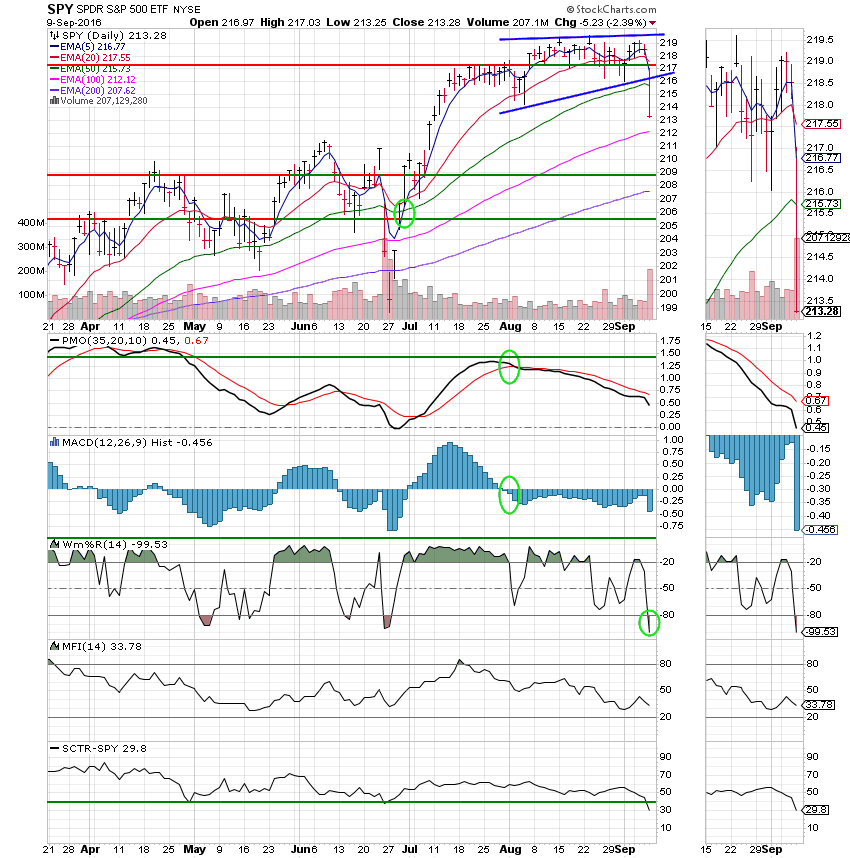

Good Evening, There’s no other way to describe it. It was a bloodbath out there today! The only thing I saw that was working were a few inverse ETF’s and we don’t have those in TSP. What we do have is the G fund and today was a very good day to be in it. It seems that market players were panicking about a rate increase again. They have grown wary of a Fed that in their eye’s never delivers. We’ve had record low interest rates since the great recession and only this pitiful recovery to show for it. That’s the way they see it. The way I see it is what’s the big deal? The Fed increases rates and we still have record low rates. Heck, for that matter they could increase it two or three times and we’d still have low rates. I’m saying the problems are a little deeper than an interest rate increase. Not to change the subject, but is anybody surprised by this selloff in September? Would anyone be caught off guard if this developed into a correction? You shouldn’t if you follow this blog. We have been expecting some sluggish action and hoping that it will provide us with a better entry point into equities for a nice fall run. Only time and our charts will tell.

The day’s selloff left us with the following results: Our TSP allotment fell back -0.44%. Think that’s terrible?? Think again. For comparison, the Dow lost -2.13%, the Nasdaq -2.54%, and the S&P -2.45%. The ugly and then theirs ugly!!!

Wall St. drops amid worries over North Korea test, rate outlook

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allotment is now +1.56% for the year not including the days results. Here are the latest posted results:

| 09/08/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0977 | 17.9397 | 29.8789 | 38.991 | 25.1595 |

| $ Change | 0.0007 | -0.0728 | -0.0656 | -0.1160 | -0.0235 |

| % Change day | +0.00% | -0.40% | -0.22% | -0.30% | -0.09% |

| % Change week | +0.03% | -0.09% | +0.09% | +0.36% | +1.36% |

| % Change month | +0.04% | -0.23% | +0.51% | +1.40% | +2.83% |

| % Change year | +1.22% | +5.81% | +8.41% | +10.66% | +4.42% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.2873 | 24.2419 | 26.4985 | 28.2671 | 16.0641 |

| $ Change | -0.0109 | -0.0257 | -0.0384 | -0.0468 | -0.0288 |

| % Change day | -0.06% | -0.11% | -0.14% | -0.17% | -0.18% |

| % Change week | +0.12% | +0.23% | +0.33% | +0.38% | +0.44% |

| % Change month | +0.28% | +0.59% | +0.85% | +1.00% | +1.14% |

| % Change year | +2.89% | +4.45% | +5.73% | +6.38% | +6.91% |