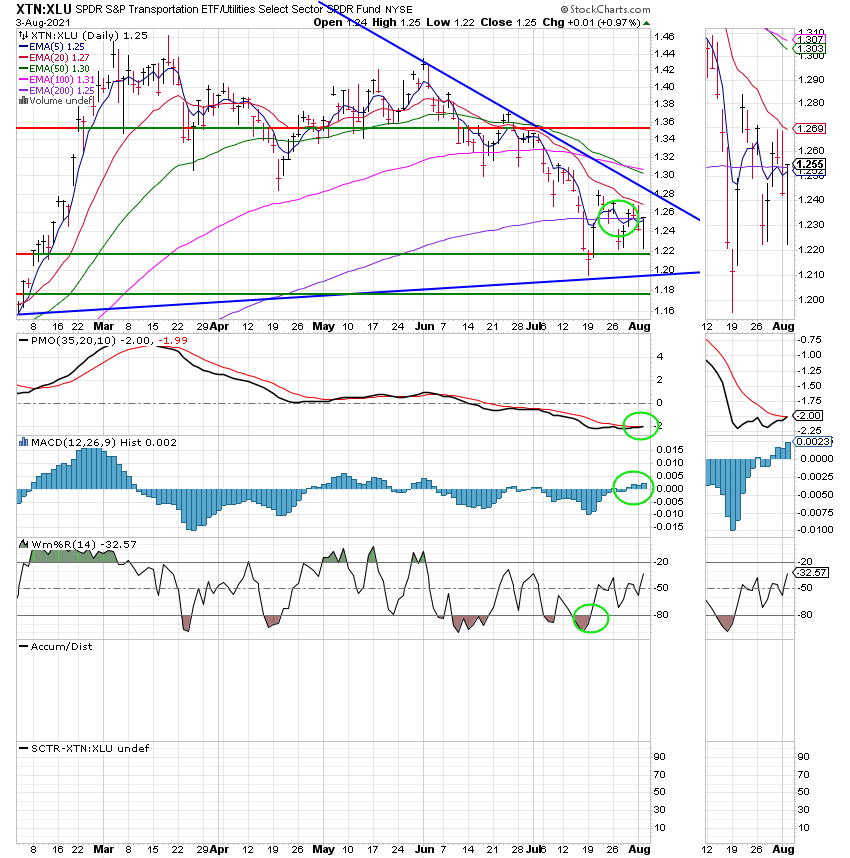

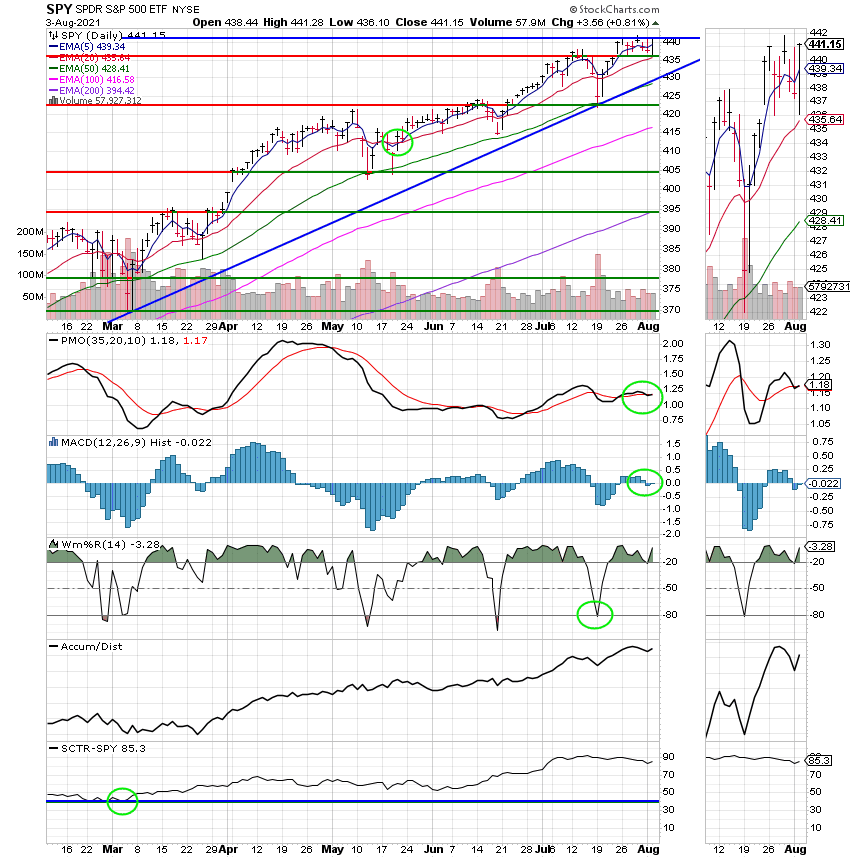

Good Evening, The S&P 500 moved to a new record today which means our allocation cut a new high for the year as well. Of course that’s good and that’s why we’re invested in equities and right now the chart for the C Fund is in solid shape. All that noted I must say that I believe some storm clouds are starting to gather. So where do I start? I guess with COVID. The seven-day average of daily coronavirus cases in the U.S. reached 72,790 on Friday, surpassing the peak seen last summer when the nation didn’t have an authorized Covid-19 vaccine, according to data compiled by the Centers for Disease Control and Prevention. Folks, I know that COVID 19 is a divisive subject but regardless of where you stand on it this is the same type of news we watched before the economic shutdown and while this may not lead to a full blown shutdown it will surely lead to greater restrictions and already has with indoor mask wearing being mandated again in several localities. Make no mistake these restrictions will weigh the market down and a full blown shutdown would kill it. Secondly, stock valuations are getting very high and it is becoming harder and harder to justify them. A market that believes valuations are high becomes a skittish market and will sell off on the least bit of bad news. Thirdly you have seasonality. Make no mistake, September and October and historically the worst two months for the stock market. Why should we expect it to be any better this year with the aforementioned issues and I’m not even done. Fourth, we are just overdue for a correction which is defined as a pullback of 10% or more (20% or more is a bear market). In normal year we usually have two to three pullbacks of 5% or more and one that is 10% or more. So far this year we’ve had none of those. I will add that a correction is healthy in a normal market, but can we really call this a normal market with the pandemic and all the Fed Stimulus that remains in place? Either way this market is screaming for a correction. I will even say that it needs one to stay healthy! Fifth, a few of the indicators I watch ( and I watch several) are calling for a pullback. I will give you one such example. One of the things I watch is a ratio between the transportation and utility sectors. You will never have a rally with out transportation and you will never have a sizeable pullback without a rally in the utility sector as utilities are seen as a safe haven. Here is the chart:

As you can see the chart has been moving lower. To make this simple for those of you that don’t read charts if the chart moves higher that favors Transportation if it moves lower if favors Utilities. As the chart moves lower it favors a pullback and when it moves higher it favors rally. I have about a half dozen or so indicators that are getting in this kind of shape. While one of these indicators alone does not mean that a pullback is immanent the greater weight of evidence is found in numbers (other charts that agree) and those numbers are growing. I can’t possible show them all but chose this one because the transportation sector is seldom wrong when it come to such predictions. The bottom line is that if this chart doesn’t turn back up soon we will have a pullback. I could go on and on but to sum this all up. There are several indicators that are telling us to keep a high level of vigilance. Conditions are ripe for a correction.

The days trading left us with the following results: Our TSP allotment posted a gain of +0.82%. For comparison, the Dow was up +0.80%, the Nasdaq +0.55%, and the S&P 500 +0.82%. Praise God for such a good day!

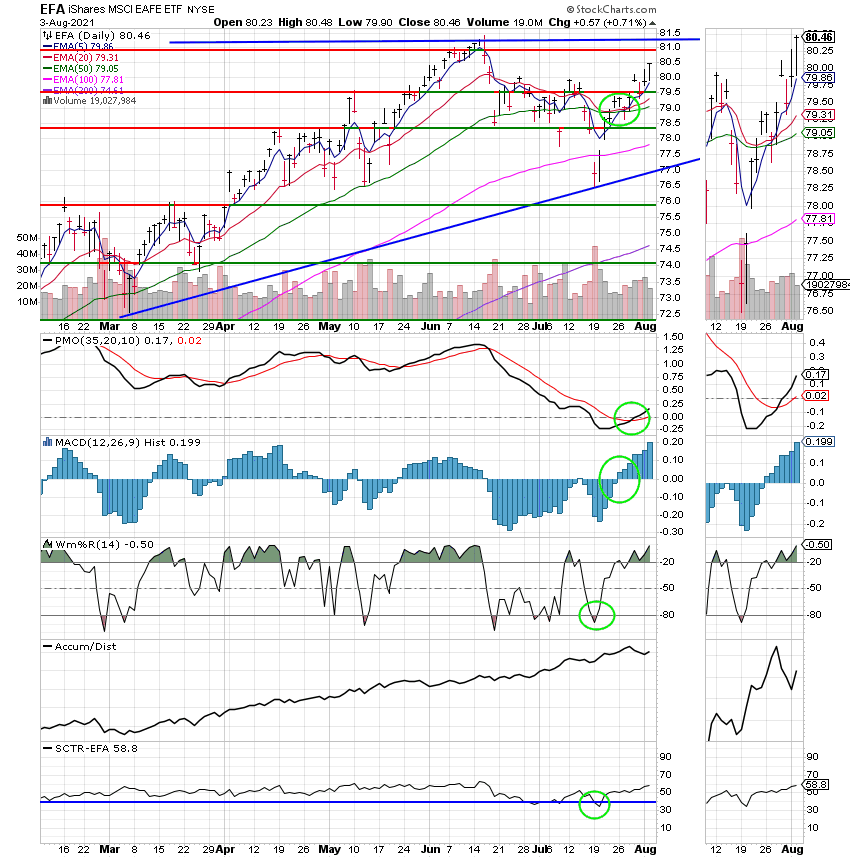

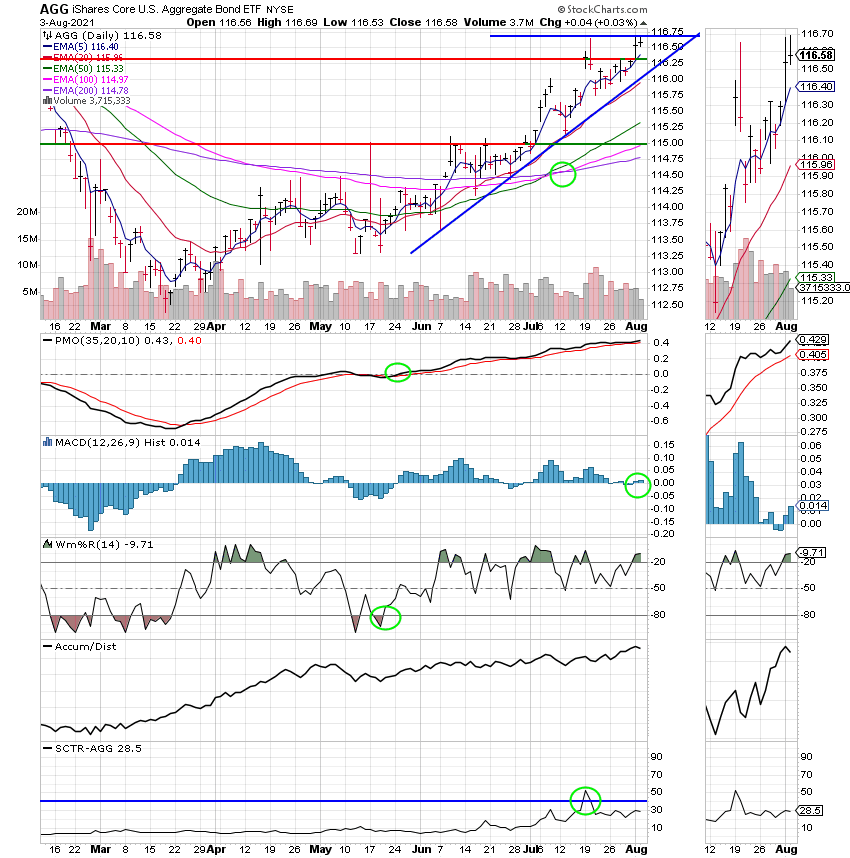

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now +17.08% for the year. Here are the latest posted results:

| 08/03/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6381 | 21.1742 | 66.3806 | 84.7405 | 39.3039 |

| $ Change | 0.0005 | 0.0007 | 0.5403 | 0.2437 | 0.1902 |

| % Change day | +0.00% | +0.00% | +0.82% | +0.29% | +0.49% |

| % Change week | +0.01% | +0.26% | +0.63% | +0.14% | +1.18% |

| % Change month | +0.01% | +0.26% | +0.63% | +0.14% | +1.18% |

| % Change year | +0.79% | -0.10% | +18.72% | +14.20% | +11.06% |

Are allocation is performing well. Our task at this time is to monitor our charts and stay vigilant for the next market trend. That’s all for tonight. Have a great evening and may God continue to bless your trades!