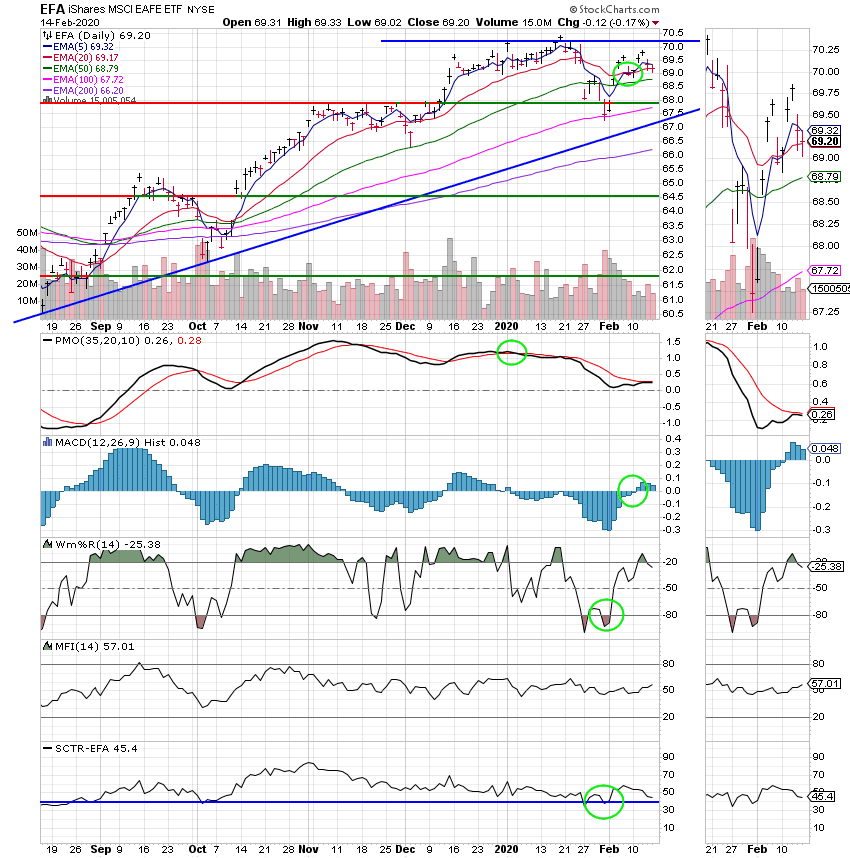

Good Evening, Well we had a successful week despite the corona virus. It slowed things down a bit today but the S&P 500 still closed the week out with a nice gain. China is the #2 economy in the world and there is no doubt that economic growth there will slow down the most that it has done since the great recession. The coronavirus, now called Covid-19, has taken 1,380 lives and infected 63,851 people, according to Chinese authorities. In a recent Reuters survey of 40 economists, the respondents see China’s economy in the current quarter suffering its slowest growth since the financial crisis, but believe the downturn will be short-lived if the outbreak is contained. And that is a big if. No one really knows what the final economic implications of the corona virus out break will be. You already know my plan which is to watch the major economic indicators. If they go south it will be time to sell. Speaking of economic indicators, it was reported that Germany which is I believe the largest economy in the Euro-zone could be forced into a recession due to the corona virus. Germany relies heavily on exports to China. So the slowdown there could drive them into two consecutive quarters of economic decline which is the definition of a recession. This has already become a drag on the international funds with a heavy European flavor. Can you say I fund? At any rate this is the type of thing that could affect your investment decisions. I’m not making any predictions but it could well start a contagion if Germany slides into a recession. So far nothing irreparable has happened. Lets pray that the Chinese officials can keep this contained. If we ever get the report that it has been totally contained it will be a great day for our investments. Also, lets not forget the human aspect of this. We often become callous to what is happening in the world as we talk about finances. Perhaps that’s why The Lord said the love of money is the root of all evil… Even before we pray for our finances we need to take some time to pray for the many victims of this virus. That God will put his healing hand upon them and wipe the corona virus from the face of this earth in the mighty name of Jesus!

The days action left us with the following results: Our TSP allotment posted a modest gain of +0.18%. For comparison, the Dow slipped -0.09%, the Nasdaq added +0.20%, and the S&P 500 was up +0.18%. Praise God for another good week!

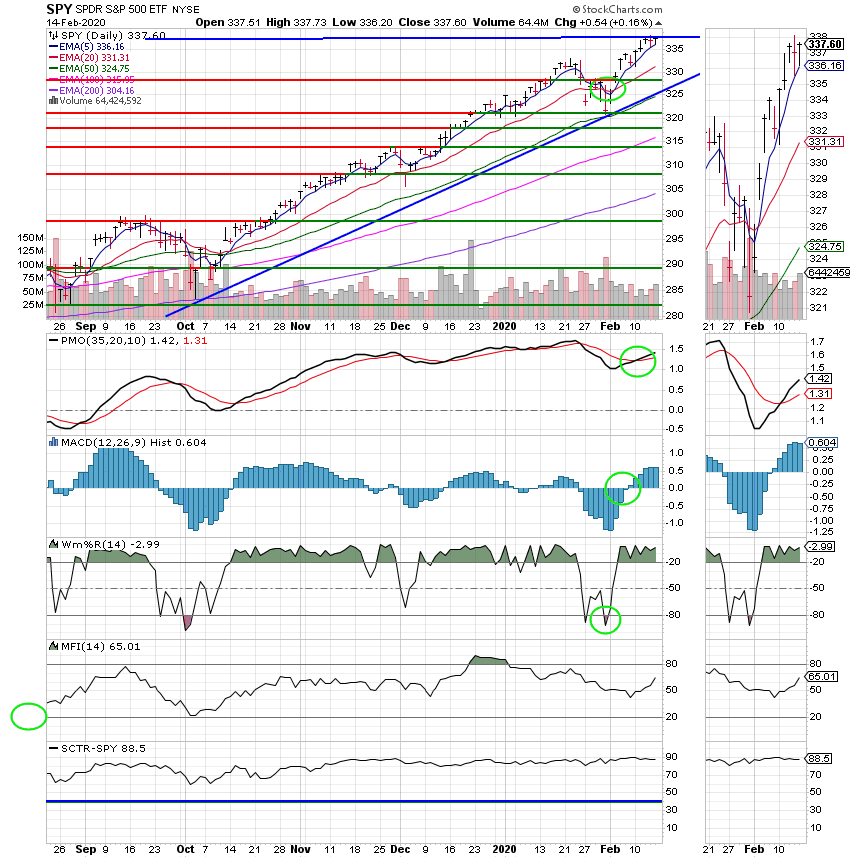

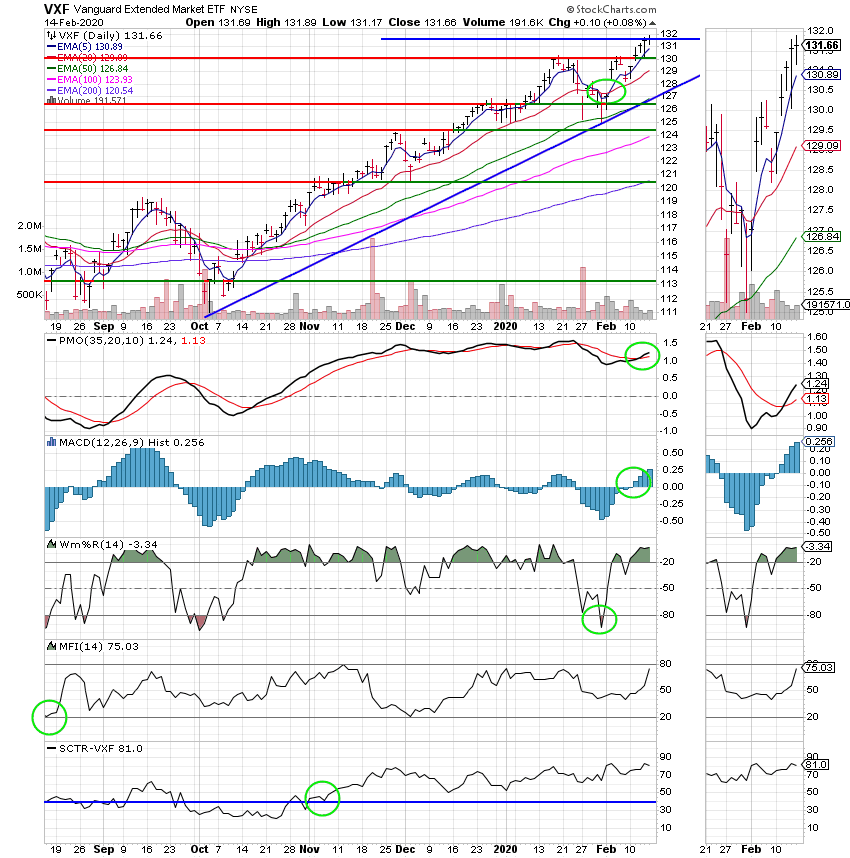

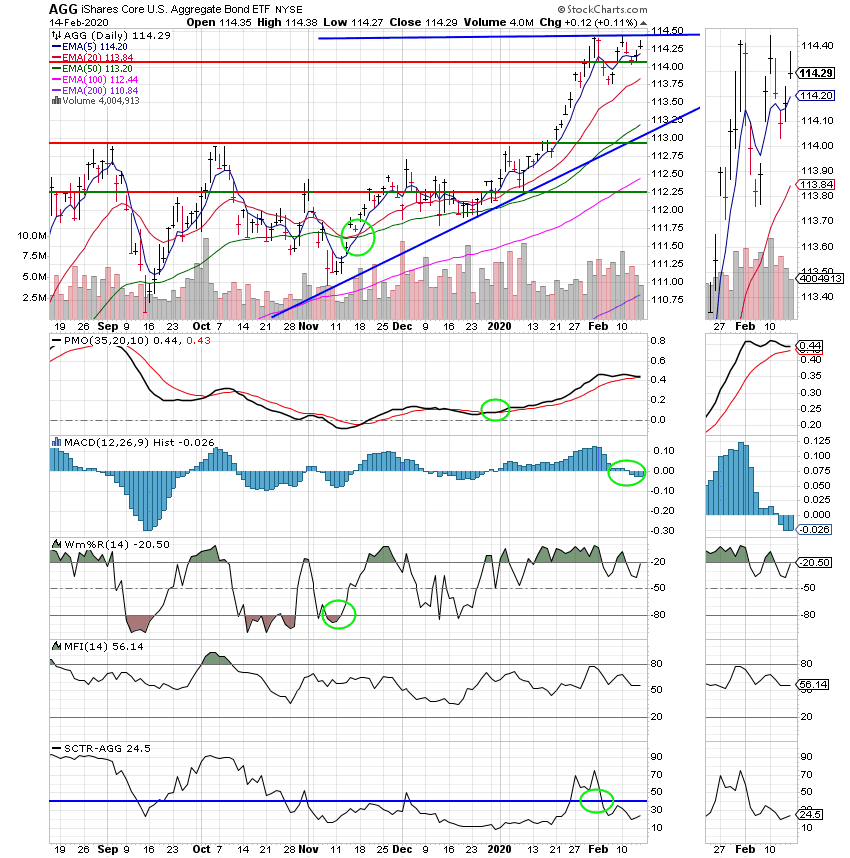

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 100/C. Our allocation is now +4.86% on the year. Here are the latest posted returns:

| 02/14/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.3881 | 20.0889 | 49.5578 | 58.761 | 32.6163 |

| $ Change | 0.0007 | 0.0296 | 0.0986 | 0.0472 | -0.0777 |

| % Change day | +0.00% | +0.15% | +0.20% | +0.08% | -0.24% |

| % Change week | +0.03% | +0.02% | +1.65% | +2.46% | -0.03% |

| % Change month | +0.06% | -0.03% | +4.91% | +5.06% | +2.49% |

| % Change year | +0.23% | +1.88% | +4.86% | +4.42% | -0.31% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 21.3812 | 29.6045 | 35.5497 | 39.3233 | 23.0671 |

| $ Change | 0.0039 | 0.0058 | 0.0105 | 0.0129 | 0.0080 |

| % Change day | +0.02% | +0.02% | +0.03% | +0.03% | +0.03% |

| % Change week | +0.27% | +0.31% | +0.72% | +0.85% | +0.98% |

| % Change month | +0.91% | +1.03% | +2.46% | +2.93% | +3.34% |

| % Change year | +0.92% | +1.01% | +2.00% | +2.33% | +2.60% |