Good Evening, The market remains in a trading range balanced between economic progress and new cases of the delta variant of COVID 19. Todays economic progress came in the way of a $1 trillion dollar infrastructure plan passed by the Senate. The Senate’s infrastructure plan, which includes $550 billion in new spending on transportation and broadband, is expected to help give the economy a boost as peak growth slows following the reopening from the pandemic. With regard to new cases of the Delta Variant of COVID 19 the U.S. reported a seven-day average of more than 108,600 new cases per day as of Sunday, up 36% from a week earlier, according to data from Johns Hopkins University. If and when there is news concerning new COVID related restrictions expect it to weigh on the market. Enough of this and we’ll see a sizable selloff. I don’t necessarily see this as the end of the world but rather view it as an opportunity. While there may indeed be a sell off, there will also just as likely be a monster rally when the virus recedes. My strategy is to short this action if possible and make a healthy profit in the aforementioned rally. Also, as I mentioned several times lately, we are overdue for a correction. It will benefit us greatly to be very patient at this point. We need to watch our charts and execute our plan. If you are new to our group and are sitting on cash it would be advisable to wait for this pullback before you put your money to work. Also, never forget to keep praying for our group. It’s so important!

The days trading left us with the following results: Our TSP allocation posted a modest gain of +0.10%. For comparison, the Dow gained +0.46%, the Nasdaq fell -0.49%, and the S&P 500 added +0.10%. Praise God for a day in the green!

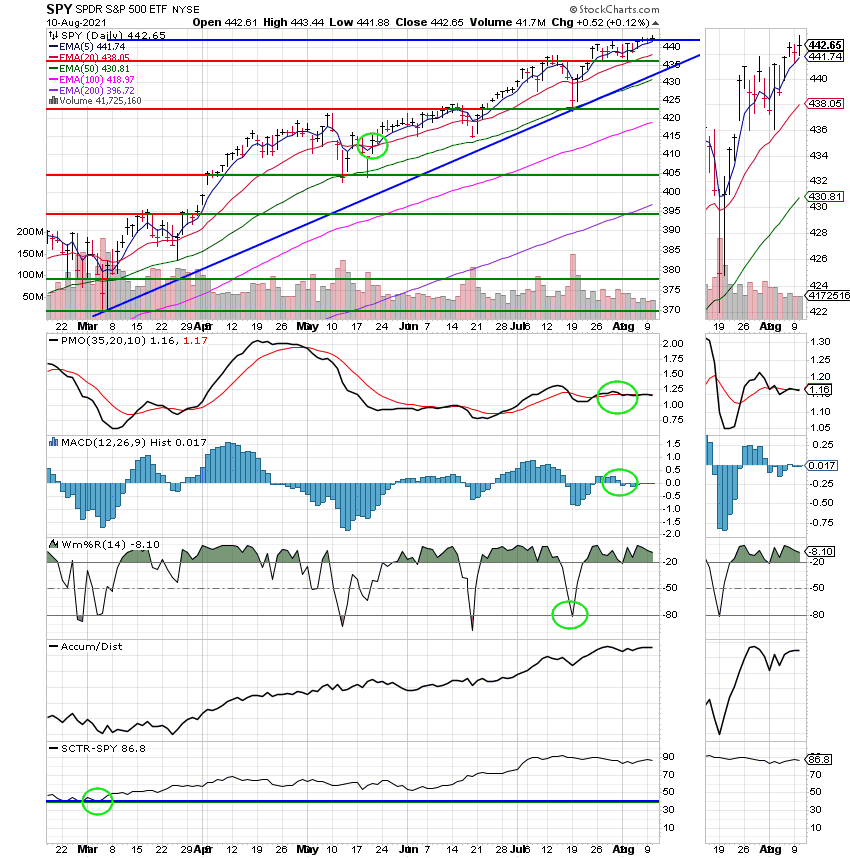

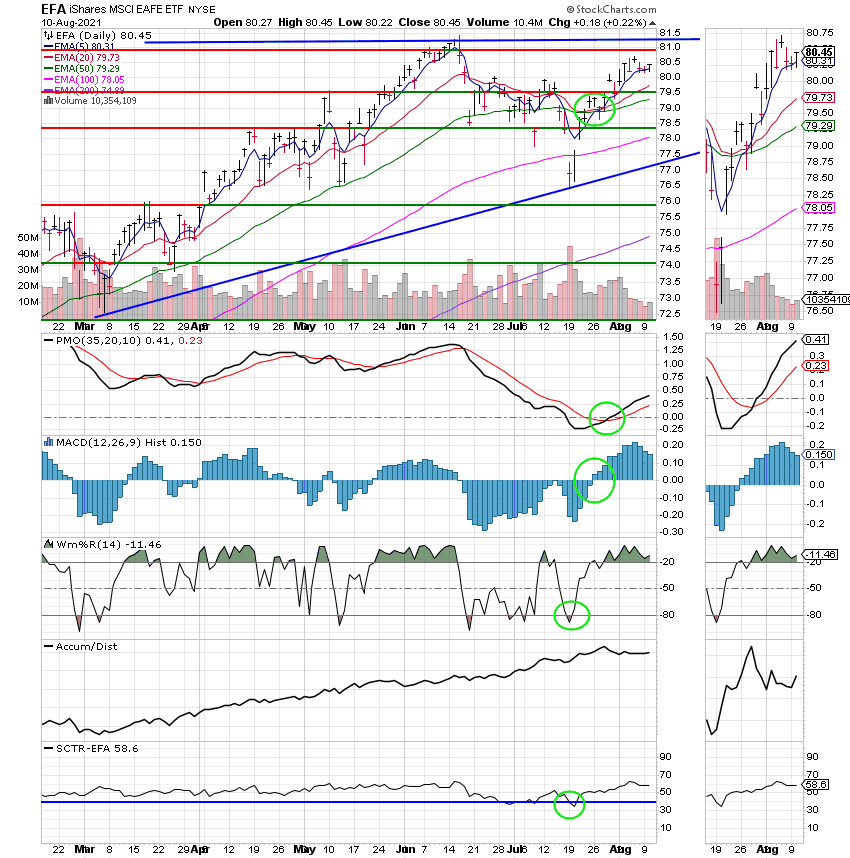

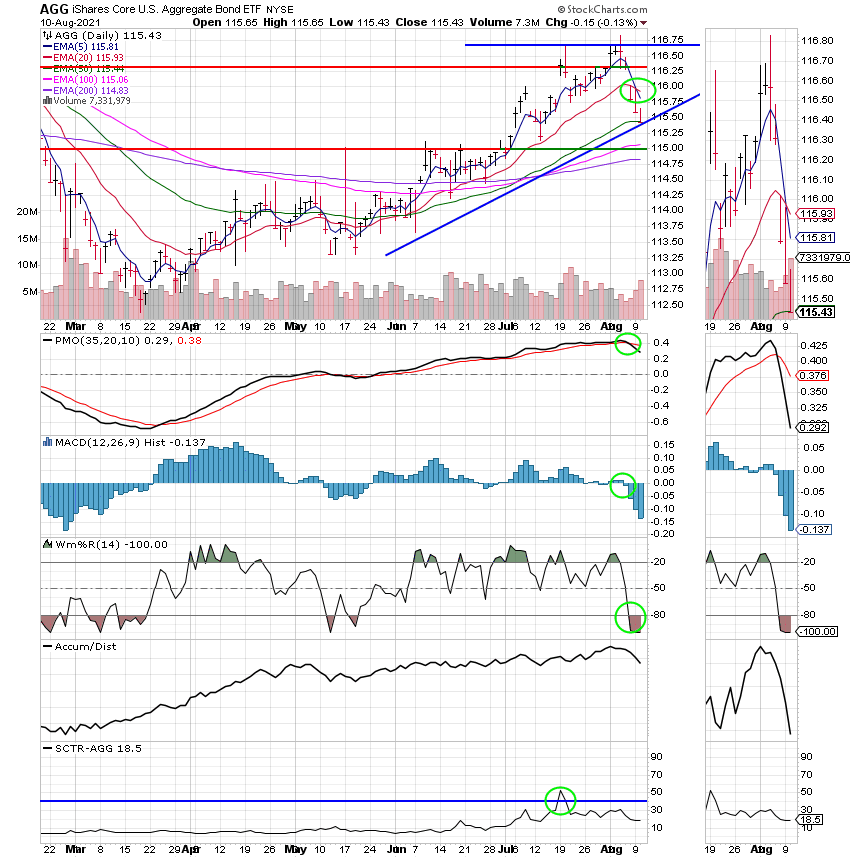

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now +17.36% on the year not including the days results. Here are the latest posted returns:

| 08/09/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6415 | 21.004 | 66.5358 | 85.1659 | 39.2638 |

| $ Change | 0.0017 | -0.0288 | -0.0579 | -0.1364 | 0.0146 |

| % Change day | +0.01% | -0.14% | -0.09% | -0.16% | +0.04% |

| % Change week | +0.01% | -0.14% | -0.09% | -0.16% | +0.04% |

| % Change month | +0.03% | -0.54% | +0.87% | +0.65% | +1.08% |

| % Change year | +0.81% | -0.91% | +19.00% | +14.78% | +10.95% |