Good Evening, Normally this is my favorite time of the year for the market. If you are invested correctly you can sit back and watch the gains add up. You can relax! Not this year. No Sir/ No Ma’am. 2021 has been a volatile year. Of course everyone blames the Covid virus but that’s just one facet of this tangled web. You have the Fed, the economic recovery, global supply chain issues, folks returning or not returning to work, a relatively new administration trying to establish their policies, green energy and global warming, social and political unrest, interest rates, inflation, treasury bond rates, a border crisis, Russia and Ukraine, China and Taiwan, and the list goes on and on. What is creates in the end is volatility and the more volatility you have the harder it is to trade. This past week was a good example. With few exceptions stocks sold off in what the the media claimed was a response to the new Omicron variant of the Covid Virus. You remember in last weeks blog we talked about Omicron and how South African doctors were claiming that the symptoms were mild. In that discussion we came to the conclusion that there was probably nothing to fear and that’s exactly the way it turned out leading to yesterdays and today’s relief rally. Last weeks sell off took my indicators to the brink of selling and moving to the G fund. Many of them were close to bear market territory. By the matter of fact, many many small cap stocks did enter a bear market which is to say a decline of 20% or more. A good example of that are the ARK Funds operated by Kathy Wood (ARKG, ARKF, ARKK, ARKQ, ARKW, and ARKX). You might remember these funds. Five of them were among the top ten ETF’s in 2020. they had an average return of 145%!!! As you might remember we had a great year as well but we didn’t touch that and neither did anyone else! The ARK Funds invest in 5 areas of innovation. Don’t ask what the five areas are right now, you can check on their web site if you really want to know. Suffice to say they invest in things like Electric vehicles, Artificial Intelligence, Robotics, Self driving cars, and Genetic therapy…..new and disruptive technology. Why tell you this? I wanted you to understand the setting in which I tell you what I about to tell you. The great majority of these kind of stocks are small cap stocks. Not all, but definitely a majority. Anyway, what I am going to tell you now is significant and should not be overlooked. Of all to those funds. Let me say if again out of All of those funds! Only 2 stocks that make of the funds were not in a bear market! Only Two!!! Understand one thing and understand it well. We have talked about it many times over the years. Small cap stocks are the early warning system. They are the canary in the coal mine! They are the first to sell off and the first to come back. You probably noticed that the S Fund was underperforming recently. Well it’s about one half small caps and the other half mid caps. The point I want to make here is that is how close we came to the edge of the cliff. This market is not as healthy as the media has made it out to be. Yes, we have turned back from the edge of the cliff for now, but that doesn’t mean we should throw caution to the wind. We need to keep a very close eye on these small caps. They could be warning us of something to come. For now we are still invested at 100/C and our chart for the C Fund is still putting up a buy signal. That’s how we knew that the market would likely turn back from the edge of the cliff. That’s the reason we didn’t sell. We did however come close, very close. Folks, keep an eye on those small caps and I might add that it might be a good idea (hint hint) to put a few of those ARK funds on your watch list. They might just tell you which way the wind is blowing. I can certainly tell you one thing. If they are doing good you can bet that the S Fund will be doing good was well…….

The days trading left us with the following results: Our TSP allotment posted a nice gain of +2.07%. For comparison, the Dow added +1.40%, the Nasdaq +3.03%, and the S&P 500 +2.07%. Praise God for such a wonderful day! We sure needed it after all the recent selling!

Stocks rally for a second day, Nasdaq jumps 3% as investors reassess omicron risk

The days action left us with the following signals: C-Buy, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now +12.51% on the year not including the days gains. Here are the latest posted results:

| 12/06/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7198 | 20.9605 | 69.2546 | 81.8771 | 37.9805 |

| $ Change | 0.0021 | -0.0656 | 0.8053 | 1.1730 | 0.2575 |

| % Change day | +0.01% | -0.31% | +1.18% | +1.45% | +0.68% |

| % Change week | +0.01% | -0.31% | +1.18% | +1.45% | +0.68% |

| % Change month | +0.02% | +0.03% | +0.57% | -1.30% | +1.21% |

| % Change year | +1.28% | -1.11% | +23.86% | +10.34% | +7.32% |

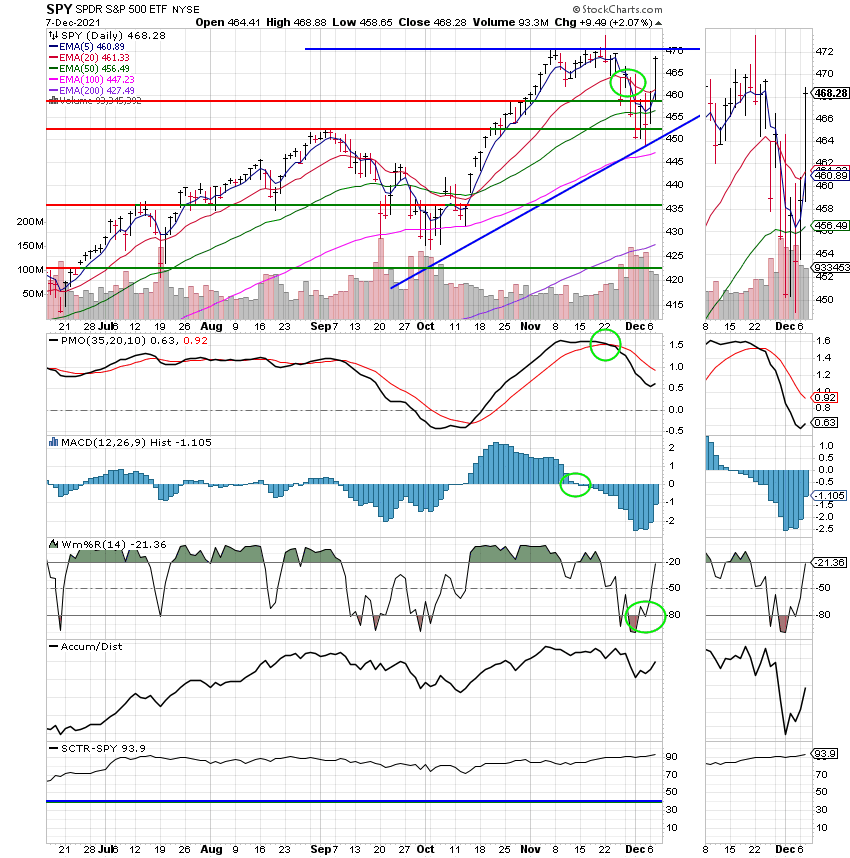

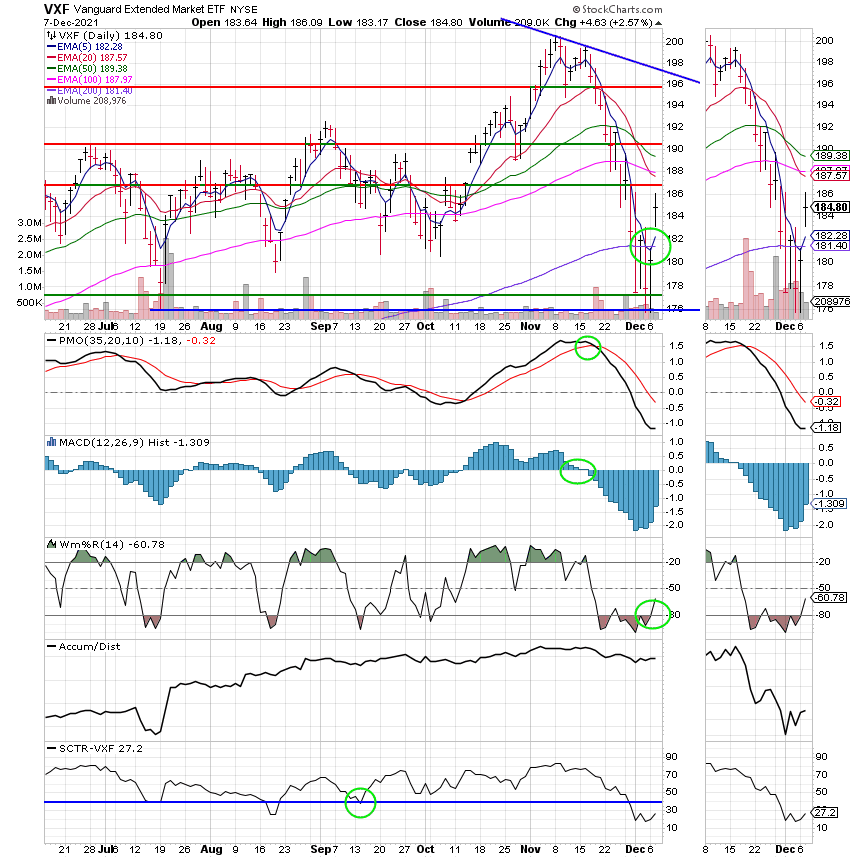

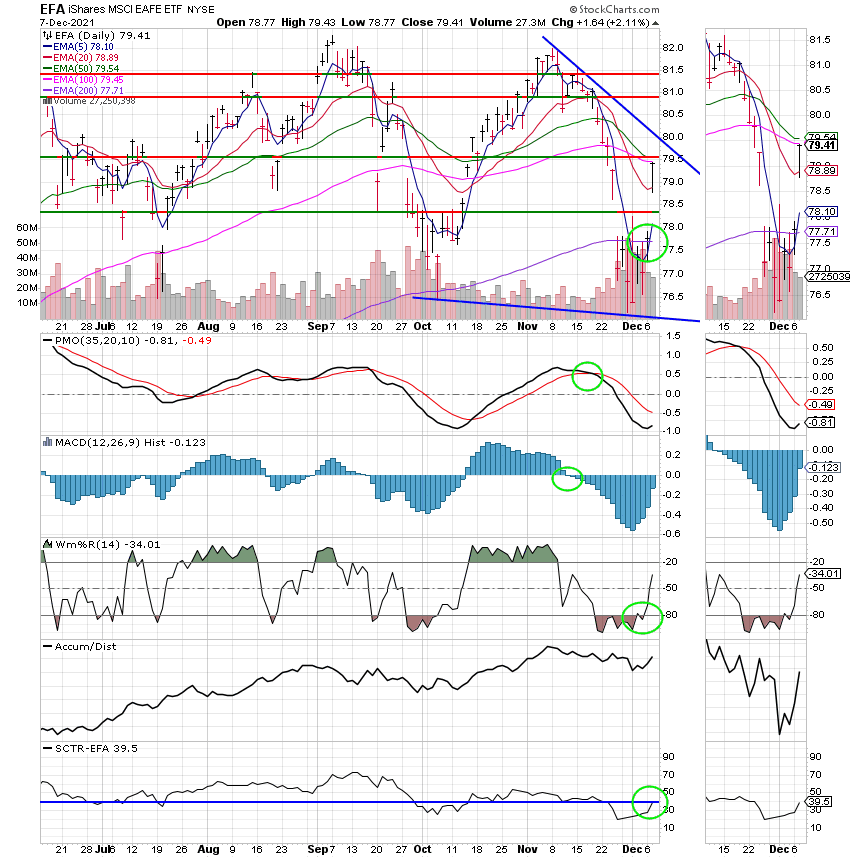

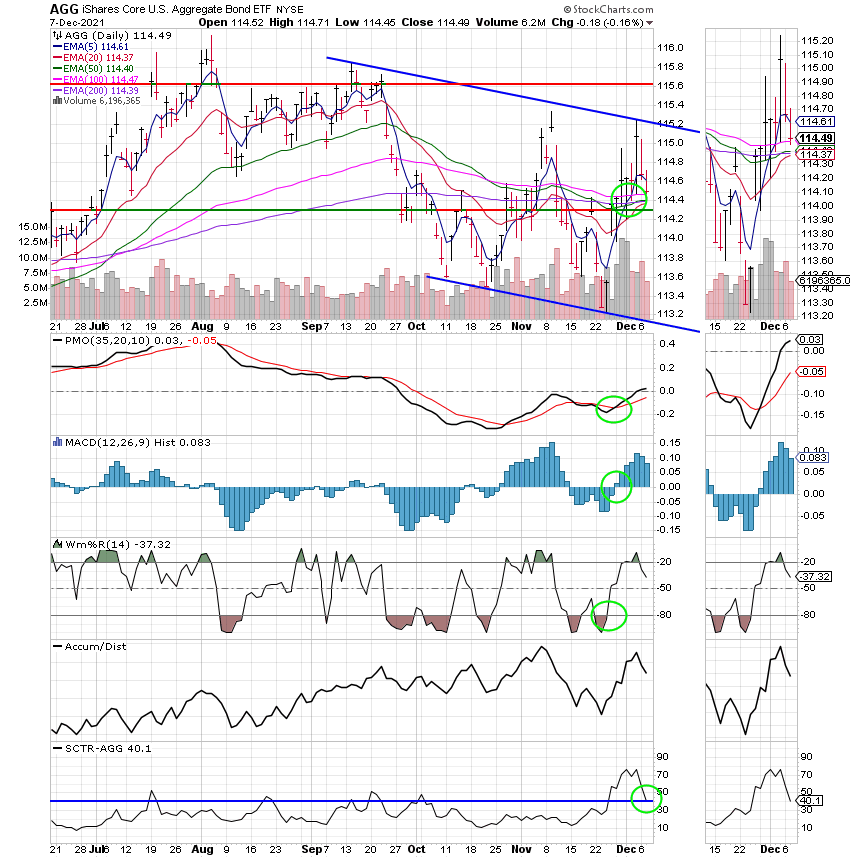

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying! We might just make it out of this year with a decent profit yet. That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.