Good Evening, It’s oil again! Oil tanked and so did the market. The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow lost -1.80%, the Nasdaq -2.24%, and the S&P 500 -1.87%. It was a bloodbath out there!

It’s Groundhog Day For Oil as Another Selloff Wipes Out Stocks

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/G. Our allocation is now +0.20% on the year not including the days results. Here are the latest posted results:

| 02/01/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9448 | 17.1594 | 26.185 | 32.1792 | 22.7017 |

| $ Change | 0.0009 | -0.0477 | -0.0113 | 0.0176 | -0.0392 |

| % Change day | +0.01% | -0.28% | -0.04% | +0.05% | -0.17% |

| % Change week | +0.01% | -0.28% | -0.04% | +0.05% | -0.17% |

| % Change month | +0.01% | -0.28% | -0.04% | +0.05% | -0.17% |

| % Change year | +0.20% | +1.21% | -5.00% | -8.67% | -5.78% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.607 | 22.6061 | 24.1539 | 25.4367 | 14.2868 |

| $ Change | -0.0046 | -0.0098 | -0.0135 | -0.0157 | -0.0089 |

| % Change day | -0.03% | -0.04% | -0.06% | -0.06% | -0.06% |

| % Change week | -0.03% | -0.04% | -0.06% | -0.06% | -0.06% |

| % Change month | -0.03% | -0.04% | -0.06% | -0.06% | -0.06% |

| % Change year | -0.94% | -2.60% | -3.63% | -4.27% | -4.92% |

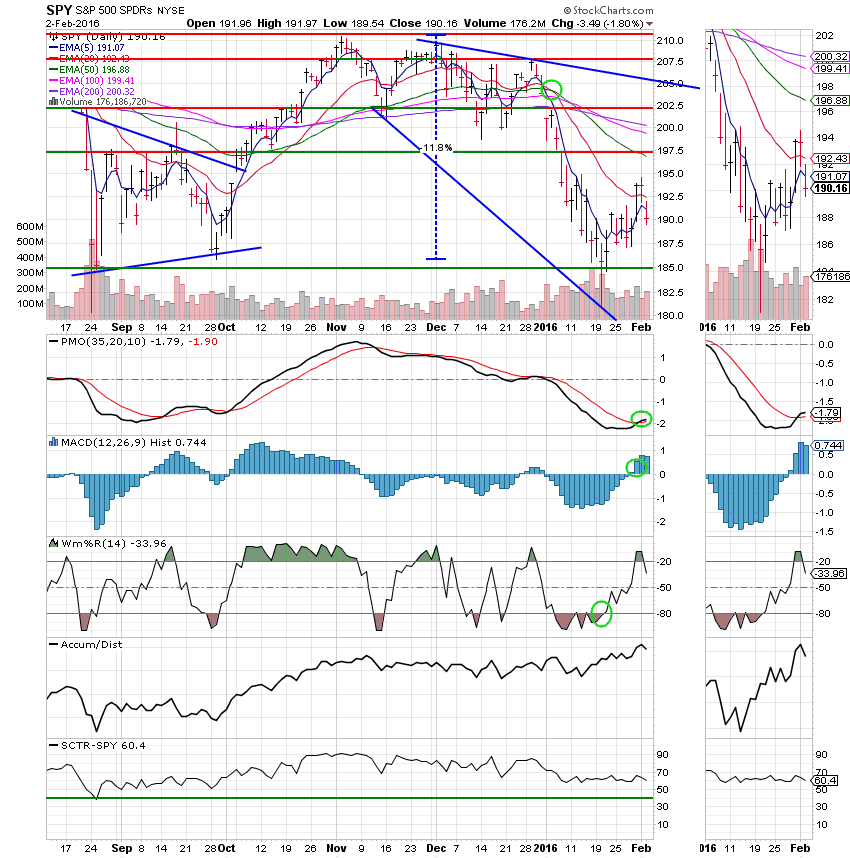

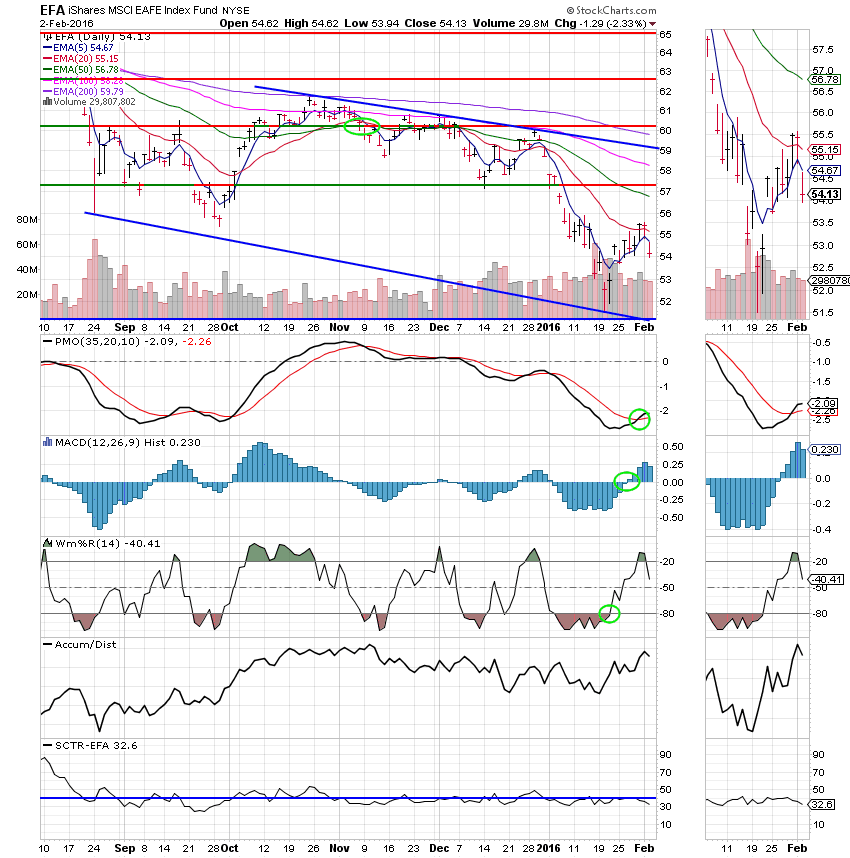

Lets take a look at the charts: (All signals annotated with Green Circles) If you click on the charts they will become larger!

C Fund: The PMO Moved to a buy signal today. However,price still prevents this chart from being anything but neutral. An SCTR of 60.4 gives the C Fund a failing grade.

S Fund: Just as the C Fund, the PMO has moved to a buy signal. Does it indicate more upside to come? Maybe, but an SCTR of only 22.2 tells you all you need to know about this one!

I Fund: Despite positive signals in the MACD, PMO, and Williams%R, price continues to move down the established descending channel. An SCTR of 32.6 tells you to stay away from this one!

F Fund: Price continues to follow the upper trend line higher. A steady SCTR of 95.5 tells us that this one is working well. My only concern with this fund is fundamental. If interest rates increase it will suffer.

There’s really nothing new to report. Sometimes that’s the way that it is for a long while. You just have to be patient! Pray and keep watching your charts. You’ll know when the time is right to buy back in. Have a nice evening and may God continue to bless your trades!