Good Evening, The market continued to rally this morning. It looked like the major indices would have their 6th straight day of gains. However, it was not to be as stocks headed south in the afternoon session finishing well in the red. It was pretty much the same old reason the market has been volatile in recent months, concern over a growing number of Covid 19 cases. We’ve talked about how the volatility will continue. So the selling should come as no surprise. Especially after five successive days of gains. In truth, a little selling is a healthy thing. It keeps the market from overheating and is totally normal in a bull market. The swings are what have been greater than normal but that is due to the Corona Virus and will continue until it burns out or there is a vaccine. Several noted analysts have pointed out that our medical system is dealing with the virus much more effectively than it did during the initial breakout and the prevailing train of thought is that is what will keep the market moving higher in spite of a second outbreak. The fact that hospitals are now being more effective in treating Covid 19 patients should also prevent a second implementation of the draconian measures taken to close down the economy earlier this year. For that reason the market remains what I would describe as cautiously optimistic. As long as our health system is not totally overwhelmed the overall trend should be for the market to move higher. That said, we should not expect the market to move strait up. It will be a series of higher highs and higher lows and also be aware that the range between the highs and lows will likely remain large due to the aforementioned volatility. The bottom line is that if you believe this is the case you must not allow yourself to be pressured into selling the next time we have a three or four day sell off. What is important in most cases and especially in this case is that the lower trend line and the closest support after that are not broken on the charts. That would be the blue lines and the green and red lines respectively on our charts shown below. As long as those remain in tact you can let her ride!

The days trading left us with the following results: Our TSP allotment fell back -1.37%. For comparison, the Dow dropped -1.51%, the Nasdaq -0.86%, and the S&P 500 -1.08%.

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/S. Our allocation is now +16.44% on the year not including the days results. Here are the latest posted results:

| 07/06/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.449 | 20.9555 | 46.9567 | 54.0427 | 30.0523 |

| $ Change | 0.0013 | 0.0106 | 0.7338 | 0.7673 | 0.5122 |

| % Change day | +0.01% | +0.05% | +1.59% | +1.44% | +1.73% |

| % Change week | +0.01% | +0.05% | +1.59% | +1.44% | +1.73% |

| % Change month | +0.01% | +0.19% | +2.59% | +1.99% | +3.30% |

| % Change year | +0.60% | +6.28% | -0.64% | -3.97% | -8.14% |

| L INC | L 2025 | L 2030 | L 2035 | L 2040 | |

| Price | 21.2689 | 10.1224 | 34.4434 | 10.161 | 37.769 |

| $ Change | 11.2072 | 10.1224 | 24.3654 | 10.1610 | 27.6910 |

| % Change day | +0.37% | +0.82% | +0.98% | +1.07% | +1.17% |

| % Change week | +0.37% | +0.82% | +0.98% | +1.07% | +1.17% |

| % Change month | +0.63% | +1.22% | +1.67% | +1.61% | +1.99% |

| % Change year | +0.39% | +1.22% | -1.17% | +1.61% | +-1.72% |

| L 2045 | L 2050 | L 2055 | L 2060 | L 2065 | |

| Price | 10.1871 | 21.9759 | 10.2392 | 10.2392 | 10.2393 |

| $ Change | 10.1871 | 11.8978 | 10.2392 | 10.2392 | 10.2393 |

| % Change day | +1.25% | +1.33% | +1.60% | +1.60% | +1.60% |

| % Change week | +1.25% | +1.33% | +1.60% | +1.60% | +1.60% |

| % Change month | +1.87% | +2.26% | +2.39% | +2.39% | +2.39% |

| % Change year | +0.39% | +1.22% | -1.17% | +1.61% | -1.72% |

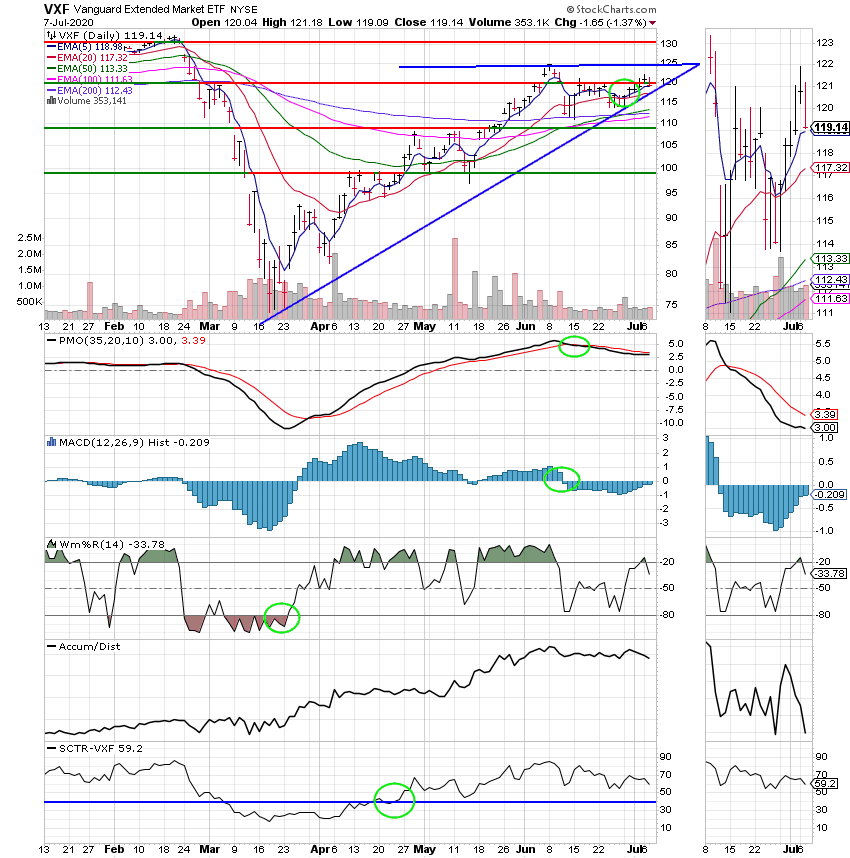

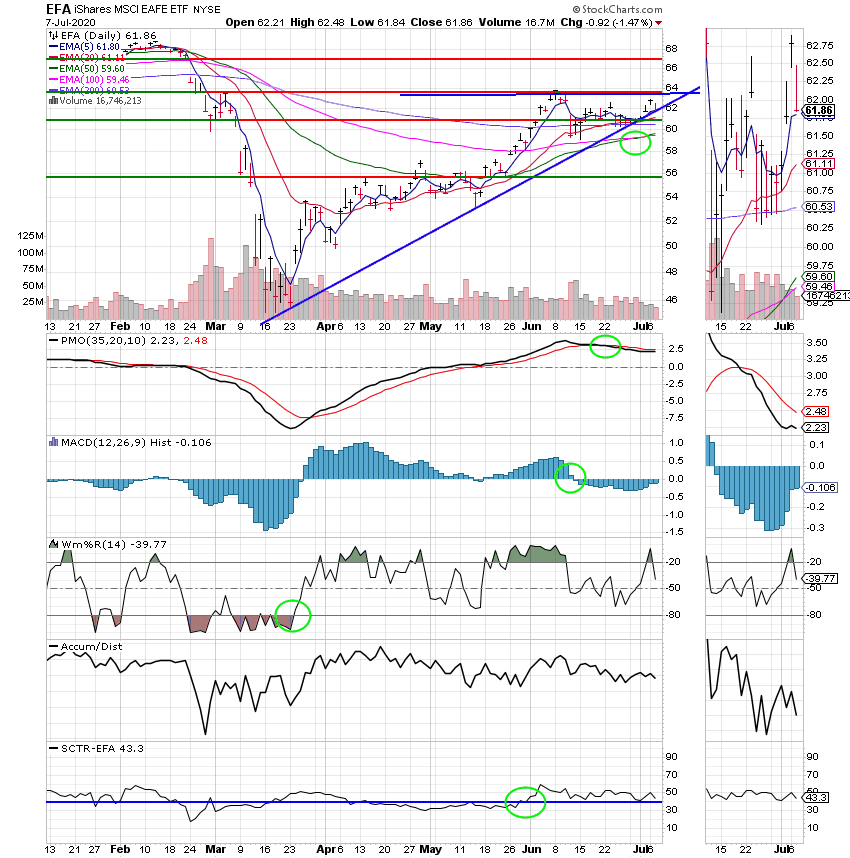

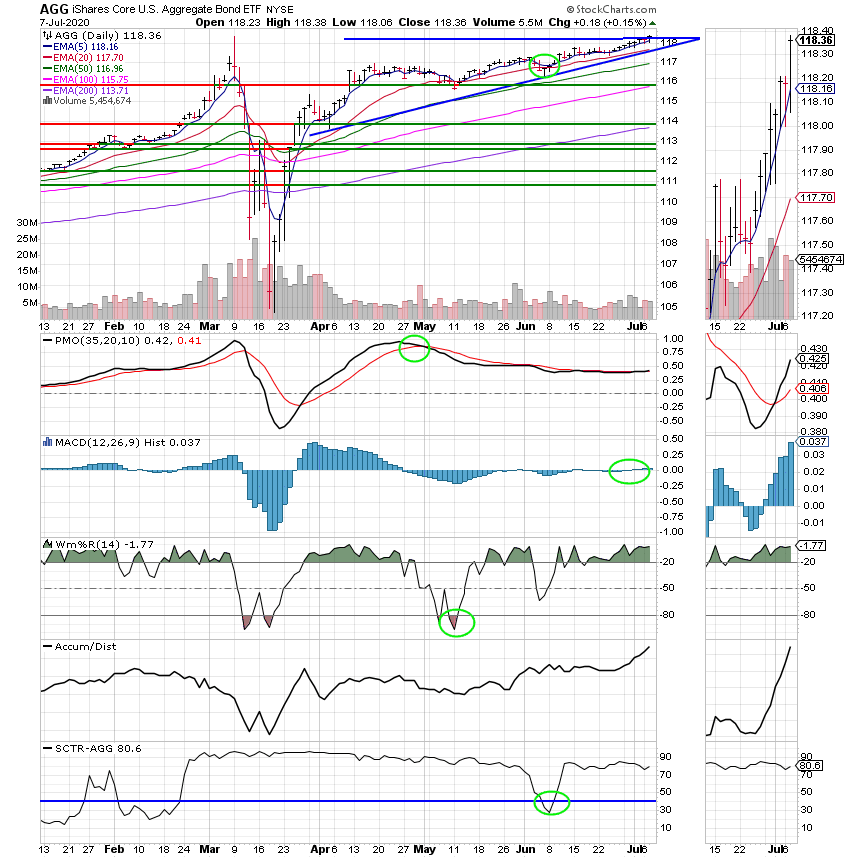

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

I hope you all enjoyed Wayne’s analysis last night. It should give you a fresh perspective on where this market may be heading! That’s all for tonight. Have a nice evening and may God continue to bless your trades. Also, it is my prayer that each one of you remain safe and healthy.