Good Evening, The market continued it’s recent pattern of starting off slow and closing strong. It appears that traders were trying to load up ahead of tomorrows jobs report. Hopefully, that’s a good omen of what’s to come…..

The action left us with the following results: Our TSP allotment gained +0.0875%. For comparison, the Dow was up +0.26%, the Nasdaq +0.09%, and the S&P 500 +0.35%.

Wall Street snaps up shares in late-day scramble

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 75/G, 25/C. Our allocation is now +0.84% on the year not including the days results. Here are the latest posted results:

| 03/02/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9674 | 17.2659 | 26.904 | 33.347 | 22.6372 |

| $ Change | 0.0007 | 0.0048 | 0.1145 | 0.3333 | 0.0906 |

| % Change day | +0.00% | +0.03% | +0.43% | +1.01% | +0.40% |

| % Change week | +0.03% | -0.19% | +2.00% | +2.82% | +2.44% |

| % Change month | +0.01% | -0.34% | +2.83% | +3.17% | +2.43% |

| % Change year | +0.35% | +1.83% | -2.39% | -5.36% | -6.05% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7079 | 22.8502 | 24.4909 | 25.8386 | 14.5365 |

| $ Change | 0.0189 | 0.0557 | 0.0814 | 0.1001 | 0.0642 |

| % Change day | +0.11% | +0.24% | +0.33% | +0.39% | +0.44% |

| % Change week | +0.46% | +1.06% | +1.45% | +1.69% | +1.92% |

| % Change month | +0.54% | +1.28% | +1.76% | +2.04% | +2.33% |

| % Change year | -0.37% | -1.54% | -2.28% | -2.76% | -3.26% |

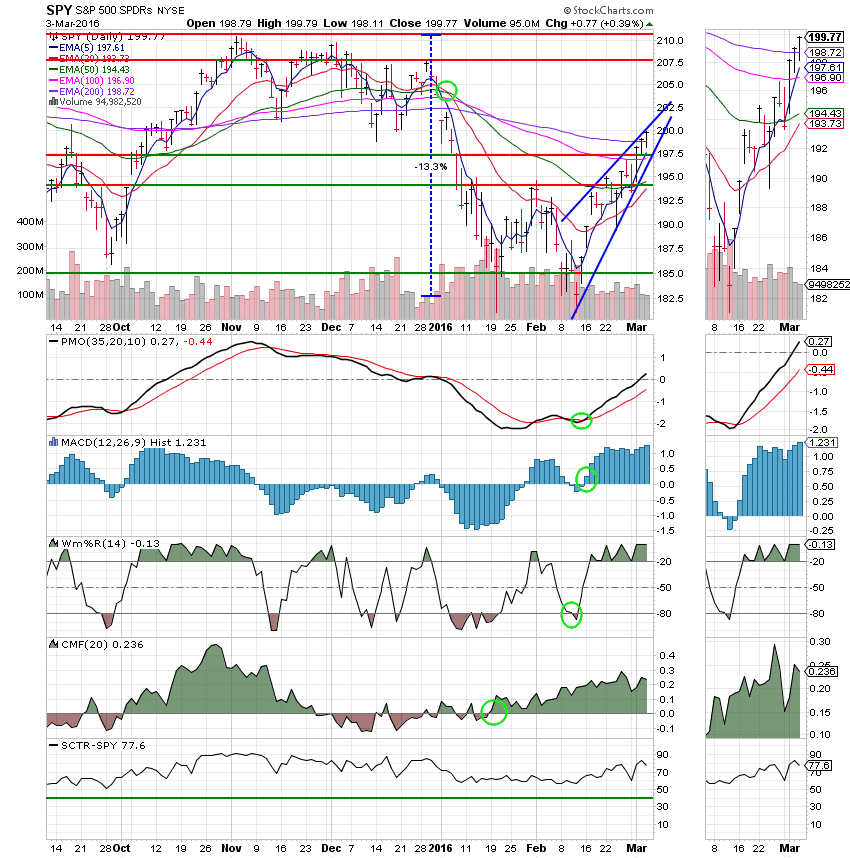

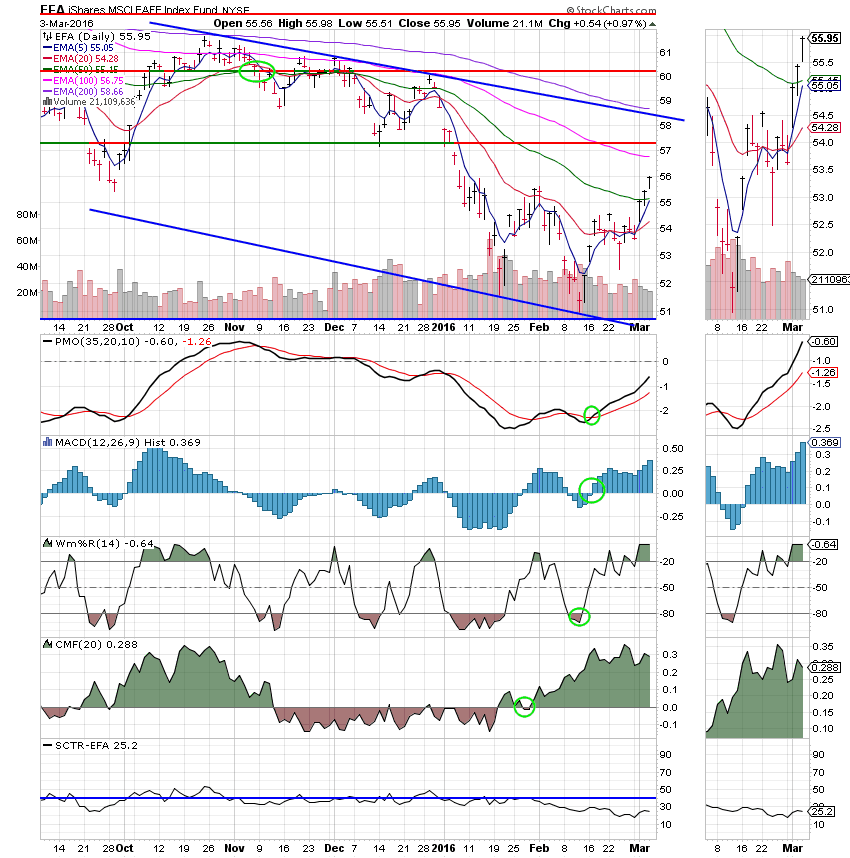

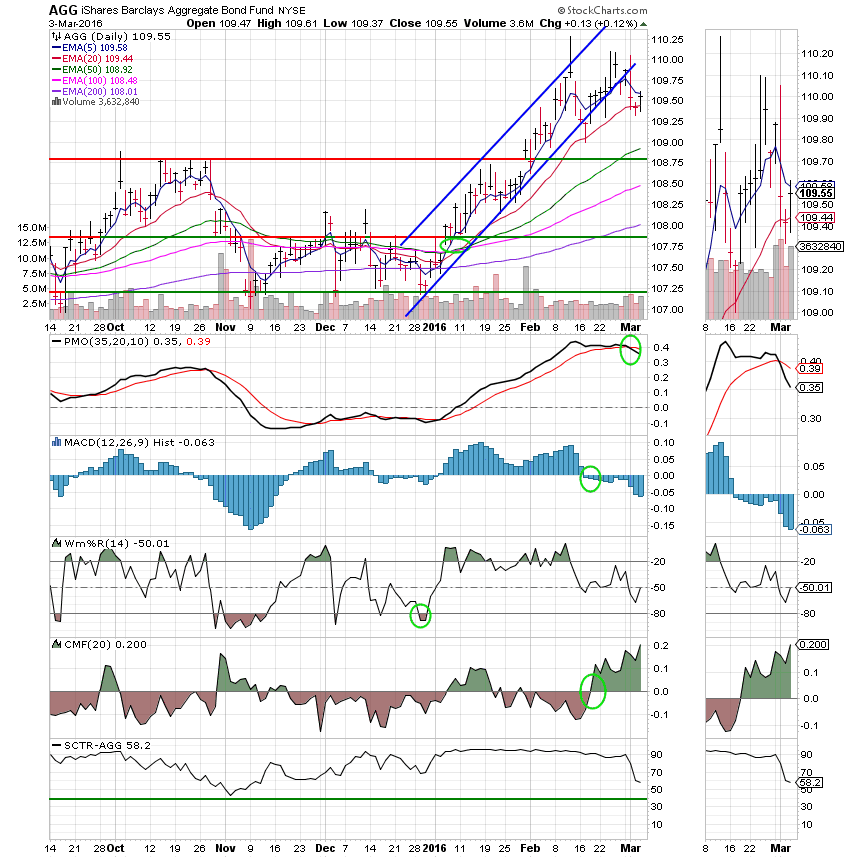

Now lets take a look at the charts. If you click on the charts they will become larger. All signals are annotated with Green Circles.

C Fund: Prices steady rise is pulling us closer to our next planned entry point which is the 5 EMA passing up through the 200 EMA. Depending on how the market trades, we could easily reach that signal in the next few days.

S Fund:

I Fund:

F Fund: The SCTR has now dropped to 58.2 reflecting the recent weakness of this fund.

The key right now is to be patient and not force anything. It’s easy to become too anxious and fall into a trap. Things are looking good right now, but that can easily change. We may get another chance to put some more money to work in the next two days. I’ll put out on alert it that’s the case. That’s all for tonight. Have a great evening!