Good Evening, All three major indexes posted new all time highs today. Although, the gains where moderate at best. The major indexes have also broken ever so slightly out of the tight trading range they have been in for the past eight weeks. The only question is will it hold?

The days trading left us with the following results: Our TSP allotment dropped -0.27%. For comparison the Dow gained +0.64%, the Nasdaq +0.46%, and the S&P 500 +0.47%. Stocks were up and bonds were down.

The days action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Neutral. The I Fund is started to heat up. We’ll take a look at the chart below. We are currently invested at 100/F. Our allocation is now +1.53% on the year. Here are the latest posted results.

| 08/11/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.0801 |

17.9334 |

29.8876 |

38.264 |

24.7651 |

| $ Change |

0.0006 |

-0.0592 |

0.1447 |

0.1521 |

0.1499 |

| % Change day |

+0.00% |

-0.33% |

+0.49% |

+0.40% |

+0.61% |

| % Change week |

+0.02% |

+0.15% |

+0.20% |

+0.01% |

+2.69% |

| % Change month |

+0.04% |

-0.38% |

+0.69% |

+0.31% |

+1.30% |

| % Change year |

+1.10% |

+5.77% |

+8.44% |

+8.59% |

+2.78% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.2444 |

24.1479 |

26.3608 |

28.0976 |

15.9549 |

| $ Change |

0.0156 |

0.0500 |

0.0804 |

0.1005 |

0.0659 |

| % Change day |

+0.09% |

+0.21% |

+0.31% |

+0.36% |

+0.41% |

| % Change week |

+0.21% |

+0.42% |

+0.60% |

+0.69% |

+0.77% |

| % Change month |

+0.17% |

+0.36% |

+0.51% |

+0.59% |

+0.67% |

| % Change year |

+2.65% |

+4.05% |

+5.18% |

+5.74% |

+6.18% |

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

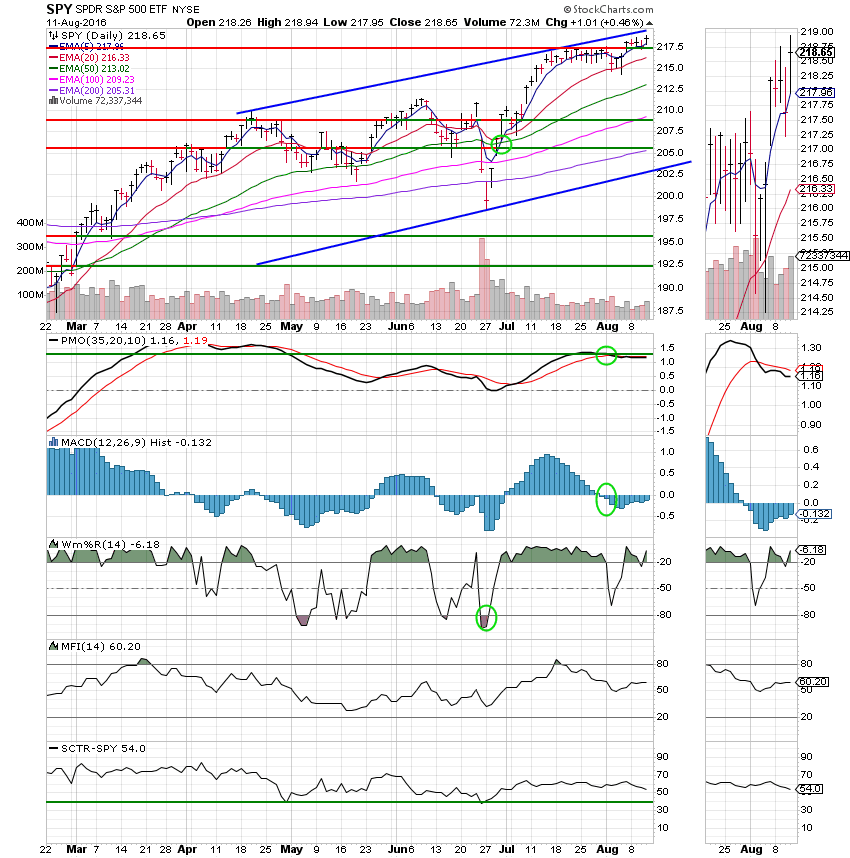

C Fund:

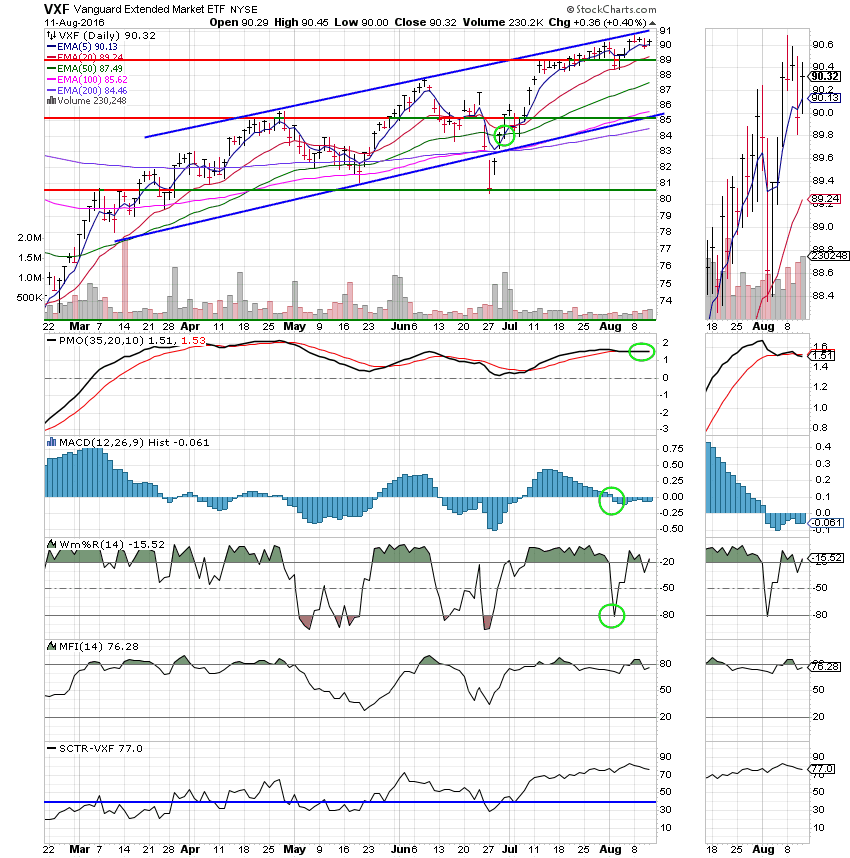

S Fund:

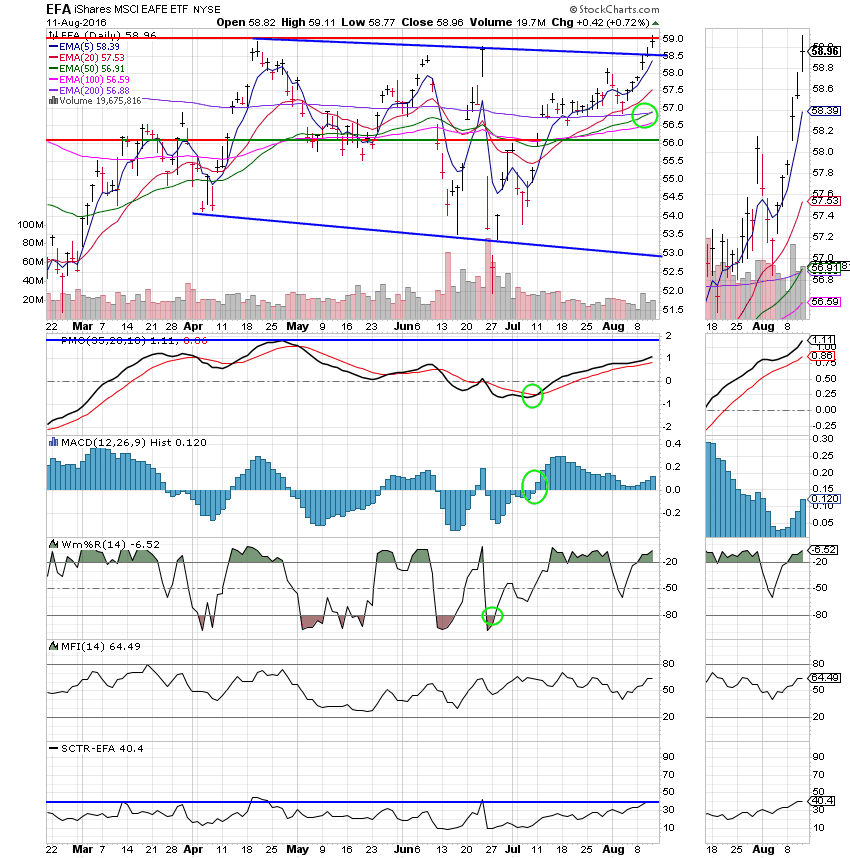

I Fund: The I Fund generated an overall buy signal today when the 50 EMA passed up though the 200 EMA. Price also tested resistance at 59.0. This chart has outperformed the past 3 sessions. We will watch it closely and consider allocating some funds here if overhead resistance is broken at 59.0. I’d also like to see the SCTR improve.

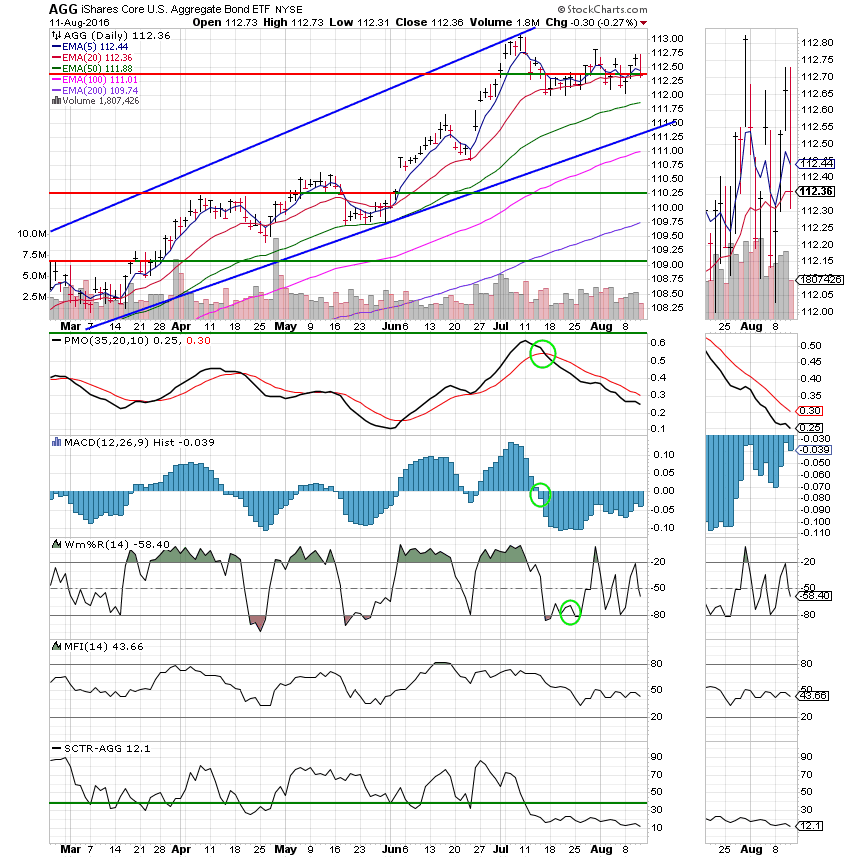

F Fund: Moving sideways. There are a lot of head winds due to speculation about a FED rate increase in September.

That’s all for tonight. The I Fund is looking promising. We’ll watch it’s chart as well as the major indexes. Remember, a day can make a big difference so we will approach this bull with caution. I would still prefer to see a pullback. Does this market pullback anymore?? Keep praying that God will guide our group. He has never let us down before. Give Him all the praise! Have a nice evening.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.