall Street lauds jobs growth

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allotment is now +3.41% on the year, but that does not include today’s gains. Here are the latest posted results:

| 05/07/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7127 | 16.9248 | 27.7462 | 37.7665 | 26.3428 |

| $ Change | 0.0008 | 0.0422 | 0.1114 | 0.1858 | -0.2328 |

| % Change day | +0.01% | +0.25% | +0.40% | +0.49% | -0.88% |

| % Change week | +0.03% | -0.28% | -0.89% | -0.48% | -0.89% |

| % Change month | +0.04% | -0.65% | +0.19% | +0.23% | -1.16% |

| % Change year | +0.66% | +0.73% | +2.14% | +4.05% | +8.77% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6902 | 23.4958 | 25.5906 | 27.3067 | 15.5503 |

| $ Change | 0.0067 | 0.0076 | 0.0116 | 0.0170 | 0.0076 |

| % Change day | +0.04% | +0.03% | +0.05% | +0.06% | +0.05% |

| % Change week | -0.16% | -0.41% | -0.54% | -0.61% | -0.69% |

| % Change month | -0.04% | -0.12% | -0.15% | -0.17% | -0.19% |

| % Change year | +1.37% | +2.61% | +3.16% | +3.52% | +3.96% |

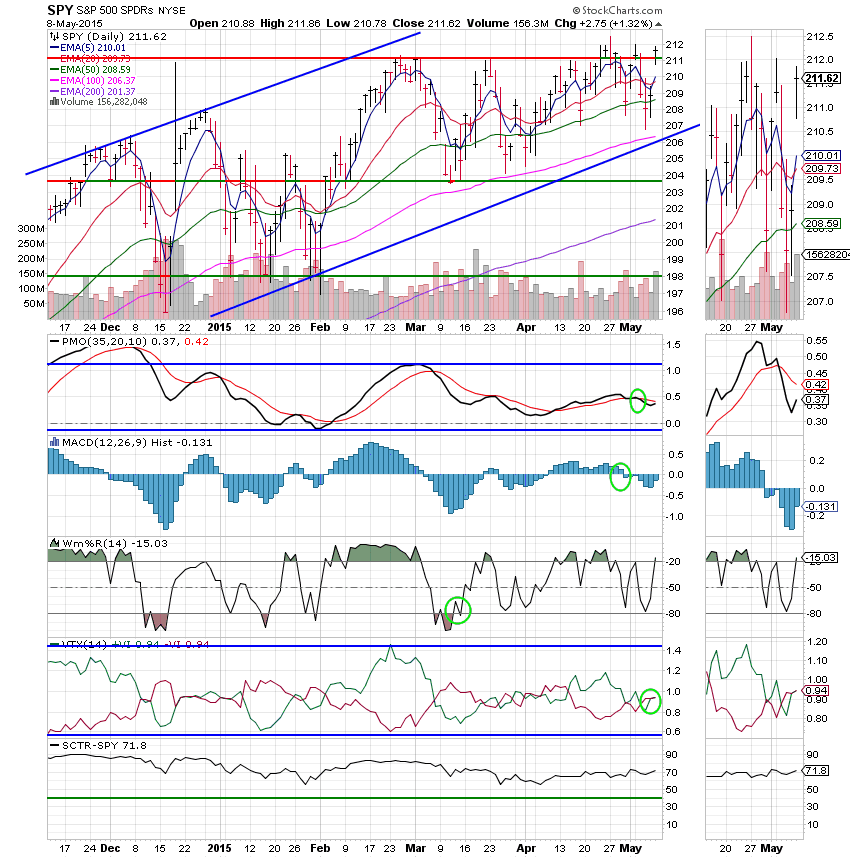

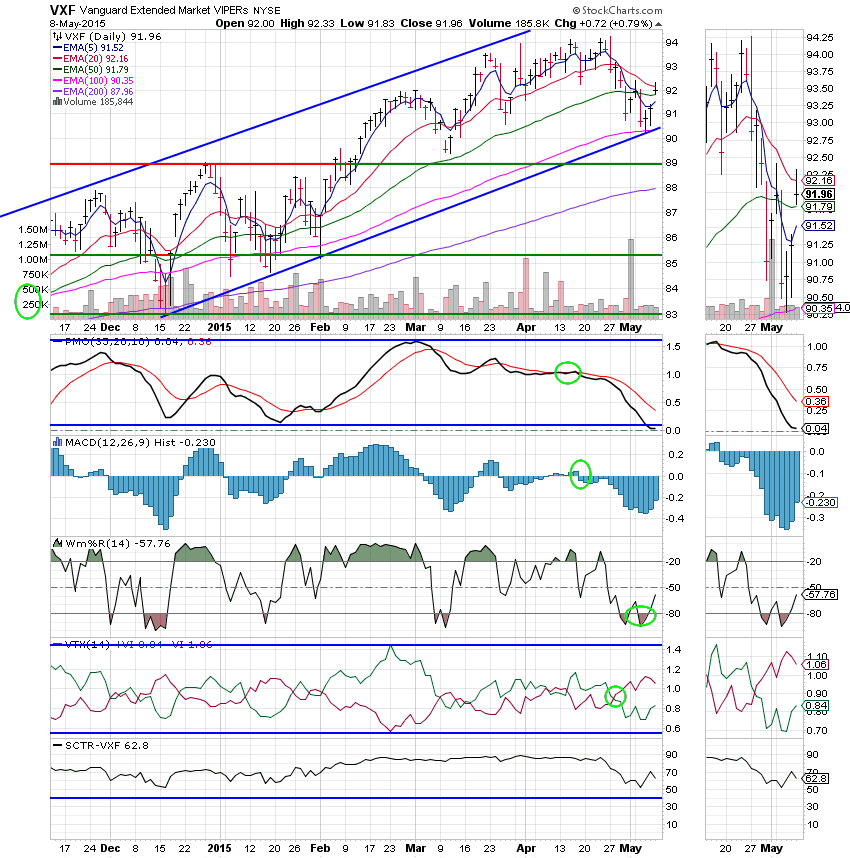

Let’s hit the charts:

C Fund: Price closed above its 20 EMA and above resistance near 211. All indicators improved and are moving toward a buy signal if price holds up.

S Fund: While the S Fund managed a decent gain today, small caps lagged in performance as compared to the rest of the market. Price managed to regain its 20 EMA so a sell signal is definitely off the table for now. The Williams %R continued higher and still has a lot of room to run. This fund repaired some damage today, but still has a lot of work to do. One area of concern is a dropping SCTR. This is actually a ranking as compared to the S Funds peers. It has dropped and is now at 62.8, indicating that there may be better places to put your money at this time. That does not mean that this fund will lose money. Only that it may not make as much as its peers. I do not use the SCTR as a buy/sell indicator, although I will sell a chart and buy another one if it falls below forty. That said, I normally only use it as a tool to determine how many funds I will allocate to a particular position.

I Fund: Wow, what a day. Price regained its 20 EMA .closed above resistance and moved back into the middle of the ascending wedge! The VTX went positive and all other indicators strengthened on the day. An SCTR of 86.1 supports our allocation of 63% to this fund!

F Fund: Bonds jumped today as traders anticipated that interest rates would stay low for a while longer. Price regained its 100 EMA and the Williams %R turned up, indicating that the F Fund will probably make a short term run.

That said, this fund has a lot of work to do before I would consider allocating any funds here. We’ll keep it in our tool box for another day.

God blessed us with another wonderful day. Our analysis was solid and our allocation is working well. We’ll keep an eye on our charts and see how far this run will take us. After a one day run up this big, I would expect some consolidation on Monday. Have a great weekend!

God bless,

Scott![]()

***Just a reminder that you can review the performance of our allocation at the website TSPTALK.com in the autotracker section under the screen name KyFan1.