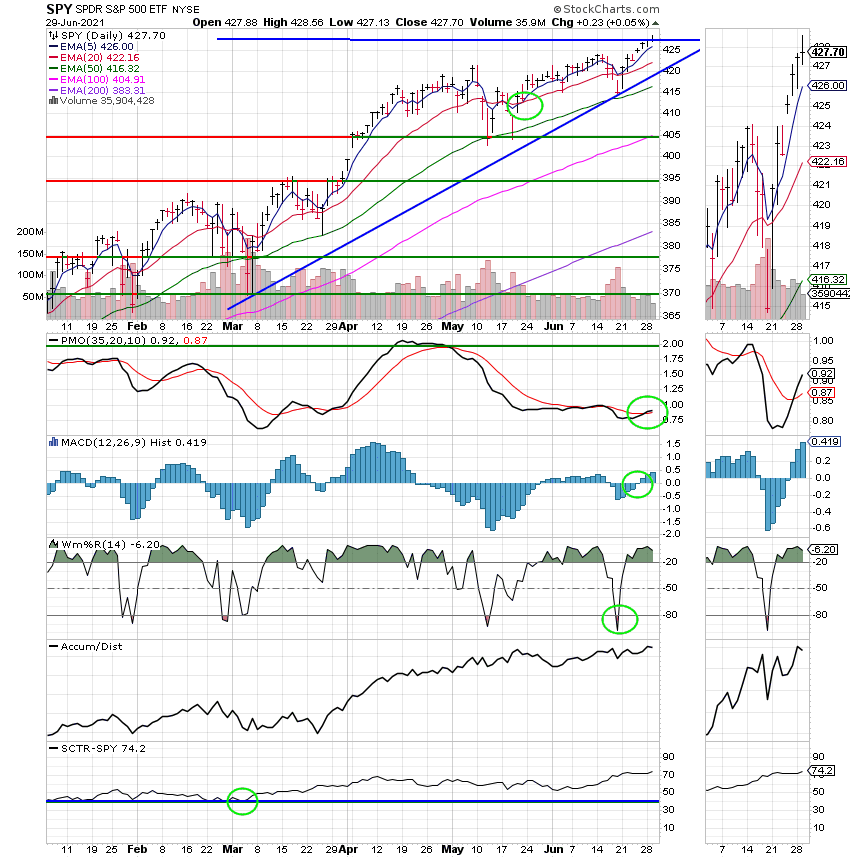

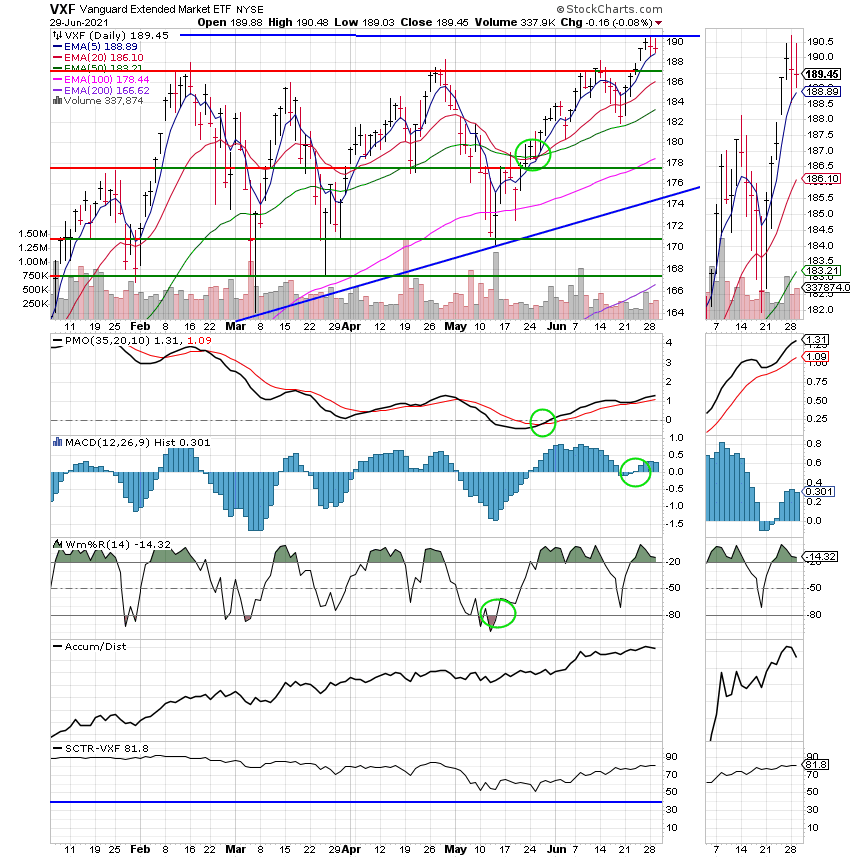

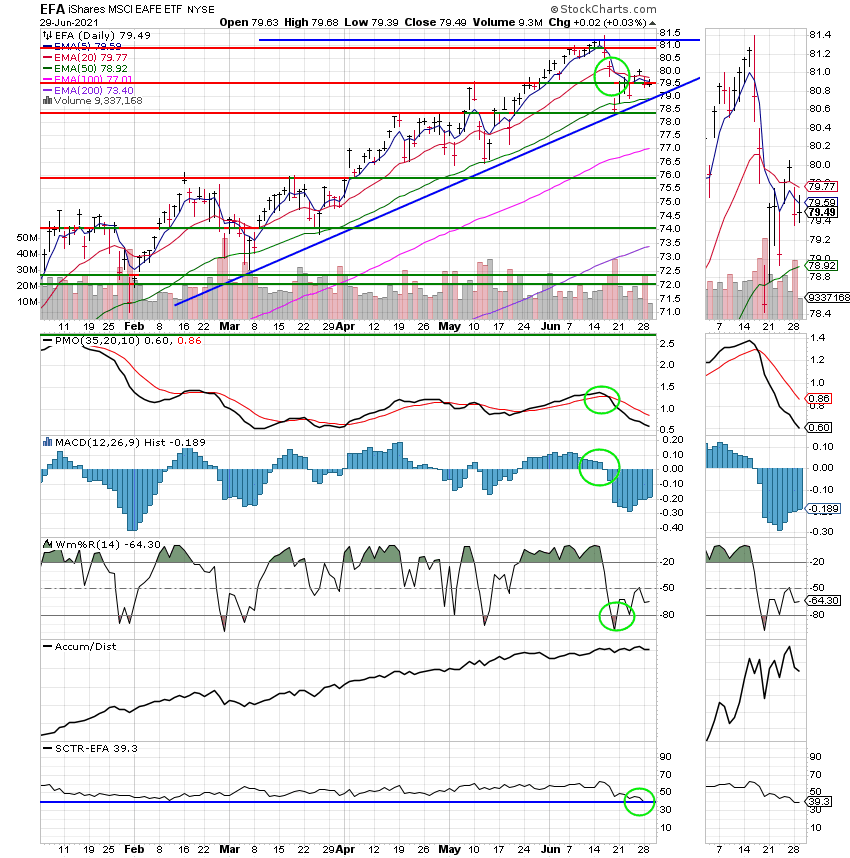

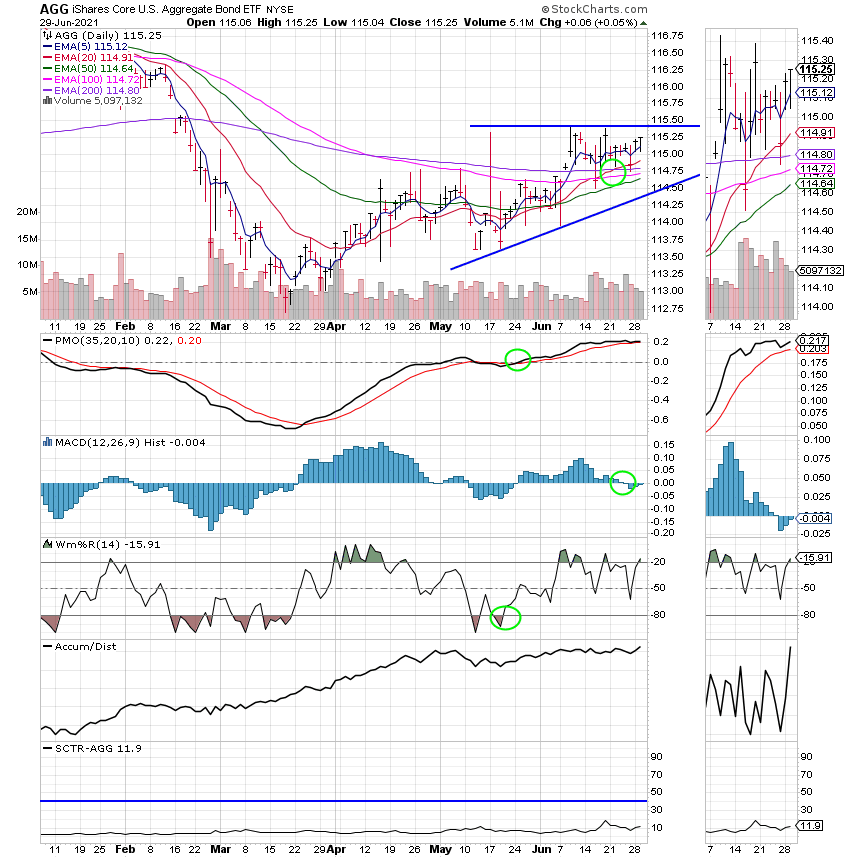

Good Evening, Tomorrow is the last trading day of June and the last trading day of the quarter. I wasn’t always sure that we would finish the first half of the year in the green, but by the grace of God we did. I am fairly confident given no unforeseen land mines that we will finish the second half of the year in the green also. While some of the first 6 months of the year have been turbulent our charts of the C and the S Funds never generated sell signals. So we stuck with our allocation of 100% S and didn’t look back despite numerous messages asking us if when we might move to the C Fund. Our charts continued to favor small and mid caps and given that the chart for the S Fund was slightly better than that of the C Fund we never had a reason to change. If you are new to our group and wonder if we ever change you can ask the old timers and they will tell you that we have exhausted our available moves on many occasions in the past. It’s just that the S fund has had and continues to have a great run! So where do we find ourselves now?? We currently have an up trending market that is swinging back to small and midcap growth stocks. Why is it moving that way? Because bond yields and corresponding interest rates have settled down and are currently moving somewhat sideways. Not so long ago we were experiencing a painful sell off as bond yields were rising. As I mentioned in more than a few recent blogs its mostly about inflation. There are two trains of thought. The first is that the recovering economy will cause the inflation to heat up and force the Fed to cut back on it’s financial stimulus. The second which I might add is shared by the Fed is that inflation will cool down after a while and that high inflation is temporary or as they call it transitory. Having that mindset, the Fed has said repeatedly that they will not be in a hurry to raise interest rates or cut back on their monthly bond purchases. They have said that they are willing to allow inflation to run above their target rate of 2 percent. In other words since they think that the inflation is temporary they are willing to let it run a little hot. I am in this camp. Don’t fight the Fed. However, the bears believe that the inflation will get too hot too fast and force the Fed to take action. While I do not agree with the bears, I have stated in recent blogs that the Fed will eventually have to reduce their stimulus, but I do not think that will happen soon. Let me be clear about this. As of right now I am bullish on the next six months. After that who knows? We will continue to do what we do. We will watch our charts and respond to what we see. We are reactive traders and will react the same way to charts that tell us to sell whether in be in six weeks or in six months. Of course I must also add that we will continue to pray and seek the guidance of our Heavenly Father! The true reason for our success!!

The days trading left us with the following results: Our TSP allotment slipped slightly at -0.08%. For comparison, the Dow edged up +0.03%, the Nasdaq +0.19%, and the S&P 500 +0.03%. All in all it was a pretty flat day.

The days action left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are currently invested at 100/S. Our allocation is now +15.81% for the year. Here are the latest posted returns:

| 06/29/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6147 | 20.8625 | 64.345 | 85.9343 | 38.9202 |

| $ Change | 0.0007 | 0.0126 | 0.0237 | -0.1378 | -0.0457 |

| % Change day | +0.00% | +0.06% | +0.04% | -0.16% | -0.12% |

| % Change week | +0.02% | +0.32% | +0.27% | -0.36% | -0.65% |

| % Change month | +0.12% | +0.66% | +2.20% | +3.77% | -0.55% |

| % Change year | +0.64% | -1.57% | +15.08% | +15.81% | +9.98% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 23.0221 | 11.8768 | 41.9148 | 12.5904 | 47.6538 |

| $ Change | -0.0007 | -0.0018 | -0.0087 | -0.0030 | -0.0128 |

| % Change day | +0.00% | -0.02% | -0.02% | -0.02% | -0.03% |

| % Change week | +0.00% | -0.04% | -0.06% | -0.07% | -0.08% |

| % Change month | +0.45% | +0.77% | +0.96% | +1.04% | +1.12% |

| % Change year | +3.34% | +6.43% | +8.09% | +8.83% | +9.58% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 13.0587 | 28.6151 | 14.0664 | 14.0664 | 14.0663 |

| $ Change | -0.0039 | -0.0094 | -0.0065 | -0.0064 | -0.0064 |

| % Change day | -0.03% | -0.03% | -0.05% | -0.05% | -0.05% |

| % Change week | -0.08% | -0.09% | -0.15% | -0.15% | -0.15% |

| % Change month | +1.20% | +1.27% | +1.46% | +1.46% | +1.46% |

| % Change year | +10.22% | +10.88% | +13.33% | +13.33% | +13.33% |