Good Evening, In 2008, it all came down to the banks and here we are again. In 2016, it all comes down to the banks. Yes oil is a factor, a slowing world economy is a factor. But again, it simply comes back to the banks. When the financial sector really tanks, you know for sure that your in a bear market and that your going to go lower. So why are the banks doing badly? It’s all about interest rates. You see, it’s harder for banks to turn a profit in this low interest rate environment which puts a lot of pressure on them to start with. However, when you start talking about a negative interest rate environment like the central banks are doing now, you are talking about a whole new level of pain for banks. By the matter of fact some of them such as the bank of Japan and Sweden have already enacted negative interest rates. Negative interest rates hurt banks because they have to pay to park money. For that matter so does any depositor. Negative interest rates also make already cheap money even cheaper so the banks are hit with a double whammy by not being able to earn as much from loans. Therefore, the lower the interest rates go, the lower financial stocks go. Especially banks……

Today, banks led the market lower. Although it finished off it’s lows for the day on more rumors that OPEC will cut oil production, it still finished deeply in the red. The days action left us with the following results: Our TSP allotment was steady in the G Fund while the Dow lost -1.60%, the Nasdaq -0.39%, and the S&P 500 -1.23%.

Banks drag Wall Street lower as growth fears, rate outlook weigh

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our TSP allocation is now +0.24% on the year not including the days results. Here are the latest posted results:

| 02/10/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9515 | 17.3274 | 25.0378 | 30.0193 | 21.4002 |

| $ Change | 0.0007 | 0.0210 | 0.0037 | 0.0791 | -0.0461 |

| % Change day | +0.00% | +0.12% | +0.01% | +0.26% | -0.21% |

| % Change week | +0.03% | +0.50% | -1.44% | -2.66% | -3.46% |

| % Change month | +0.05% | +0.70% | -4.42% | -6.66% | -5.90% |

| % Change year | +0.24% | +2.20% | -9.16% | -14.80% | -11.18% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4416 | 22.0743 | 23.3672 | 24.4685 | 13.6638 |

| $ Change | 0.0012 | 0.0002 | -0.0003 | -0.0005 | -0.0005 |

| % Change day | +0.01% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | -0.39% | -1.00% | -1.39% | -1.64% | -1.88% |

| % Change month | -0.97% | -2.39% | -3.31% | -3.87% | -4.42% |

| % Change year | -1.87% | -4.89% | -6.77% | -7.91% | -9.07% |

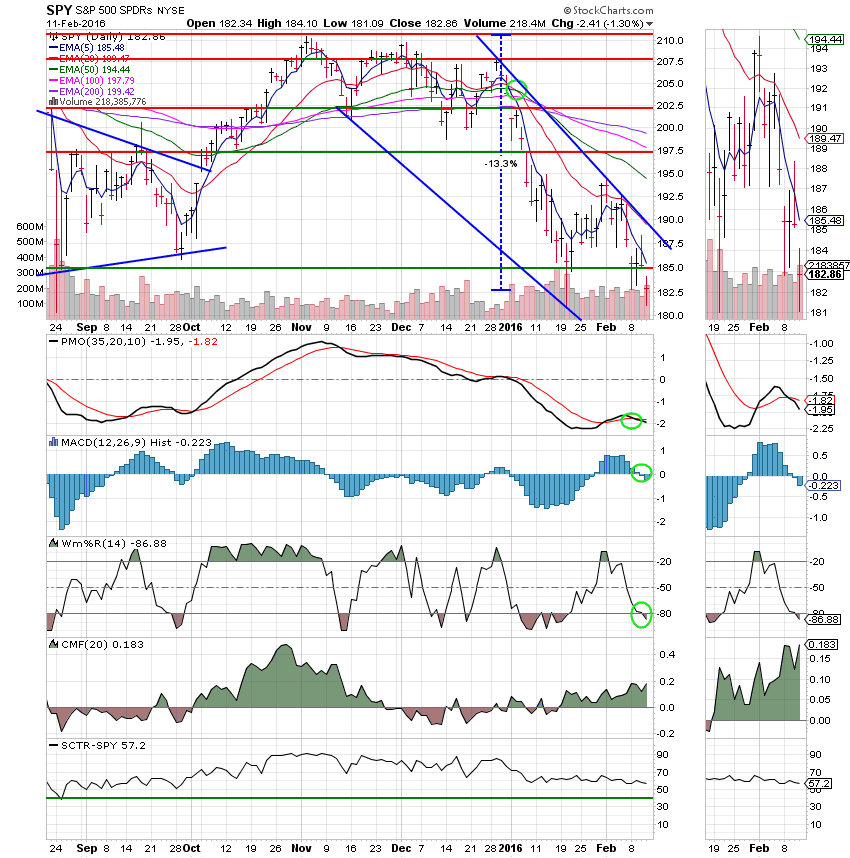

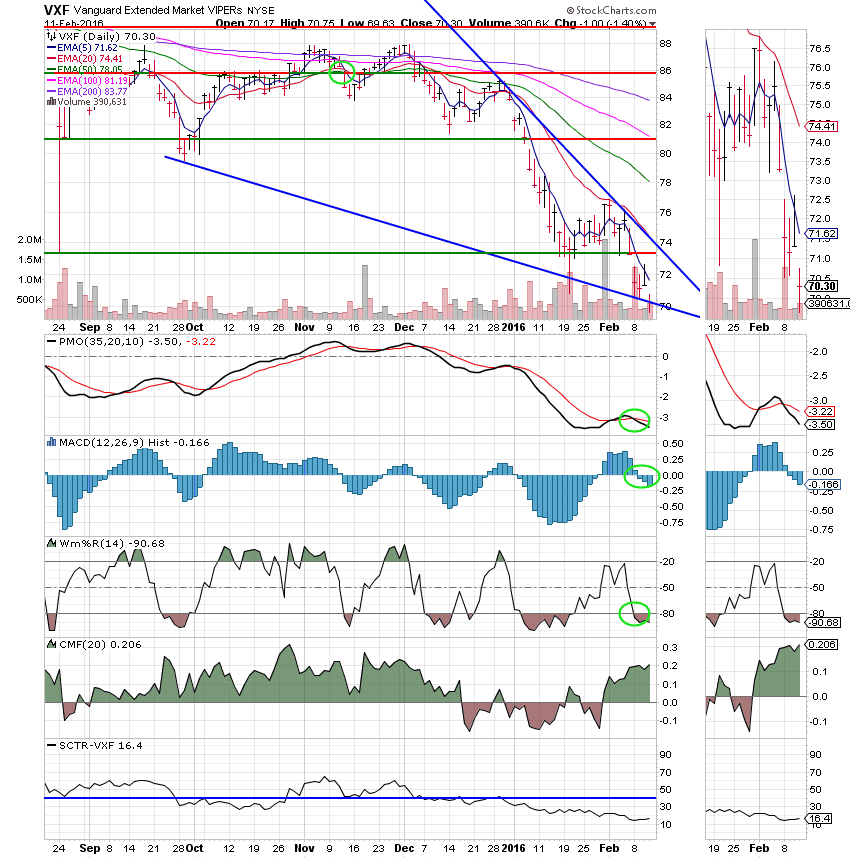

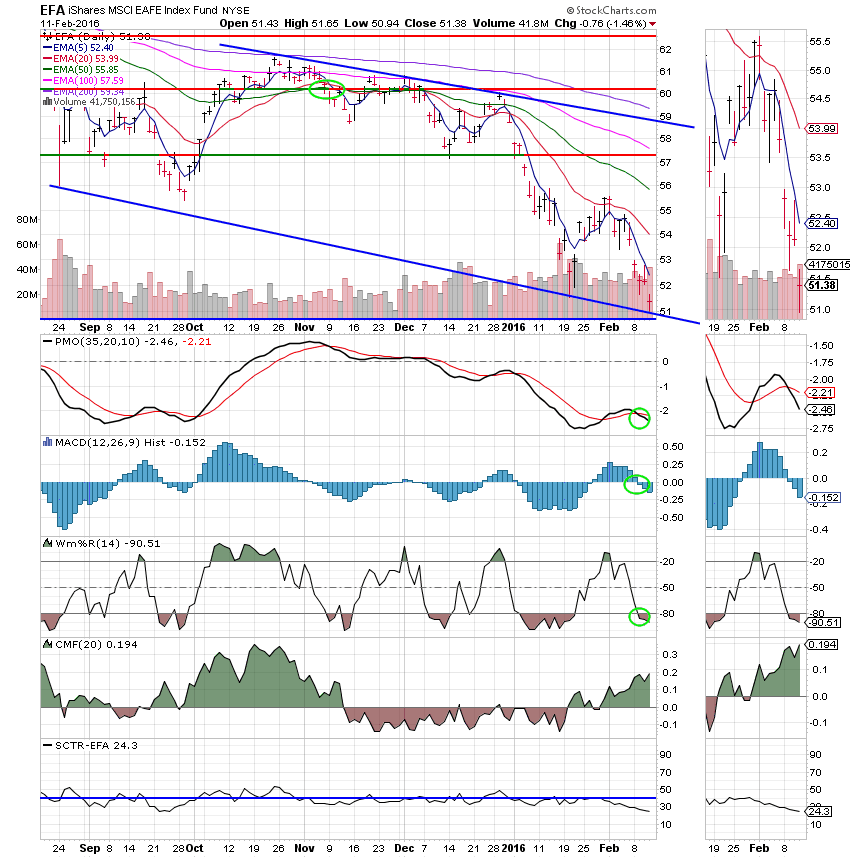

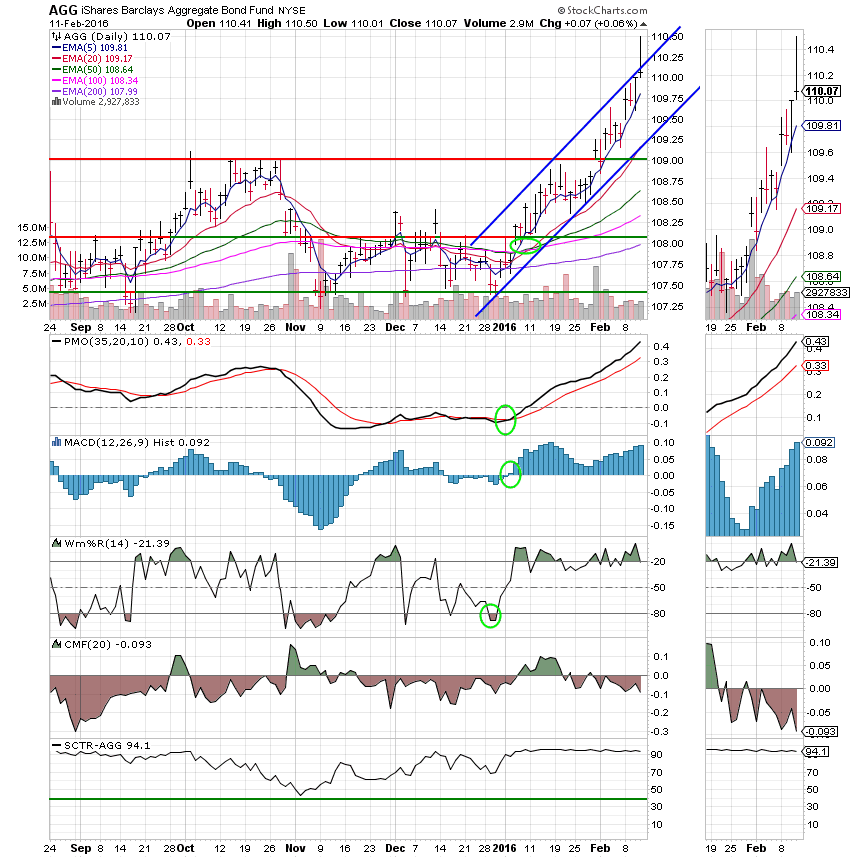

Lets take a look at the charts: (All signals annotated with Green Circles) If you click on the charts they will become larger!

C Fund: Today resistance broke at 185. My new down side target is 145 or 1450 for the SPX. Lets hope I’m wrong this time!

S Fund:

I Fund:

F Fund: Still working!

Any doubts that we’re in a bear market??? Our main priority now is capital preservation. I thank God again for guiding us to a place of safety. May he continue to guide our hand! Have a great evening and I’ll see you tomorrow.