Good Evening, Again, Greece failed to reach an agreement with it’s creditors this weekend. Again, the market sold off. I have already given my opinion on Greece. So now, the question is where do we go from here? The answer is pretty much the same as it has been. We’ll hang in there as long as our charts will let us do so and then we’ll sell if it becomes necessary to do so. Will we be forced to sell before the end of this Greek crisis? It’s really hard to say. My answer to that is that no one knows. Wednesday’s FOMC meeting could steal the stage from Greece and totally overshadow the news out of Europe. Any hints that the FED gives in regard to the timing of an interest rate increase will be closely followed. Market perception of the FED remarks could wildly swing trading one way or the other. Should both the news from Greece and the FED go against us, we could easily see a correction. If the news is all good, we could see new highs. If Greece and the FED go 1 and 1, we could drift in the same old trading range. It’s really anybodies guess. Today, the dip buyers drove us off the lows yet again. Buying dips has become a routine response to any selling. Many traders just don’t believe the market will fall. There is no real fear of the market since it has been a long time since the bulls have been trapped. However, a more recent characteristic of this market is it’s inability to gain any ground after a bounce. Perhaps the news one Wednesday will be the catalyst that will finally break us from this tight trading range. I know that I like most traders really don’t care which way we go as long as we go somewhere…… Which ever direction that is, with God’s help we’ll deal with it.

Greek angst weighs on Wall Street; health stocks rise

The days trading left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now + 4.44% on the year not including today’s results. Here are the latest posted results.

| 06/12/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7418 | 16.7696 | 27.9025 | 38.6413 | 26.4484 |

| $ Change | 0.0008 | -0.0068 | -0.1948 | -0.1525 | -0.0680 |

| % Change day | +0.01% | -0.04% | -0.69% | -0.39% | -0.26% |

| % Change week | +0.04% | +0.04% | +0.12% | +0.16% | +1.39% |

| % Change month | +0.07% | -1.31% | -0.53% | +0.71% | -0.35% |

| % Change year | +0.86% | -0.19% | +2.71% | +6.46% | +9.21% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7354 | 23.6016 | 25.7344 | 27.4875 | 15.6653 |

| $ Change | -0.0189 | -0.0613 | -0.0862 | -0.1056 | -0.0674 |

| % Change day | -0.11% | -0.26% | -0.33% | -0.38% | -0.43% |

| % Change week | +0.12% | +0.28% | +0.34% | +0.38% | +0.43% |

| % Change month | -0.09% | -0.17% | -0.21% | -0.22% | -0.23% |

| % Change year | +1.63% | +3.07% | +3.74% | +4.20% | +4.72% |

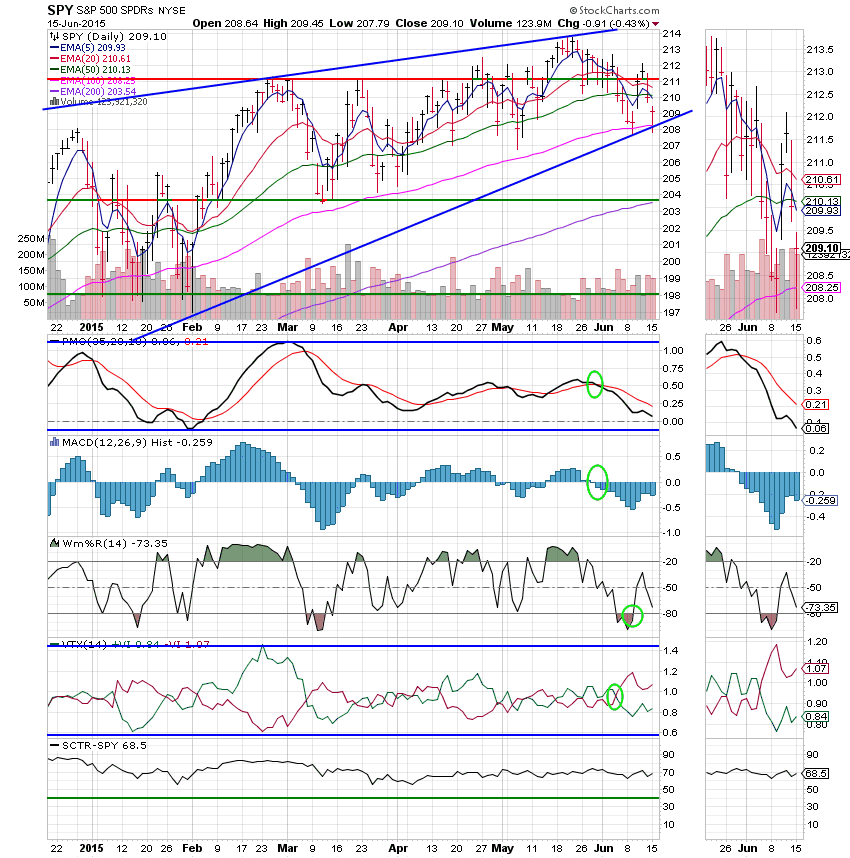

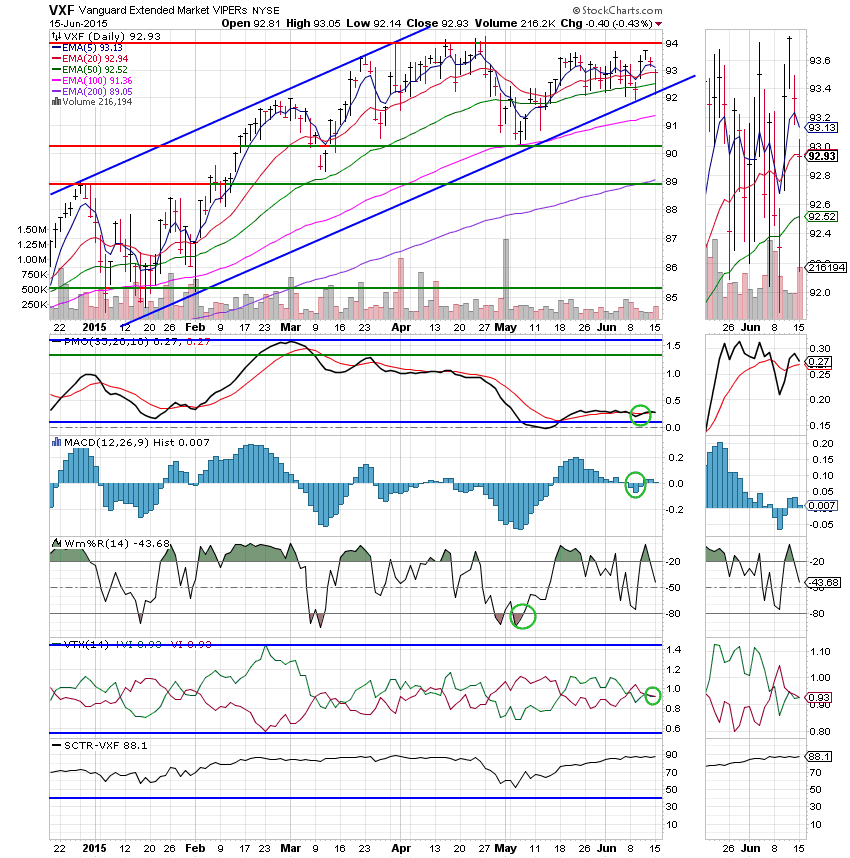

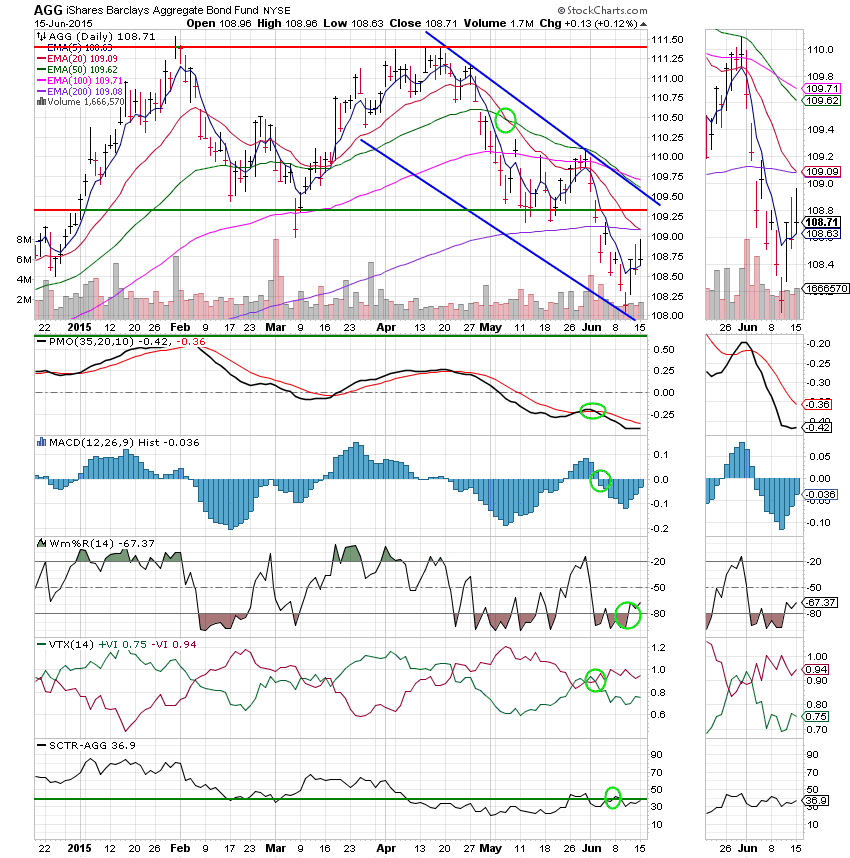

Lets take a look at the charts: (All signals annotated with Green Circles)

C Fund: Price bounced off the lower trend line but still remains below it’s 50 EMA and could generate a sell signal if it stays there long enough.

S Fund: Price Bounced off the lower trend line and closed right on it’s 20 EMA. The afternoon strength was just enough to keep the indicators in positive configurations. A little more weakness and they’ll likely start rolling over.

I Fund: The I Fund continues to weaken as price remains below it’s 50 EMA and is slowly pulling the 20 EMA toward a negative crossover which will likely result in a sell signal for this Fund. The PMO is in a free fall which is bearish. In addition, the remaining indicators also continue to weaken. Right now the I Fund is the weakest of our equity based funds. The SCTR is a relatively strong 72.9 as compared to other funds. In this case, that doesn’t necessarily tell you that this is the place to be as much as that there are worse places to be. In short, it is an overall reflection of the weakness of this market as a whole.

F Fund: Bonds managed a small bounce today. Likely in response to the recent volatility in stocks. The 20 EMA, crossed down though the 50 EMA which is very bearish. The Williams %R is signaling some more short term gains. However, this fund is in an established down trend and has a lot of work to do before that can be reversed. If you feel the necessity to run to a safe haven right now, the G Fund is your best bet.

For now we remain in a narrow trading range as all eyes are on the FED minutes due out at 2 PM ET Wednesday. That’s all for tonight. May God continue to bless your trades. Keep praying for our group!