Good Evening,

I can’t say that it was an exciting day, but I’ll definitely take it. The market started the morning slightly in the green and quietly moved up on low volume to post modest gains on the day. The media is saying that traders were convinced by a slightly worse than expected weekly government jobless claims report that there will be no interest rate increases until later in the year (I told you this interest rate thing would go on and on…). The bears are saying that there is no conviction in a move up with low volume, but that argument hasn’t worked in a long time. This market has been rising on low volume since 2009. I’m sure that if and when it deeply corrects that there will be several pundits that will say I told you so. That’s kind of like saying it’s going to rain. The next time it rains I can say I told you so. Nevertheless, if you live in California you may have some more drought to go before that time comes….. The bottom line is this: We are currently in an established uptrend and the market is slowly inching higher. Even though it lacks enthusiasm, it is foolish to fight this trend. It may be slow, but it’s going up and we should definitely stick with it as long as we can.

The day’s action left us with the following results. The I Fund came through for us today and our TSP allotment made a nice gain of +0.408%. For comparison, the Dow broke even at 0.00%, the Nasdaq added +0.38%, and the S&P 500 rose to another new record with a gain of +0.23%. The bears keep saying it can’t be done and all the while we keep setting records. The trend is your friend! I thank God for the successful year that our group is having so far. May he continue to guide our hand!

S&P ends at all-time highs but traders eye weak volume

The day’s action left us with the following results: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 23/C, 14/S, 63/I. We will check the balance of our allocation on the 26th and re-balance at that time if necessary. Our allocation is now +5.99% on the year not including today’s gains. Here are the latest posted results:

| 05/20/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7231 | 16.8788 | 28.2805 | 38.6579 | 27.0612 |

| $ Change | 0.0008 | 0.0048 | -0.0233 | 0.0341 | 0.0355 |

| % Change day | +0.01% | +0.03% | -0.08% | +0.09% | +0.13% |

| % Change week | +0.03% | -0.51% | +0.18% | +0.75% | -0.49% |

| % Change month | +0.11% | -0.92% | +2.12% | +2.60% | +1.53% |

| % Change year | +0.73% | +0.46% | +4.10% | +6.51% | +11.74% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7739 | 23.7637 | 25.9651 | 27.7662 | 15.8479 |

| $ Change | 0.0009 | 0.0021 | 0.0028 | 0.0037 | 0.0025 |

| % Change day | +0.01% | +0.01% | +0.01% | +0.01% | +0.02% |

| % Change week | +0.01% | +0.02% | +0.04% | +0.06% | +0.07% |

| % Change month | +0.43% | +1.02% | +1.31% | +1.51% | +1.72% |

| % Change year | +1.85% | +3.78% | +4.67% | +5.26% | +5.95% |

Let’s take a look at the charts. After all, that’s really what it’s all about anyway!

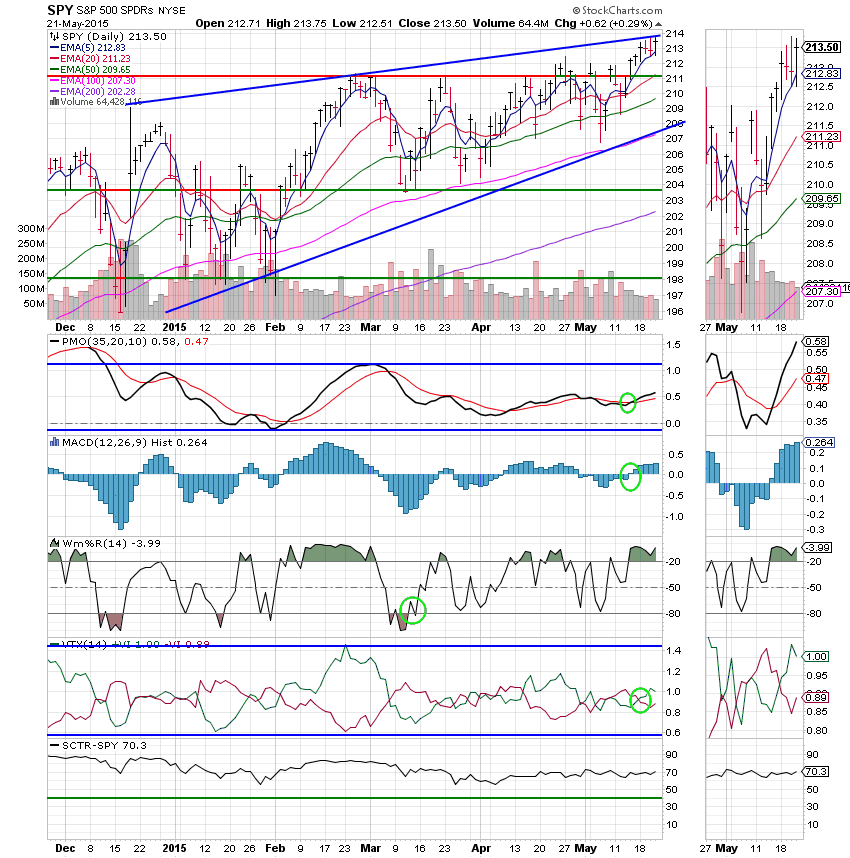

C Fund: Price was repelled after challenging the upper trend line, but still finished with a respectable gain. All indicators are currently stable and in positive configurations.

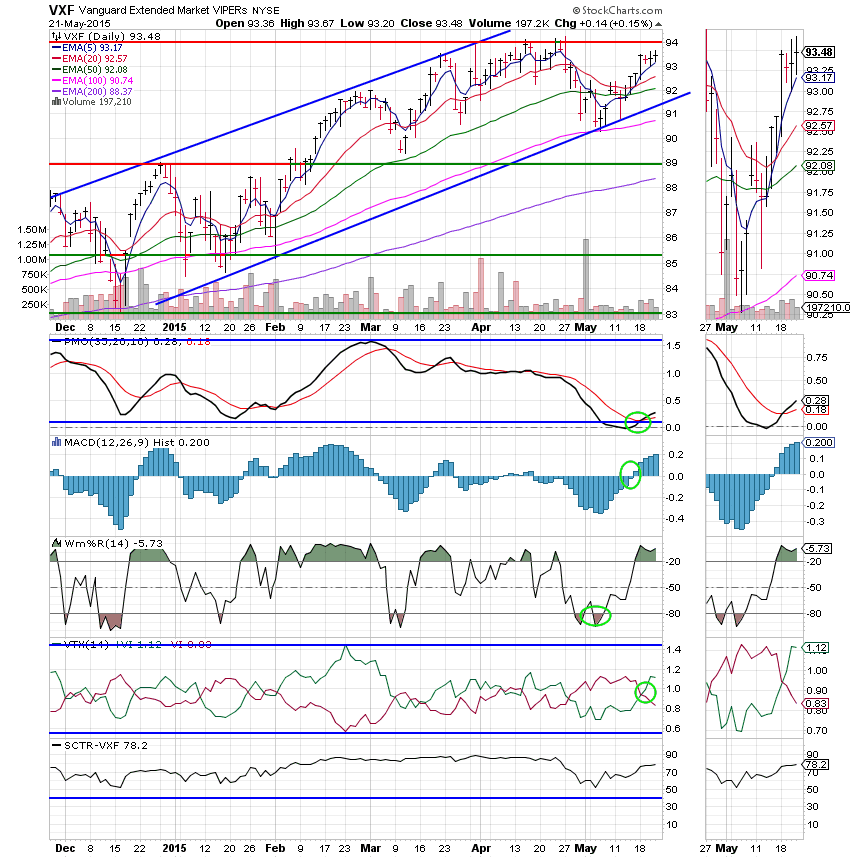

S Fund: Price is slowing as it approaches resistance at 94. We will watch carefully to see if price can take out this key area of resistance. All indicators are stable at this time.

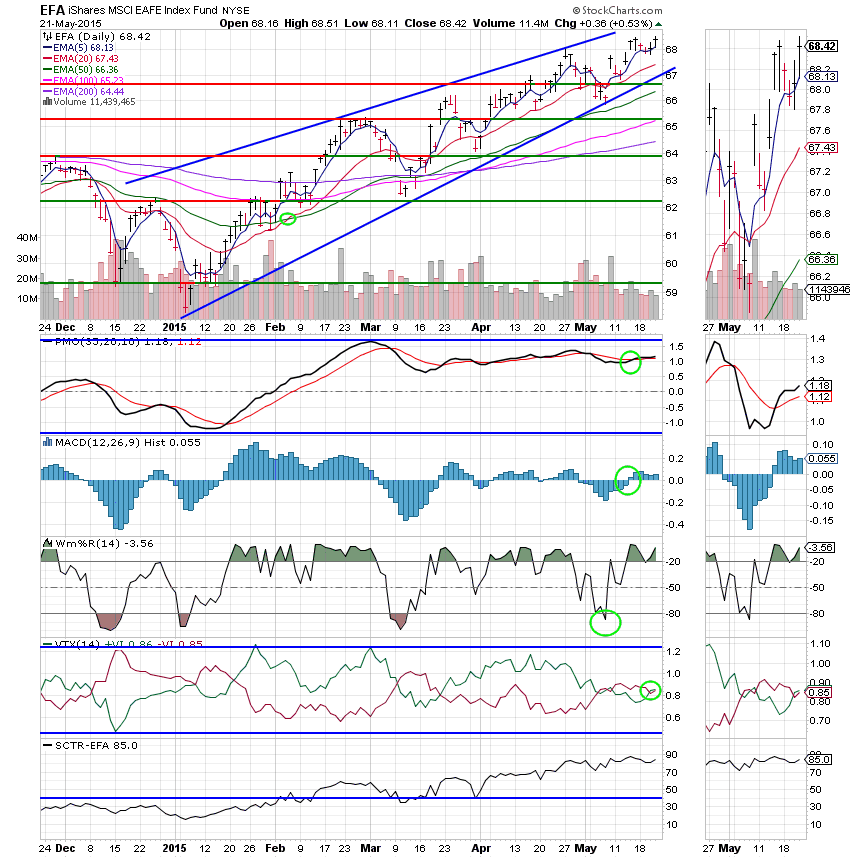

I Fund: Price continues to move up the bullish ascending wedge. As you can probably guess from the name of the pattern, I expect it to resolve to the upside. We will know for sure if and when it executes. I would be amiss not to say that occasionally these patterns can resolve downward. However, I will be surprised if this one does. All indicators are strengthening and the SCTR remains very strong at 85.

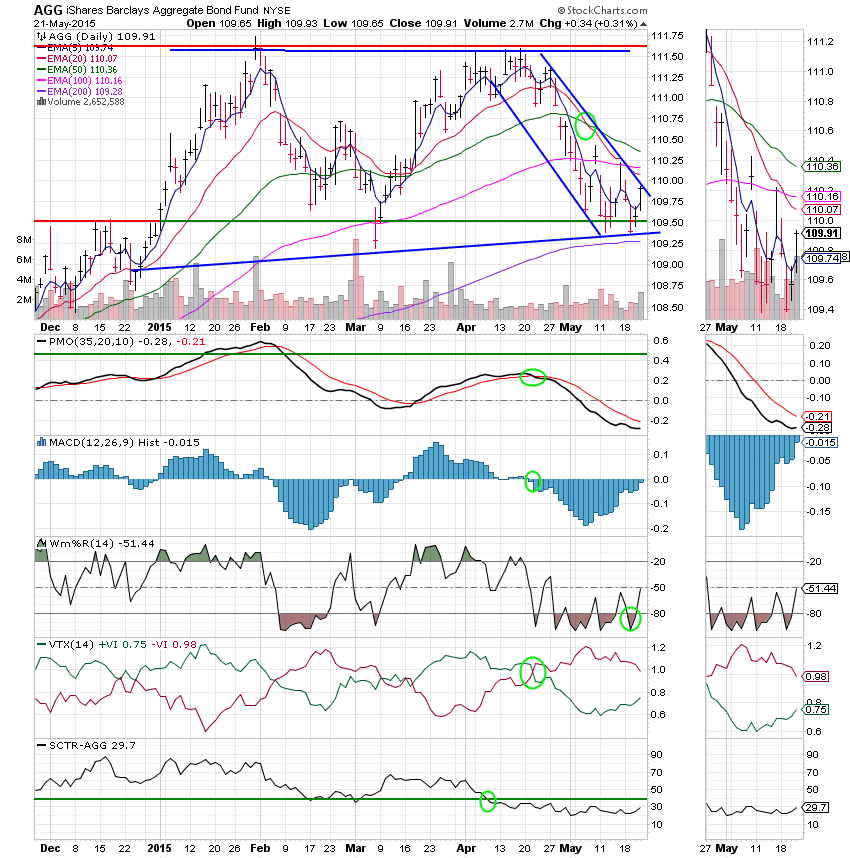

F Fund: Price continued to move up after testing the lower trend line in the 109.30 area. I have drawn some short term trend lines for the current down trend. It would be a good sign for the F Fund if price could pass through the upper descending trend line. We will keep an eye on this area to see if the current down trend can be broken. We’ll also keep an eye on support at close to 109.50. In addition, notice that the Williams %R is moving up signaling that there may be more short-term gains. All that said, I’m not real excited about the F Fund.

The current market pattern is very slowly moving up. As I said at the beginning, I’ll take that every day if I can get it. When you’re making a small move up, you’re keeping everything you made the day before. One of the mantras of this group is “It’s not what you make that matters, it’s what you keep that’s important”. If you’re new to our group you’re going to hear that a lot around here! Anyway, that’s all for tonight. I’ll be on the road tomorrow so I won’t blog unless there’s some type of major catastrophe in the market. It’s pretty much steady as she goes and I expect that the action will be slow tomorrow ahead of the long weekend.

I hope you all have nice plans for a special weekend. I’ll be heading to a big Mopar cruise in Somerset, Kentucky. Most of the folks that have been with me a long time are used to my car stuff, but, for those of you who are not car oriented, Mopars are Chrysler Products. Everybody’s got to have a hobby. Cars and playing bass guitar are mine.

Anyway, I hope all of you find some time to engage in whatever it is that you love to do this weekend! The market will be there when things get started back up on Tuesday. Don’t forget to take a little time to thank God for giving us the opportunity to enjoy the many things that He has provided for us. Also, give Him thanks for all those who currently serve and have served in our military who have sacrificed so much in order that we might have the freedom to do so.

God bless,

Scott![]()