Good Evening, Today was another good example of how this market can ignore bad news. Brexit, no problem, European Banks Collapsing, no problem, US Job creation anemic, just another day… The bottom line is when the machines start buying, nobody wants be left behind. That’s a trade that’s been working for several years now and I don’t see it stopping any time soon. That said, the persistent upside on defensive things such as precious metals and bonds is troubling. More than likely, it is a signal that there is more downside to come. Keep a close eye on your charts and don’t get faked out by the machines! Make your trades when you know it’s right, not when you feel it’s right!

The days rollercoaster left us with the following results. Our TSP allotment gained +0.19%. For comparison, the Dow added +0.44%, the Nasdaq +0.75%, and the S&P 500 +0.54%. It’s like I said prior to the last selloff. When stocks and bonds go up at the same time something has to give!

Wall Street up on cautious Fed, upbeat data

The days action left us with the following signals: C-Buy, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/F. Our allocation is now +1.98% on the year not including todays results. Here are the latest posted results.

| 07/05/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0575 | 18.0137 | 28.4949 | 35.8587 | 22.9871 |

| $ Change | 0.0025 | 0.0890 | -0.1946 | -0.4816 | -0.4566 |

| % Change day | +0.02% | +0.50% | -0.68% | -1.33% | -1.95% |

| % Change week | +0.02% | +0.50% | -0.68% | -1.33% | -1.95% |

| % Change month | +0.02% | +0.71% | -0.47% | -0.92% | -1.20% |

| % Change year | +0.95% | +6.24% | +3.38% | +1.77% | -4.60% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.0167 | 23.5215 | 25.3914 | 26.8999 | 15.1845 |

| $ Change | -0.0341 | -0.1118 | -0.1804 | -0.2261 | -0.1479 |

| % Change day | -0.19% | -0.47% | -0.71% | -0.83% | -0.96% |

| % Change week | -0.19% | -0.47% | -0.71% | -0.83% | -0.96% |

| % Change month | -0.09% | -0.27% | -0.43% | -0.52% | -0.61% |

| % Change year | +1.37% | +1.35% | +1.31% | +1.24% | +1.05% |

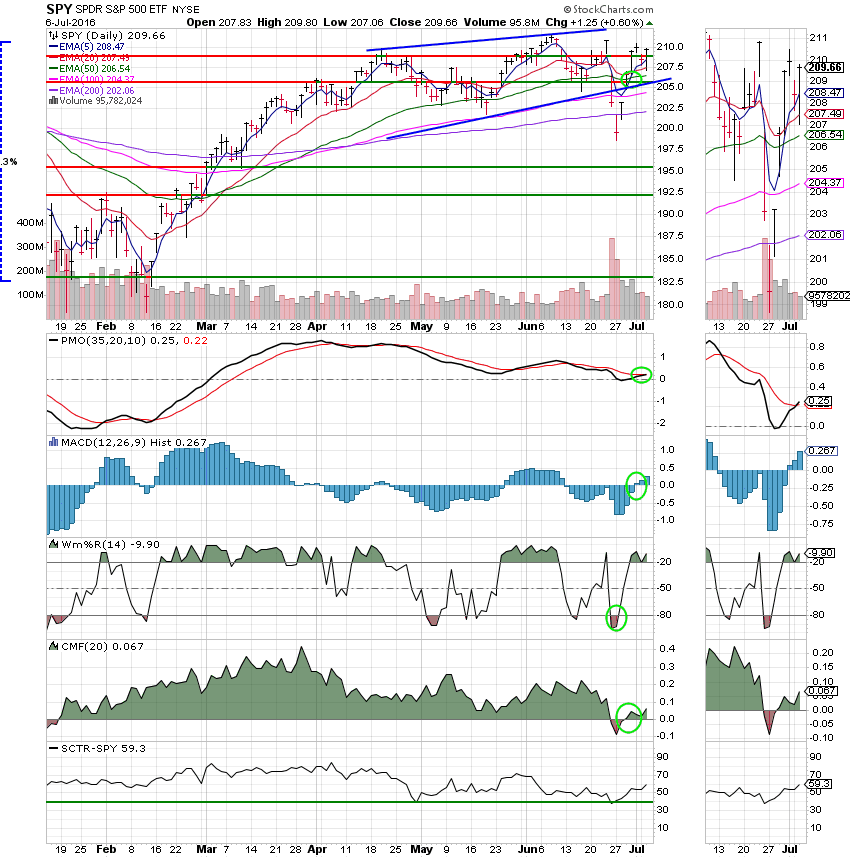

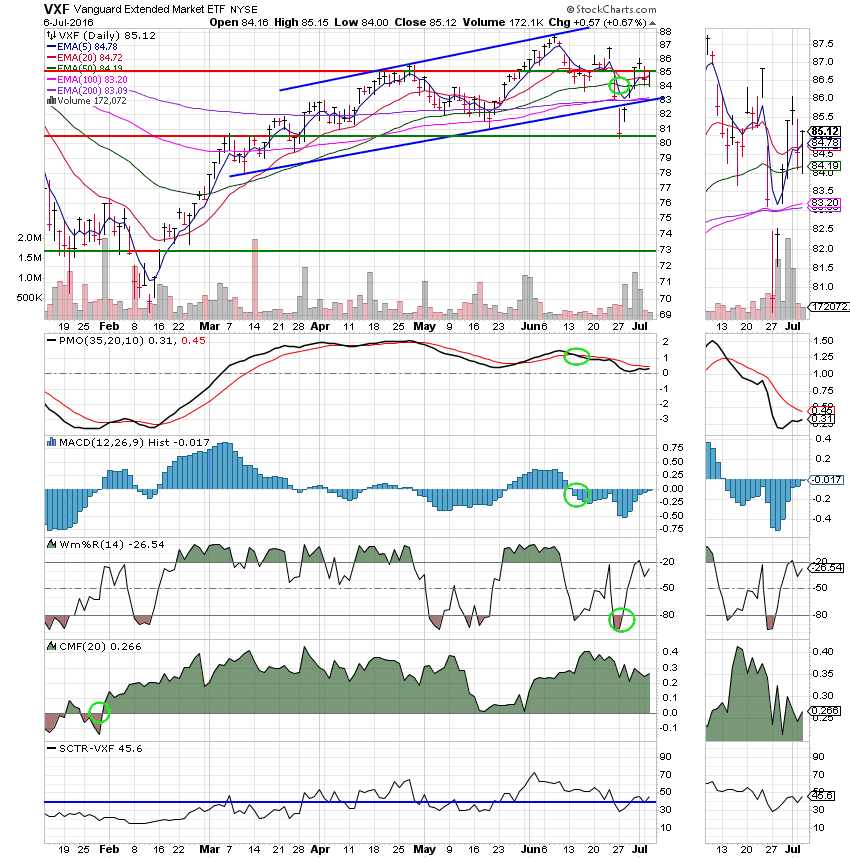

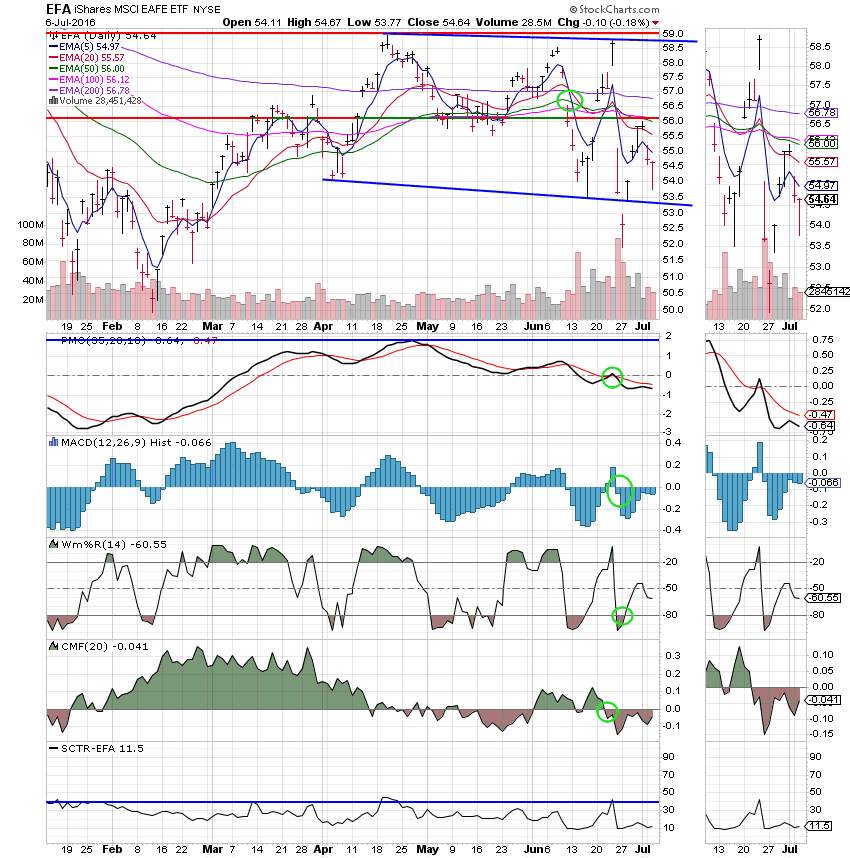

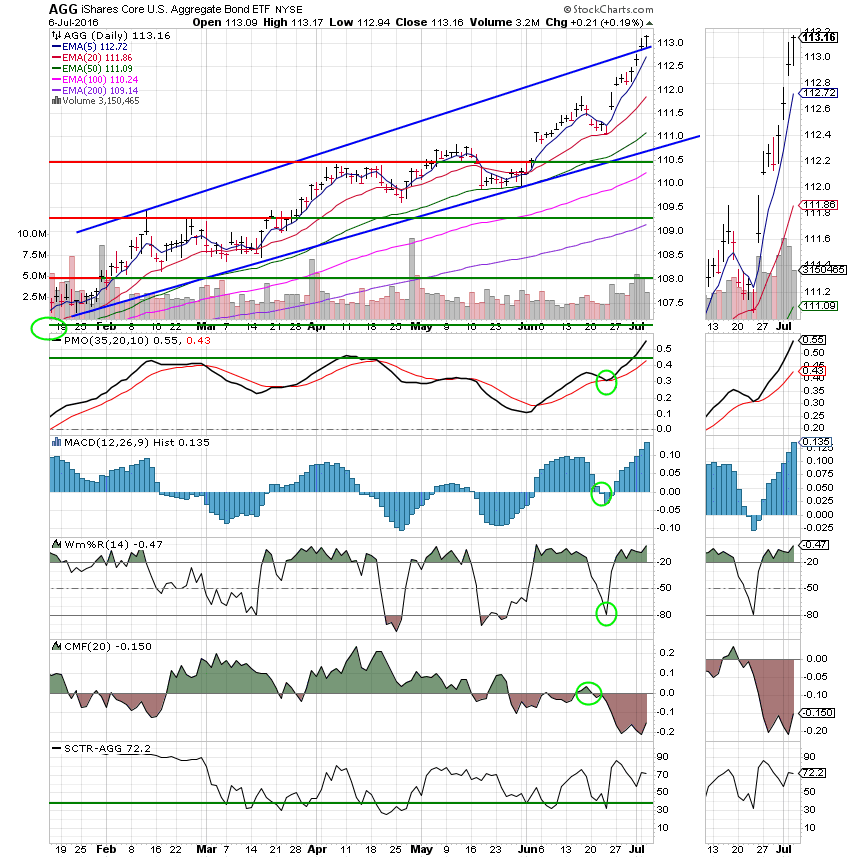

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: The C Fund moved to a buy signal today when the PMO moved into a positive configuration. All indicators are getting stronger for this chart. The SCTR is still a little weak at 59.3.

S Fund: Small caps are struggling a little bit as evident by the S Funds Neutral signal. This neutral signal is supported by a low SCTR of 45.6.

I Fund: This one is still a sell and it is still trending down. A large amount of this fund is made up of European stocks. What does that say about all stocks?? This is a world economy and it’s hard to ignore the poor action abroad. An SCTR of only 11.5 tells us to beware of the I Fund! This one is still heading down.

F Fund: It may not be glamorous, but the F Fund is making consistent money. Price has again broken through the upper trend line exceeding the well established trading channel. The only negatives with this chart are a negative CMF and the fact that it’s starting to look a little extended and in need of a rest. An SCTR of 72.2 is the best of any of our TSP funds. I’m leaving 100% here for now….

The market is heading up again right??? Not so fast, I have a problem with this rally when defensive sectors are looking so good. I also have a problem with the fact that all my charts are still favoring the bears. For instance, consumer staples are out performing consumer discretionary stocks; the S&P 500 is out performing banks, the S&P 500 is out performing technology, Utilities are outperforming the S&P 500…the list goes on and on and it’s all bearish. The bottom line is that I just don’t trust this rally. My indicators such as the ones I mentioned continue to throw up caution flags. That being the case, I find myself in no hurry to jump back into equities. Ideally I’d like to see a pullback of 10% or more before I would feel confident in the C, S, or I Funds. But will the machines let that happen?? Only the charts will tell us for sure. That’s all for tonight. I apologize to my many friends once again for our recent technical difficulties. I will mention again, if there are problems with the website I will try to post any relevant updates on our Facebook page. Have a great evening and may God bless your trades.