Good Evening, During this season, it really doesn’t matter which way the market moves. In the end it comes back to neutral or at least significantly close. Today was just another day that the market traded in the incredibly tight range that it has been in since early July. This weeks reason is that that we are treading water as we wait for world bankers to conclude their meeting in Jackson Hole Wyoming. This meeting has been the platform from which many significant announcements have been made by the Federal Reserve Chairman/ women. Also, to a lesser degree, there is the influence of anything that goes on there with regard to world monetary policy. I guess we’ll just have to wait until Friday.

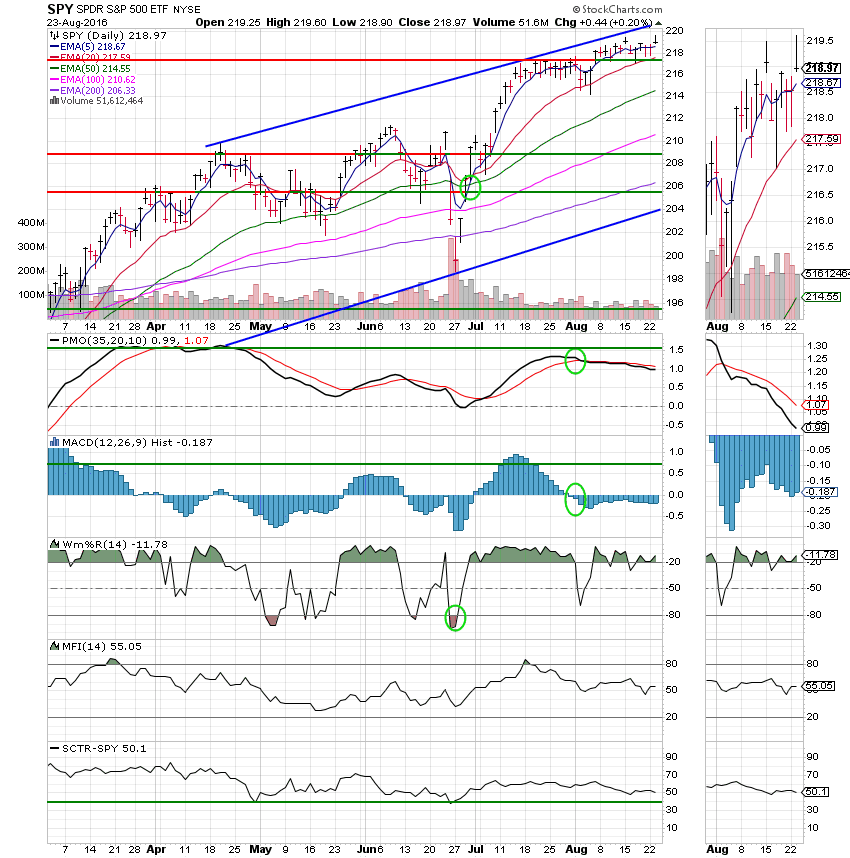

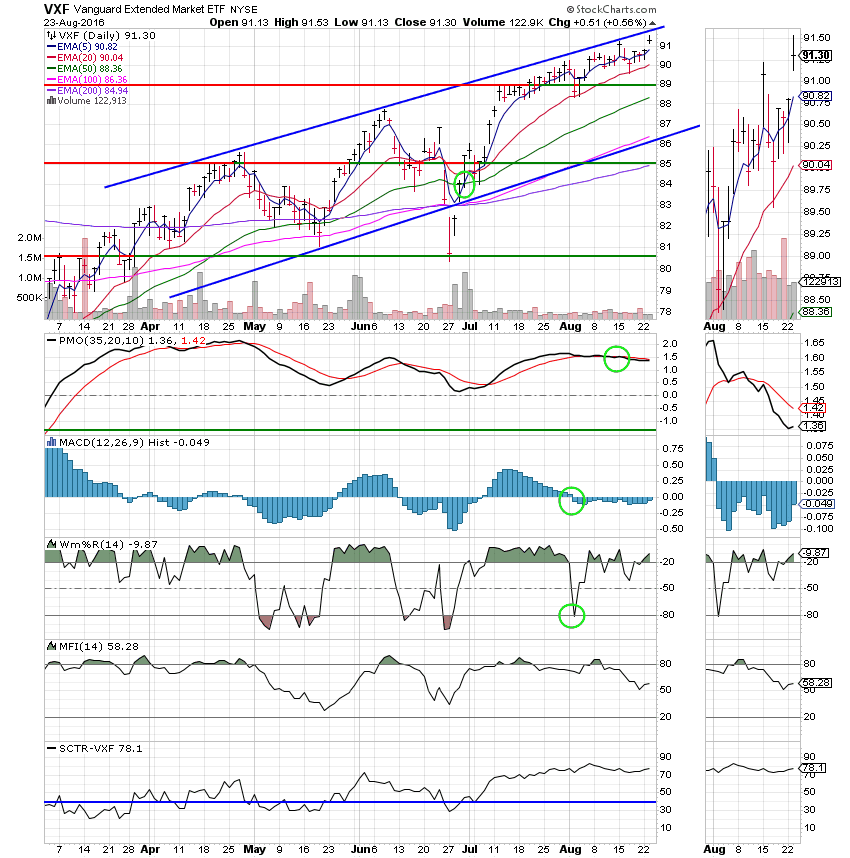

The days trading left us with the following results: Our TSP allotment eked out a gain of +0.03%. For comparison, the Dow added +0.10%, the Nasdaq +0.30%, and the S&P 500 +0.20%. A lot of smoke but no fire. Gains that are made one day are erased the next. We’ll have to keep an close eye on this tight trading range on our charts. Not to keep repeating myself, but when it finally breaks we’ll know which way to go.

Wall Street rises with tech stocks; one eye on Fed

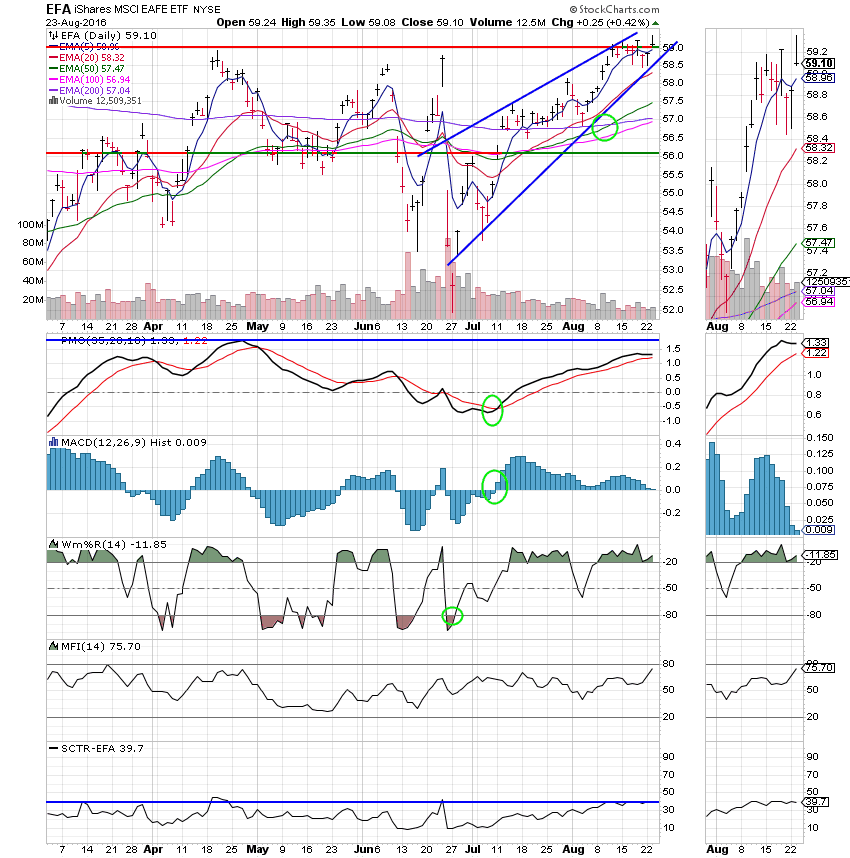

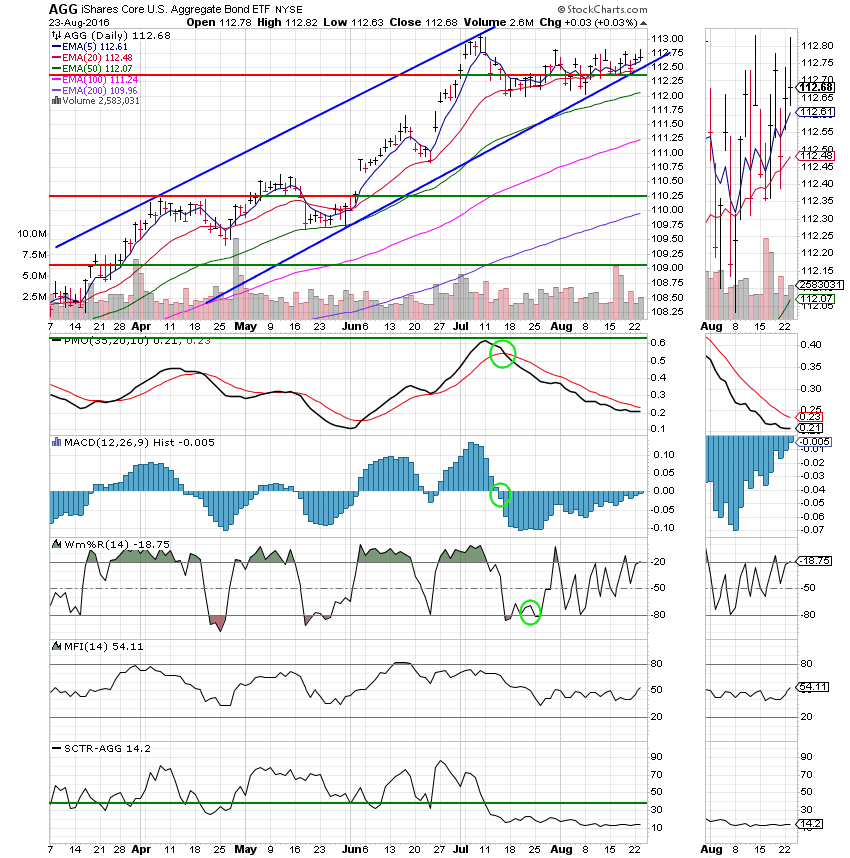

The days action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Neutral. We are currently invested at 100/F. Our allocation is now +1.84% on the year not including the days results. Here are the latest posted results:

| 08/22/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0869 | 17.9885 | 29.868 | 38.4543 | 24.6966 |

| $ Change | 0.0019 | 0.0384 | -0.0161 | 0.0803 | 0.0360 |

| % Change day | +0.01% | +0.21% | -0.05% | +0.21% | +0.15% |

| % Change week | +0.01% | +0.21% | -0.05% | +0.21% | +0.15% |

| % Change month | +0.09% | -0.07% | +0.62% | +0.81% | +1.02% |

| % Change year | +1.15% | +6.10% | +8.37% | +9.13% | +2.50% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.252 | 24.1527 | 26.3621 | 28.0975 | 15.9535 |

| $ Change | 0.0056 | 0.0092 | 0.0121 | 0.0143 | 0.0085 |

| % Change day | +0.03% | +0.04% | +0.05% | +0.05% | +0.05% |

| % Change week | +0.03% | +0.04% | +0.05% | +0.05% | +0.05% |

| % Change month | +0.22% | +0.38% | +0.51% | +0.59% | +0.66% |

| % Change year | +2.69% | +4.07% | +5.18% | +5.74% | +6.17% |