Good Evening, As we enter the final month of year the market is focused on three issues. #1 Fiscal Stimulus from the government. Can democrats and republicans come to an agreement across the aisle on a pandemic stimulus bill? That is the question that is most on the minds of investors. #2 Distribution of the Covid 19 vaccines that have been developed in 2020. It won’t happen overnight but the more this is accomplished the better the market will get. This is the second thing on investors minds. #3 Coming in at number three is the current wave of Covid 19 cases across the US. This could be number one expect for optimism over the vaccine. Anyway, that’s what is shaping the market. There’s no use in beating around the bush these are the issues. I will add the the market appears to be somewhat more settled now that we have President Elect. As I have repeated a thousand times. The market hates uncertainty!

The days trading left us with the following results. Our TSP allotment slipped -023%. For comparison, the Dow added +0.20%, the Nasdaq also slipped -0.05%, and the S&P 500 posted a modest gain of -016%. I will add the even though it was modest the S&P gain was a new all time high!

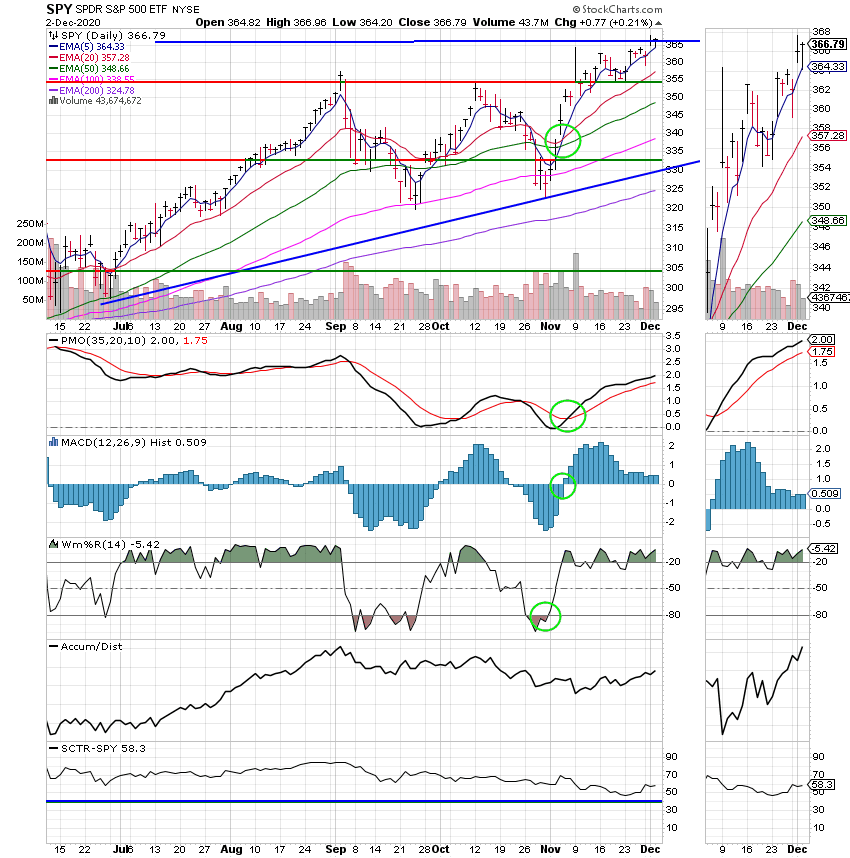

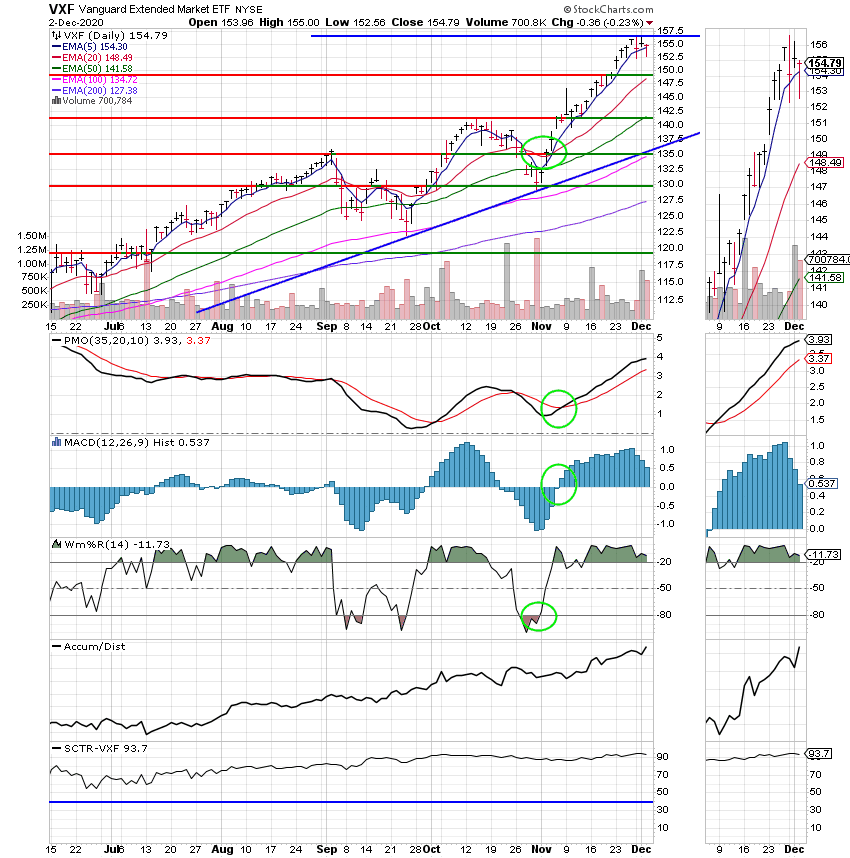

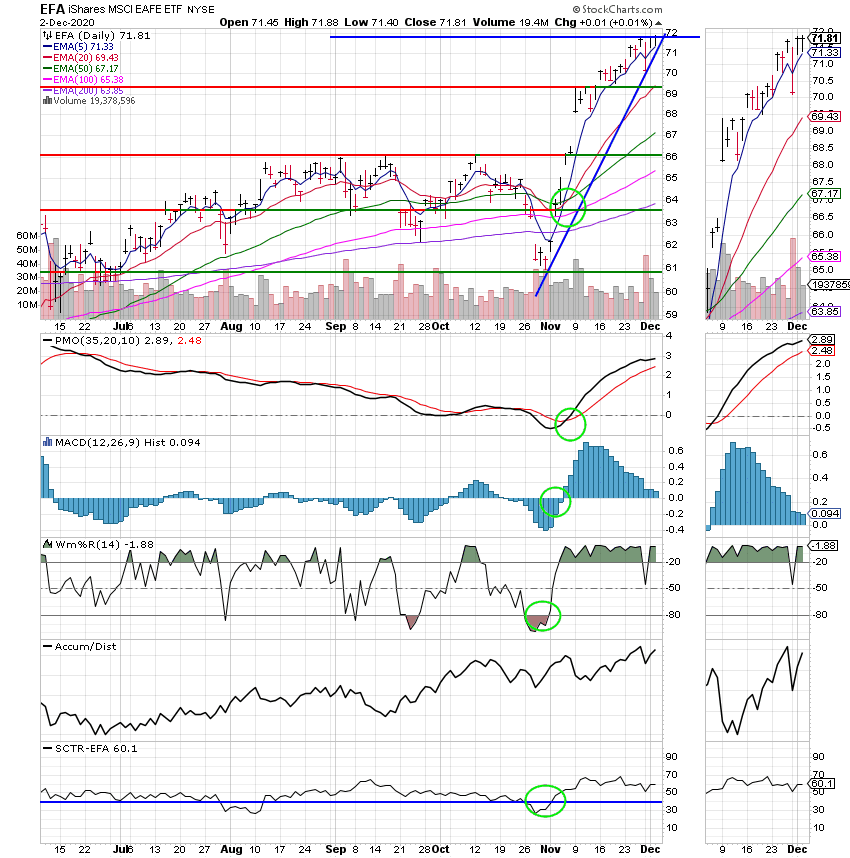

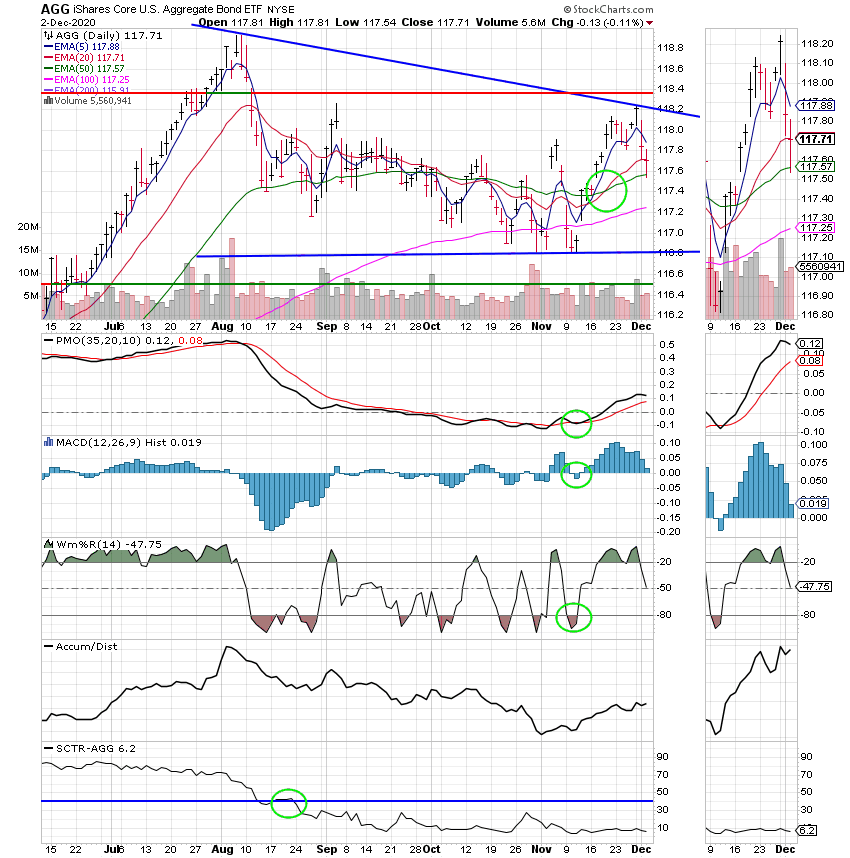

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our allocation is now +38.73% on the year not including the days results. Here are the latest posted results:

| 12/01/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4968 | 21.0938 | 54.4504 | 69.6009 | 34.1572 |

| $ Change | 0.0004 | -0.0730 | 0.6078 | 0.4102 | 0.3378 |

| % Change day | +0.00% | -0.34% | +1.13% | +0.59% | +1.00% |

| % Change week | +0.01% | -0.27% | +0.68% | -0.51% | -0.25% |

| % Change month | +0.00% | -0.34% | +1.13% | +0.59% | +1.00% |

| % Change year | +0.90% | +6.98% | +15.21% | +23.68% | +4.40% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.088 | 10.9632 | 37.9432 | 11.2965 | 42.374 |

| $ Change | 0.0454 | 0.0514 | 0.2193 | 0.0714 | 0.2915 |

| % Change day | +0.21% | +0.47% | +0.58% | +0.64% | +0.69% |

| % Change week | +0.03% | +0.08% | +0.10% | +0.10% | +0.11% |

| % Change month | +0.21% | +0.47% | +0.58% | +0.64% | +0.69% |

| % Change year | +4.26% | +9.63% | +8.87% | +12.97% | +10.26% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 11.5224 | 25.0528 | 11.9801 | 11.9802 | 11.9803 |

| $ Change | 0.0845 | 0.1959 | 0.1171 | 0.1171 | 0.1171 |

| % Change day | +0.74% | +0.79% | +0.99% | +0.99% | +0.99% |

| % Change week | +0.11% | +0.12% | +0.16% | +0.16% | +0.16% |

| % Change month | +0.74% | +0.79% | +0.99% | +0.99% | +0.99% |

| % Change year | +15.22% | +11.43% | +19.80% | +19.80% | +19.80% |