Good Evening,

Today the market dropped and the media reported that investors were reacting to more Greek drama? Really? This is yet another example of news written to match the market results. The real deal is that the market had a big run up on Friday and consolidated today. It continues to struggle against overhead resistance as it has not had a real correction in over three years. Like them or not, corrections create opportunity and this has been a market of limited opportunity in their absence. Expect more of the same until this market corrects or should I say until the Central Bankers allow it to correct. Back in the fall I wrote that a 5% return would be a good return in 2015 and I’m sticking to it.

Today’s action left us with the following results: Our TSP allotment closed down -0.676% on the day. For comparison, the Dow lost -0.47%, the Nasdaq -0.20%, and the S&P 500 -0.51%. I thank God that we were able to hang onto most of our gains from Friday!

Wall Street ends down on global jitters; oil stocks lower

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allocation is now +4.99% on the year not including the day’s results. Here are the latest posted results:

| 05/08/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7135 | 16.9603 | 28.1198 | 38.0729 | 26.8024 |

| $ Change | 0.0008 | 0.0355 | 0.3736 | 0.3064 | 0.4596 |

| % Change day | +0.01% | +0.21% | +1.35% | +0.81% | +1.74% |

| % Change week | +0.04% | -0.07% | +0.44% | +0.33% | +0.84% |

| % Change month | +0.04% | -0.45% | +1.54% | +1.05% | +0.56% |

| % Change year | +0.66% | +0.94% | +3.51% | +4.89% | +10.67% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7414 | 23.6622 | 25.8216 | 27.5863 | 15.7307 |

| $ Change | 0.0512 | 0.1664 | 0.2310 | 0.2796 | 0.1804 |

| % Change day | +0.29% | +0.71% | +0.90% | +1.02% | +1.16% |

| % Change week | +0.13% | +0.29% | +0.36% | +0.40% | +0.46% |

| % Change month | +0.25% | +0.58% | +0.75% | +0.86% | +0.96% |

| % Change year | +1.67% | +3.33% | +4.09% | +4.58% | +5.16% |

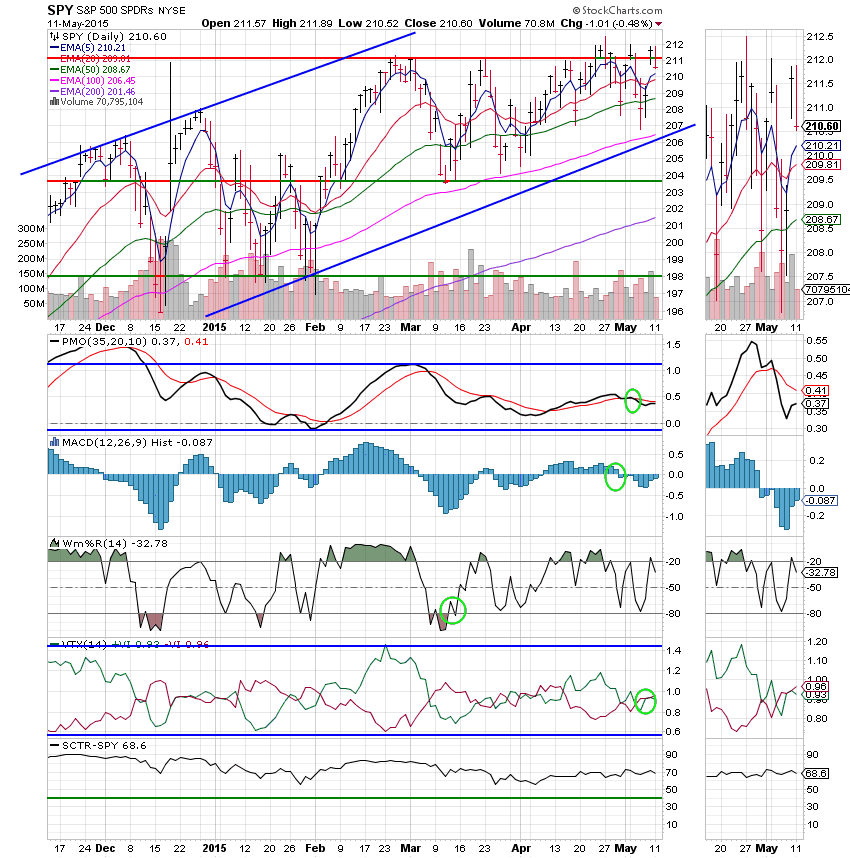

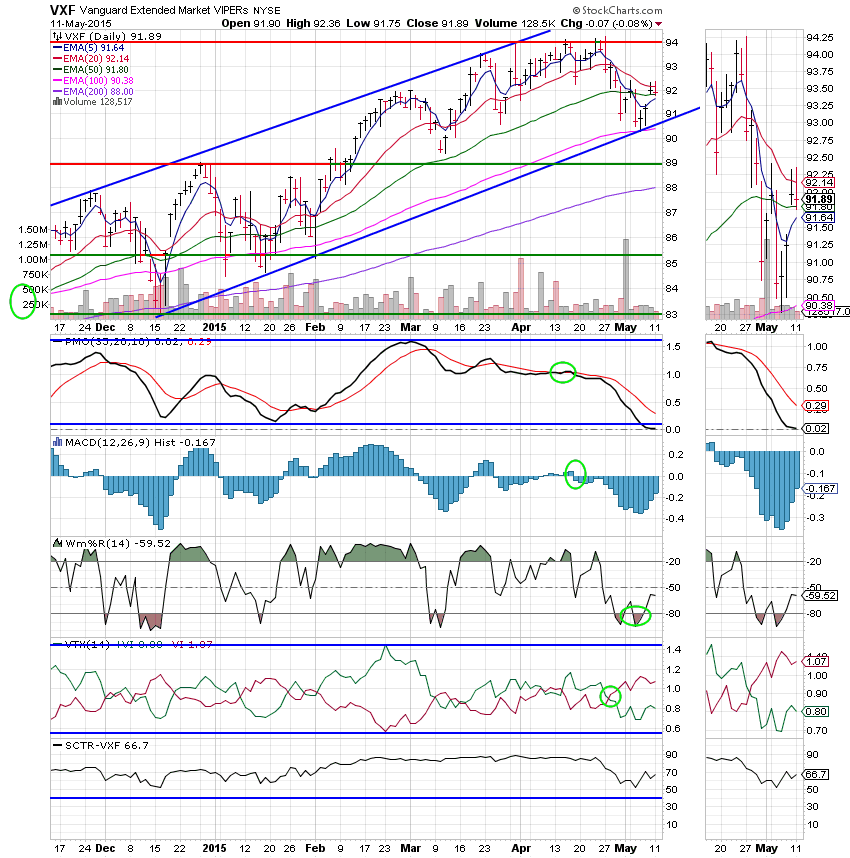

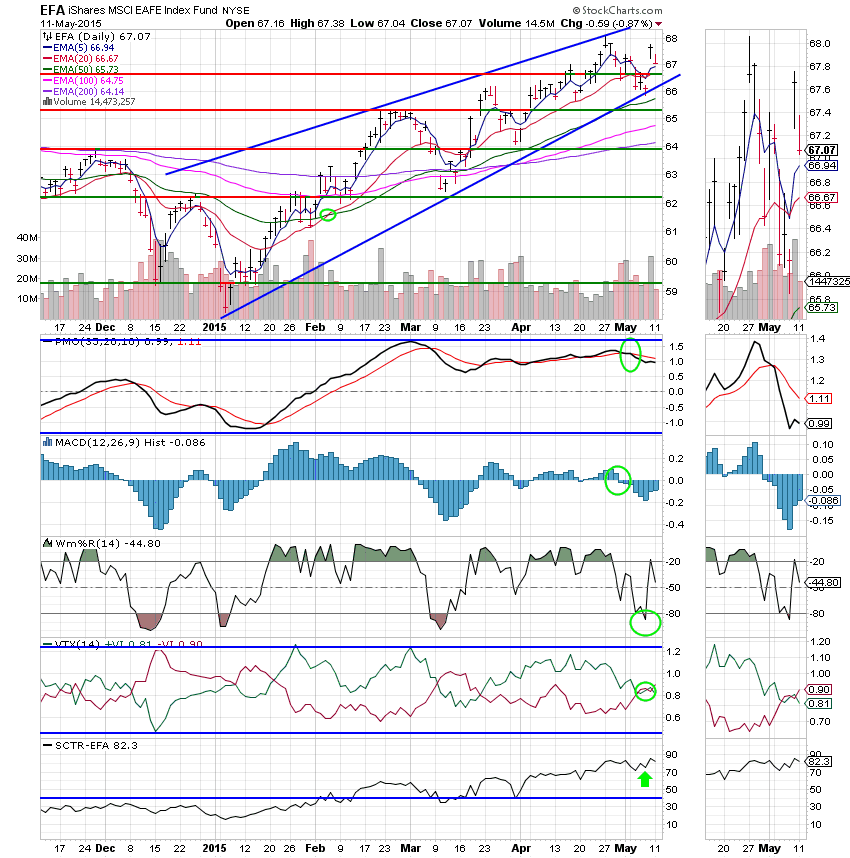

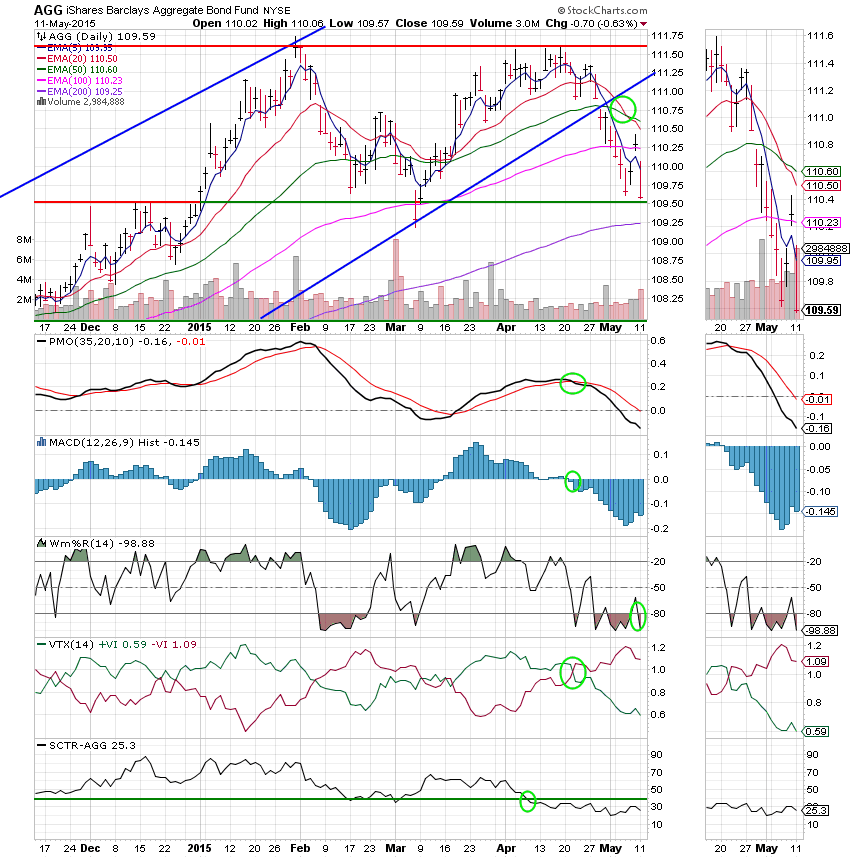

Let’s take a look at the charts.

C Fund: Priced dropped back below support but still remains above its 20 EMA.

S Fund: Price remains under the 20 EMA but over the 50 EMA. The rest of the indicators remain unchanged with the exception of the SCTR which is slowly drifting up. This indicates that the S Fund is starting to perform better as compared to other funds and stocks in its class.

I Fund: Price dropped today, but is still over its 5 EMA as well as support at 66.70. It also managed to hang onto over half of Friday’s gains. For the most part, the remainder of the indicators remain unchanged.

F Fund: Today price put in a lower low and is now challenging support at 109.50. The sell signal that was generated a few days back has been verified by continued weak action. All indicators are heading lower showing that bonds haven’t bottomed just yet.

There’s really not much to write about. The action continues to remain choppy as we thought it would be and I expect to see more of the same. That’s all for tonight. May God continue to bless your trades.

God bless,

Scott![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.