Good Evening, The market started off with some small gains and then reversed to close with losses in the 1 percent range. I’m really not surprised though. The selling put the major indices right back in the middle of the tight range that they have been in since February. Of course the bears are chattering again about how interest rates and global concerns are really going to take us down this time and I will admit that it is possible. However, as long as we stay in this trading range, I’m not going to give the edge to either the bulls or the bears. Tomorrow has the potential to really shake things up with the big jobs report and the Greek situation. Also, we have an OPEC meeting that could issue a decision that will oversupply the oil market for quite some time not to mention volatility in the bond market. I’m betting on another Greece it saved rally. But really, it’s anybodies guess. We could easily make or lose triple digits tomorrow. All we can do is watch the charts and sell if it breaks or hold if it doesn’t. There’s only so many ways I can say that we have to play the action before us. There’s no use to worry about what might happen, it’s a waste of time. With God’s help you just deal with it when it comes!

The days selling left us with the following results: Our TSP allotment closed down -0.942%. For comparison, the Dow lost -0.94%, the Nasdaq -0.79%, and the S&P 500 -0.86%.

Wall St. drops before jobs report; Greece worries linger

The days action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +4.39% on the year. Here are the latest posted results:

| 06/04/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7353 | 16.8359 | 27.9073 | 38.3708 | 26.6115 |

| $ Change | 0.0008 | 0.0503 | -0.2421 | -0.3602 | -0.1869 |

| % Change day | +0.01% | +0.30% | -0.86% | -0.93% | -0.70% |

| % Change week | +0.02% | -0.92% | -0.51% | +0.00% | +0.27% |

| % Change month | +0.02% | -0.92% | -0.51% | +0.00% | +0.27% |

| % Change year | +0.81% | +0.20% | +2.73% | +5.72% | +9.88% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7352 | 23.6101 | 25.7454 | 27.4967 | 15.6723 |

| $ Change | -0.0257 | -0.0940 | -0.1346 | -0.1677 | -0.1090 |

| % Change day | -0.14% | -0.40% | -0.52% | -0.61% | -0.69% |

| % Change week | -0.09% | -0.14% | -0.17% | -0.19% | -0.19% |

| % Change month | -0.09% | -0.14% | -0.17% | -0.19% | -0.19% |

| % Change year | +1.63% | +3.11% | +3.79% | +4.24% | +4.77% |

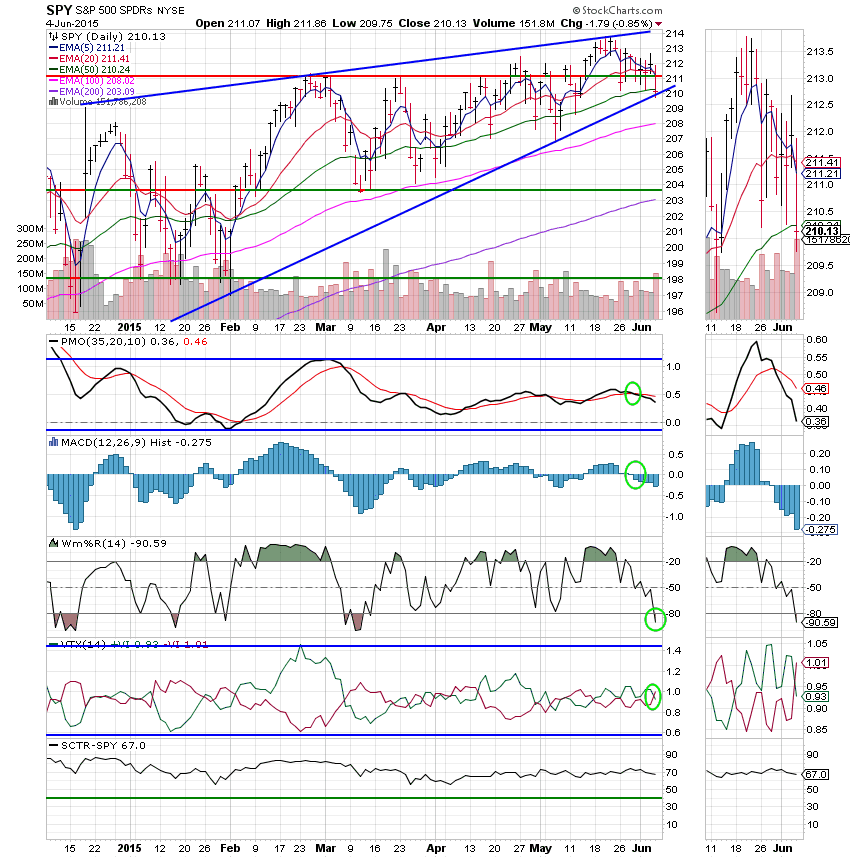

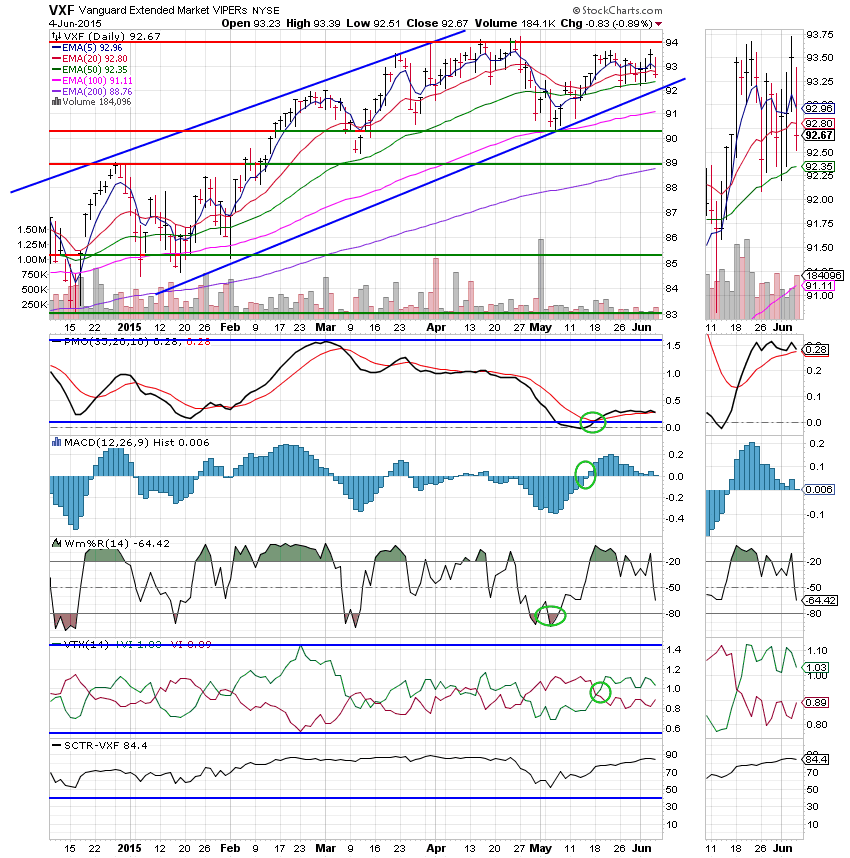

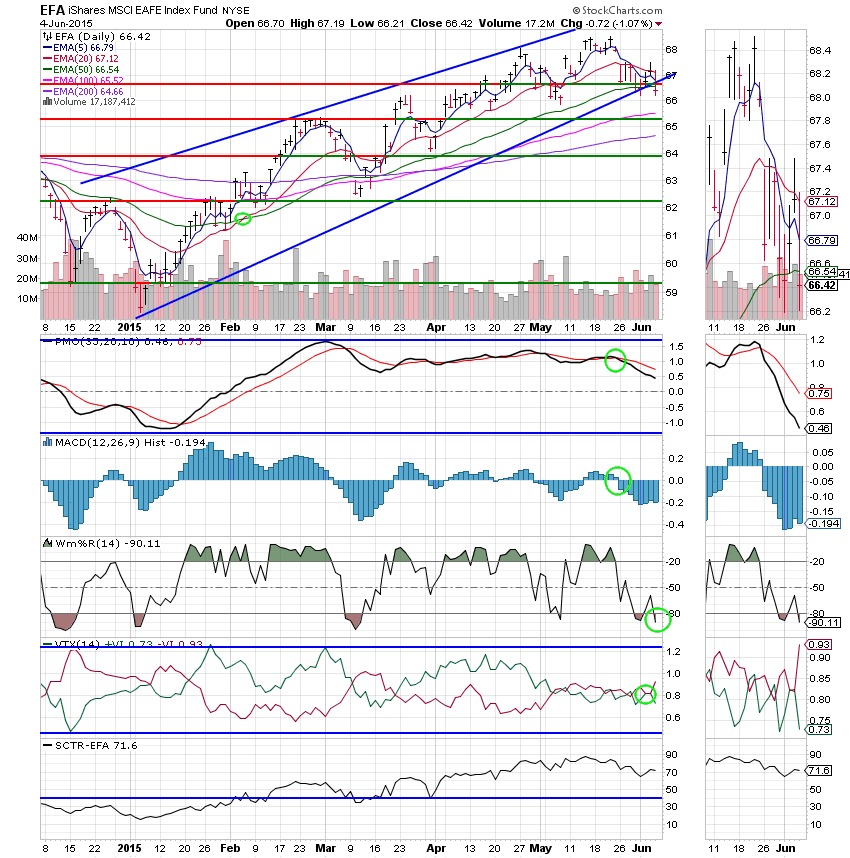

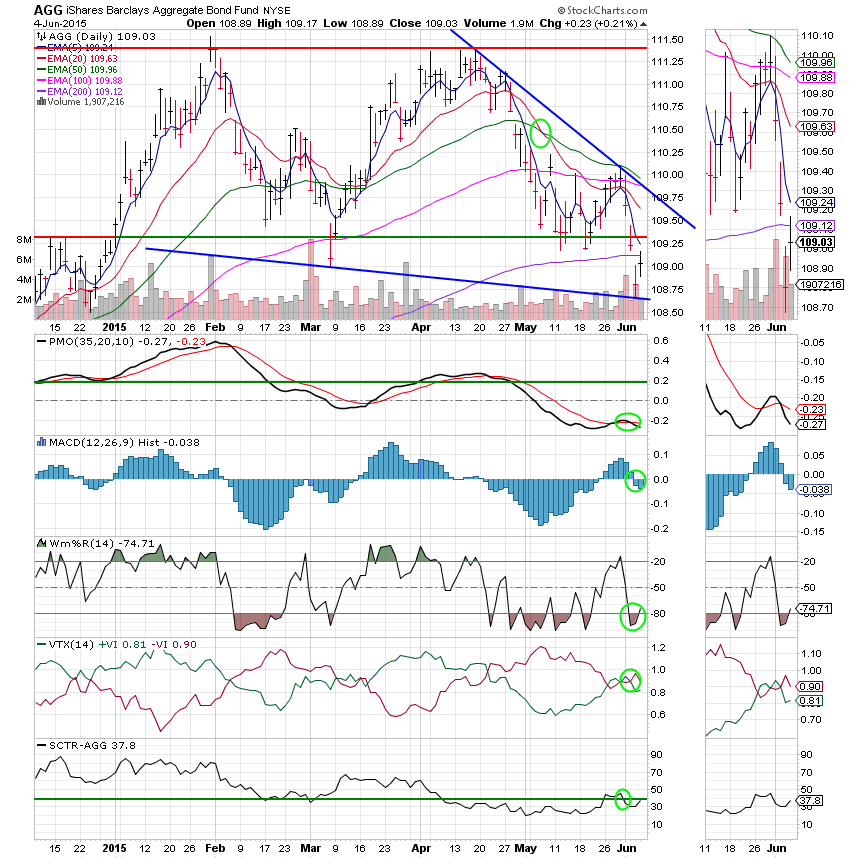

Lets take a look at the charts:

C Fund: Price dropped below support in the 211 area and below it’s 50 EMA. The Williams %R moved into a negative configuration putting all indicators but price on sell. The Williams %R is now oversold so the C Fund may be ready to bounce.

S Fund: Price closed below it’s 20 EMA. The other indicators all weakened, but managed to stay in positive configurations so the S Fund is still on an overall buy signal. The fact that it was able to maintain a buy signal is a testament to it’s recent strength. This strength is reflected by an SCTR of 84.4.

I Fund:Price dropped below it’s 50 EMA and below support at 66.70. The Williams %R whipsawed back into a negative configuration. This chart is an overall neutral signal and has a lot of work to do before it can get back to a buy. On the bright side, it’s starting to get a little oversold and looks primed for a bounce.

F Fund: Price rebounded today, but still remains under it’s 200 EMA. The Williams %R moved back into a positive configuration. Normally, I’d say that is signaling a short term gain, but given the current volatility in the bond market, I’m not really sure how much we can read into this signal. The F Fund is clearly in a downtrend until proven otherwise!

It was a rough day out there, but as I said earlier, I’m not surprised. We’re still in the same trading range and until we break out of it, there will be more of the same. We’ll see if the news tomorrow can break things loose. I’m pretty sure it’s going to be interesting. May God continue to bless your trades. Give Him all the praise for He and He alone it worthy! Have a nice evening.