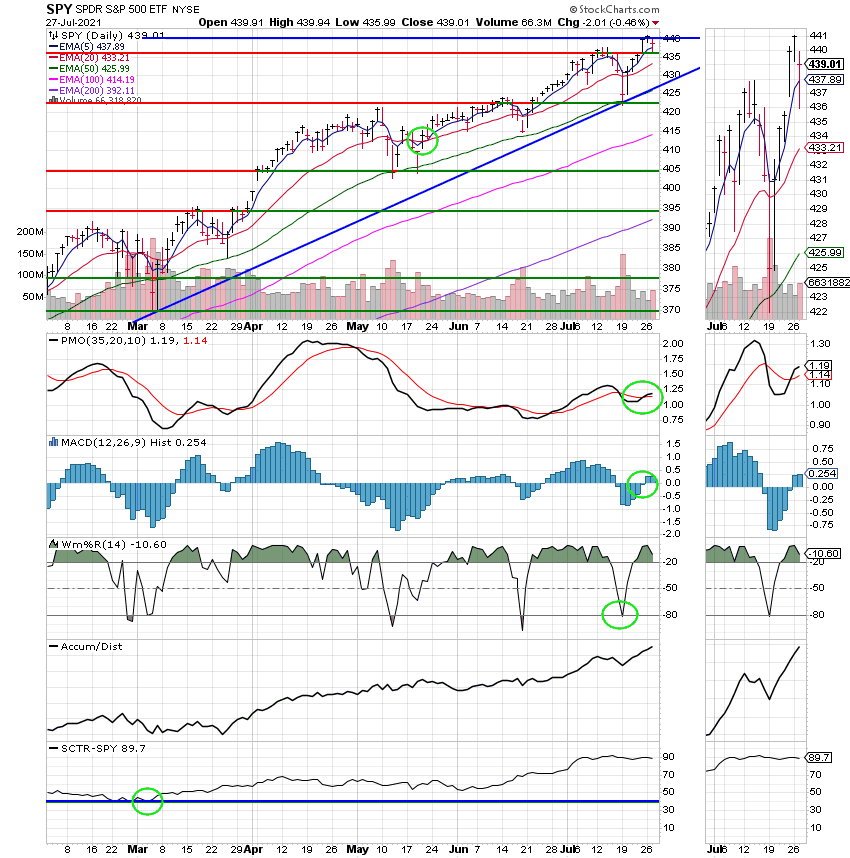

Good Evening, The market turned down today as it awaits tomorrow afternoons statement following this weeks Fed meeting. The selling broke a string of five consecutive days of gains for the S&P 500. While this type of rest should be considered normal and healthy there have been some troubling signals from some of our indicators telling us to keep an eye out for a possible correction. The two that stick out the most to me are the Transportation and Utilities Sectors. Whether you subscribe to the Dow theory or not I have never seen a sustained rally without the Transportation sector moving higher and right now it’s in decline. The opposite holds true for the Utilities sector which is considered a defensive sector and normally moves higher during a decline and right now it is putting up buy signals. Ditto that for other defensive sectors such as consumer staples and health care which are also moving higher. Add all that to the fact that we are due for a correction (which is a pullback of 10% or more) and we should be raising our level of vigilance. Am I predicting a correction? No, I don’t make predictions. I am saying that we are due for one and current conditions support that fact. So why don’t I just move?? Simple, I don’t have a sell signal in the C Fund. A market that’s due for a correction can hold and normally does hold on a lot longer than most of us consider a reasonable amount of time. To just move then our money because we think the market is moving in a certain direction would be market timing. We could be too early or too late and cost ourselves money and that’s not what we do. I’ll leave that to the market timers. We are trend followers. That is what we do! When the trend changes we change. We are in it for the long term gains not the short term gains that you get from timing the market….I’ll leave those to the….well….market timers. There are some folks that seem to have success with that strategy but I have never been able to have any success with it myself. So I stick to what works best for me. Following the trend utilizing good technical analysis with a healthy dose of praying! Never forget that last ingredient!!

The days trading left us with the following results: Our TSP allotment posted a drop of -0.47%. For comparison, The Dow lost -0.24%, the Nasdaq -1.21%, and the S&P 500 -0.47%.

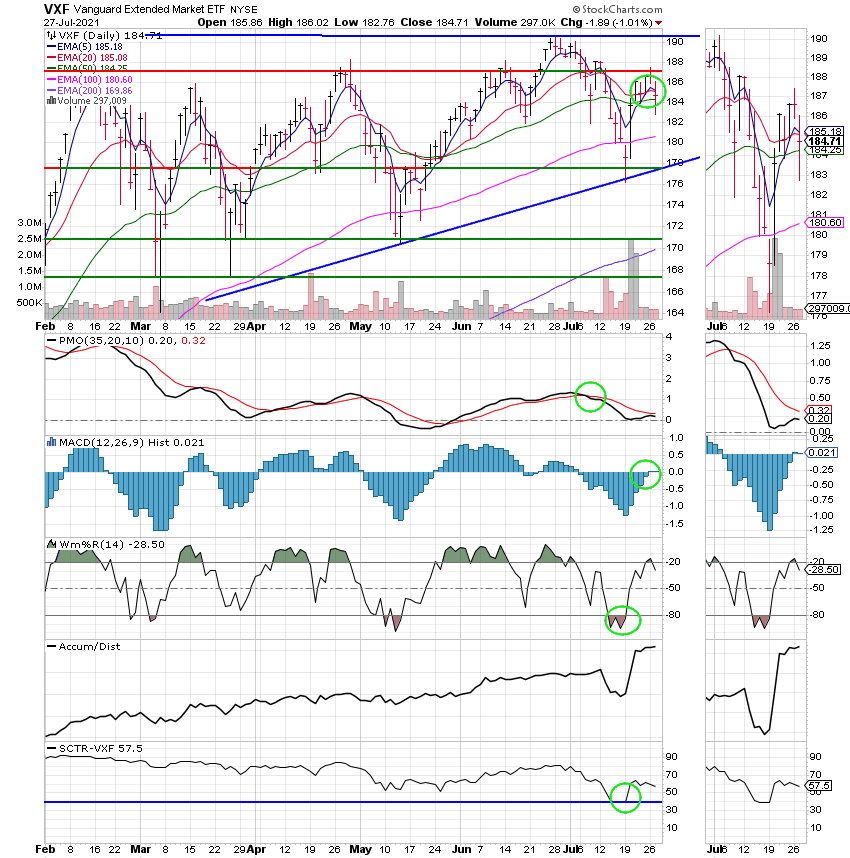

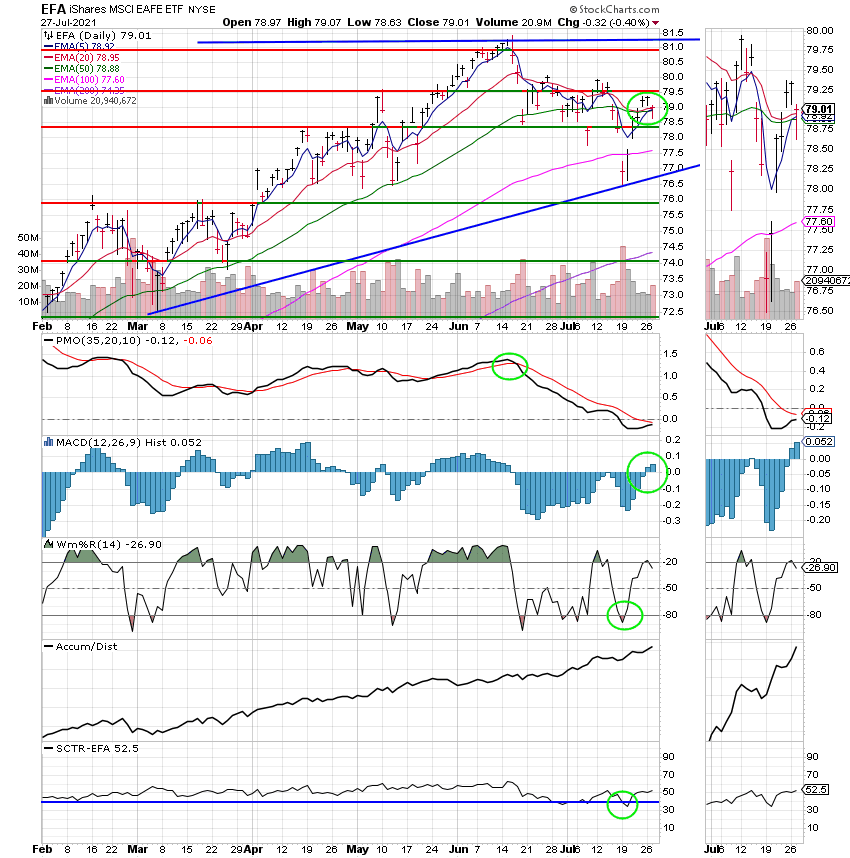

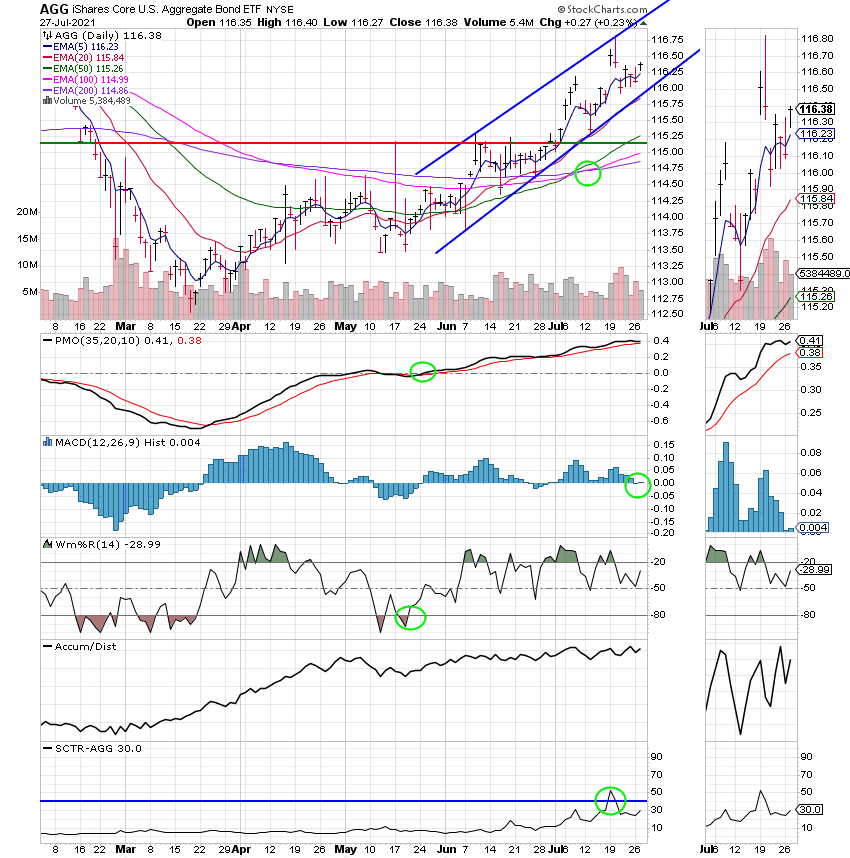

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now +17.04% for the year not including the days results. Here are the latest posted results:

| 07/26/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6329 | 21.0554 | 66.3543 | 84.6333 | 38.791 |

| $ Change | 0.0021 | -0.0119 | 0.1586 | 0.0187 | -0.0261 |

| % Change day | +0.01% | -0.06% | +0.24% | +0.02% | -0.07% |

| % Change week | +0.01% | -0.06% | +0.24% | +0.02% | -0.07% |

| % Change month | +0.11% | +0.84% | +2.98% | -1.22% | +0.57% |

| % Change year | +0.75% | -0.66% | +18.68% | +14.06% | +9.61% |