Good Evening. Another day with no agreement between Greece and the EU. The result was about what I expected. Actually, it was better than I expected and I attribute that to the fact that most everyone expects there to be a deal, even if it is a last minute deal. That said, many investors are jittery about the lack of an agreement so late in the game. As I have noted here in previous blogs, there will likely be more volatility until we see an agreement and that does not bode well for tomorrow as there are no more meetings scheduled until Saturday. Again, the Saturday meeting is billed as the last chance for an agreement. Yeah right! We’ve heard that one before. After all, we still have Monday before Greece defaults on their payment to the IMF on Tuesday. Why get in a hurry? If you ask me, a lot of the problem has to do with the fact that Greece has a leftest government that is dealing with the fiscally responsible Germans which are trying to get the socialists to cut domestic programs and retirement benefits. The Germans are asking “How are you going to pay this back without making any cuts” and the Greek government keeps trying to submit proposals minus any substantial cuts. Sounds kind of like congress doesn’t it? By the matter of fact it reminds me an awful lot of the negotiations over the budget ceiling a while back. The market went through the same type of turmoil then as it is now until the Republicans and Democrats finally came to a last minute agreement. They wanted an agreement then and the European’s want an agreement now. I’d say it’s likely that we’ll get a last minute agreement of some kind. Also, while I’m being positive, I’ll point out that it is the end of the quarter which usually has a positive bias as money managers seek to boost their performance. Put it all together and we could come out of the month of June with profit after all! More than likely we’ll have to wait until Monday afternoon to find out.

The days trading left us with the following results: Our TSP allotment slipped back -0.251%. For comparison, the Dow fell back -0.42%, the Nasdaq -0.20%, and the S&P 500 -0.30%.

Wall Street ends lower, but health stocks rally

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are still invested at 30/C, 70/S. However, we put out an alert for an interfund transfer to 30/C, 40/S, 30/I that will be effective after tomorrows market close. Our allotment is now +4.85% on the year not including the today’s results. Here are the latest posted results:

| 06/24/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7515 | 16.7838 | 28.1043 | 38.937 | 26.7781 |

| $ Change | 0.0008 | 0.0331 | -0.2073 | -0.3944 | -0.0858 |

| % Change day | +0.01% | +0.20% | -0.73% | -1.00% | -0.32% |

| % Change week | +0.03% | -0.43% | -0.05% | -0.30% | +1.64% |

| % Change month | +0.13% | -1.22% | +0.19% | +1.48% | +0.90% |

| % Change year | +0.92% | -0.11% | +3.46% | +7.28% | +10.57% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7759 | 23.716 | 25.8902 | 27.6753 | 15.786 |

| $ Change | -0.0210 | -0.0751 | -0.1089 | -0.1377 | -0.0890 |

| % Change day | -0.12% | -0.32% | -0.42% | -0.50% | -0.56% |

| % Change week | +0.06% | +0.20% | +0.24% | +0.26% | +0.32% |

| % Change month | +0.14% | +0.31% | +0.39% | +0.46% | +0.54% |

| % Change year | +1.86% | +3.57% | +4.37% | +4.91% | +5.53% |

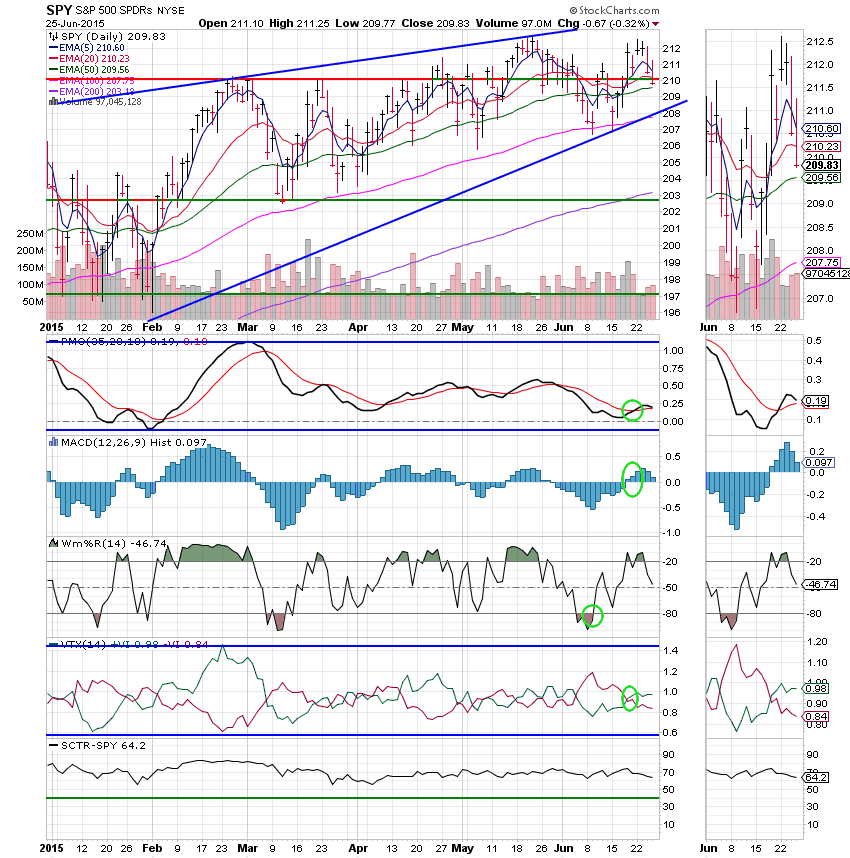

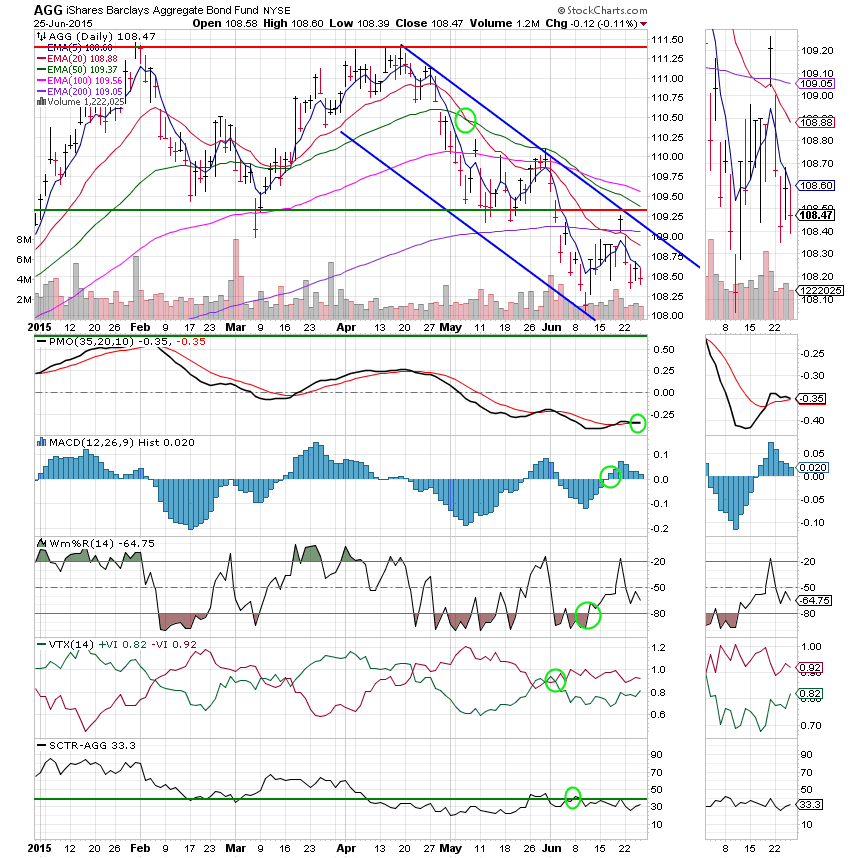

Lets hit the charts. (All signals annotated with Green Circles)

C Fund: Price closed below support at close to 210, but the C Fund continues to hang onto it’s buy signal.

S Fund: Price closed below support and 94. However the S Fund is still on a buy signal.

I Fund: The I Fund has been showing the most strength of our equity based funds the past several days and managed to break even today with price holding above support at 66.70. Should we get a Greek agreement, this fund is ready to run!

F Fund: The F Fund gave up it’s gains from yesterday with price remaining in the middle of the descending channel. The PMO crossed back down through it’s EMA moving the F Fund to an overall sell signal. This Fund remains in a clear down trend.

I don’t expect any real action until Monday. However, it will be interesting to see if some of the market players decide to load up for a possible agreement in Saturday’s meeting. I certainly wouldn’t bet against them if they do. That’s all for tonight. Have a great evening and may God continue to bless your trades!