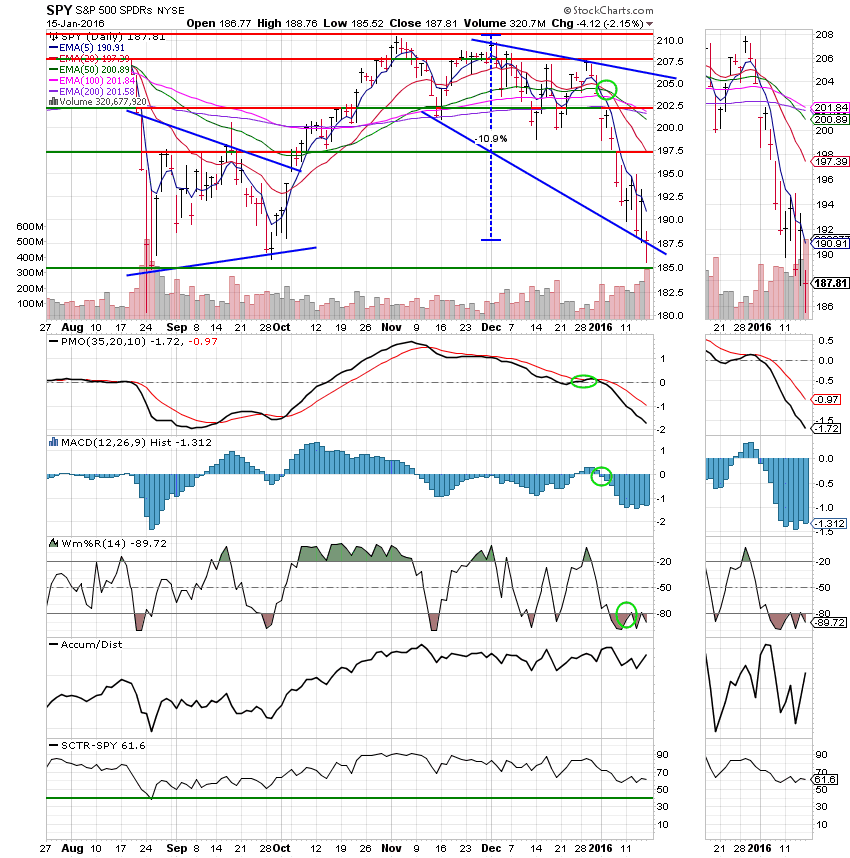

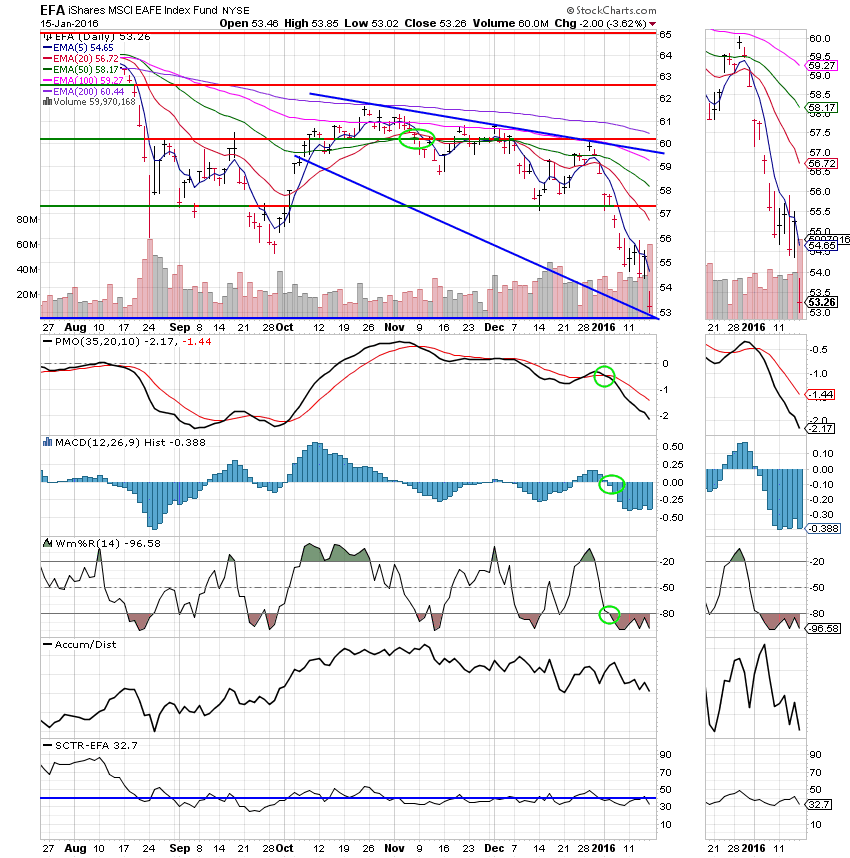

Good Evening, At least it is for us! Last night we talked about how it was a really good day, but that the charts didn’t indicate that it was anything more than an oversold bounce. Today’s massive sell off proved that our caution was warranted! Oil had a bad day and again, the market followed suite. Is there anybody out there that doubts our bear market call? If so, by all means, be the first to buy and hold. Meanwhile, I will praise God for guiding us into the G Fund as He has done in all the sell offs since 1997. That’s right, He hasn’t failed us even one time. Believe what you will, but that’s my story and I’m sticking to it!! Our main theme here at My TSP Guide is that “It’s not what you make that’s important. It’s what you keep!!”

Today’s sell off left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow was slaughtered at -2.16%, the Nasdaq -2,74%, and the S&P 500 -2.16%. There should be little doubt now. We are in a downtrend!

Wall St. hemorrhages as oil falls and China fears deepen

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now +0.09% on the year not including the day’s results. Here are the latest posted results:

| 01/14/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9282 | 17.0809 | 25.9365 | 31.987 | 22.6033 |

| $ Change | 0.0010 | -0.0355 | 0.4266 | 0.3891 | 0.1453 |

| % Change day | +0.01% | -0.21% | +1.67% | +1.23% | +0.65% |

| % Change week | +0.04% | +0.09% | +0.01% | -2.21% | +0.21% |

| % Change month | +0.09% | +0.74% | -5.90% | -9.22% | -6.19% |

| % Change year | +0.09% | +0.74% | -5.90% | -9.22% | -6.19% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5607 | 22.5081 | 24.0234 | 25.2841 | 14.1937 |

| $ Change | 0.0434 | 0.1329 | 0.1941 | 0.2367 | 0.1511 |

| % Change day | +0.25% | +0.59% | +0.81% | +0.95% | +1.08% |

| % Change week | -0.02% | -0.10% | -0.17% | -0.22% | -0.27% |

| % Change month | -1.20% | -3.02% | -4.15% | -4.85% | -5.54% |

| % Change year | -1.20% | -3.02% | -4.15% | -4.85% | -5.54% |