Good Evening, The bears tried to take us down again this morning, but the dip buyers showed up and made them pay again. The market moved up through out the afternoon closing at it’s highs for the day. One thing of note, is what I call the Berkshire Hathaway effect. The Monday after Berkshire Hathaway’s annual shareholder meeting is always higher. That is good. The days following that Monday are usually lower as investors lose their euphoria. That is not so good. We will see if it happens again………

The days trading left us with the following results: Our TSP allotment gained a nice +0.89%. For comparison, the Dow added +0.66%, The Nasdaq +0.88%, and the S&P 500 +0.78%. Praise God, we had them covered today!

Wall St. rebounds; Nasdaq breaks seven-day losing run

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, and F-Neutral. We are currently invested at 100/S. Our allotment is now +3.27% on the year not including the days gains. Here are the latest posted results:

| 04/29/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0093 | 17.5566 | 28.0492 | 35.5944 | 24.0022 |

| $ Change | 0.0014 | 0.0239 | -0.1427 | -0.2158 | -0.1297 |

| % Change day | +0.01% | +0.14% | -0.51% | -0.60% | -0.54% |

| % Change week | +0.04% | +0.41% | -1.24% | -1.07% | -1.46% |

| % Change month | +0.14% | +0.41% | +0.39% | +1.73% | +1.89% |

| % Change year | +0.63% | +3.55% | +1.77% | +1.02% | -0.39% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9445 | 23.4521 | 25.3492 | 26.8784 | 15.1919 |

| $ Change | -0.0161 | -0.0535 | -0.0832 | -0.1037 | -0.0675 |

| % Change day | -0.09% | -0.23% | -0.33% | -0.38% | -0.44% |

| % Change week | -0.20% | -0.54% | -0.78% | -0.92% | -1.06% |

| % Change month | +0.34% | +0.58% | +0.75% | +0.85% | +0.95% |

| % Change year | +0.96% | +1.05% | +1.14% | +1.16% | +1.10% |

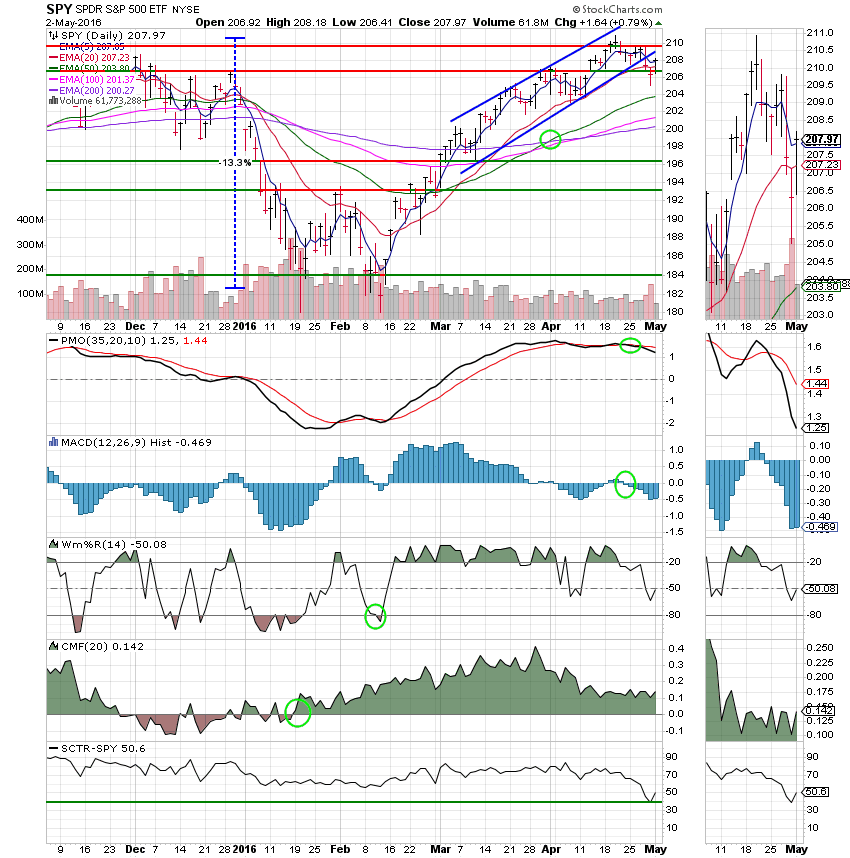

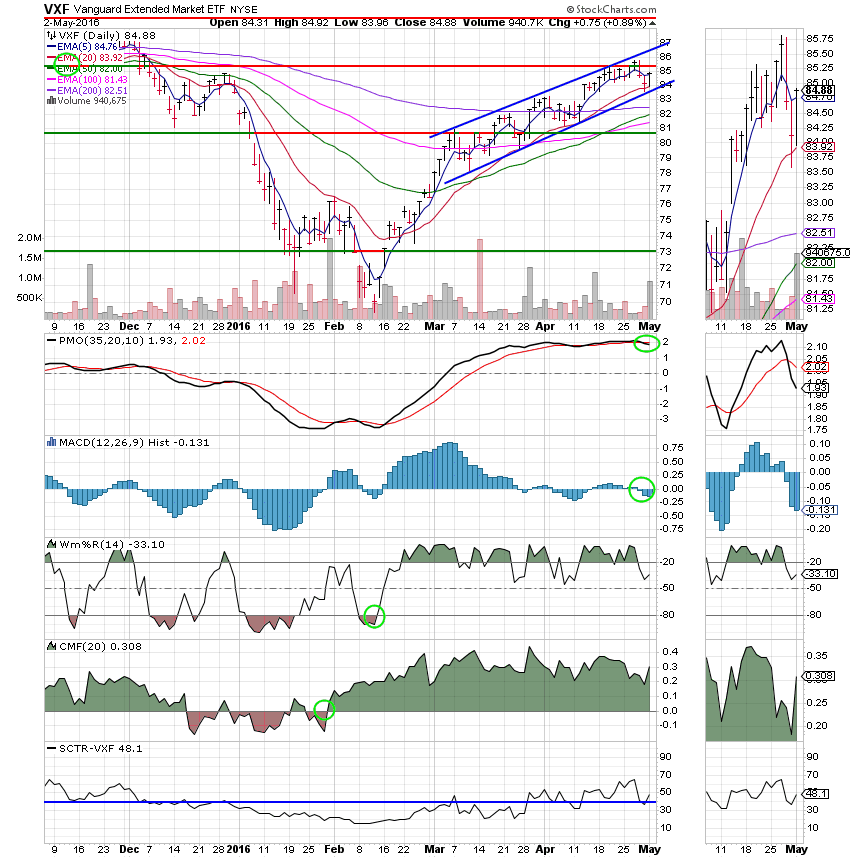

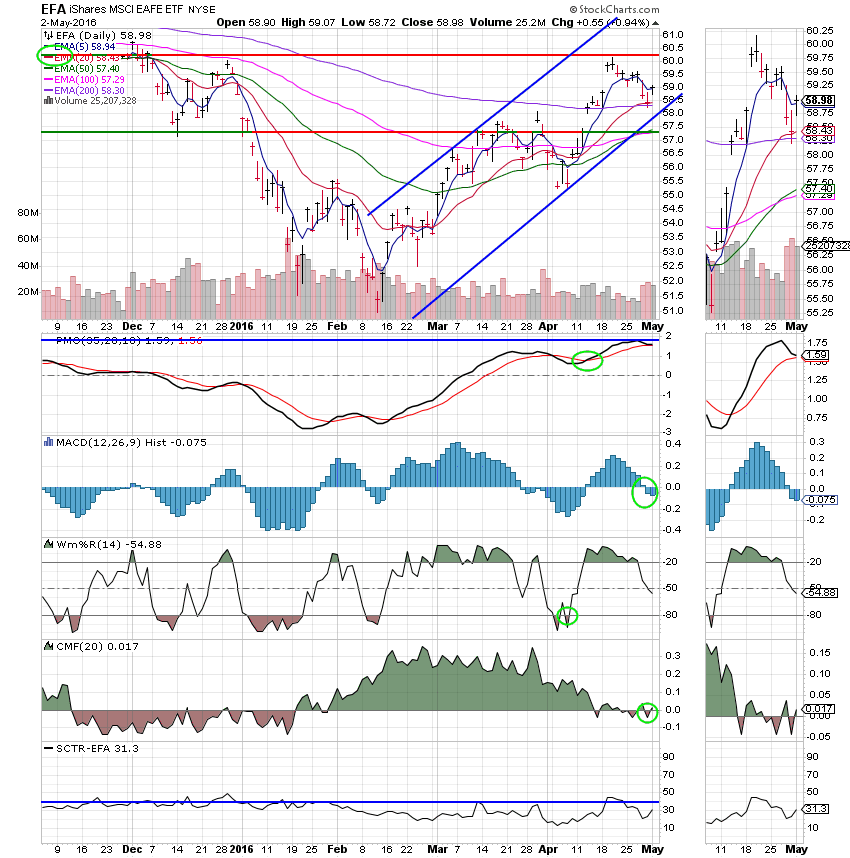

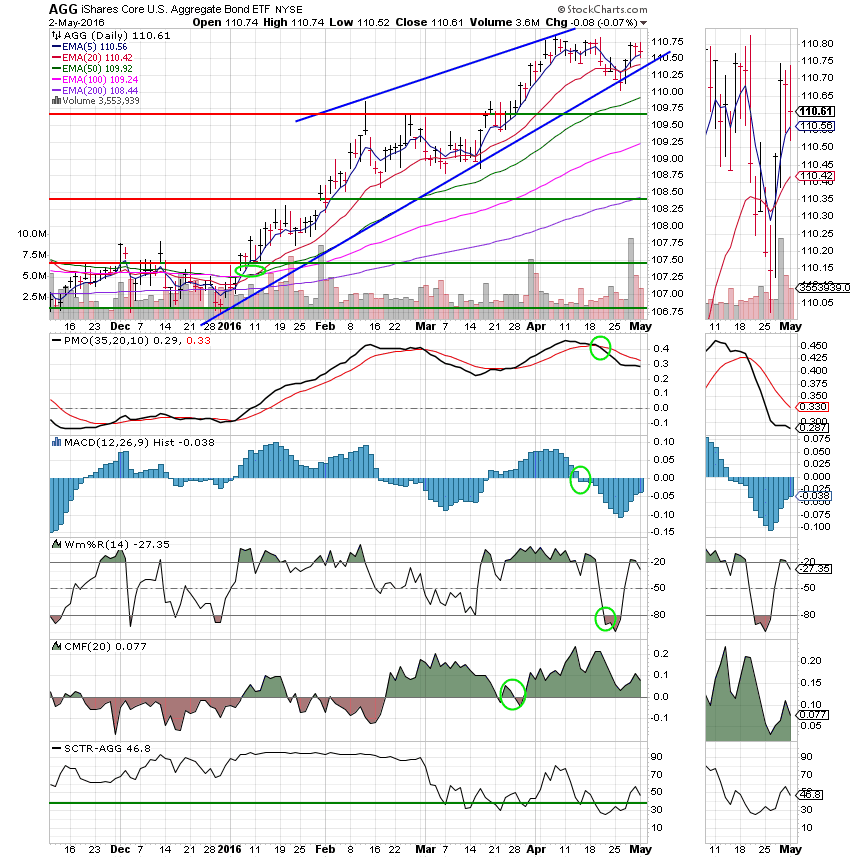

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

Our move to the S Fund paid off today as it will on most up days. However, as I have said many times. The S Fund is a fund that you want to own when the market is going up, not when it is going down. In order for this allocation to work well, the market must have more up days than down….. That’s all for tonight. Have a nice evening and I’ll see you tomorrow!