Good Evening, In recent blogs we discussed how the Corona Virus might truly effect the market. We talked about the fact that it would have to directly affect economic indicators and/or corporate reports. We also mentioned a few isolated incidents such as Under Armor (UA) and Nike (NKE) and how they up to now have had no real effect on the market. Well today mighty Apple (AAPL) lowered their quarterly guidance based on the fact that their supply line had been disrupted due to factory closures in China and that their sales would miss the mark as a result of decreased demand for I phones in China. After all, folks there can’t buy cell phones when their quarantined. Apple is a little different deal than Under Armor. No offense intended to Under Armor but Apple is the worlds largest corporation. So when they talk the market listens. The Apple report definitely raises the caution level. So where does that leave us now? The next caution flag will be raised when a corporation that does not have a factory or suppliers in China issues a bad report due to the virus. Perhaps UPS (UPS) or FedEx (FDX) or Cummings (CMI). Another bell weather stock Walmart (WMT) that does have suppliers in China also issued a bad report today adding additional downward pressure on the market, but as far as I know they didn’t mention the corona virus. Nevertheless, you have to wonder if the virus or possibly even the trade war might have had a China related effect on that report….. The bottom line is that the supply trains are starting to be effected. So we need to pay careful attention to our charts and any news concerning this subject. Apple has an awful lot of suppliers……..

Coronavirus threatens Apple supply chain, sales; shares drop

Nasdaq Closes at Record High as Apple Issues Revenue Warning

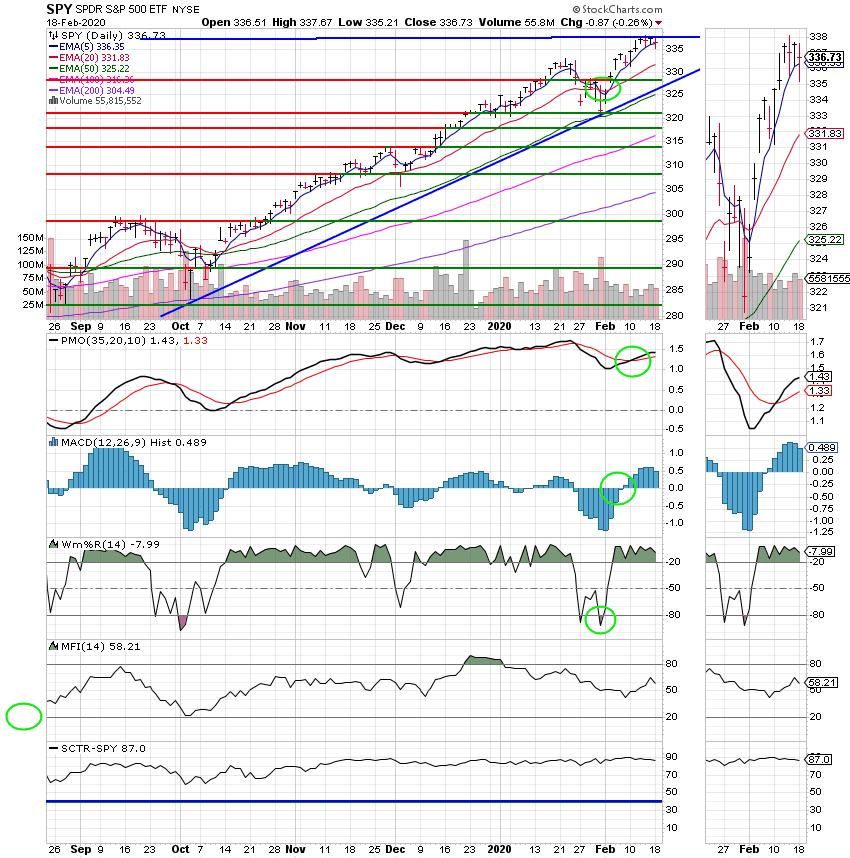

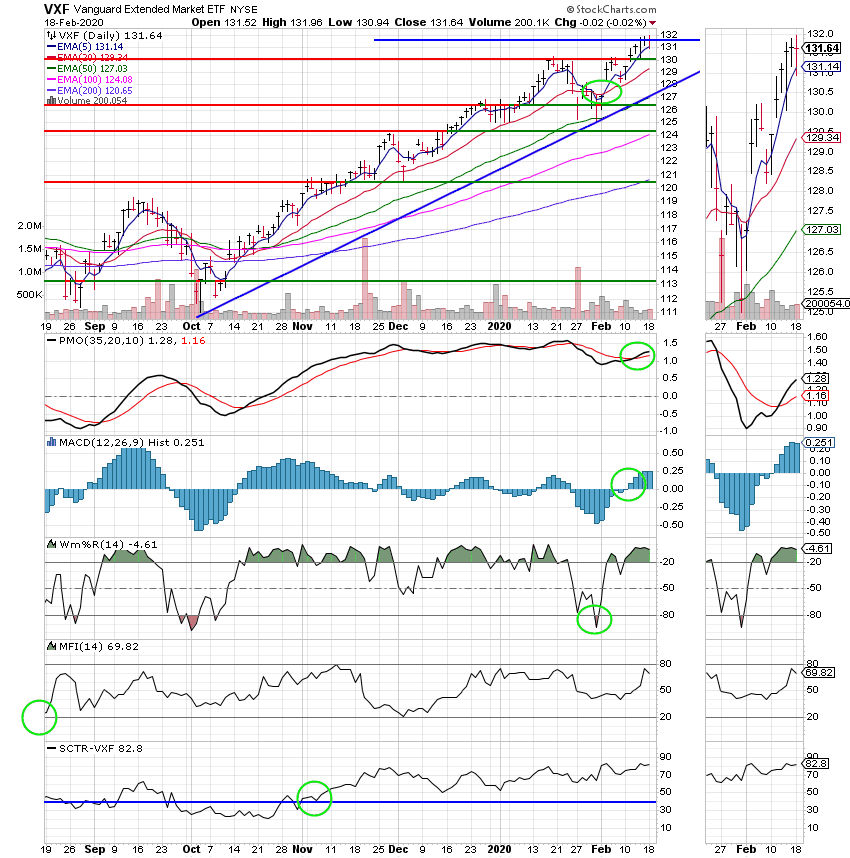

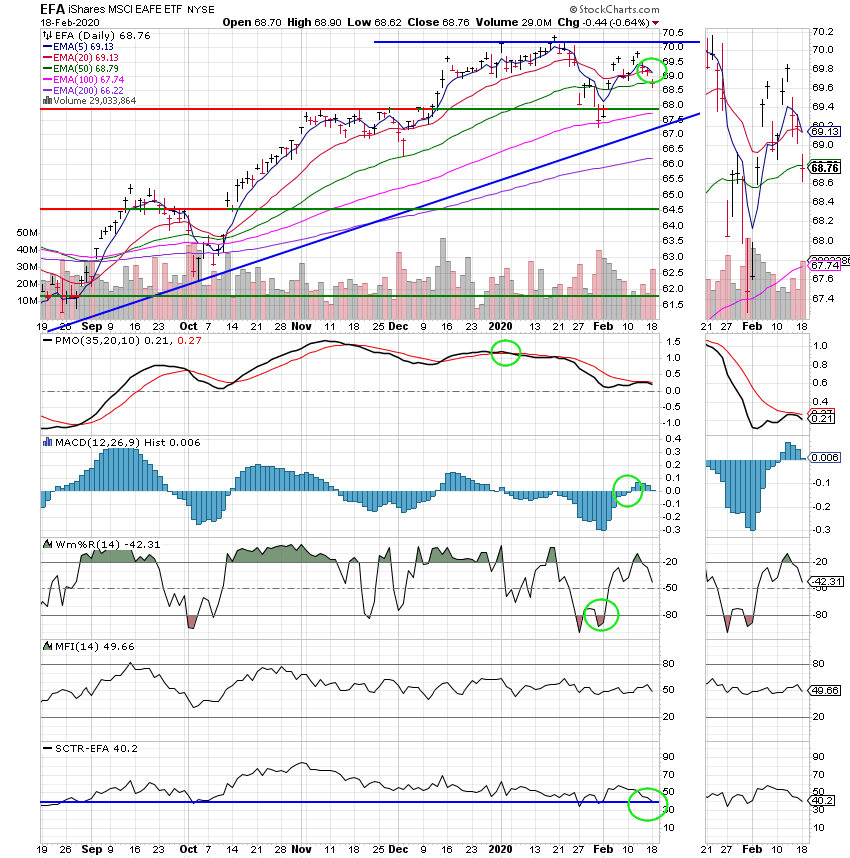

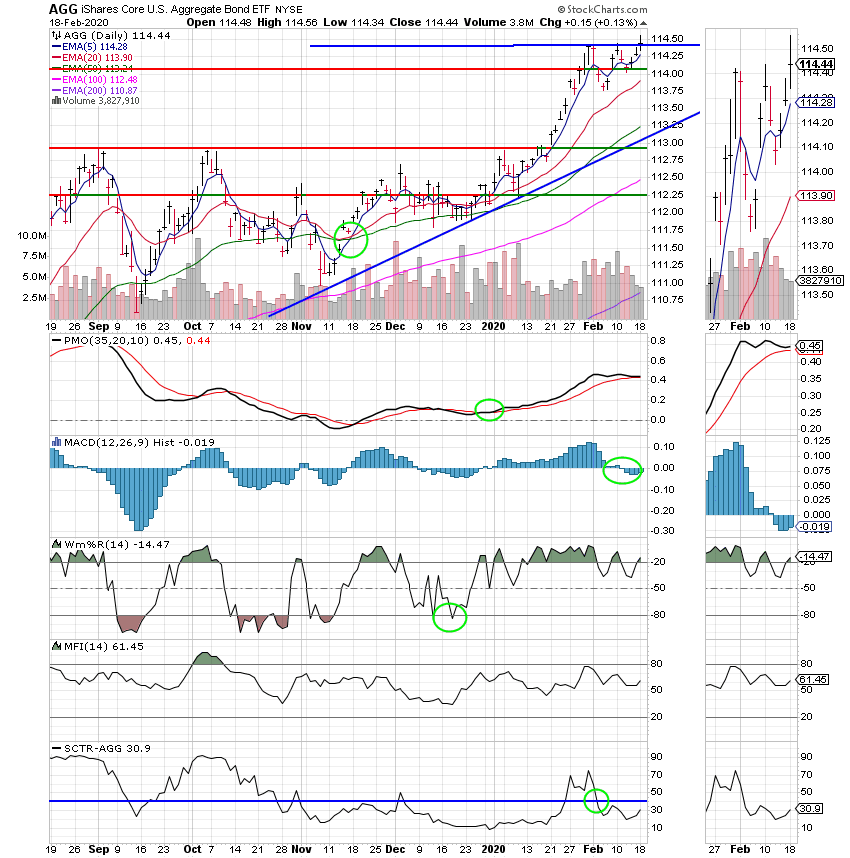

The days action let us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 100/C. Our allocation is now +4.86% on the year not including the days results. Here are the latest posted results:

| 02/17/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.3881 | 20.0889 | 49.5578 | 58.761 | 32.6163 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.06% | -0.03% | +4.91% | +5.06% | +2.49% |

| % Change year | +0.23% | +1.88% | +4.86% | +4.42% | -0.31% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 21.3812 | 29.6045 | 35.5497 | 39.3233 | 23.0671 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.91% | +1.03% | +2.46% | +2.93% | +3.34% |

| % Change year | +0.92% | +1.01% | +2.00% | +2.33% | +2.60% |

One response to “02/18/2020”

The market needs a wall of worry to climb. Any short term pull backs should be bought. A market that frequently goes up after hearing bad news definitely wants to go higher. This economy is on fire due to the Trump Economic Miracle. DJ 60k by the end of Trump’s second term.