Good Evening, I have a special treat for you this evening. I will start by saying that we have a lot of talented and well educated folks among our group. Some of these folks are way way beyond me when it comes to the field of mathematics and what is Technical Analysis but mathematics and statistics? I have definitely met some folks that humble me when answering their questions. The following gentleman is one that I have corresponded with for quite some time. He has a passion for both technical analysis and helping others which is a unique. Years ago I got started in this business by helping several of my co workers in the Bureau of Prisons. I found myself studying when I was home so I could make myself a better investor and in turn answer their increasingly difficult questions. That grew into an E mail and which grew further to this website. This gentleman is following much the same path that I did and has become a pretty good analyst. As you all know I backed off of some of the technical analysis in my posts. They used to be mostly hard core technical analysis but have evolved into more of general market commentary. This was born from the necessity to keep things simple as I have an ever increasing influx of new and inexperienced people joining our group. Most of them simply glaze over when you talk about things like Exponential moving averages or Moving average convergence divergence. So for their sake’s I keep it simple and try to direct them to resources that will help them learn TA. Many of the same resources that I used I might add. That said, I realize that most of my old folks are bored with a steady diet of milk and want some meat. To that end I have with much encouragement talked my good friend into sharing some of his technical analysis with our group. So without further delay I would like to introduce Wayne from the DOD.

Hi, I have been serving in the Department of Defense for quite some time. Like everybody else, I have some military background, but unlike gun-nuts in Special Force. I served part-time and temporary assignments as a military contractor.

I previously had some work experience in the corporate world as well.. After receiving an ad from the Census Bureau, I canvased and recruited last year and earlier this year.

I want to give special thanks to Scott, that I can share my comments and analysis on his blog. Furthermore, I appreciate Scott’s blog to provide free TSP allocation recommendation to military personnel, veterans, and Federal Government employees. This is great!!

Personally, I like to help and encourage people save and invest their hard earned money instead if seeing them spend and waste it. I am not a financial advisor, but my analysis will hopefully help people to make educated investment decisions : )

Below is my analysis about the S&P 500 and TSP allocation:

So far, this pandemic has followed the patterns of an ‘event-driven’ bear market—steep, but shorter and less severe than structural and cyclical bear markets. This event-driven bear could evolve into a structural bear if the outbreak materially worsens and stimulus ends.

IMHO, It is obvious a confirmed bull market from VIX(Volatility Index), Copper, lumber, put/call ratio, and new highs new lows, etc.

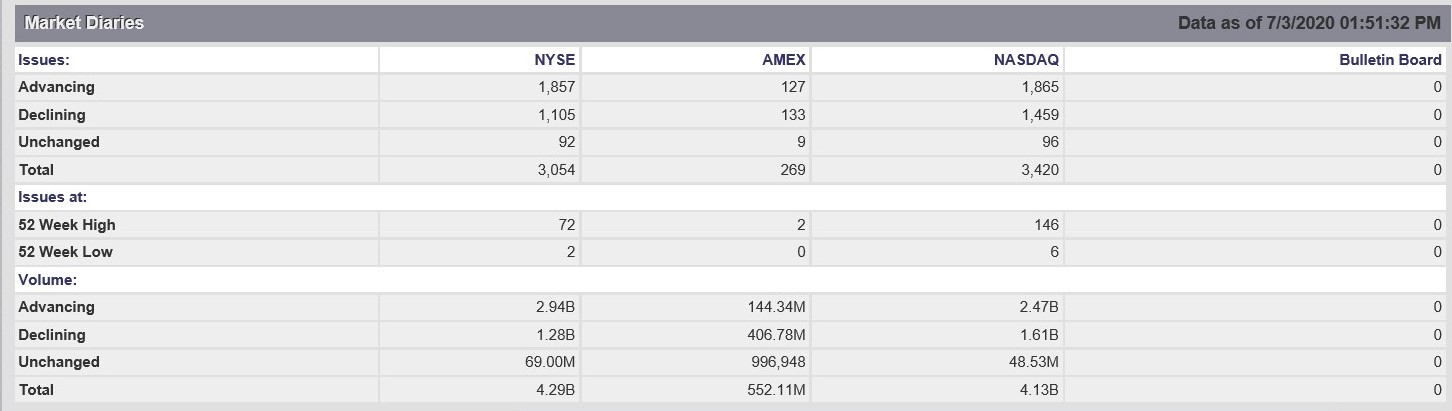

New highs new lows ratio: NYSE and NASDAQ are not extreme in compare with Feb. 23rd, 2020. Although it is now quite high (NYSE 72:2, NASDQ 146:6), we still need to be cautious. There might be technical correction this week.

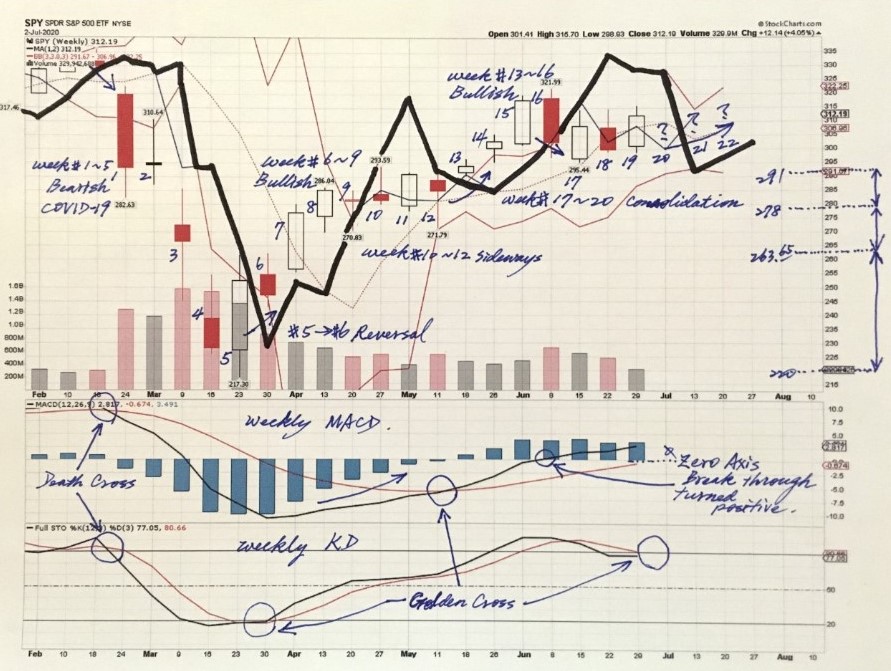

Weekly chart above: #10-12 was 3 weeks sideways, #13 to #16 was bullish.

#17- 20 sideways consolidation and then #21 -22 continue up.

Weekly MACD is above 0-Axis, Weekly KD shows golden cross soon.

Above are my TSP movements in C fund (S&P 500 index). On February 23rd, I moved all assets into G fund when the big down fall and circuit breaks.

After March 24th, I saw the buying signal. I decided to move first 20% in C fund on March 26th. If it went down further, I could move more in.

However, it didn’t appear to build another leg on April 7th, so I moved another 45% in C fund.

On April 20th, the technical chart looked healthy. Therefore, I move the rest 35% in C fund, totally 100% in C fund (S&P 500 index).

There were 3-5 pull-back’s (technical adjustment), we are still 100% in C fund. Because, Scott and I both know it is not a bear market. It is actually a bull market with some healthy technical adjustments.

The market is now picking up the signal that the worst of the economic crisis is over, although it will take the job market years to fully recover.

This coming week, we will see some pull-back as both the hourly KD and MACD have a dead cross. However, after the dip, the S&P should continue higher.

“If we wish to avert failure in speculation we must deal with causes. Everything in existence is based on exact proportion and perfect relationship. There is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things. Faraday said: `There is nothing in the Universe but mathematical points of force.’

– WD Gann

May God Bless.

Wayne