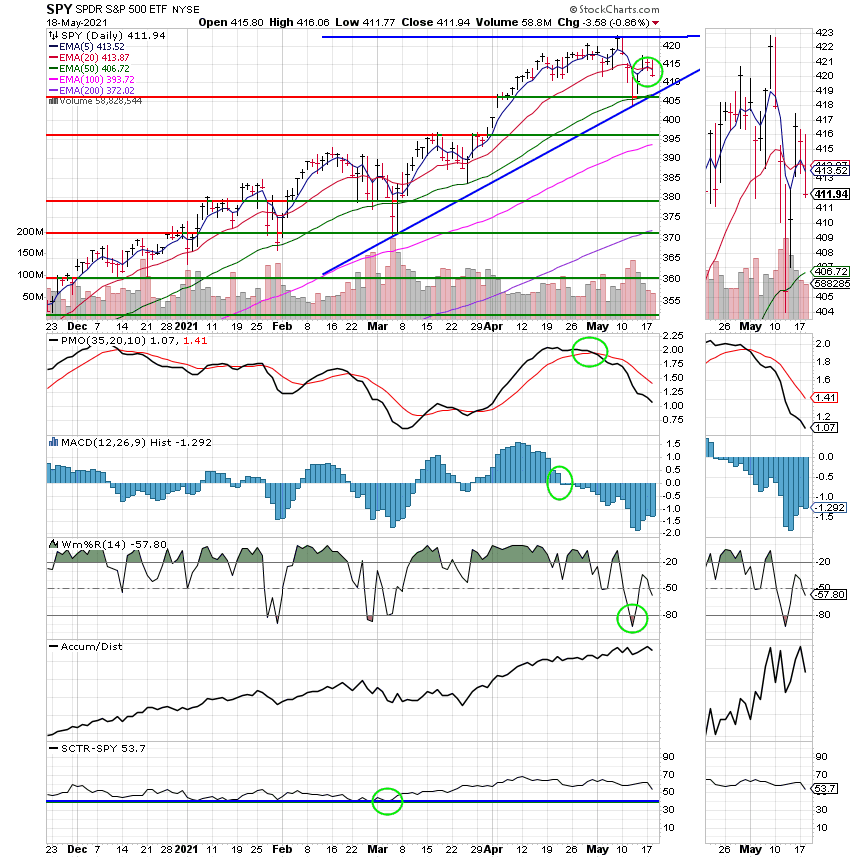

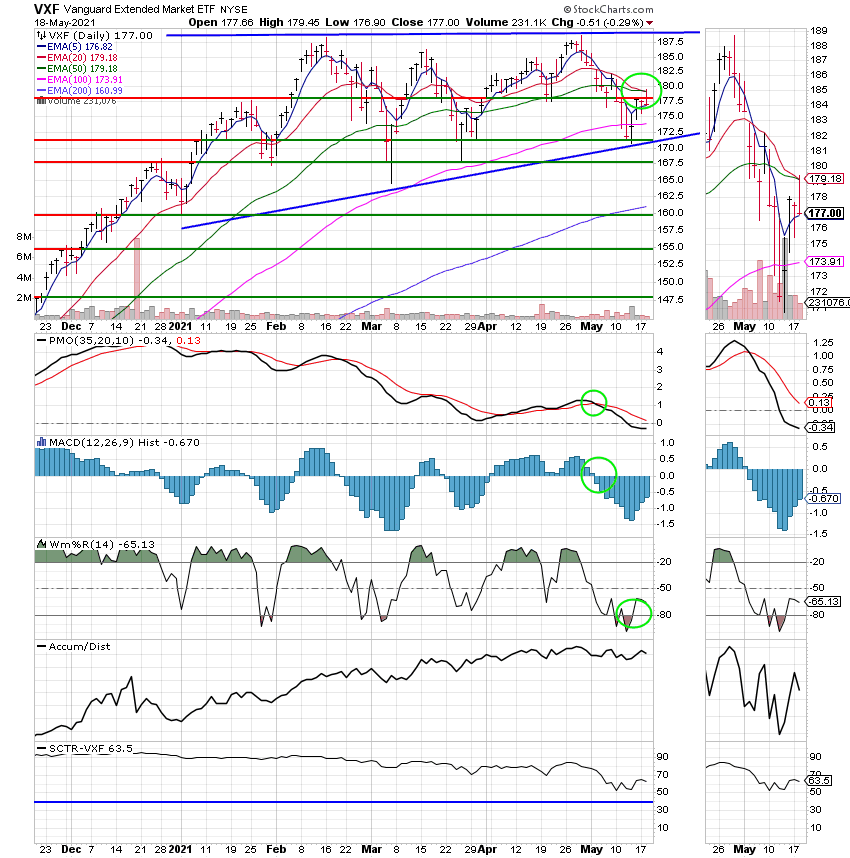

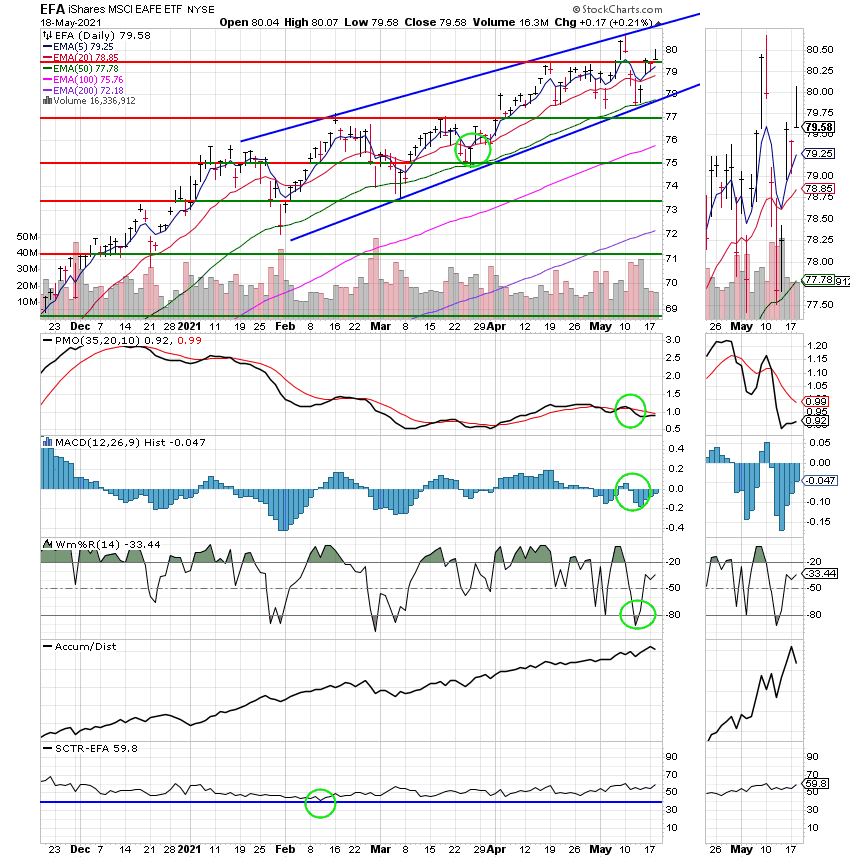

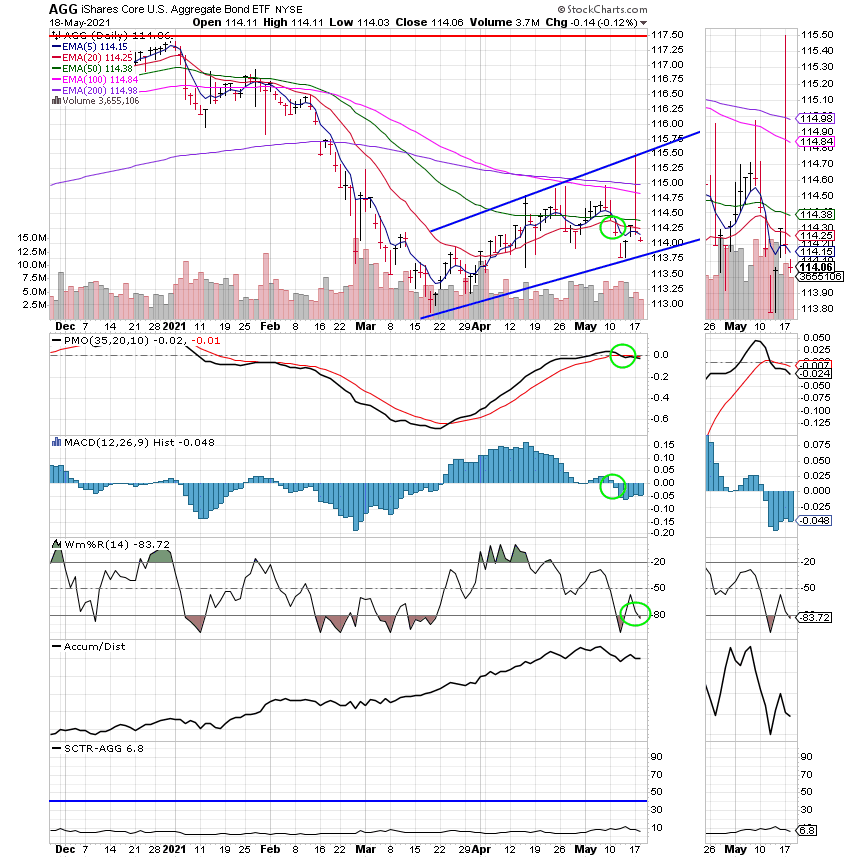

Good Evening, Well I’m back. I bet you hardly missed me. I had some really challenging internet coverage to say the least at some of the places I was staying, but I managed to keep up somewhat with what was going on…… I found myself wishing that I had not been able to view the trading at all as the action tended to be nauseating! The market continued to be without clear leadership and when you added other news related issues (such as the pipeline hack or the bridge over the Mississippi being shut down) to the mix the market was very confused just as it was again today. A report was released this morning showing that new housing starts had dropped off the pace from last month coming in below estimates which caused investors to step back and take a look at their strategy. For the past couple weeks and up to today their main concern has been that a hot running economy would cause inflation and that higher inflation would cause the Fed to back off of their stimulus to include the monthly buying of bonds and holding interest rates near record lows. The words taper and increase were thrown around by traders quit a bit causing increased volatility. Believe me when I tell you that there will be a price to pay for all this stimulus. It’s one thing for traders to talk about interest rates increasing or bond purchasing being tapered but it is entirely another for the Fed to mention them. It says here to sell first and ask questions later when you hear talk like that out of the Fed! However, things with the Fed remain good for now. They have repeated many times that they have no intention of cutting stimulus at this time. They have even gone as far as to say that they are willing to let the economy run a little hotter than usual to aid in the pandemic recovery. You see the Fed is particularly interested in two things. Inflation and the job market. They normally prefer for inflation to run under 2.0%. When it gets to 2.0% they increase the interest rates to tighten up the economy. This controls inflation. The other issue is jobs which is one the Feds biggest missions. Their mandate with regard to jobs is to try to keep the US workforce as close to full employment as possible. That is one of the reasons they are willing to let inflation run a little hot in this case. To help folks get back to work after the pandemic. Unemployment is currently around 6%. It is my understanding that economists consider full employment to be around 3% unemployment. So in this particular case the Fed is willing to overlook inflation at 2% in favor of getting us back to full employment as long as it doesn’t stay that high for a protracted period of time. Of course the Fed is looking at things like GDP as well but inflation and employment are the two biggies. All that said the market is moving one direction of the other depending on what news is released effecting the aforementioned issues. Today the report about new housing rates decreasing had investors questioning the value and recovery related stocks they have been buying to be best positioned for the economic recovery. Conversely they went out and re-purchased some of the beaten up tech stocks that have been sold in order to add recovery stocks. As you will remember it was tech stocks such as Apple and Tesla that led the market back during the recovery from the February sell off. Another side issue here is that higher interest rates also concern investors about tech stocks as tech stocks prosper best in low interest rate environment. So when there is a report about inflation moving higher investors really dup the tech stocks and so the volatile circle continues…… As usual all we can do other than pray of course is to watch our charts and hang in there as long as there is a high percentage chance that the trend will continue higher.

The days trading left us with the following results: Our TSP allotment fell in the late afternoon session slipping -0.29%. For comparison, the Dow dropped -0.78%, the Nasdaq -0.56%, and the S&P 500 -0.85%. It was another roller coaster day!

S&P 500 flat as telecom weakness offsets strong retail earnings

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Sell. We are currently invested at 100/S. Our allocation is now +8.31% on the year not including the days results. Here are the latest posted results:

| 05/17/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5859 | 20.6287 | 62.3067 | 80.3681 | 38.2871 |

| $ Change | 0.0020 | -0.0108 | -0.1576 | -0.1472 | 0.0296 |

| % Change day | +0.01% | -0.05% | -0.25% | -0.18% | +0.08% |

| % Change week | +0.01% | -0.05% | -0.25% | -0.18% | +0.08% |

| % Change month | +0.07% | -0.13% | -0.35% | -3.59% | +1.37% |

| % Change year | +0.47% | -2.68% | +11.44% | +8.31% | +8.19% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.8151 | 11.686 | 41.0703 | 12.3136 | 46.5211 |

| $ Change | -0.0054 | -0.0067 | -0.0315 | -0.0105 | -0.0433 |

| % Change day | -0.02% | -0.06% | -0.08% | -0.09% | -0.09% |

| % Change week | -0.02% | -0.06% | -0.08% | -0.09% | -0.09% |

| % Change month | +0.02% | -0.04% | -0.09% | -0.11% | -0.14% |

| % Change year | +2.41% | +4.72% | +5.91% | +6.44% | +6.97% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.7268 | 27.8442 | 13.6259 | 13.6258 | 13.6256 |

| $ Change | -0.0127 | -0.0297 | -0.0171 | -0.0171 | -0.0171 |

| % Change day | -0.10% | -0.11% | -0.13% | -0.13% | -0.13% |

| % Change week | -0.10% | -0.11% | -0.13% | -0.13% | -0.13% |

| % Change month | -0.17% | -0.19% | -0.25% | -0.25% | -0.25% |

| % Change year | +7.42% | +7.89% | +9.78% | +9.78% | +9.78% |