Good Evening,

There was still some lingering concern about interest rates and the market started off with a pretty good drop in the morning but eased up in the afternoon as bond yields dropped on the day somewhat relieving those concerns. The dip buyers are always looking for an excuse to give it a go since they have become so accustomed to v-shaped recoveries that they automatically look at each sell off as a buying opportunity. Only a few of us old fashioned guys still fear a loss because we can actually remember one. I got news for all you: I still think it’s possible for the market to take a good old fashioned thrashing. So I’ll stick with a novel concept. If and when I get a sell signal, I will sell and ask questions later…..

The day’s action left us with the following results: Our TSP allotment slipped back -0.134% on the day. For comparison, the Dow dropped -0.20%, the Nasdaq -0.35%, and the S&P 500 -0.29%. I’d much rather see a gain, but at least we did out perform the big three. I thank God for that.

Wall St. ends weaker as global bond worries deepen

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allocation is now +4.84% for the year not including the day’s results. Here are the latest posted results:

| 05/11/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7159 | 16.8668 | 27.9824 | 38.0454 | 26.7948 |

| $ Change | 0.0024 | -0.0935 | -0.1374 | -0.0275 | -0.0076 |

| % Change day | +0.02% | -0.55% | -0.49% | -0.07% | -0.03% |

| % Change week | +0.02% | -0.55% | -0.49% | -0.07% | -0.03% |

| % Change month | +0.06% | -0.99% | +1.05% | +0.97% | +0.53% |

| % Change year | +0.68% | +0.39% | +3.01% | +4.82% | +10.64% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7266 | 23.6228 | 25.7675 | 27.5217 | 15.6914 |

| $ Change | -0.0148 | -0.0394 | -0.0541 | -0.0646 | -0.0393 |

| % Change day | -0.08% | -0.17% | -0.21% | -0.23% | -0.25% |

| % Change week | -0.08% | -0.17% | -0.21% | -0.23% | -0.25% |

| % Change month | +0.17% | +0.42% | +0.54% | +0.62% | +0.71% |

| % Change year | +1.58% | +3.16% | +3.88% | +4.33% | +4.90% |

Now let’s hit the charts.

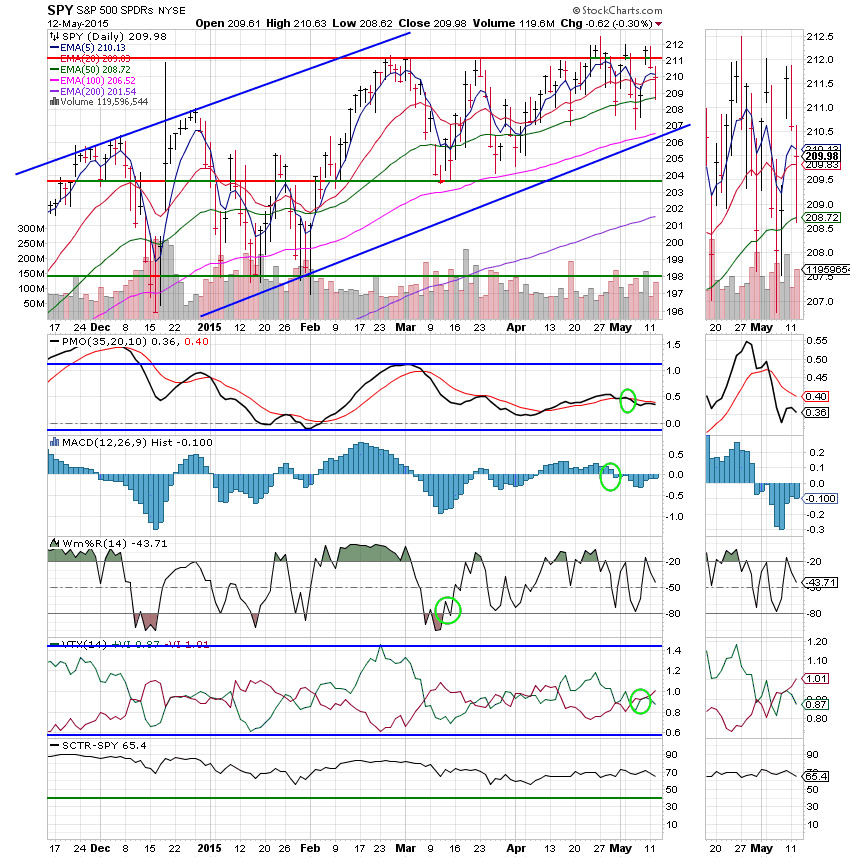

C Fund: Price finished under its 5 EMA today, but still remains above its 20 EMA. It’s holding up well considering the current dip!

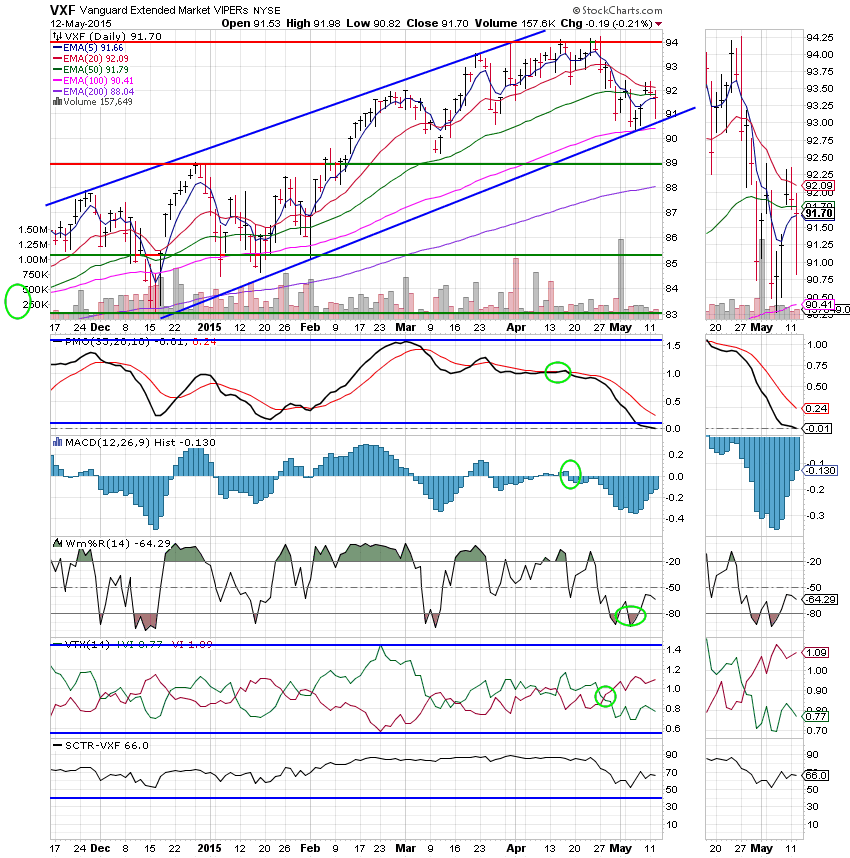

S Fund: Price is once again below its 50 EMA. However. the 20 EMA is sufficiently high enough over the 50 EMA that there is no danger of a sell signal at this time. The SCTR is hanging in there at 66.0….

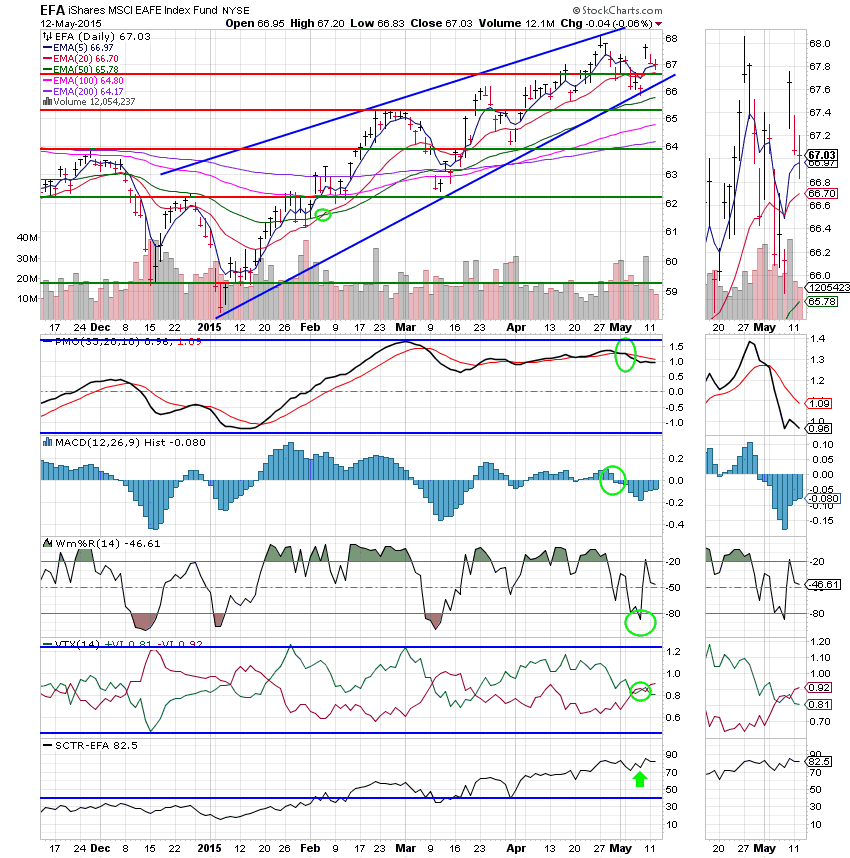

I Fund: The I Fund is also holding up well during the current dip. Price is still at its 5 EMA keeping the uptrend well intact. The SCTR also remains strong at 82.5!

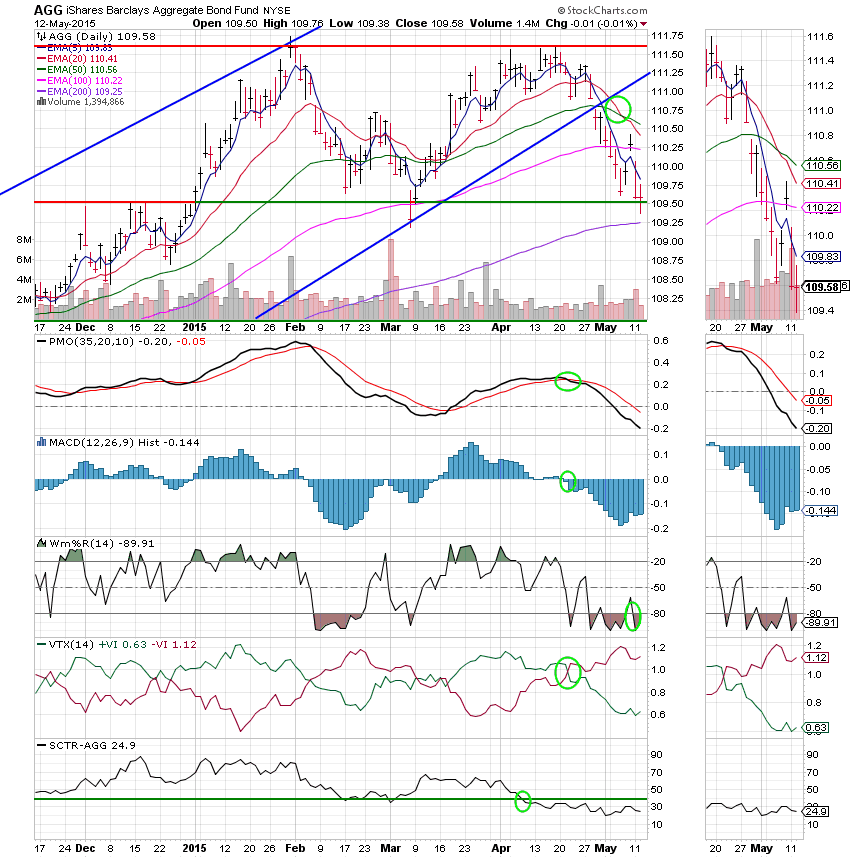

F Fund: The SCTR has dropped to a pitiful 24.9. Nothing else needs to be said……….

Price closed back up well off its lows today so perhaps well see some uphill action tomorrow. That said, as long as this market remains at or near all time highs, expect it to be a slow slog. We’ll keep our eyes on the charts and play the action that’s before us.

God bless and have a great evening!

Scott ![]()