Good Evening, The market hit new highs today, but there seems to be a lack of the jubilation that would have accompanied such news in past years. Investors seemed to have shrugged off brexit and other economic concerns. Despite this, I find their demeanor somewhat cautious rather than celebratory. The only way to make money in this market is to chase extended stocks and funds. No one is comfortable with that. Also, given the fact that defensive investments such as utilities, precious metals, and municipal bonds have led the way, it’s not surprise that there is more caution than excitement. That is precisely the reason that I am in no hurry to increase my exposure to equities. I firmly believe ,given the negative seasonality that begins this month and lasts until the end of September, that we will have an opportunity to reenter the equity market after a pullback. A better opportunity than we have right now. Granted, it is hard not to pull the trigger on stocks when your out and it seems like everyone else is in…..However, as I have always said, this isn’t mad money we are playing with, it’s retirement money! And where retirement money is concerned it’s what you keep that’s most important!!! Keep building on what you have, not rebuilding what you lost.

The days rally left us with the following results: Our TSP allotment fell back -0.26%. For comparison, the Dow gained +0.44%, the Nasdaq +0.64%, and the S&P 500 +0.34%.

Strong economy, earnings bets propel S&P 500 to record high

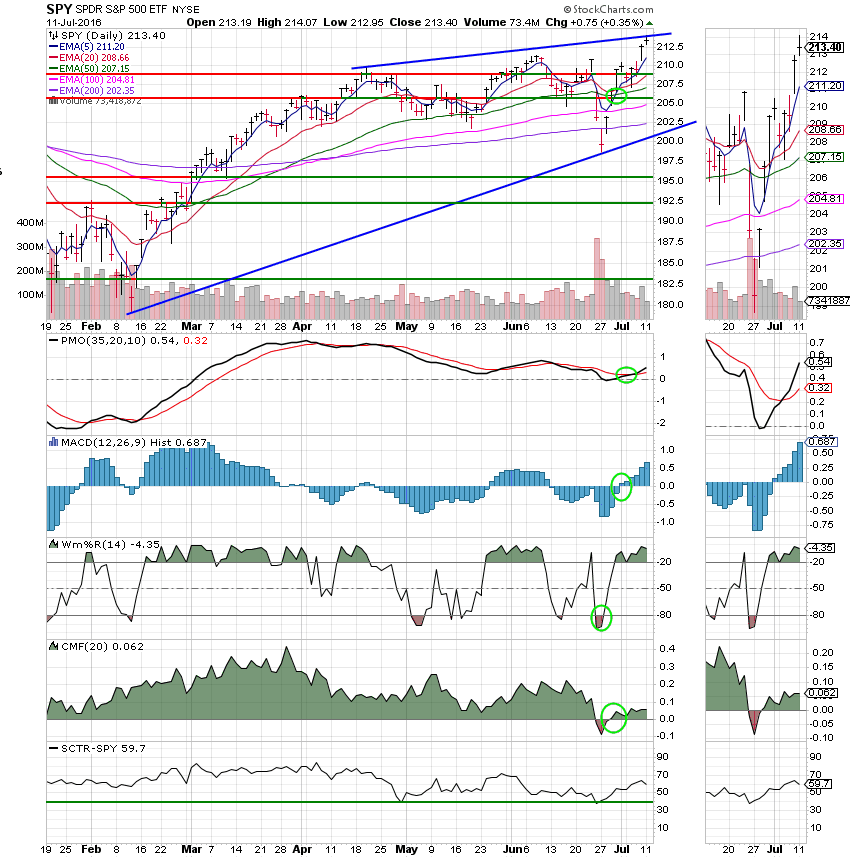

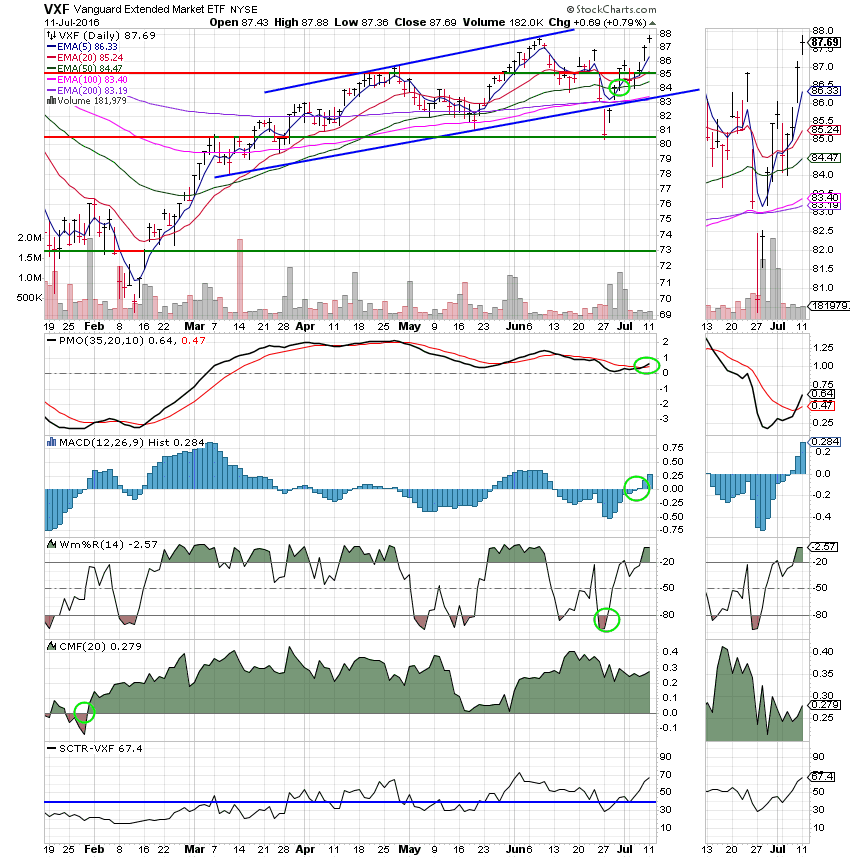

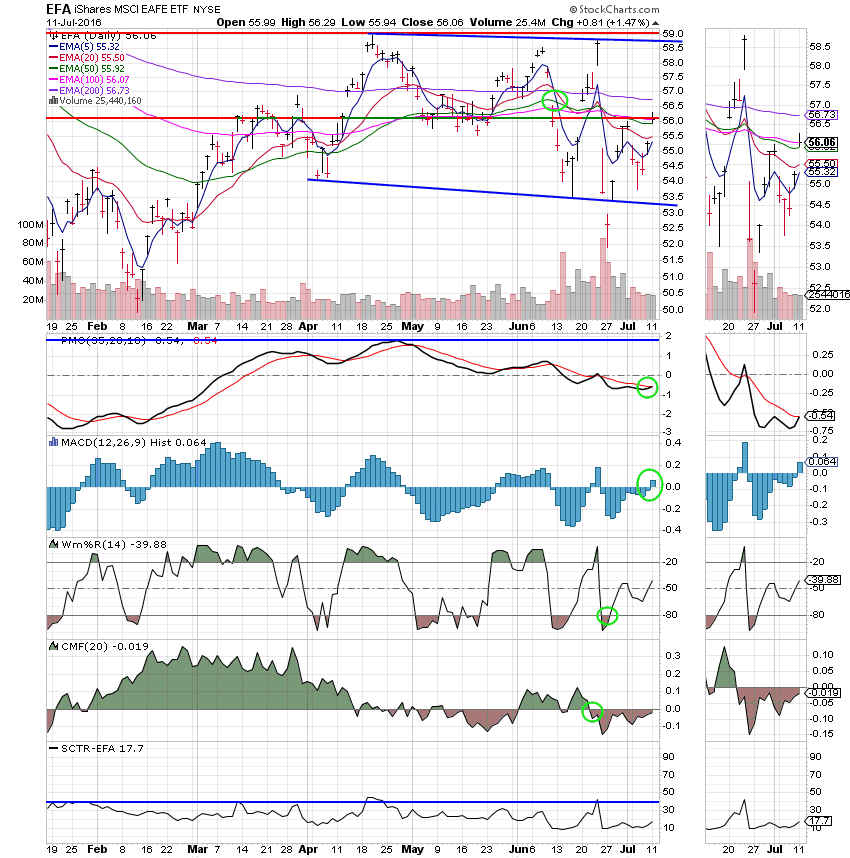

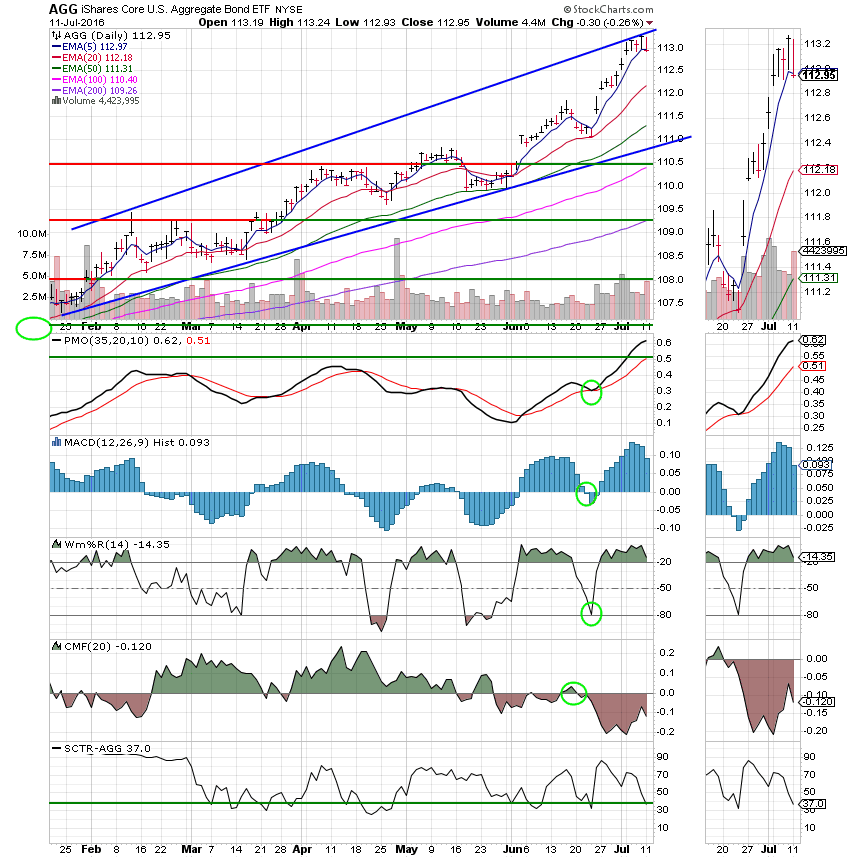

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Buy. We are currently invested at 100/F. The signal whipsawed after we exited the S Fund and entered the F Fund with the S Fund generating a second buy signal. Our strategy now is to stay in the F Fund as long as we don’t get a sell signal and wait for a better entry point into equities on a pullback. I know several of you follow the signals straight up and that is definitely working better right now than taking fundamentals into consideration. By all means, our allocation is just a recommendation. Do what you feel comfortable with and what works best for you. Our allocation is currently +1.87% on the year. Here are the latest posted results:

| 07/11/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0612 | 17.994 | 29.1715 | 37.1728 | 23.4222 |

| $ Change | 0.0019 | -0.0369 | 0.0994 | 0.2755 | 0.2426 |

| % Change day | +0.01% | -0.20% | +0.34% | +0.75% | +1.05% |

| % Change week | +0.01% | -0.20% | +0.34% | +0.75% | +1.05% |

| % Change month | +0.05% | +0.60% | +1.90% | +2.71% | +0.67% |

| % Change year | +0.98% | +6.13% | +5.84% | +5.50% | -2.79% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.1055 | 23.773 | 25.7836 | 27.3859 | 15.4975 |

| $ Change | 0.0218 | 0.0631 | 0.0990 | 0.1231 | 0.0800 |

| % Change day | +0.12% | +0.27% | +0.39% | +0.45% | +0.52% |

| % Change week | +0.12% | +0.27% | +0.39% | +0.45% | +0.52% |

| % Change month | +0.40% | +0.79% | +1.11% | +1.28% | +1.44% |

| % Change year | +1.87% | +2.43% | +2.87% | +3.06% | +3.14% |