Good Evening, Our scenario of a last minute agreement didn’t play out. However, a post default agreement was on the table this morning when Greek Prime Minister Alex Tsipras sent a letter to the European Union and ECB President Mario Draghi stating the he would agree to the last terms put forth by the EU. At that point the market rallied as we all expected that it would. Then a strange thing happened. Tsipras took a defiant stand in a speech to the Greek people recommending to them that they reject the EU proposal when they vote in a referendum on whether or not to accept it on Sunday. I said “what”? Is this guy nuts? He just got up and told the people to reject what he said in the letter that he would accept. This is madness. On top of that the Greek finance minister released a statement in this afternoon saying that he expected to have an agreement by Monday. Are you kidding me? I mean this man seriously needs help. His country is bankrupt and the banks are starting to close! If I was the EU, I couldn’t get kick these people to the curb fast enough. God’s word talks about men like Tsipras. In James 1:8 it says that a double minded person is unstable in all they do…… I fully expect more volatility. I also expect this saga to go on for at least a few more weeks and that to me is disappointing.

On the positive side, the market decided to ignore Tsipras and finished off it’s lows for the day. Our TSP allotment added +0.562%. For comparison, the Dow gained +0.79%, the Nasdaq +0.53%, and the S&P 500 +0.69%. I thank God for another positive day!

Wall St. ends higher but energy stocks fall and Greece hopes waiver

The days action Left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allocation is now +2.25% on the year not including the days results. Here are the latest posted results:

| 06/30/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7564 | 16.8104 | 27.509 | 38.0981 | 25.797 |

| $ Change | 0.0008 | 0.0076 | 0.0747 | 0.1955 | -0.1787 |

| % Change day | +0.01% | +0.05% | +0.27% | +0.52% | -0.69% |

| % Change week | +0.02% | +0.64% | -1.81% | -1.82% | -2.96% |

| % Change month | +0.17% | -1.07% | -1.93% | -0.71% | -2.80% |

| % Change year | +0.96% | +0.05% | +1.26% | +4.96% | +6.52% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6926 | 23.4122 | 25.4596 | 27.1463 | 15.4402 |

| $ Change | 0.0036 | 0.0040 | 0.0073 | 0.0122 | 0.0058 |

| % Change day | +0.02% | +0.02% | +0.03% | +0.04% | +0.04% |

| % Change week | -0.36% | -1.04% | -1.36% | -1.56% | -1.80% |

| % Change month | -0.33% | -0.97% | -1.28% | -1.46% | -1.66% |

| % Change year | +1.39% | +2.24% | +2.63% | +2.91% | +3.22% |

Lets take a look at the charts: (All signals annotated with Green Circles)

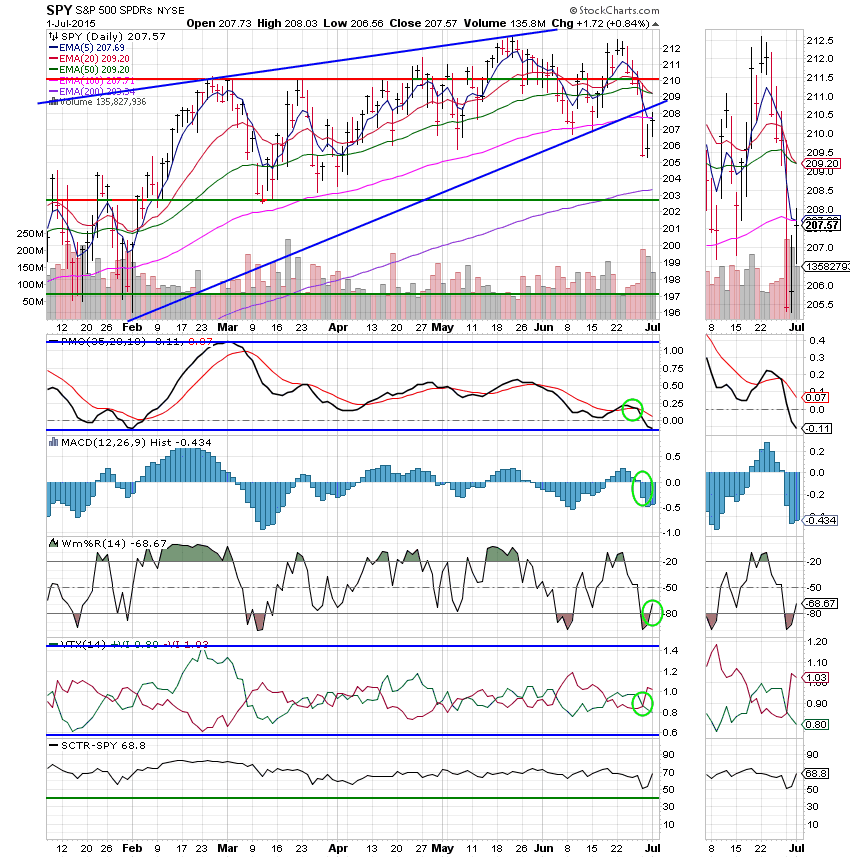

C Fund: Price managed a decent gain on the day, but was repelled at the lower trend line. The 20 EMA is now very close to passing through the 50 EMA which is bearish. That said, the Wiliams %R turned up in oversold territory signaling that there will likely be more upside in the short term. Of course, I am always hoping that will turn into a long term run as all long terms runs have to start somewhere.

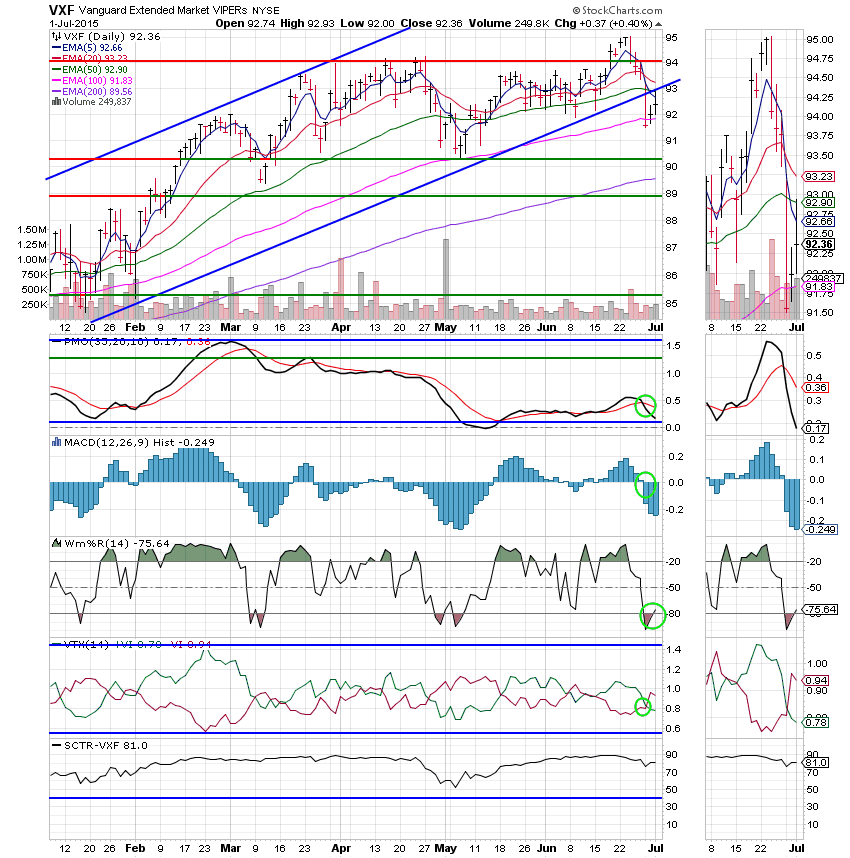

S Fund: The S fund is in the best shape of our equity based funds after Monday’s selloff. Price actually breached it’s 50 EMA during the morning but was unable to sustain that level. The 20 EMA is still well above the 50 EMA so there is no chance of a crossover there. As with the C Fund, the Williams %R turned up in oversold territory and has plenty of room to run. Small caps lagged in performance today. While this is the closest thing we have to a small cap fund, it is actually a small cap/ mid cap blend so it did a little better than the average small cap fund today but a little worse than the large cap funds. As I mentioned yesterday, we are taking our cues on whether to sell or not from the S Fund in hopes that the more responsive small caps will keep us from selling prematurely.

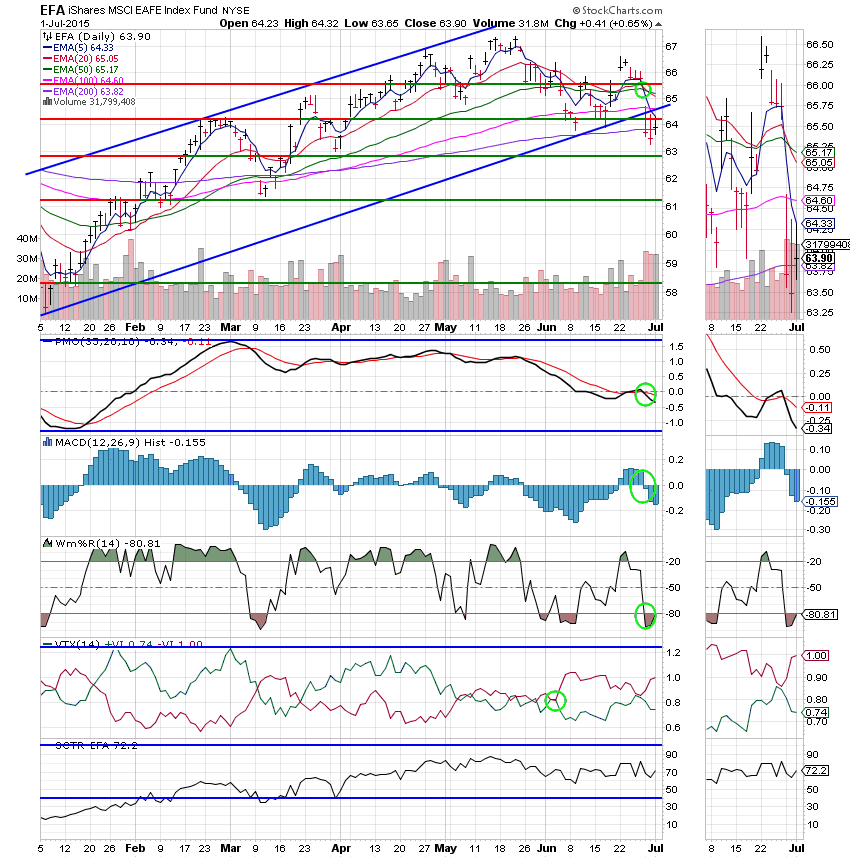

I Fund: Price briefly broke though resistance at 64.20, but was unable to hold that position. The 20 EMA has now passed well through the 50 EMA with all other indicators in negative configurations for an overall sell signal. The Williams %R did turn up but failed to pass up through the -80 barrier needed to put it in positive configuration. Nevertheless, the fact that it turned up is encouraging so we’ll hold this one for now. However, should our other funds break down as well, we will honor the sell signal.

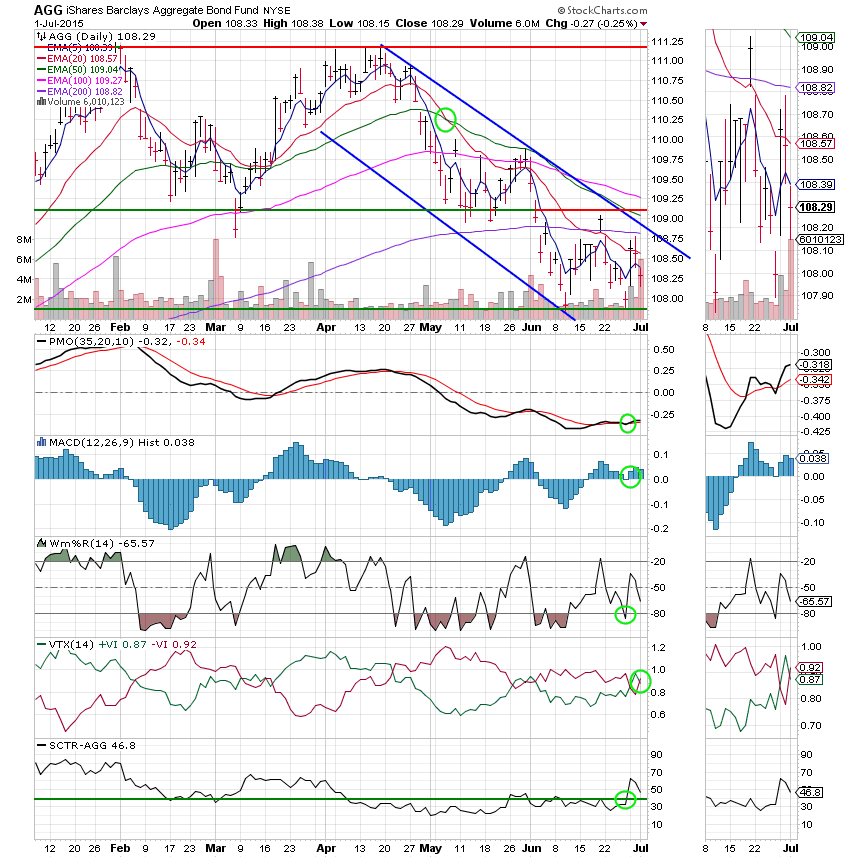

F Fund: Bonds headed back down much as we predicted they would do when stocks regained some strength. The VTX turned bearish today so I believe the down trend will continue once the Greek issue is resolved. However, resistance at close to 107.80 is holding for now. This fund is in an established down trend until it proves otherwise.

You can’t pay a lot of attention to what happens tomorrow as we’re not expecting additional news out of Greece. Right now the next big news making event will be the Greek referendum scheduled for of all days, Sunday. There’s no trading on Friday, so tomorrow will be the last trading day before the 4th of July holiday. That day is traditionally a positive day so we’ll be praying that we can wipe out a little more of Monday’s deficit before the long weekend. The trading will likely take it’s cue from tomorrows jobs report. That’s all for tonight! Keep praying and God will continue to guide us through this Greek crisis. Give Him all the praise! Have a nice evening and I’ll see you tomoorow.