Good Evening, The market started the week by bouncing back from last weeks sell off led by the tech sector. While the broader market is participating to a somewhat greater extent it is still tech that is defining the direction that this market goes. I believe it has a lot to do with the fact that tech is just a larger part of things than it used to be. It is true that tech led one of the greatest rallies in market history during the nineties which I might add led to the the so called “tech bubble” bursting in 2000 resulting in one of the more notable bear markets in the past 50 years. Back in those days it was the large industrial stocks that led the way. Yes tech stocks were prominent in the market but to a much lesser extent in the economy. Not so today, tech is everywhere and continues to change the way we live and the way the economy functions. Stocks like Tesla (TSLA), Proto Labs (PRBL), Facebook (FB), Amazon (AMZN), Microsoft (MSFT) and Nvidia (NVDA) to name a few are reshaping their industries with new disruptive technology. The market is a great predictor. For the most part investors bet on the future and in the 90’s they were betting on where we are now. Tech continues to change the way that our life and economy functions and the pandemic has only made that process move along faster. Could you have imagined working from home in the 80’s or 90’s? Tech not only made it possible for the “work at home” environment to function during the pandemic but it managed to make big money while it was doing it. So the notion that all the money is going to role out of tech stocks back into things like banks, industry and energy is ludicrous! Tech is here to stay and the economy isn’t going anywhere with out it. The pandemic just made that reality get here a little faster. This is the shape of things to come and it it necessary to understand this concept to stay on top of the market. So always keep a close eye on the tech sector! As we move into the fall the election takes on a greater and greater role in shaping the market. I really don’t expect stocks to make any real progress until it is all over and then only if things go well. For starters the results of the election will have to be accepted. If they are not, look for stocks to be suppressed until they are. Secondly, if non market friendly leftists are elected look for a sizable selloff. If a market friendly Administration, House and Senate are elected it will be rally on! With so much at stake look for the market to be fixated on the election until it is over. Lastly we have the Fed meeting today and tomorrow. As long as they remain accommodating and I believe they will it will be a non event. However, there is always a small chance there could be some kind of market changing surprise so keep an eye on the Fed statement when it is released tomorrow afternoon at 2:00 PM ET. Oh yes, and I almost forgot, we still have Covid-19. There seems to be satisfactory progress being made toward a vaccine. As long as that is the case the Corona virus will not disrupt the market recovery. Other than that no news is good news when it come to the Corona Virus. Well that about covers it. We certainly have a lot to pray for don’t we. Folks, we are going to need the hand of God and the peace of Jesus to get through the next few months. So pray without ceasing!!

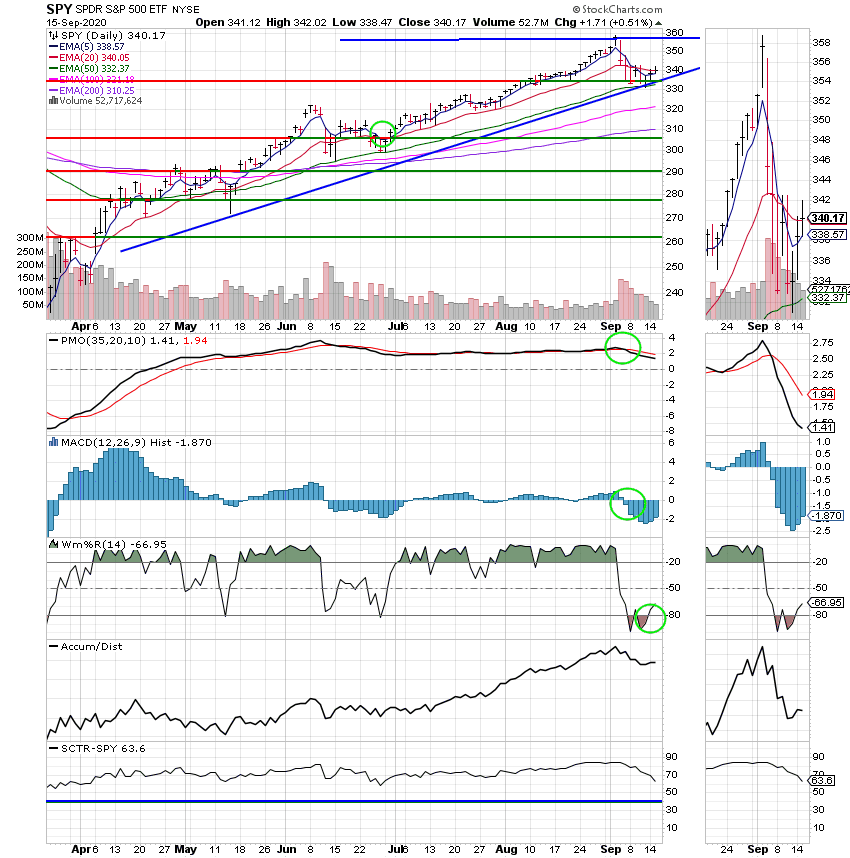

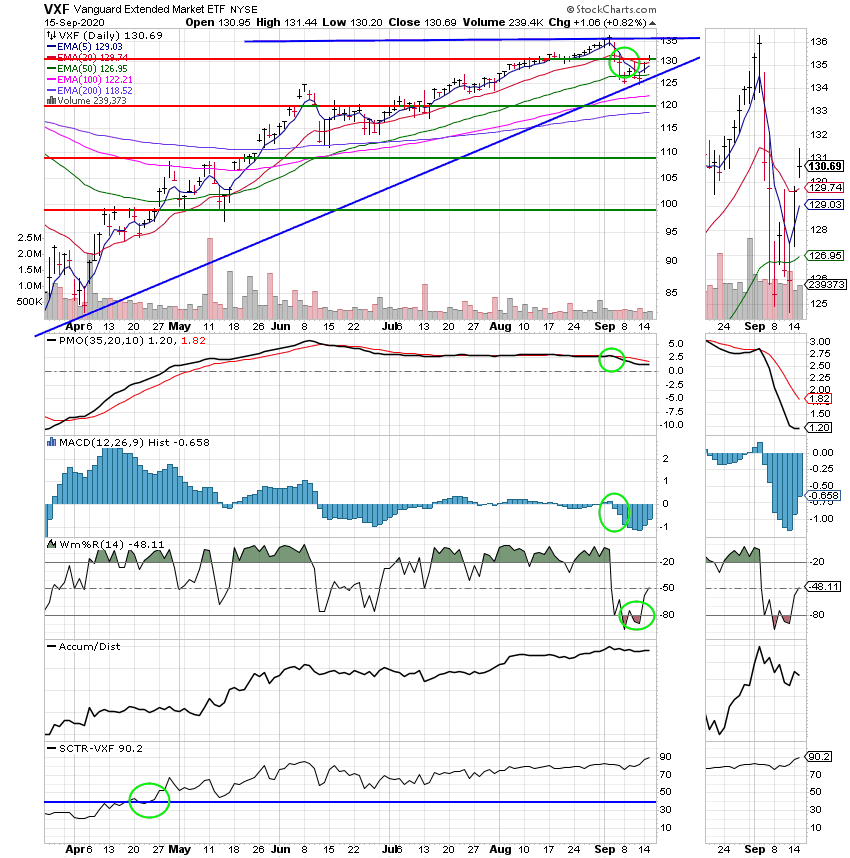

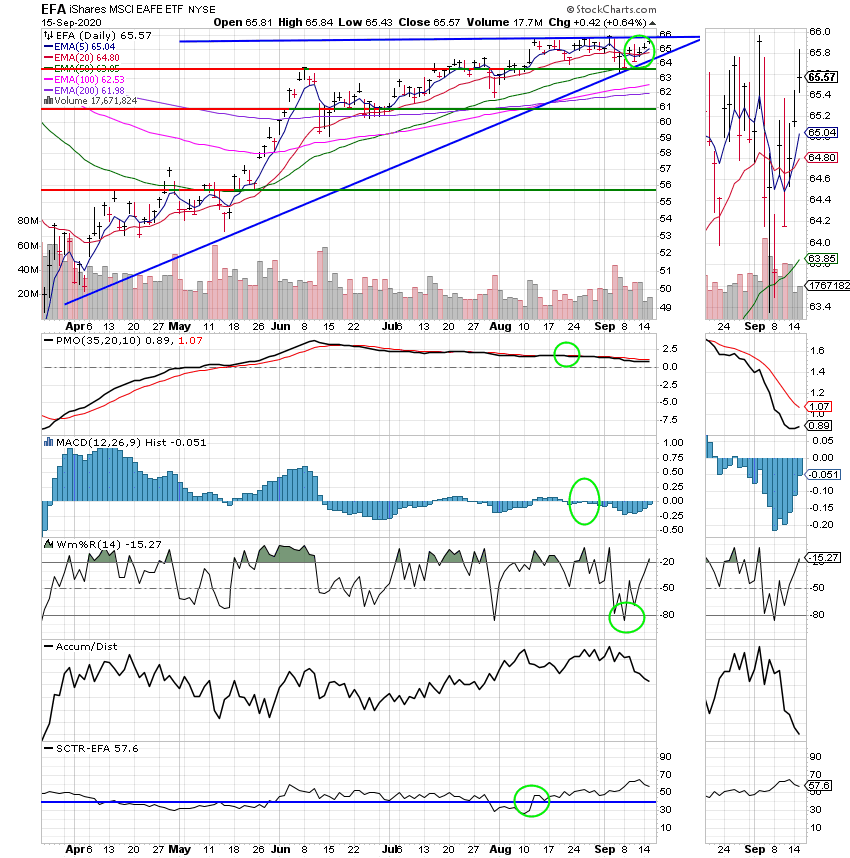

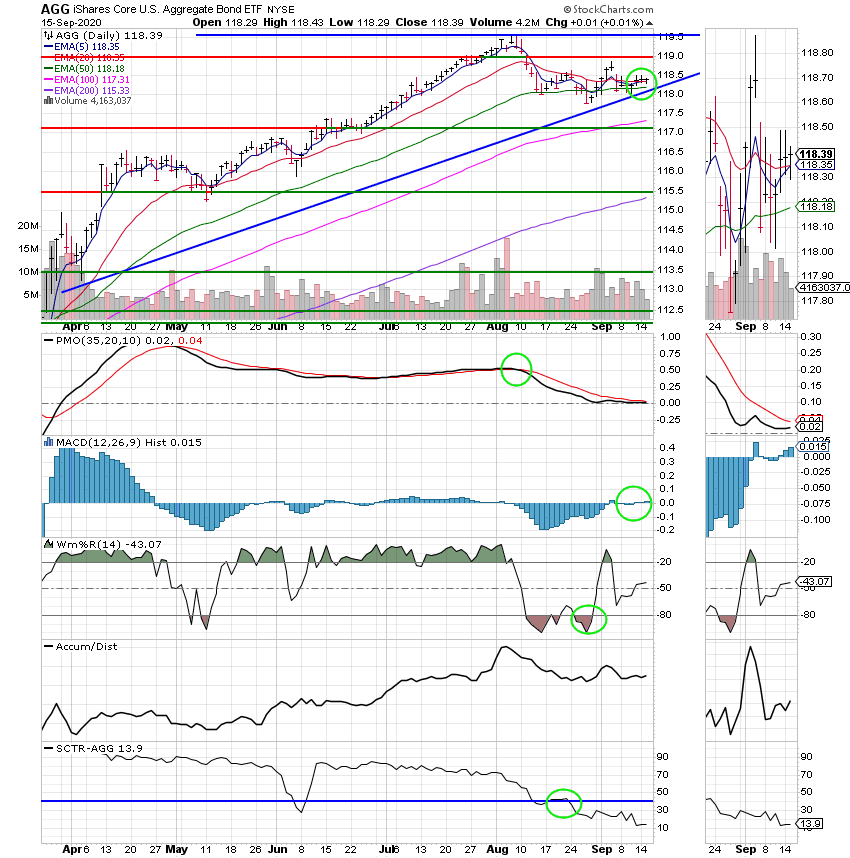

The days trading left us with the following results: Our TSP allotment posted a gain of +0.82%. For comparison, the Dow was flat at +0.01%, the Nasdaq added +1.21%, and the S&P 500 was up +0.52%. Praise God for another good day!

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +26.12% on the year. Here are the latest posted results:

| 09/15/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.47 | 21.0901 | 50.4047 | 58.5072 | 31.3925 |

| $ Change | 0.0003 | -0.0108 | 0.2629 | 0.4434 | 0.0692 |

| % Change day | +0.00% | -0.05% | +0.52% | +0.76% | +0.22% |

| % Change week | +0.01% | -0.02% | +1.84% | +3.78% | +0.94% |

| % Change month | +0.03% | +0.16% | -2.75% | -2.56% | +0.32% |

| % Change year | +0.73% | +6.96% | +6.65% | +3.96% | -4.05% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.5972 | 10.4592 | 35.8134 | 10.6039 | 39.5562 |

| $ Change | 0.0212 | 0.0235 | 0.0969 | 0.0315 | 0.1279 |

| % Change day | +0.10% | +0.23% | +0.27% | +0.30% | +0.32% |

| % Change week | +0.40% | +0.90% | +1.08% | +1.19% | +1.30% |

| % Change month | -0.32% | -0.79% | -0.96% | -1.05% | -1.15% |

| % Change year | +1.94% | +4.59% | +2.76% | +6.04% | +2.93% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.7029 | 23.1592 | 10.9006 | 10.9007 | 10.9008 |

| $ Change | 0.0371 | 0.0856 | 0.0492 | 0.0492 | 0.0491 |

| % Change day | +0.35% | +0.37% | +0.45% | +0.45% | +0.45% |

| % Change week | +1.40% | +1.50% | +1.81% | +1.81% | +1.81% |

| % Change month | -1.23% | -1.32% | -1.62% | -1.62% | -1.62% |

| % Change year | +7.03% | +3.01% | +9.01% | +9.01% | +9.01% |