Good Evening, The Fed held steady and didn’t say anything about raising the rates which is pretty much what we thought they’d do. The result was easily anticipated with all three major indices extending gains. We’ll see if some additional follow through can take place tomorrow void of any market moving events. That should tell us the true nature of the post Fed market.

The days trading gave us the following results: Our TSP allotment gained +0.597%. For comparison, the Dow added +0.69%, the Nasdaq +0.44%, and the S&P 500 +0.73%. Thank God for another good day!

Wall Street ends higher after Fed leaves investors unruffled

The days action left us with the following signals: C-Buy, S-Sell, I-Neutral, F-Neutral. We are currently invested at 33/C, 33/S, 34/I. Our allotment is now -0.67% on the year not including the day’s results. Here are the latest posted results:

| 07/28/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.782 | 16.8936 | 27.9399 | 37.5655 | 25.8931 |

| $ Change | 0.0009 | -0.0265 | 0.3420 | 0.3994 | 0.0249 |

| % Change day | +0.01% | -0.16% | +1.24% | +1.07% | +0.10% |

| % Change week | +0.02% | +0.09% | +0.65% | +0.08% | -0.66% |

| % Change month | +0.17% | +0.49% | +1.57% | -1.40% | +0.37% |

| % Change year | +1.13% | +0.55% | +2.85% | +3.50% | +6.92% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7521 | 23.5289 | 25.5976 | 27.2922 | 15.5273 |

| $ Change | 0.0319 | 0.1001 | 0.1425 | 0.1771 | 0.1125 |

| % Change day | +0.18% | +0.43% | +0.56% | +0.65% | +0.73% |

| % Change week | +0.07% | +0.10% | +0.12% | +0.13% | +0.13% |

| % Change month | +0.34% | +0.50% | +0.54% | +0.54% | +0.56% |

| % Change year | +1.73% | +2.75% | +3.19% | +3.46% | +3.80% |

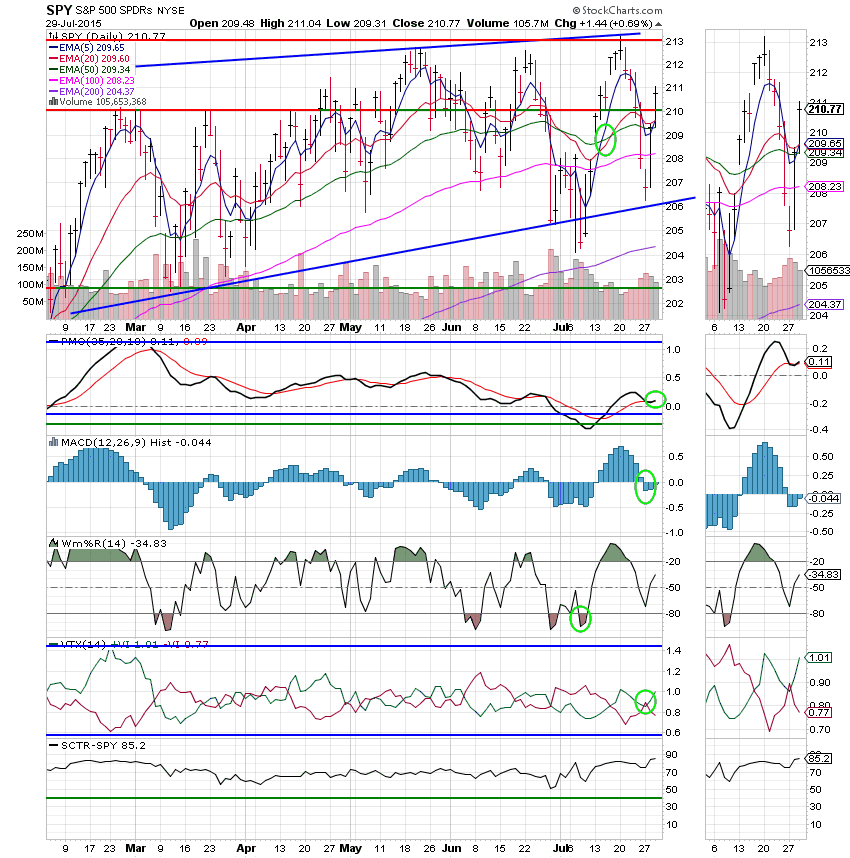

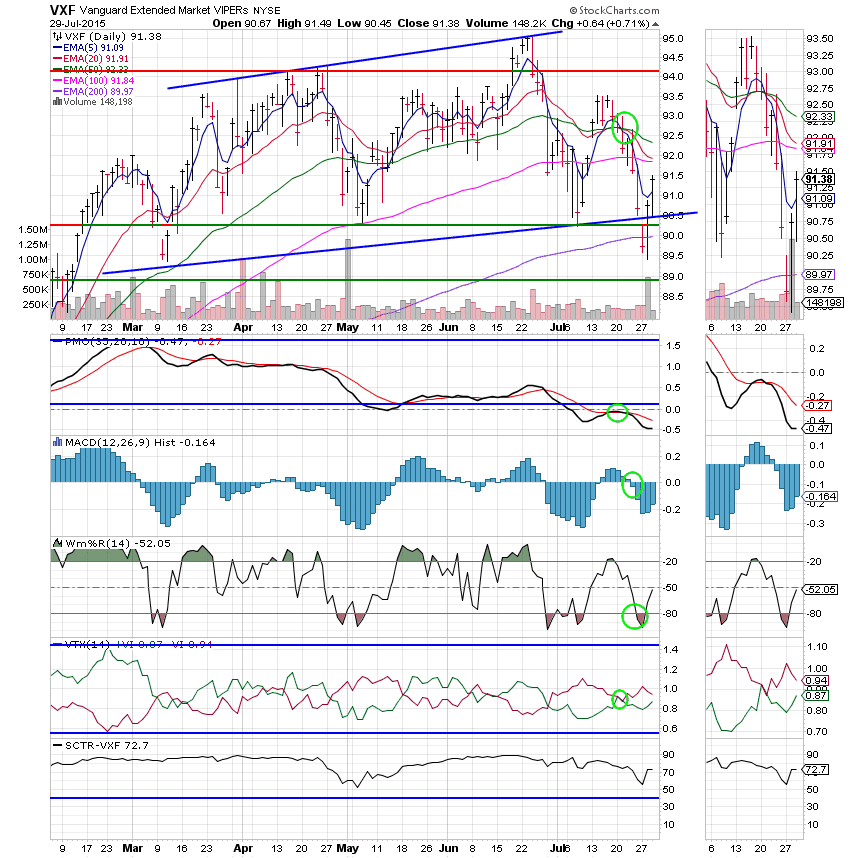

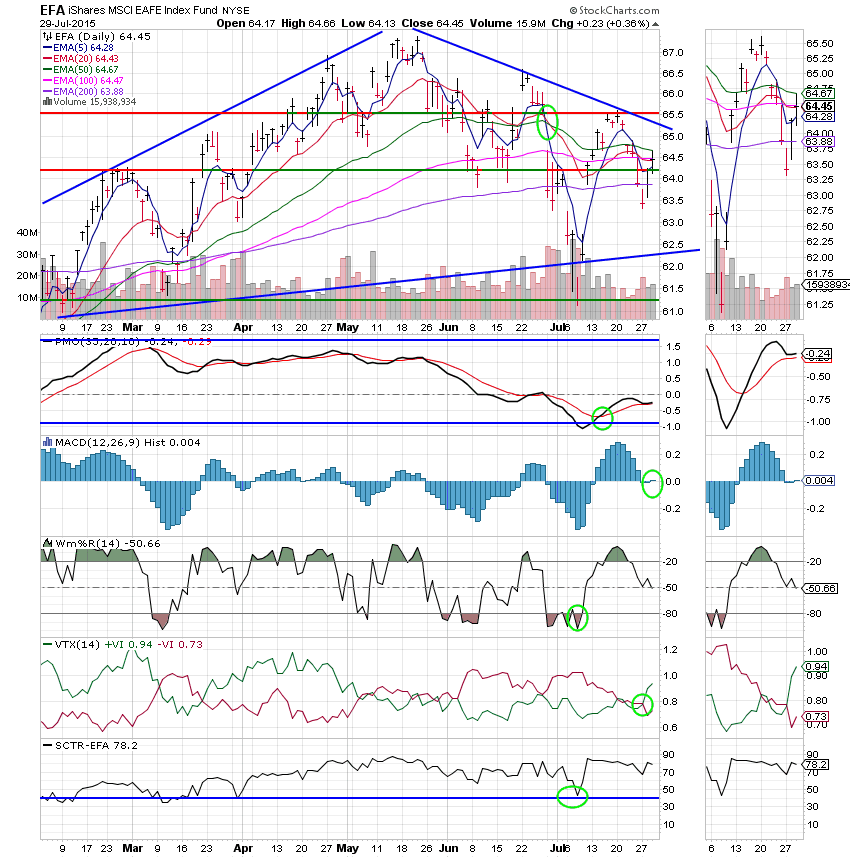

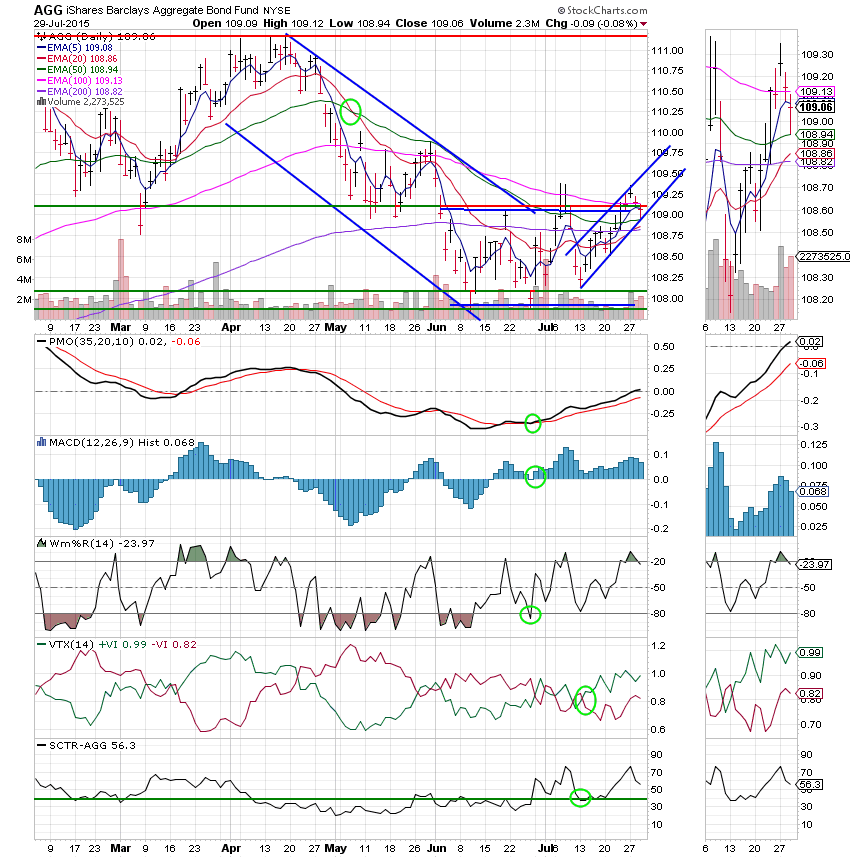

Lets take a look at the charts: (All signals annotated with Green Circles)

C Fund: The PMO crossed back up through it’s EMA today moving the overall signal for the C Fund back to buy! The MAC D is still negative, but looks like it will follow through with a buy signal tomorrow.

S Fund: Price made a nice gain today, but is still trading below it’s 100 EMA. This Fund took the most damage of our equity based funds. So it has the most work to do to generate a neutral or buy signal. That said, I’m leaving my allotment alone as the C Fund is now showing a buy signal. Small caps should follow, but their performance may still lag.

I Fund: Price reclaimed it’s 100 EMA today as the I Fund is slowly recovering from the sell off. All indicators other than price are still positive so this Fund remains at neutral.

F Fund: Price took another small dip today, but that is to be expected with the strength in stocks. The good news for this fund is that the FOMC doesn’t look like it will be raising interest rates any time soon. Price is trading in a newly established short term ascending channel. We’ll keep a close eye on this to see if it continues to rise.

So far so good for the short term. The equity based charts can still accommodate more buying so given that there are no big hurdles in the way, short term conditions are favorable for prices to rise. That’s all for tonight. Give God all the praise for another good day! See you tomorrow.