Good Evening,

The resonance from both DMI & MTM was good signal. Also, both DMI & MTM are still positive now.

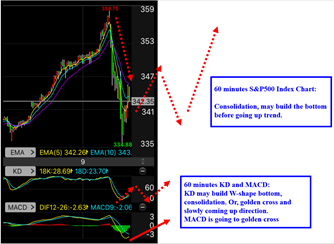

Above is S&P500 60 minutes chart:

Both KD and MACD are looking for golden cross and continue up.

It is possible to build W-shape bottom during consolidation.

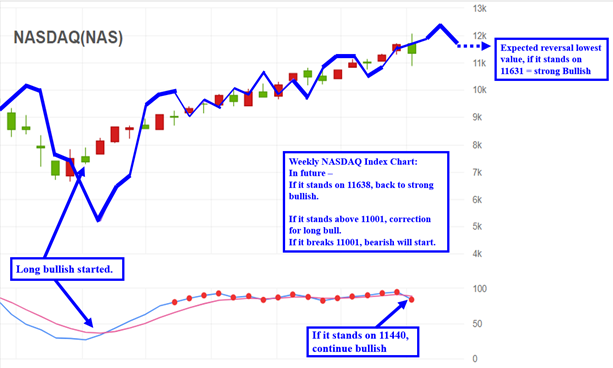

Above is the Monthly NASDAQ Index chart.

Next week, the indices should have a high probability of moving higher because this profit taking was mainly in the Tech sector (NASDAQ gained too much) and didn’t effect traditional industries by causing them to drop much such as the Russell 2000. As long as big techs like AAPL and MSFT stop dropping and then reverse for another leg up, the NASDAQ index will not fall easily.

There is the chance the selling isn’t over. However, after similar moves in June the indices eventually continued to rally and I believe they will do so this time as well!!

May God Bless,