Good Evening, The markets decided to pause ahead of tomorrows jobs report finishing mostly flat on the day. Our TSP allotment added +0.19%. For comparison, the Dow slipped -0.02%, the Nasdaq rose +0.13%, and the S&P 500 eked out a gain at +0.02%. Praise God, our Bonds held their own for a change.

Wall St. flat as investors look to jobs data

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. The signals really reflect the tight trading range that this market is in and the fact that it could easily resolve in either direction. We are currently invested at 100/F. Our allocation is now +1.47% on the year not including the days results. Here are the latest posted results.

| 08/03/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0752 | 17.9243 | 29.5598 | 37.8893 | 23.9358 |

| $ Change | 0.0006 | -0.0019 | 0.1011 | 0.2859 | -0.2514 |

| % Change day | +0.00% | -0.01% | +0.34% | +0.76% | -1.04% |

| % Change week | +0.01% | -0.43% | -0.42% | -0.67% | -2.09% |

| % Change month | +0.01% | -0.43% | -0.42% | -0.67% | -2.09% |

| % Change year | +1.07% | +5.72% | +7.25% | +7.53% | -0.66% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.1745 | 23.9547 | 26.0611 | 27.7277 | 15.7176 |

| $ Change | -0.0001 | -0.0009 | -0.0013 | -0.0009 | -0.0001 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | -0.21% | -0.44% | -0.63% | -0.74% | -0.83% |

| % Change month | -0.21% | -0.44% | -0.63% | -0.74% | -0.83% |

| % Change year | +2.26% | +3.22% | +3.98% | +4.35% | +4.60% |

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

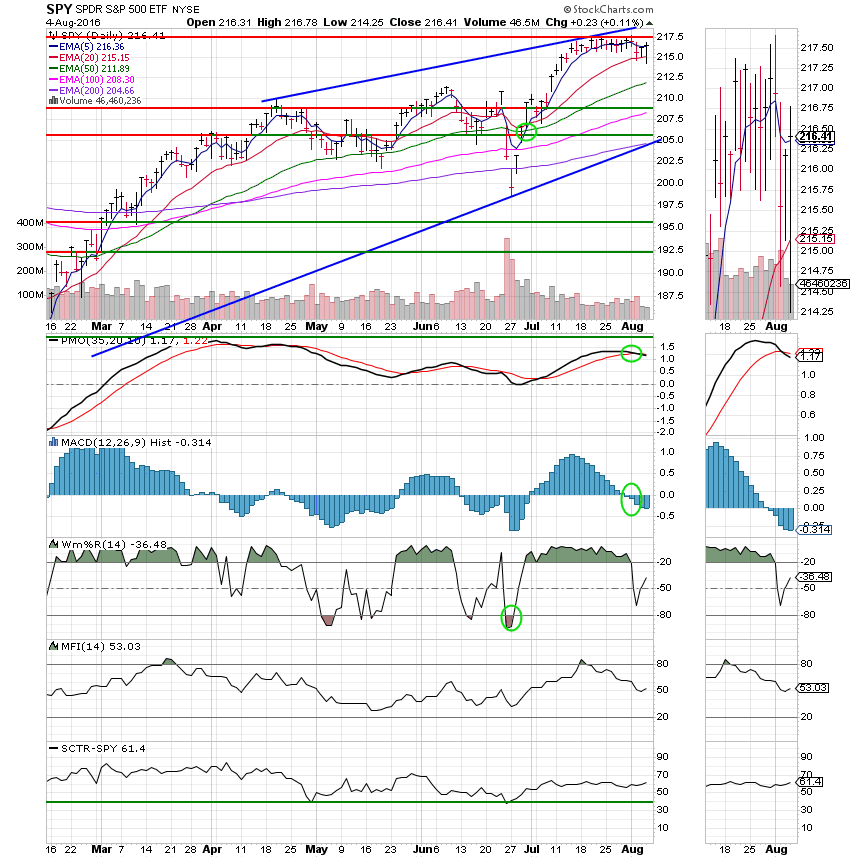

C Fund:

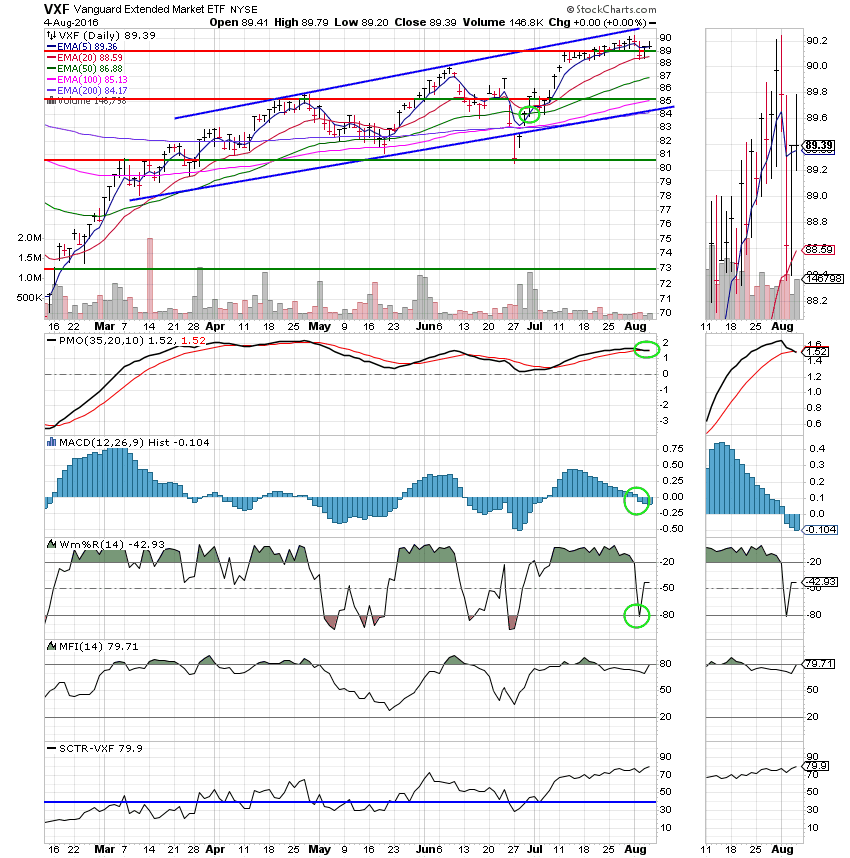

S Fund:

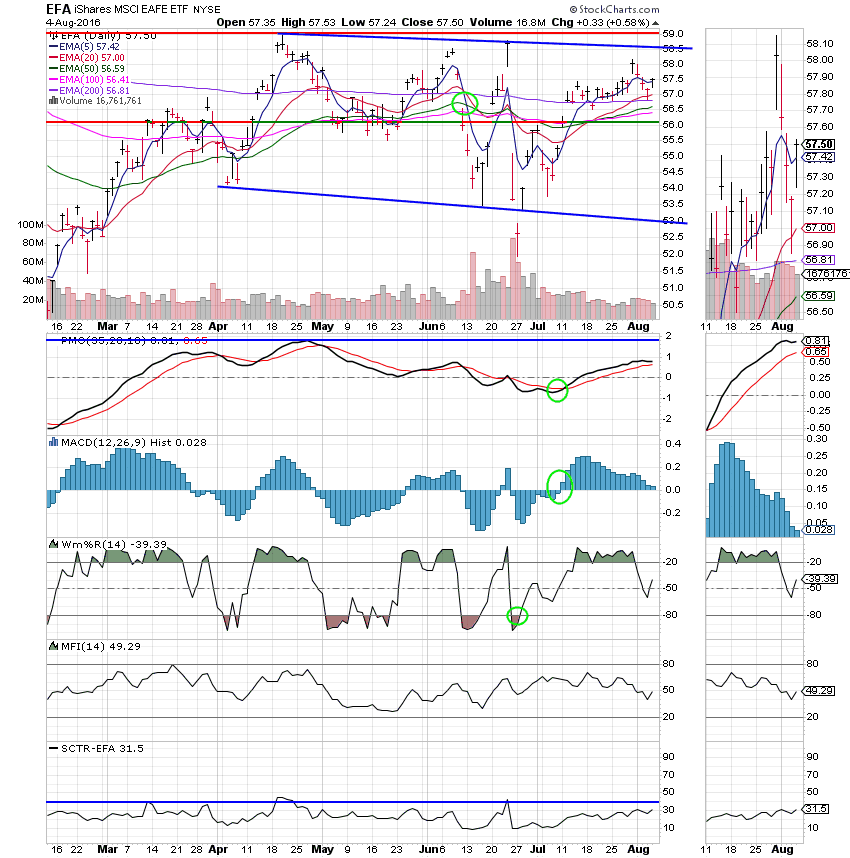

I Fund:

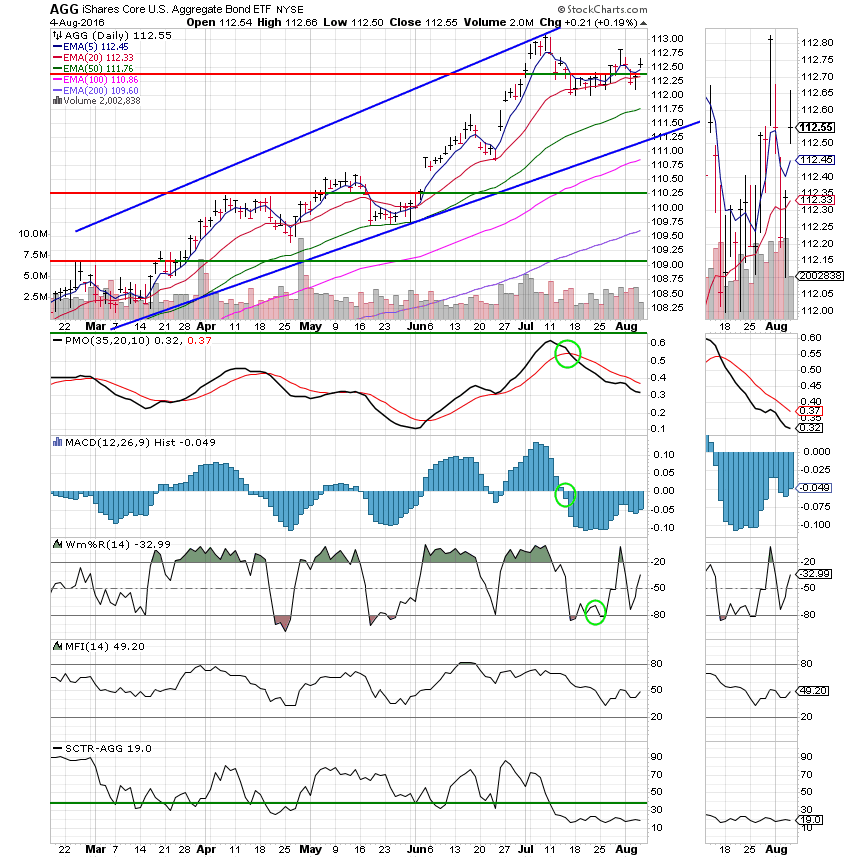

F Fund:

Tomorrow morning the Federal Government will release the jobs report. In recent months it has become a real market catalyst as it plays such an important part in the FED decision to increase interest rates. Perhaps tomorrows report will break us out of this market purgatory that we have been in. We need a pullback. That is how we make money. This endless flat action isn’t getting it done. It just is not healthy for a market to go up without taking a rest. I don’t care what it has done since 2009. What goes up, must and will come down. I would prefer that it be a little at a time rather than all at once, but the longer this trend heads up the more it makes me wonder…… Have a nice evening and may God continue to bless your trades.