Good Evening, So far the new year has been defined by volatility created by pressure from rising treasury rates. The most widely watched benchmark for treasury rates the 10 year bond briefly eclipsed a yield of 1.80 % during yesterdays trading which is the highest it has been in quite a while. However, it did manage to retreat today as we got a reprieve from the selling of the last three sessions. The Fed has already said it will raise interest rates to control inflation with Fed Chairman Jerome Powell reiterating that statement during testimony at his confirmation hearing before the Senate today. As I mentioned in last weeks blog the Fed will reduce or taper their stimulus program of monthly bond purchases and then allow their inventory of bonds they have already purchased to start expiring. Those are the primary tools they can use right now to bring rising inflation under control. Not to rehash last weeks entire blog, but the thing here that would take this a step further would be if they started to sell the bonds on their inventory in addition to just allowing them to expire. This would in fact would actively remove liquidity from the market. In effect we would move rapidly from adding liquidity to the market to removing it. Let there be little doubt, in the event that this were to take place there will be a sell off and probably a big one. As of today, to my knowledge that measure has not been mentioned by the Fed, but it is something that we should definitely keep an eye on. Jim Paulsen, chief investment strategist at the Leuthold Group, said “Historically, the stock market has suffered some nasty ‘temper tantrums,’ and numerous rate hikes eventually led to recessionary bear markets,” Paulsen said in a note Monday evening. “However, the current focus among investors may be misplaced. The stock market’s response may have less to do with the timing and number of rate hikes than it does with the ‘direction’ of real earnings.” So makes it really hard to tell for sure just where this thing is heading. That’s the reason we keep our eyes on our charts and react to the information that’s in front of us. Making predictions can be perilous!

James DePorre had and interesting observation about the current market today. According to James

“Many current market participants have never experienced a hawkish Fed. The last time there was a full cycle of rate hikes way back from June 2004 to June 2006 when rates went from 1% to 5.25%. The S&P500 enjoyed a solid uptrend during the period, but it was coming off a bear market that started in 2000 and lasted until early 2003.

Since then, there have been a few rate hikes and some threats of increased hawkishness, but it never lasted very long. In late 2018 a hawkish Jerome Powell caused a sharp drop, but coordinated dovishness by central banks around the world put an end to it, and that created another good uptrend until the pandemic hit in early 2020.

This hawkish transition by the Fed is a very major shift for the market, and it is likely to be a bumpy ride.”

I agree with that and will add that a large part of this volatility is being determined by how these inexperienced investors react to this cycle of rate increases. Simply put they panic and sell. I will also add that it has been an extraordinarily long period of time since the last cycle of increases due to all the unprecedented economic stimulus that has been put in place by the government. As we have noted before there is a price to be paid for all this……

That and Covid are pretty much what’s driving the market these days. There were several news reports on Covid and how it is starting to disrupt the supply chain once again. That is definitely contributing to the volatility so far in 2022. I won’t add anything else here because you all have been inundated with COVID news. If you don’t know about this then you’ve probably turned the news off because your so disgusted with it. I’ve thought about doing that……

The days trading left us with the following results: Our TSP allotment posted a gain of +0.92%. For comparison. the Dow added +0.51%, the Nasdaq +1.41%, and the S&P 500 +0.92%. Praise God for today’s rally!

Nasdaq rises for a second day as investors buy tech shares on the dip, Dow gains

The days action left us with the following signals: C-Buy, S-Sell, I-Buy, F-Sell. We are currently invested at 100/C. Our allocation is now -1.07% for the year not including the days results. Here are the latest posted results:

| 01/11/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7444 | 20.6036 | 71.1743 | 80.933 | 39.4203 |

| $ Change | 0.0007 | 0.0369 | 0.6459 | 1.1755 | 0.4735 |

| % Change day | +0.00% | +0.18% | +0.92% | +1.47% | +1.22% |

| % Change week | +0.02% | +0.09% | +0.77% | +1.28% | +0.23% |

| % Change month | +0.05% | -1.36% | -1.07% | -3.01% | -0.05% |

| % Change year | +0.05% | -1.36% | -1.07% | -3.01% | -0.05% |

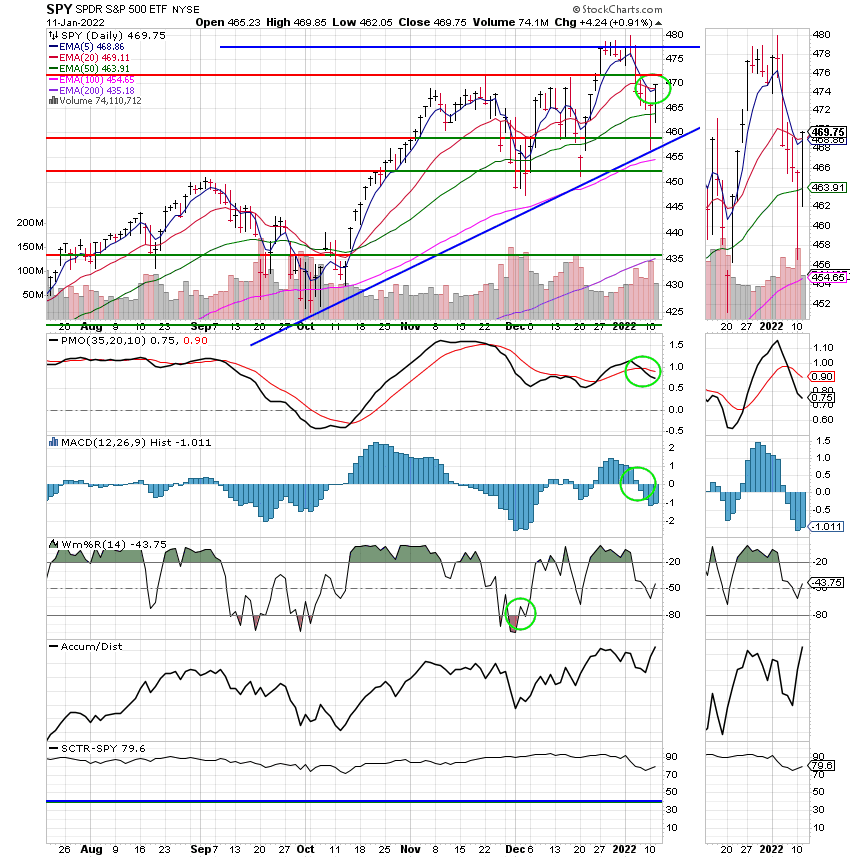

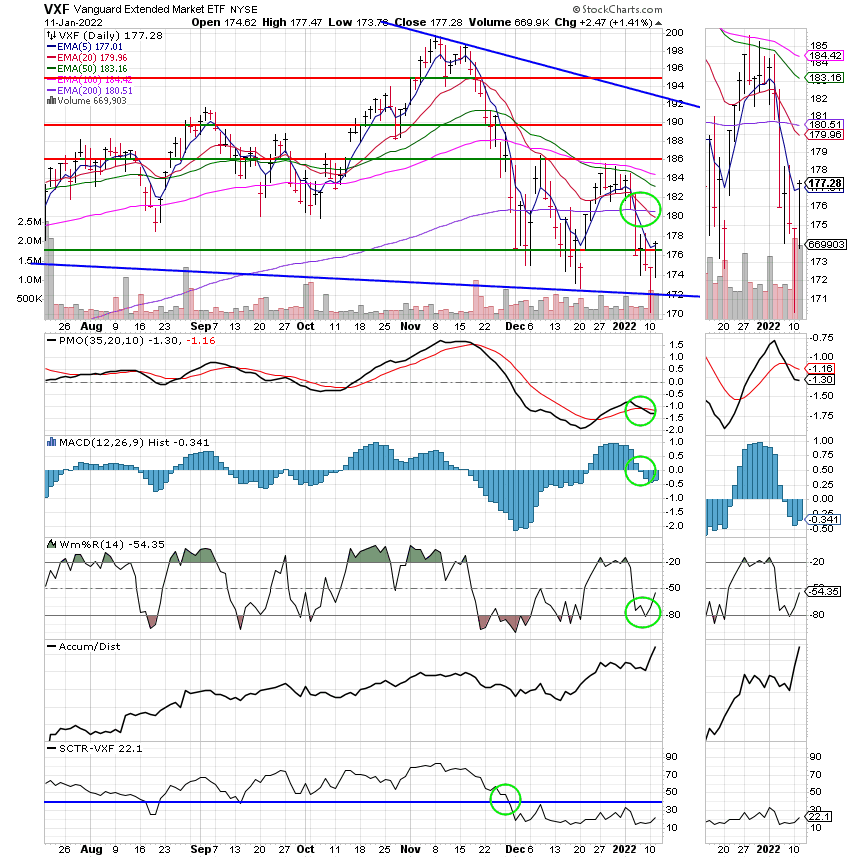

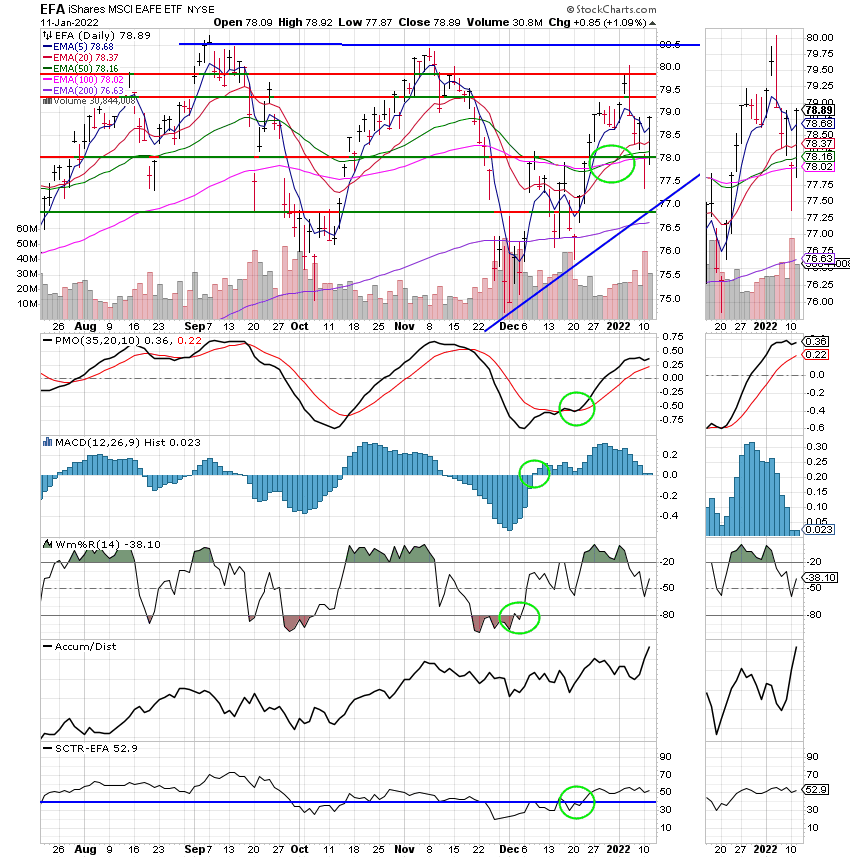

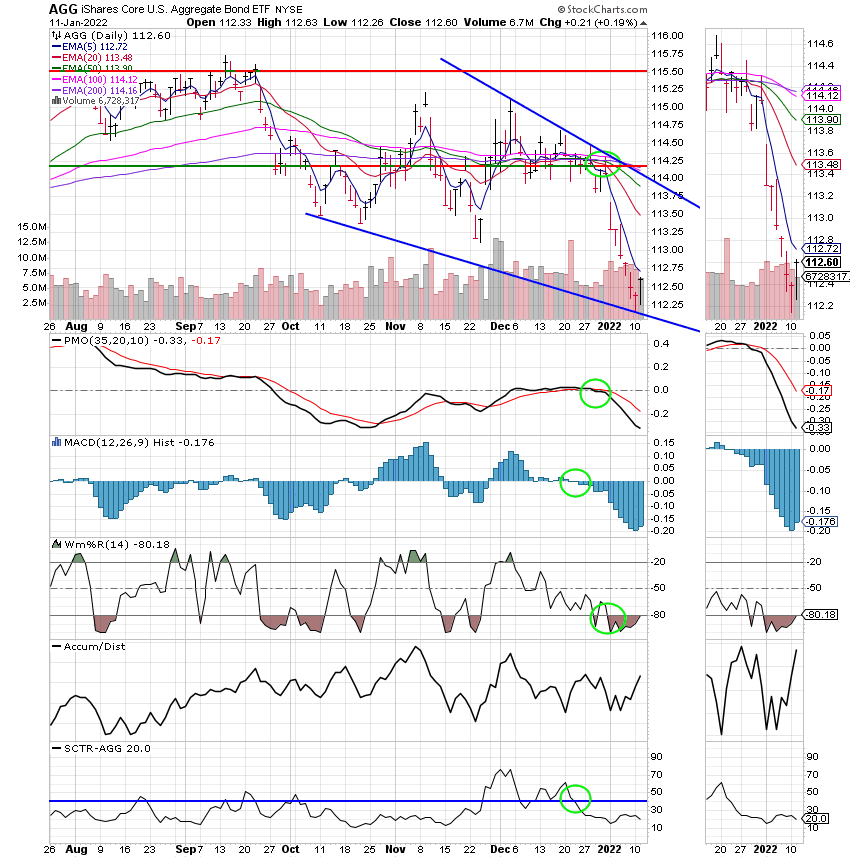

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

It’s going to be a wild ride this year. No doubt! That’s all for tonight. Have a great evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.