Good Evening, The news reported that the polls in Great Britain are now favoring remaining in the European Union ahead of Thursday’s vote there. That was enough to cause the market to do a 180 and rally for most of the day. Although, stocks did close off their highs. We’ll see if the exhuberance continues on Tuesday…

The days trading left us with the following results: Our TSP allotment outperformed the market with a nice gain of +1.10%. For comparison the Dow added +0.73%, the Nasdaq +0.77%, and the S&P 500 +0.58%. Thank God for another good day!

Wall Street ends higher as Britain seen staying in EU

The days action left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/S. Our allocation is now +4.16% on the year not including today’s gains. Here are the latest posted results:

| 06/17/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0443 | 17.7503 | 28.2374 | 35.9012 | 23.0561 |

| $ Change | 0.0008 | -0.0395 | -0.0929 | -0.0413 | 0.1254 |

| % Change day | +0.01% | -0.22% | -0.33% | -0.11% | +0.55% |

| % Change week | +0.04% | +0.06% | -1.13% | -1.28% | -1.91% |

| % Change month | +0.09% | +1.02% | -1.11% | -0.93% | -4.20% |

| % Change year | +0.86% | +4.69% | +2.45% | +1.89% | -4.31% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9649 | 23.4245 | 25.2764 | 26.7746 | 15.1164 |

| $ Change | -0.0030 | -0.0060 | -0.0081 | -0.0090 | -0.0047 |

| % Change day | -0.02% | -0.03% | -0.03% | -0.03% | -0.03% |

| % Change week | -0.24% | -0.60% | -0.86% | -1.01% | -1.16% |

| % Change month | -0.27% | -0.80% | -1.19% | -1.41% | -1.63% |

| % Change year | +1.08% | +0.93% | +0.85% | +0.76% | +0.60% |

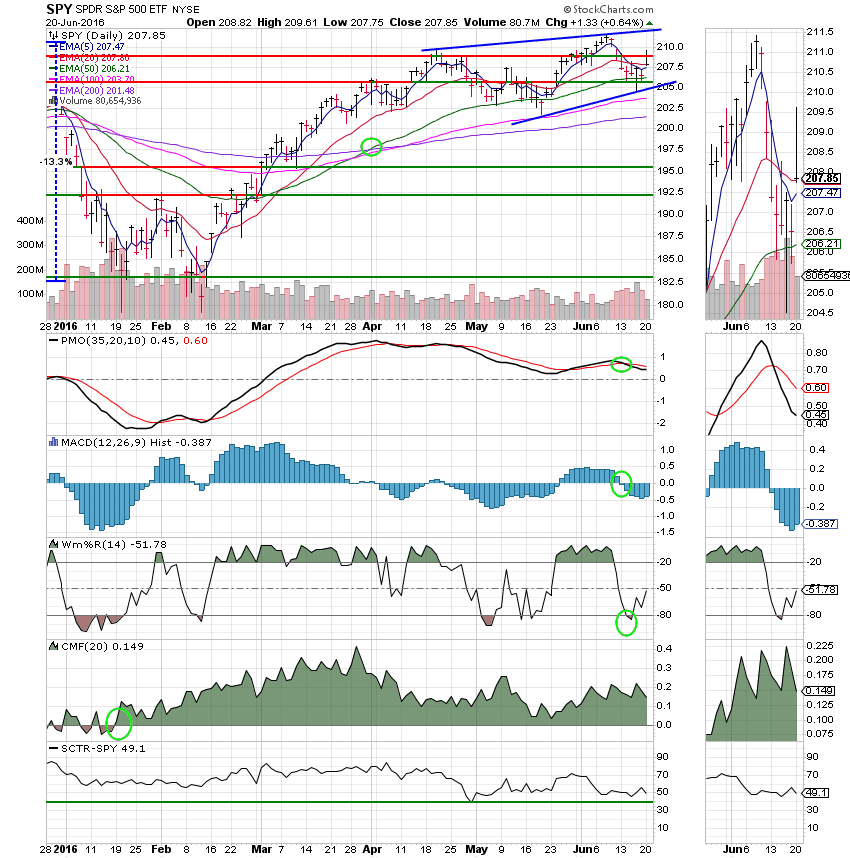

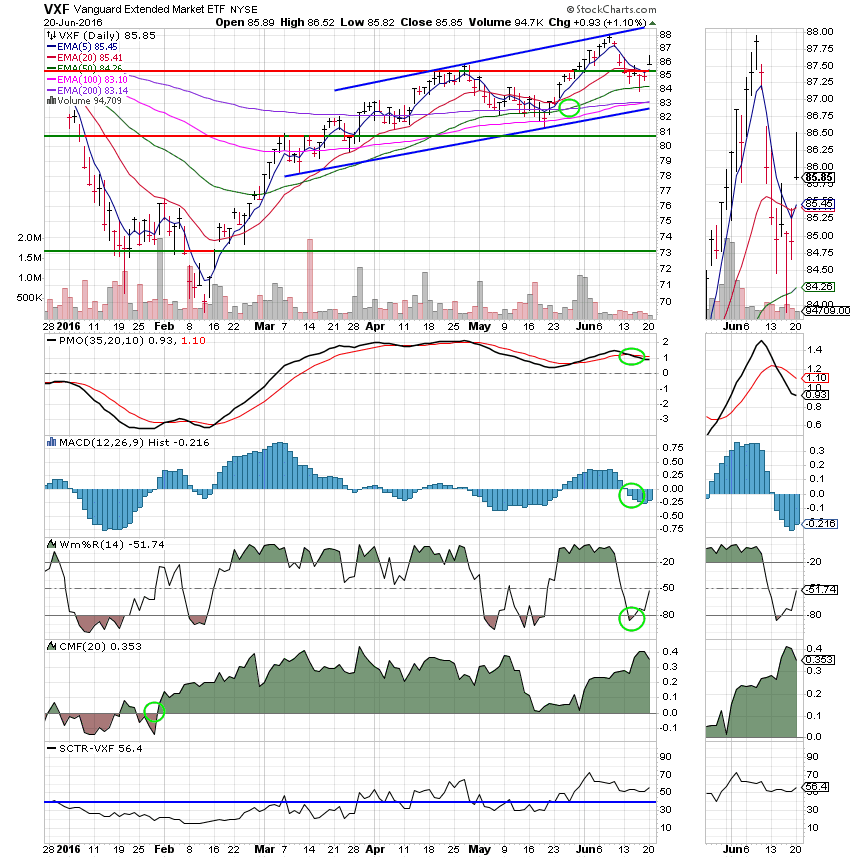

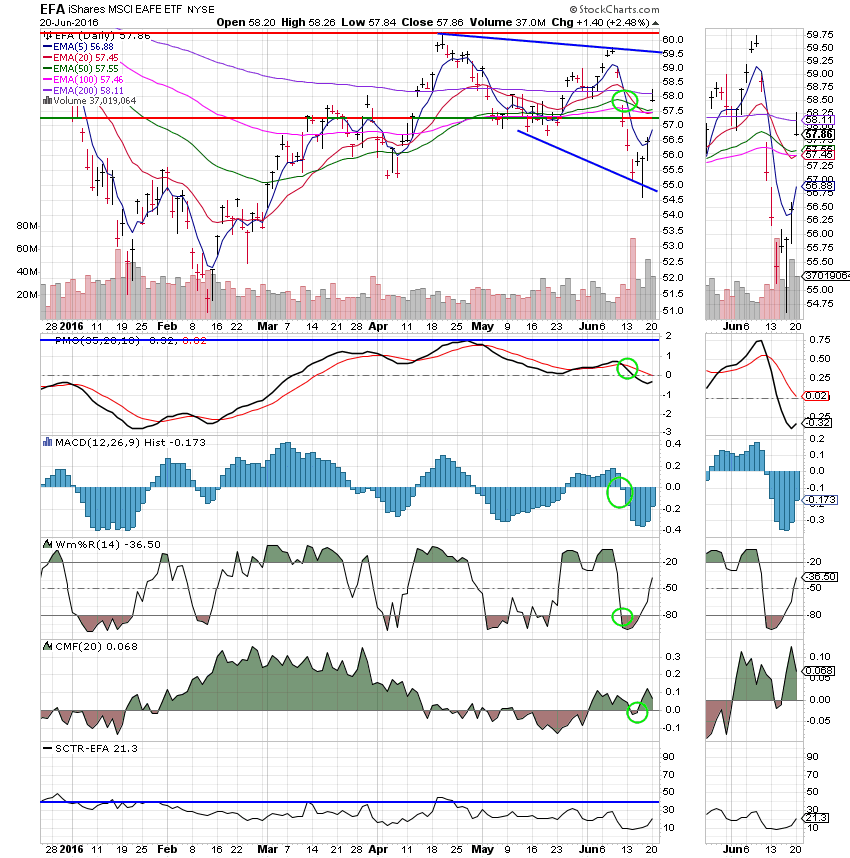

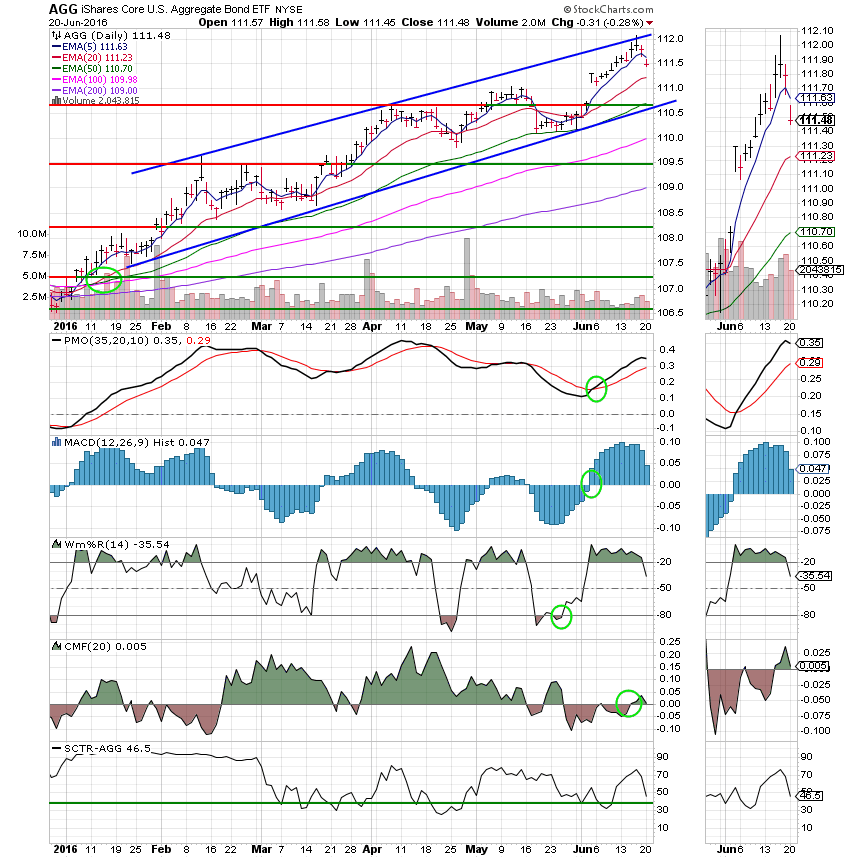

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price bounced off of support at it’s 50 EMA and remains within an ascending bearish wedge. Price will ultimately have to break though the upper trend line to move higher. While the current pattern is bearish it is not 100%. It can and does occasionally break higher. Holding to bottom trend line here will be critical.

S Fund: Price bounced off of support at 85.25 and remains solidly within it’s bullish ascending wedge.

I Fund: The I Fund by far had the best return for the day of any of our TSP funds. However, it’s chart has the most damage to repair. With an SCTR of only 21.3 it will be a while before we can put any money to work here.

F Fund: Price pulled back today but remains well within it’s established ascending channel. The F Fund is a safe bet as long as interest rates don’t rise. Today’s drop in price was more a result of the stock rally than it was fundamentals. That said, you can expect a little more downside here if stocks continue to rally.

Our allocation is working about as well as anything. However, I said it before and I’ll say it again, I believe when all is said and done that a 5 percent return will be a good return in 2016. We’ll continue to watch our charts and react to the action that’s before us. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()