Good Evening,

The market traded flat for most of the day on some less than stellar economic data, but ended the day with a slightly positive bias. The S&P 500 managed to set a new record by the thinnest of margins with a gain of just +0.08% on the day. All in all, it’s been a good week though, so I won’t complain. I’ll always take a small gain over a loss any day!

The day’s trading left us with the following results: Our TSP allotment managed a small gain of +0.115% on the day. For comparison, the Dow gained +0.11%, the Nasdaq slipped back -0.05%, and as I mention earlier the S&P 500 eked up another +0.08%. It’s been a good week. We made some nice gains and were able to hang on to all of them. Give God the Praise for He continues to guide our hand!

S&P 500 sets record despite weak data; Netflix leaps 4.5%

The week’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allotment is now +5.87% on the year, not including today’s results. Here are the latest posted results:

| 05/14/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7183 | 16.8925 | 28.2034 | 38.3259 | 27.0934 |

| $ Change | 0.0008 | 0.0305 | 0.3039 | 0.3566 | 0.1081 |

| % Change day | +0.01% | +0.18% | +1.09% | +0.94% | +0.40% |

| % Change week | +0.03% | -0.40% | +0.30% | +0.66% | +1.09% |

| % Change month | +0.08% | -0.84% | +1.84% | +1.72% | +1.65% |

| % Change year | +0.70% | +0.54% | +3.82% | +5.59% | +11.87% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.761 | 23.7312 | 25.9184 | 27.7054 | 15.8098 |

| $ Change | 0.0343 | 0.1051 | 0.1478 | 0.1821 | 0.1156 |

| % Change day | +0.19% | +0.44% | +0.57% | +0.66% | +0.74% |

| % Change week | +0.11% | +0.29% | +0.37% | +0.43% | +0.50% |

| % Change month | +0.36% | +0.88% | +1.12% | +1.29% | +1.47% |

| % Change year | +1.78% | +3.64% | +4.48% | +5.03% | +5.69% |

Let’s see how the charts look for the week.

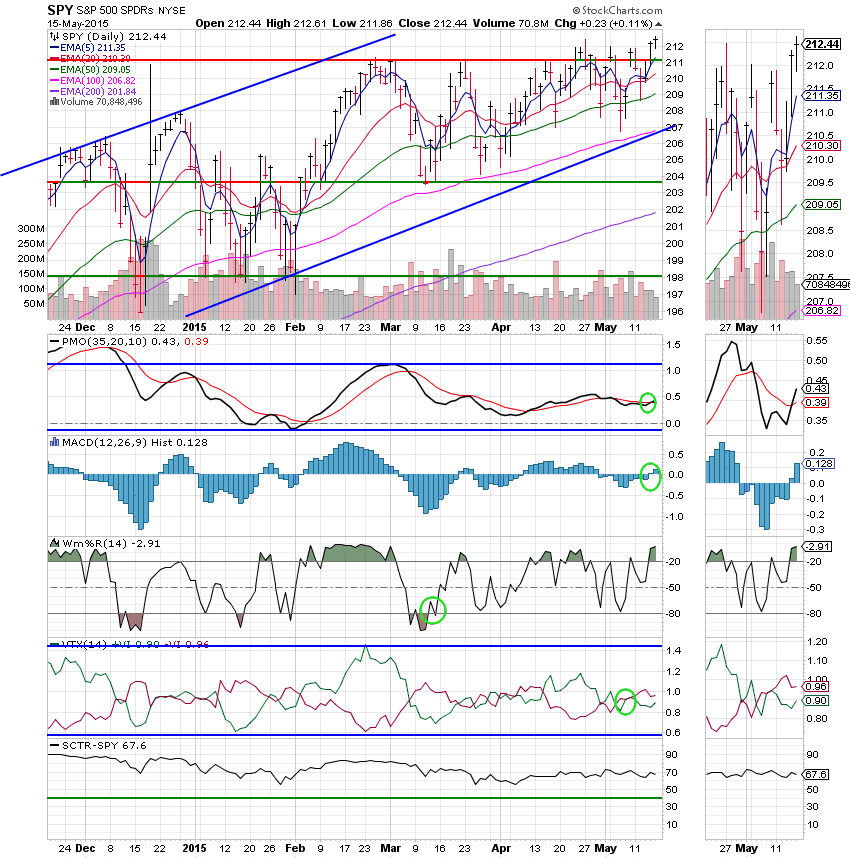

C Fund: Price maintained its place, as did the rest of the chart. This one continues with its buy signal.

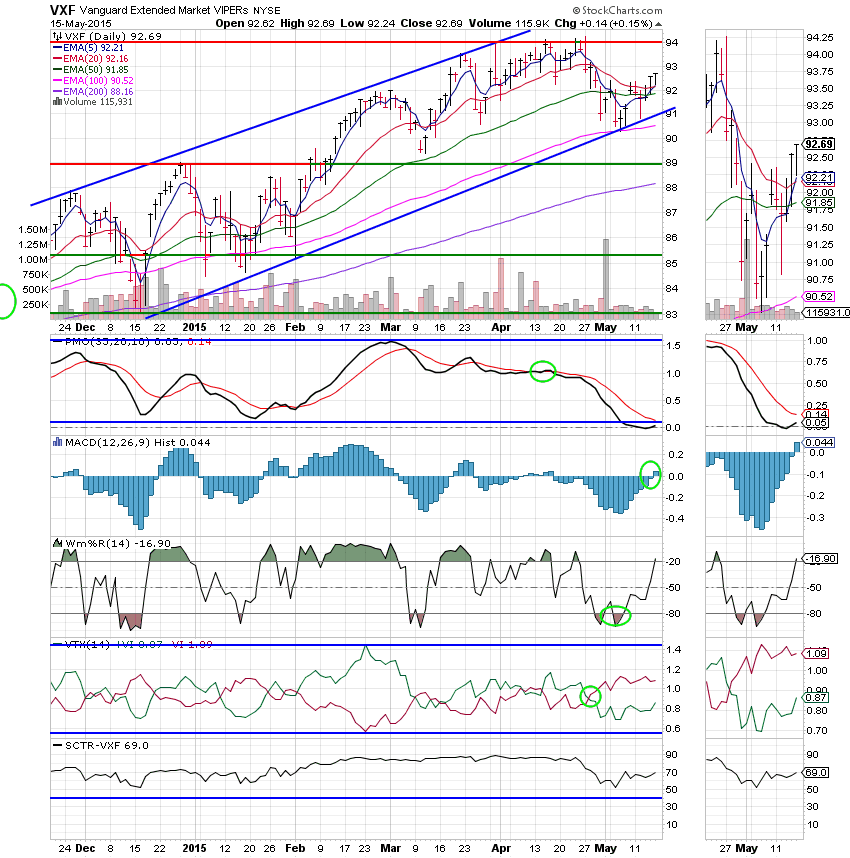

S Fund: Price held its ground above its 20 EMA. This chart continues to improve with the MAC D going positive today but still has a little work to do before it can generate an overall buy signal.

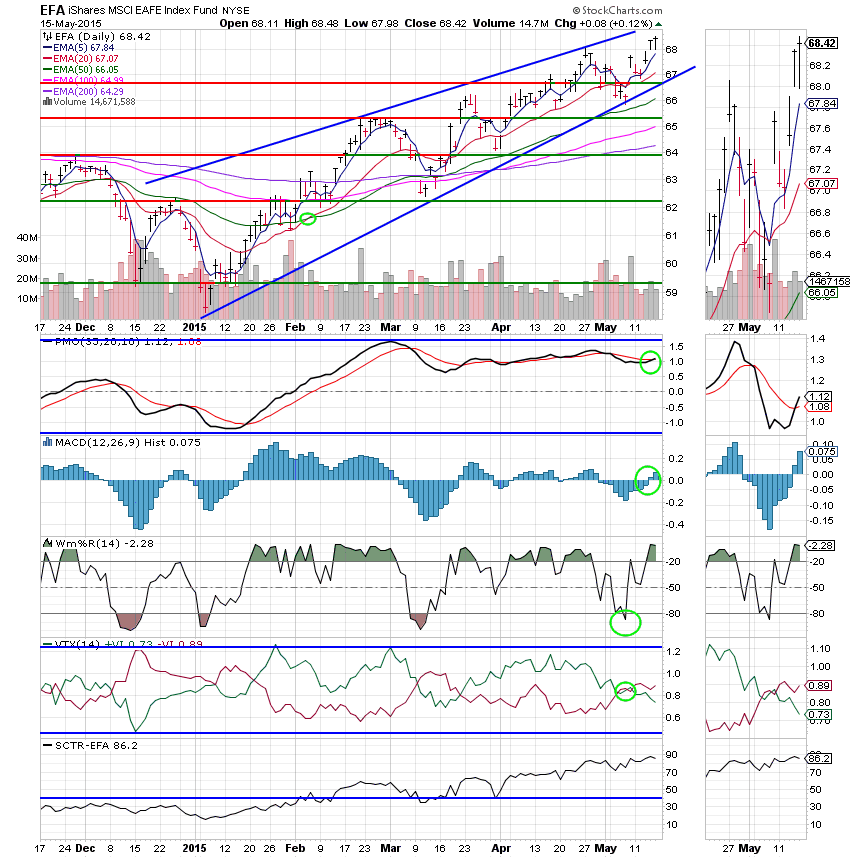

I Fund: The I Fund remains consistent as it keeps rolling on. Price continues moving up the ascending wedge. I expect this pattern to eventually resolve to the upside. Other than a little weakness in the VTX, this is a solid chart!

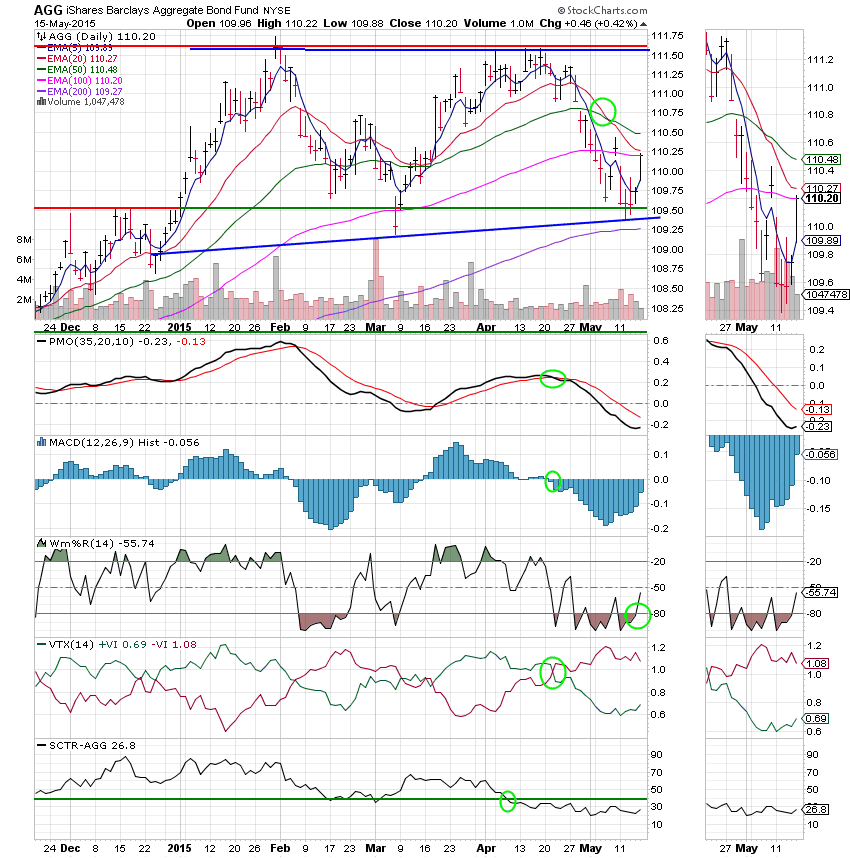

F Fund: Bonds had a nice bounce today. So is this the bottom? Price regained its 100 EMA, but still has a bunch of work to do to repair all the recent damage. The Wms%R has turned up and indicates that there is probably a little more upside in the short term. However, it’s the long term that I’m worried about and this chart has a long way to go to reestablish a long-term up trend. On the fundamental side of things, it sure looks like a lot of money moved out of bonds and into stocks. So where do you want to be???

It’s been a great week. As I mentioned earlier, we made some nice gains and held onto all of them. That’s the name of the game. Our allotment is more than competitive, which is more what this group has been accustomed to. God has always been faithful to us. Be sure and give Him thanks tonight. For now we’ll keep watching our charts and ride this wave as far as we can. Have a great weekend.

God bless,

Scott![]()