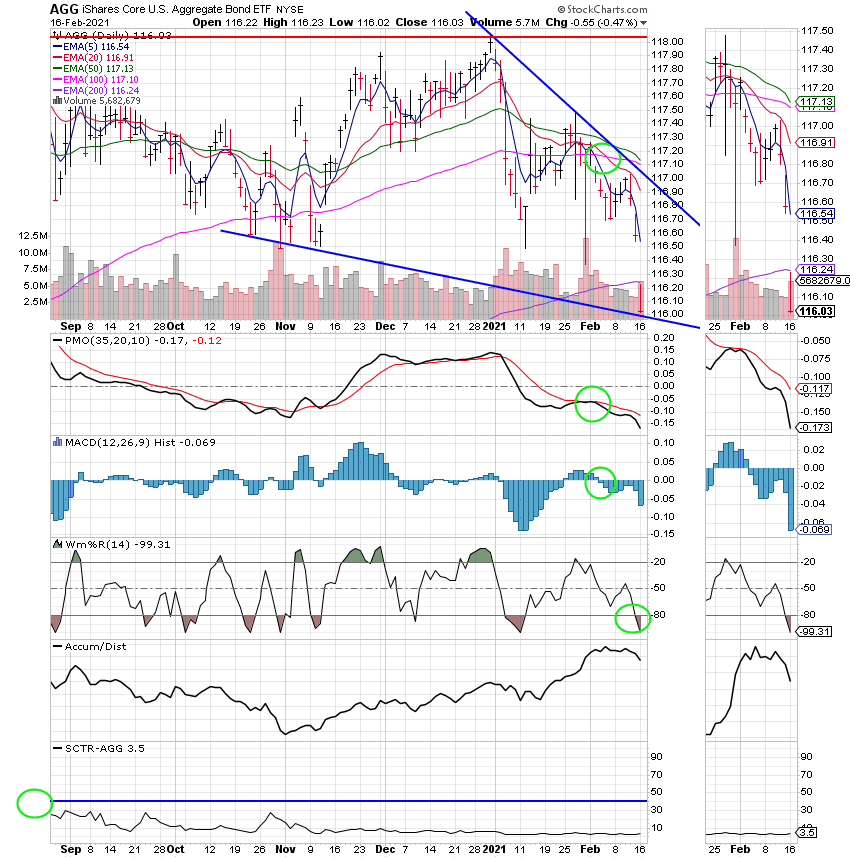

Good Evening, The market was up early and then reversed in the afternoon after investors became concerned about higher treasury yields. A new crisis! I guess they have to have something to fret about since Covid 19 and the economy are slowly starting to improve. So why are they worried about treasury yields moving higher? Rising treasury rates make bonds more desirable and take the luster off of stocks. Especially bond proxies like Utilities and Reits (Real Estate Investment Trusts). For those of you that are new to investing, those two sectors of stocks are used in lieu of bonds by dividend investors when bond yields are low. In other words investors are afraid that bonds will suck money out of the stock market. Of course, there’s also a concern that rising treasury rates signal inflation. Higher treasury yields often signal inflation and higher inflation causes interest rates to rise and of course if that happens the resulting higher rates will put the brakes on the economy. That folks is a very complicated subject. I don’t even claim to be an expert. I can discuss only the basics. If you want to know more on the about it just click on the following link:

Understanding Treasury Yield and Interest Rates

In summary, their concerns are twofold. They are worried about money leaving the market and rising inflation resulting in higher interest rates that will hurt the economy. Unless you want to become a serious bond investor in my humble opinion that’s all you really need to know…. I think the worries of the day are sufficient and right now the positives far outweigh the negatives. #1 The supply of Covid 19 vaccine is increasing. #2 The number of recorded cases of Covid 19 are beginning to decease #3 The employment situation is starting to ever so slightly improve. And… #4 The Democrats are now focused on getting a Pandemic Relief bill through congress. These things should continue move the market higher for the short to intermediate term. As always, we will watch our charts and deal with whatever we see. Up or down, good or bad.

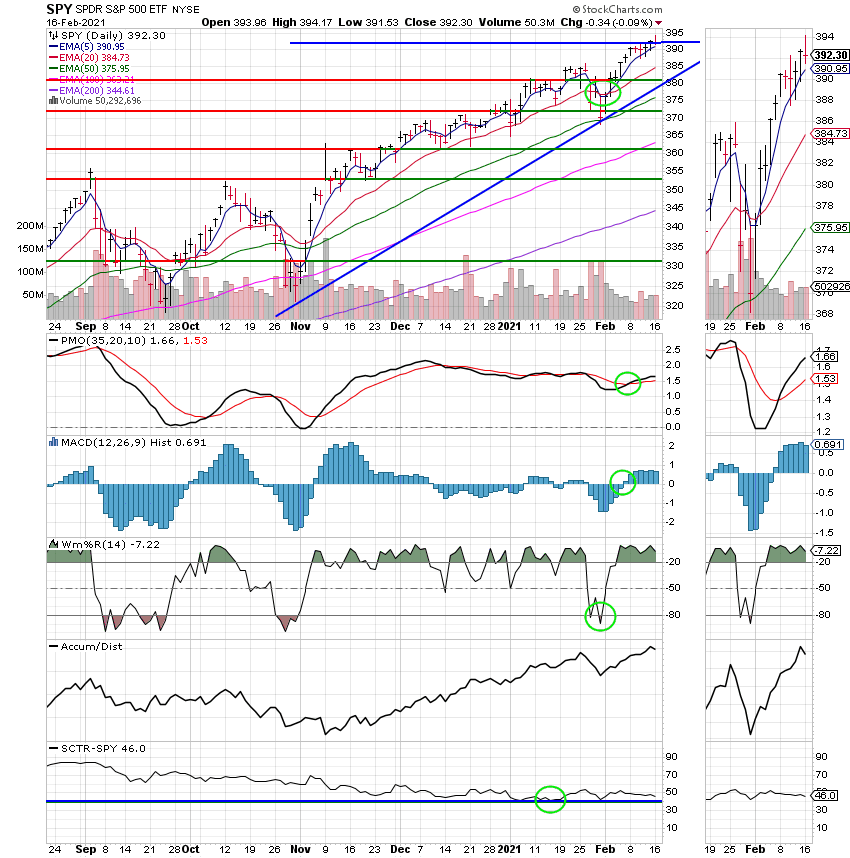

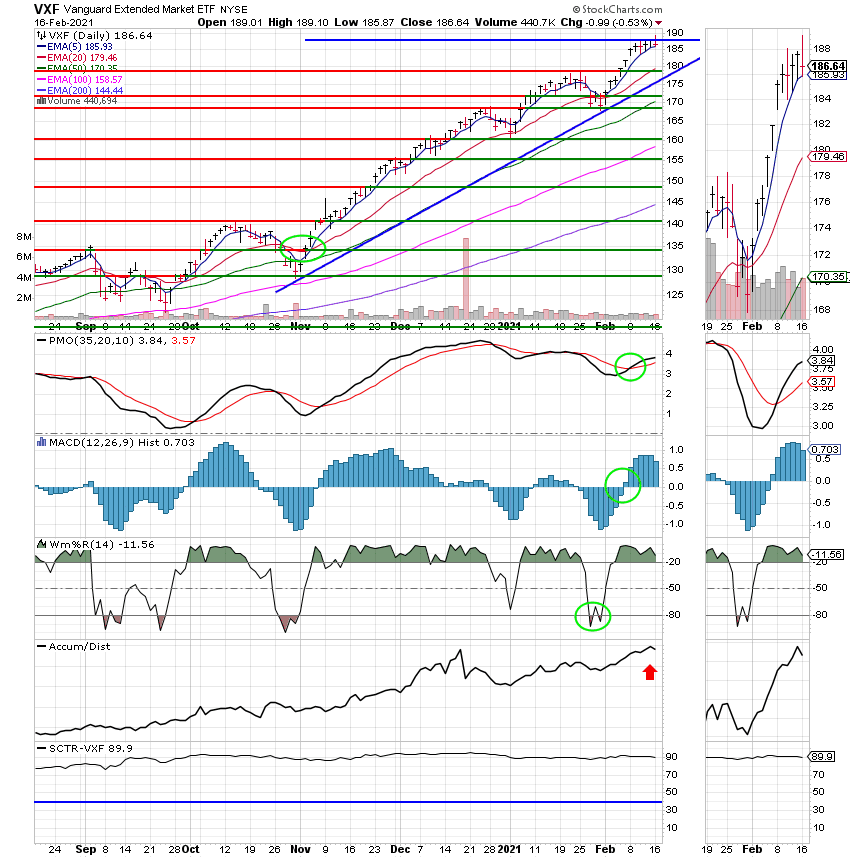

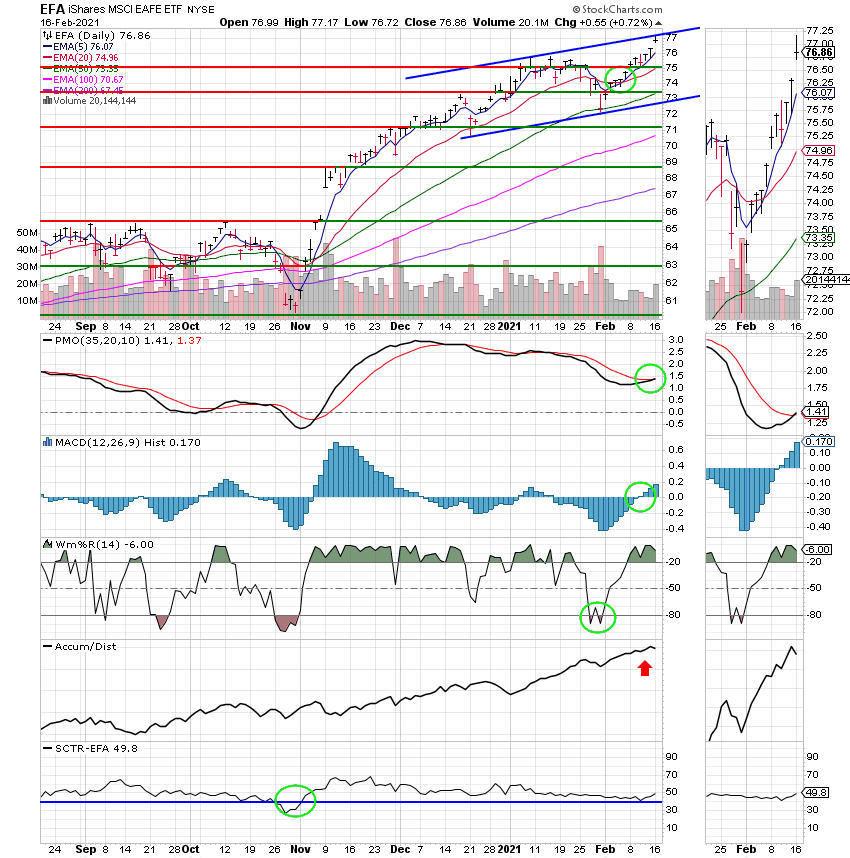

The days trading left us with the following results: Our TSP allotment fell back -0.53%. For comparison, the Dow was up +0.20%, the Nasdaq dropped -0.34%, and the S&P 500 slipped -0.06%.

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100. Our allocation is now +14.17% for the year not including the days results. Here are the latest posted results.

| 02/12/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5258 | 20.9403 | 58.6737 | 84.7162 | 36.7143 |

| $ Change | 0.0005 | -0.0603 | 0.2781 | 0.4217 | 0.1033 |

| % Change day | +0.00% | -0.29% | +0.48% | +0.50% | +0.28% |

| % Change week | +0.02% | -0.13% | +1.28% | +3.24% | +2.08% |

| % Change month | +0.03% | -0.50% | +6.01% | +11.01% | +4.89% |

| % Change year | +0.11% | -1.21% | +4.94% | +14.17% | +3.75% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.5607 | 11.4599 | 40.0961 | 12.002 | 45.268 |

| $ Change | 0.0176 | 0.0206 | 0.0917 | 0.0301 | 0.1238 |

| % Change day | +0.08% | +0.18% | +0.23% | +0.25% | +0.27% |

| % Change week | +0.42% | +0.87% | +1.10% | +1.21% | +1.32% |

| % Change month | +1.37% | +2.94% | +3.73% | +4.10% | +4.48% |

| % Change year | +1.27% | +2.69% | +3.40% | +3.74% | +4.09% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.3705 | 27.027 | 13.1371 | 13.1372 | 13.1372 |

| $ Change | 0.0362 | 0.0847 | 0.0532 | 0.0532 | 0.0531 |

| % Change day | +0.29% | +0.31% | +0.41% | +0.41% | +0.41% |

| % Change week | +1.42% | +1.52% | +1.85% | +1.85% | +1.85% |

| % Change month | +4.82% | +5.15% | +6.31% | +6.31% | +6.31% |

| % Change year | +4.41% | +4.72% | +5.84% | +5.84% | +5.84% |