Good Evening, Today was another example of how this market continues to stick to the post great recession script. Right when your mentally prepared for a correction you get a day like this. Stocks rise out of the blue! Today’s buying was more than likely the result of market players taking positions ahead of tomorrow’s 2 PM ET release of the FOMC minutes. After all, the FED minutes and subsequent press conference have usually had a positive effect on the market. So betting on a run ahead of Janet Yellen’s remarks has been a pretty solid strategy in recent years. So, could tomorrow be setting us up for a negative surprise? I am pretty sure that most folks are expecting a rate increase in September. So how much of a surprise can there be? Then you mustn’t forget Greece. The market shrugged it off today, but will it do so tomorrow? The possibility for this market to make a big move in either direction is strong. It all depends on how the cards are dealt and in the end how the market perceives them. I mentioned a few scenarios and how they might play out in yesterday’s blog. Now, we’ll just have to see which one we get. May God continue to bless our trades!

Stocks close higher despite Greece concerns; Fed in focus

The days trading left us with the following results: Our TSP allotment added +0.3697%. It was again held back by the I Fund which suffered from a stronger dollar and the indecision in Europe. For comparison, the Dow gained +0.64%, the Nasdaq +0.51% and the S&P 500 +0.57%. Thank God for a positive day!

The days action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +3.70% not including the today’s gains. Here are the latest posted results:

| 06/15/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7442 | 16.7824 | 27.7741 | 38.4659 | 26.1322 |

| $ Change | 0.0024 | 0.0128 | -0.1284 | -0.1754 | -0.3162 |

| % Change day | +0.02% | +0.08% | -0.46% | -0.45% | -1.20% |

| % Change week | +0.02% | +0.08% | -0.46% | -0.45% | -1.20% |

| % Change month | +0.08% | -1.23% | -0.98% | +0.25% | -1.54% |

| % Change year | +0.87% | -0.11% | +2.24% | +5.98% | +7.90% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7157 | 23.5237 | 25.6238 | 27.3521 | 15.5759 |

| $ Change | -0.0197 | -0.0779 | -0.1106 | -0.1354 | -0.0894 |

| % Change day | -0.11% | -0.33% | -0.43% | -0.49% | -0.57% |

| % Change week | -0.11% | -0.33% | -0.43% | -0.49% | -0.57% |

| % Change month | -0.20% | -0.50% | -0.64% | -0.71% | -0.80% |

| % Change year | +1.52% | +2.73% | +3.30% | +3.69% | +4.13% |

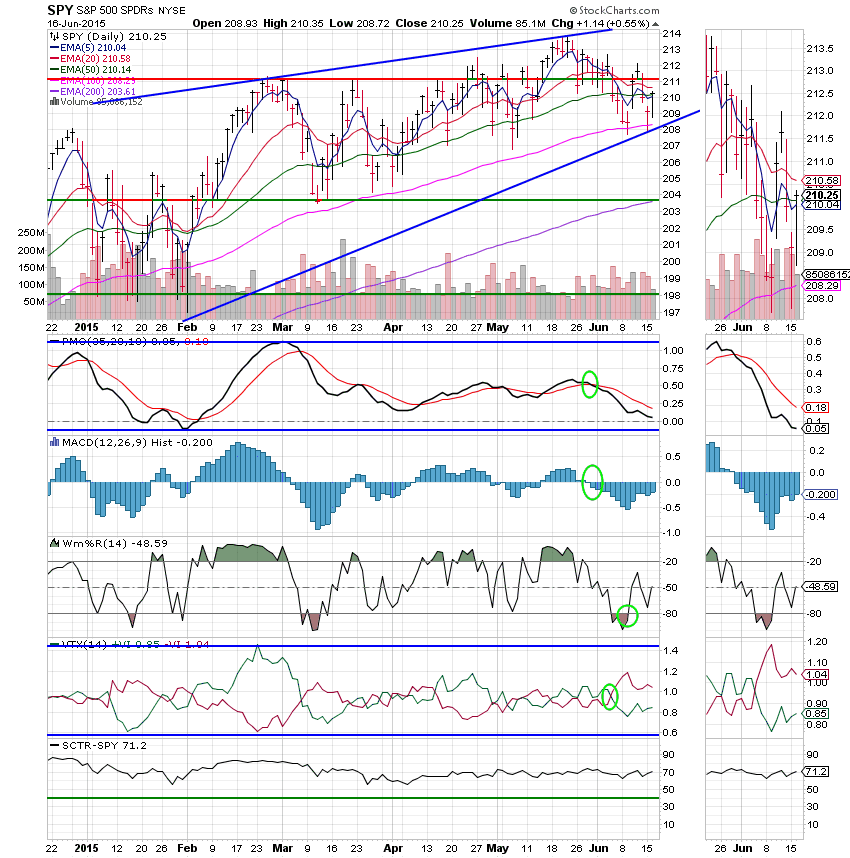

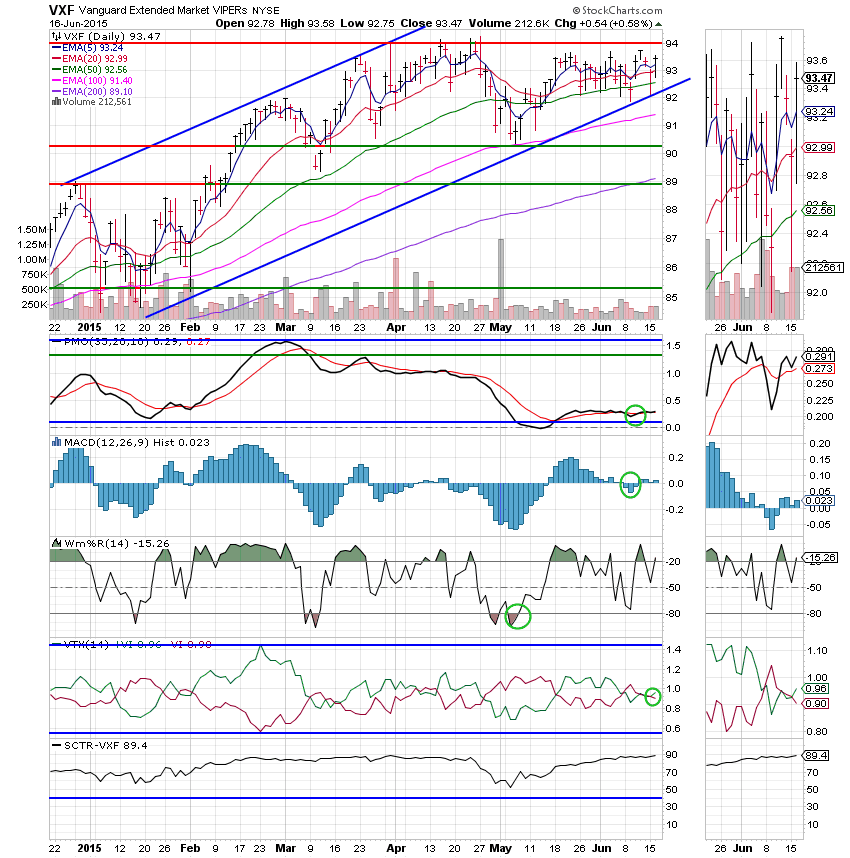

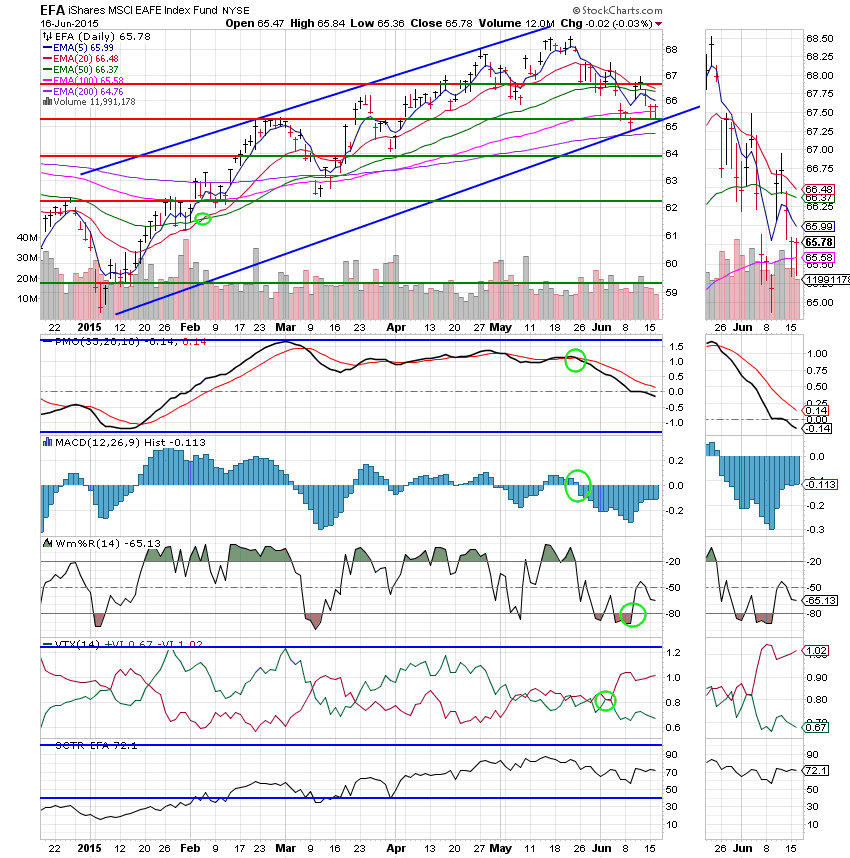

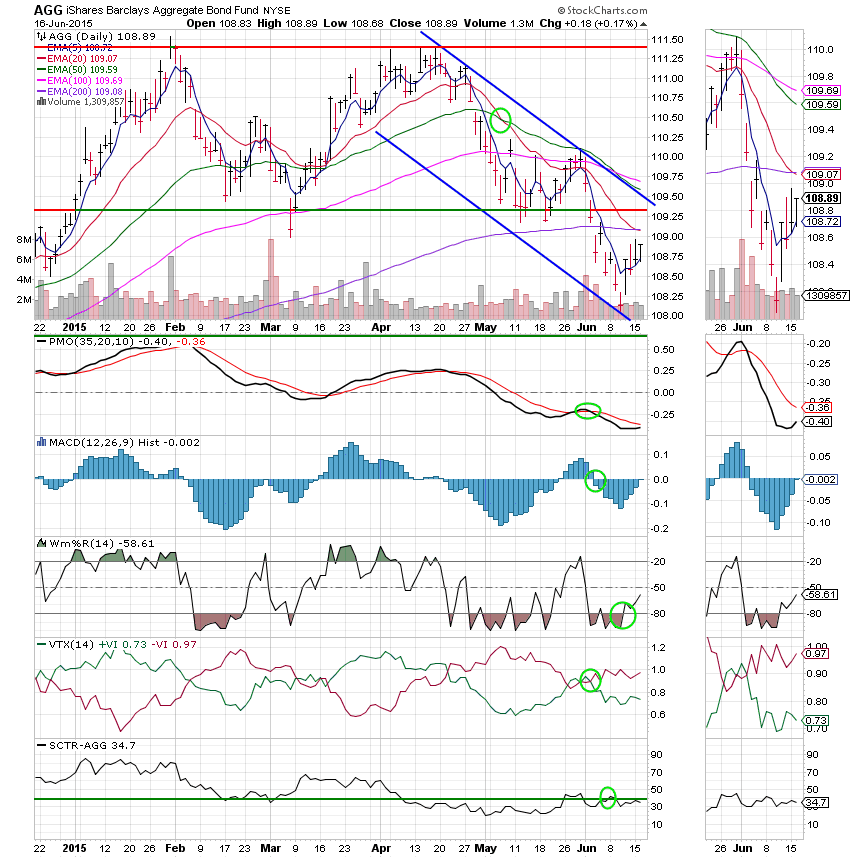

Let’s look at the charts. (All signals annotated with Green Circles)

C Fund: Price reclaimed it’s 50 EMA today. The Williams %R turned back up, but it has been subject to a lot of whipsaws in the current trading environment. The PMO is closing in on Neutral territory.

S Fund: The S Fund has nine lives when it comes to hanging onto a buy signal. Today’s strength enabled all indicators to remain in positive configurations. Recent strength is validated with an SCTR of 89.4. We will be watching to see if Price can breach resistance at 94. So far is has been unable to do so. I would consider a breach of this key resistance very bullish.

I Fund: The I Fund was flat today as it struggled with a strong dollar and the ongoing Greek Drama. Price remains below the 50 EMA making a sell signal a possibility in the near future as the 20 EMA drifts ever closer to a crossover of the 50 EMA. The PMO crossed into negative territory, but still has a long way to run before it will be pressured to turn up. Overall, this fund is starting to become extended to the downside. But is it enough to produce a bounce?

F Fund: The F Fund managed another small gain today putting priced in the middle of the descending channel. The 20 EMA has now crossed through the 200 EMA which is very bearish. The Williams %R continues to rise signaling more short term gain. However, one has to ask how a FED hint of an increase rate tomorrow might effect bonds. My guess is not so good. There’s better places to put your money right now.

Tomorrows the big day. We’ll see what the FED has to say at 2 PM ET. That should determine the direction that we head in for a week or so. Also, don’t forget the possible wild card Greece that can be dealt during tomorrows game. It should be interesting to say the least! That’s all for tonight. Have a nice evening and we’ll do it again tomorrow.