Good Evening. I really expected some more down side today, but I guess there was enough end of the quarter window dressing to power the market to a small bounce. Stocks ended with modest gains after huge losses yesterday. What we gained back was only a fraction of what we lost yesterday. However, it was a gain all we’ll take it. There’s not much new news at this time on the Greek saga. Currently, the Greek government has scheduled a referendum for Sunday in which the people can either choose to leave the European Union or accept the austerity measures required by their creditors. There was also a report that the Greek government has submitted another proposal to the EU to restructure debt. That piece of news may have have brought the market back in the afternoon after it faded early. The bottom line is that investors are hanging on every small bit of news out of Greece so expect more volatility until there is a final resolution. Also worth monitoring is the debt situation in Puerto Rico. I would think that a default by a US territory would have a greater effect on our markets here than Greece. One more thought on Greece. It is said that the Greek President stated he will resign if the people vote in favor of the austerity measures. I hear Mr. Tsipras is big buddies with Vladimir Putin….What better way to stick to the west for their Russian sanctions than to coax his leftest buddy out of the EU. What is that expression some of the young people use…. of yes…. “Just Sayin” .

The days modest rally left us with the following results: Our TSP allotment gained +0.161%. For comparison, the Dow added +0.13%, the Nasdaq +0.57%, and the S&P 500 +0.27%. Praise be to God that we didn’t lose any more ground.

Wall St. ends up on Greek hopes ahead of debt deadline

The days action left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allocation is now +2.19% on the year not including the day’s results. Here are the latest posted results.

| 06/29/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7556 | 16.8028 | 27.4343 | 37.9026 | 25.9757 |

| $ Change | 0.0025 | 0.0992 | -0.5819 | -0.9032 | -0.6082 |

| % Change day | +0.02% | +0.59% | -2.08% | -2.33% | -2.29% |

| % Change week | +0.02% | +0.59% | -2.08% | -2.33% | -2.29% |

| % Change month | +0.16% | -1.11% | -2.20% | -1.22% | -2.13% |

| % Change year | +0.95% | +0.01% | +0.99% | +4.43% | +7.26% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.689 | 23.4082 | 25.4523 | 27.1341 | 15.4344 |

| $ Change | -0.0684 | -0.2502 | -0.3575 | -0.4436 | -0.2892 |

| % Change day | -0.39% | -1.06% | -1.39% | -1.61% | -1.84% |

| % Change week | -0.39% | -1.06% | -1.39% | -1.61% | -1.84% |

| % Change month | -0.35% | -0.99% | -1.31% | -1.50% | -1.70% |

| % Change year | +1.37% | +2.23% | +2.60% | +2.86% | +3.18% |

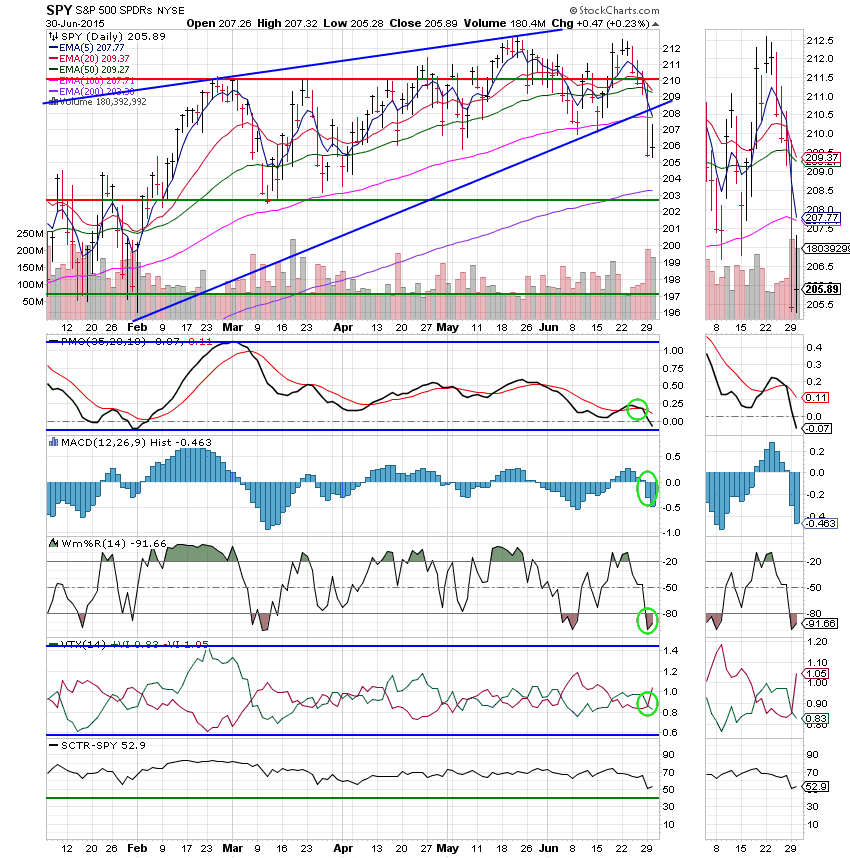

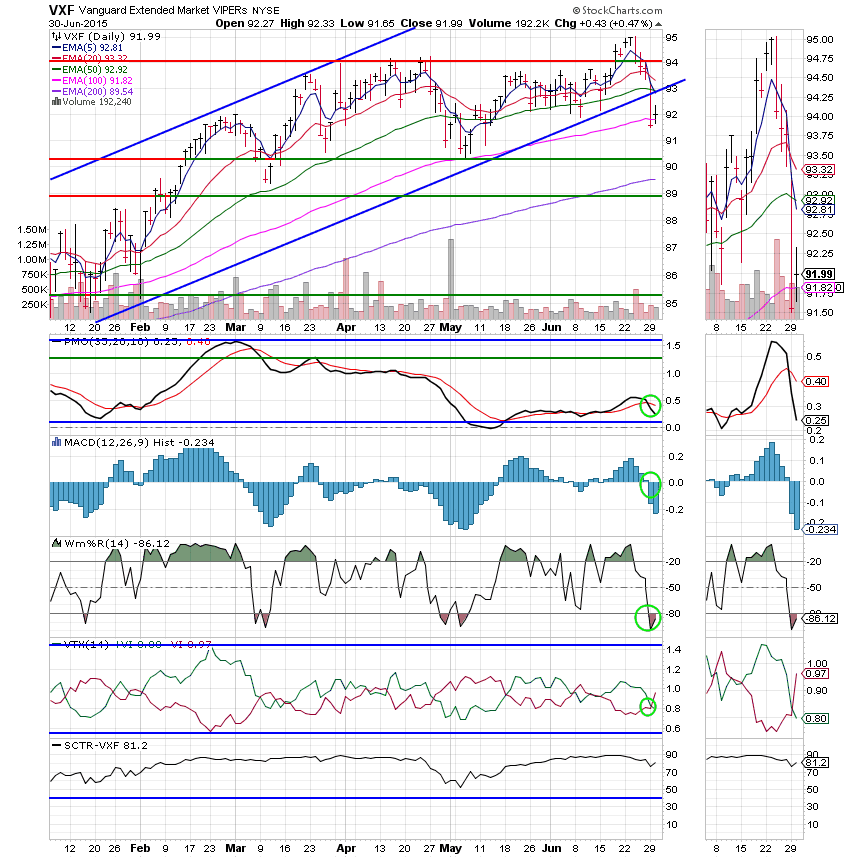

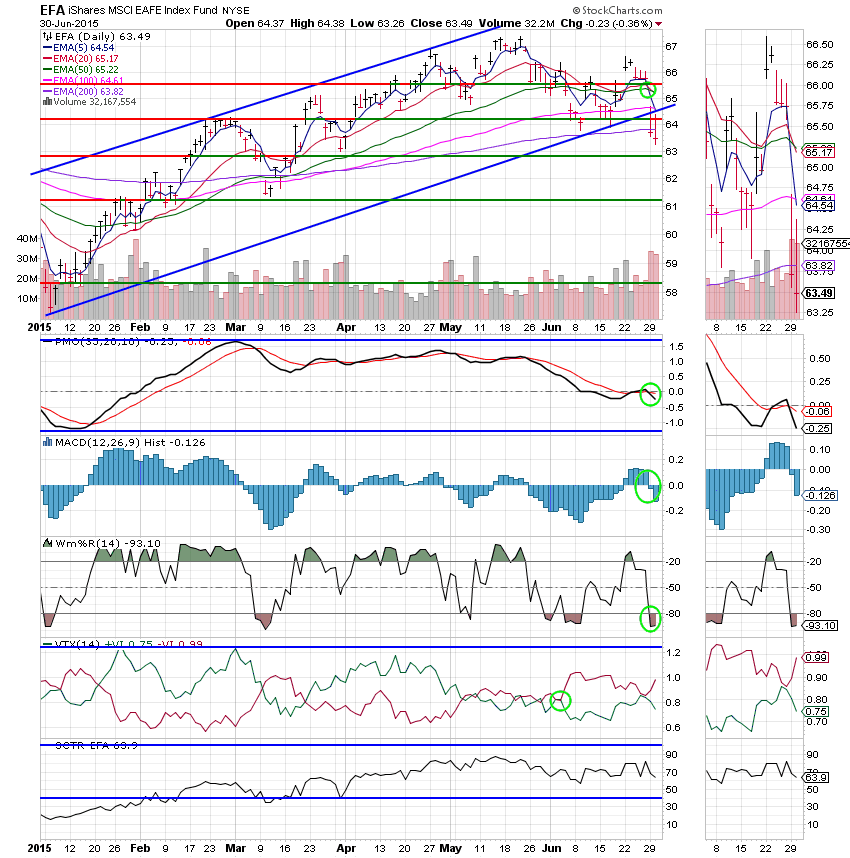

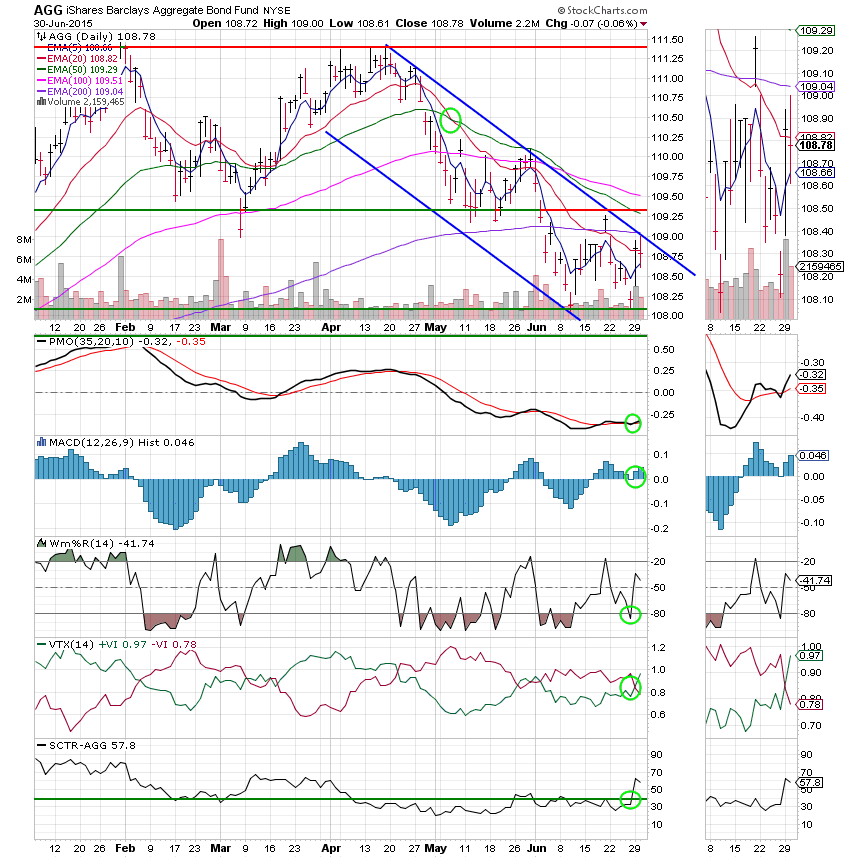

Lets take a look at the charts. (All signals annotated with Green Circles)

C Fund: Price finished for the second day under the 100 EMA as well as below the lower trend line. The 20 EMA is now kissing close to crossing through the 50 EMA which would generate a sell signal for this fund. Also worth mentioning is that the 5 EMA is threatening to pass through the 100 EMA. These developments are all bearish. On the positive side, the Williams %R has turned back up. We will keep a very close eye on this short term indicator and consider which way it might be going before we make the decision to sell this or any of our funds. The chance for some whipsaw action is very high and the Williams %R will give us the first indication of a change in direction.

S Fund: Small caps are holding up a little better and give us reason to believe that we may have a timely recovery from this sell off. Price managed to regain it’s 100 EMA. However the 5 EMA did cross through the 50 EMA and the PMO and MAC D are in free falls. As with the C fund, the Williams %R has turned back up. We will watch this short term indicator very carefully to see which way the wind might be blowing. A shift in the direction of the Williams %R in small and mid caps would be a good reason to hang onto our other equity based funds even if they generate sell signals which the I fund has already done. The Williams %R is the best defense we have against getting whipsawed!

I Fund: The I Fund generated a sell signal today when the 20 EMA passed through the 50 EMA with the other indicators all in negative configurations. So why did I not sell? As you know we were whipsawed in this fund a few weeks back and missed some good gains when we sold. A little of the right news in the next few days could make this fund really bounce. With that in mind, we’ll hold it for now and see if we get a little more confirmation on this signal. The fact that small caps popped a little bit today is reason enough to believe that a reversal could be in the works. We will watch all our equity based funds to ensure that we don’t get caught leaning the wrong way.

F Fund: This fund remains in the same tight trading range for now. I really don’t expect any resolution here until we get one in Greece. Price was flat today, but the F Fund remains Neutral for now. If you are looking for a safe haven, the G Fund is a better bet as the F fund probably hasn’t found the bottom yet and will continue going lower if the situation in stocks is resolved. In other words, the risk just isn’t worth the reward.

The question many of you are asking is to sell or not to sell. Given this markets recent history of punishing the shorts, I really think it is prudent to wait for as much confirmation as we can get that we are heading significantly down befroe we sell. And for me, that confirmation is in small caps. In other words, we will keep a very close eye on the S Fund for now. If it breaks down with no improvement in the C or I Funds, we will know that it’s time to head for the hills. Of course, we will also continue to seek the guidance of our Heavenly Father! Give Him all the Praise for He and He alone is worthy! Have a nice evening and we’ll do it again tomorrow.