Good Evening, So far the market is struggling in 2022. We discussed how it might in a blog or two last quarter. At the time I said that I expected at the minimum a correction in the coming months. This may well be the action that we anticipated. The Nasdaq actually entered correction territory today defined as a decline of 10% or more from it’s last high. That is just the Nasdaq mind you, but tech which makes up a large percentage of the Nasdaq often leads the rest of the market lower. However, as of today the Dow and S&P 500 have not reached correction territory. So what gives? Its a battle between earnings and interest rates. Depending on which one has the upper hand on a particular day you will know which way the market is heading. If treasury yields which are closely related to treasury rates rise then you can bet the market is going to have a bad day. However, if the treasury rates don’t move much or possibly even dip and we get good corporate earnings reports that day then the market rallies. Analysts would describe this as the market pricing in future interest rate increases by the Fed which they could do as many as three to four times before the end of the year. You can also factor in the fact that many economists as well as the Fed have said that the growing rate of inflation will moderate once current supply chain issues are resolved. You know, Econ 101, supply and demand. Nonetheless, recent Fed meeting minutes have indicated that Fed members were surprised at the stubborn rate of inflation that seems to be hanging on much longer than they had anticipated. Thus they have accelerated the decrease of monthly bond purchases that they were using to stimulate the market before and during the pandemic. That is the process you hear described as tapering. In addition, they have indicated that they may even actively sell the bonds that are currently on their balance sheet. This would be actively remove liquidity from the market. Finally, the Fed has stated that they will start to increase interest rates to further fight inflation. These rate increases often occur at rates of a quarter point to a half point at a time. Again, the have said that there will possibly be as many as three to four rate increases before the end of the year. This amounts to a much more aggressive plan to control inflation than they had a quarter ago. In essence the Fed has been surprised at the way this high rate of inflation has hung around and is now moving aggressively to slow it down. Some would even say they have been too slow to act. So….to tie this all up. While rates are still at historic lows, the market doesn’t like higher rates. They tighten the money supply leading to less investment and make it more expensive for corporations to borrow money increasing their costs. This is especially hard on smaller growth oriented stocks. The end result of all of this is that the valuation of stocks (their value) goes down and that ladies and gentlemen is why the market does not like rapidly rising rates. Complicated isn’t it? So to understand where this market is going you must understand this relationship. I will be the first to tell you that I for one could learn more. I think I probably know just enough to scrape by. So why are we still invested in equities?? As I have often said we don’t make investment decisions on what we think might happen because we are wrong a good percentage of the time. No, we mange risk by making our decisions based on our technical charts and right now our chart for the C Fund has not put up a sell signal according to the criteria we use. Also, there are a myriad of additional indicators that we follow and some of the ones that we value the most have not told us to sell just yet. The bottom line is that market trends have a way of moving in one direction or the other much longer than we think they should. So we watch all our indicators and make our investment decisions based on the greater weight of the analysis. Carl Swenlin who is a great technical analyst said that technical analysis is more like a wind sock than a crystal ball. I agree totally and will add emphatically that no one has a crystal ball. They just want you to think that they do……….

The days trading left us with the following results: Our TSP allotment had a rough day at -1.84%. For comparison, the Dow dropped -1.51%, the Nasdaq -2.60%, and the S&P 500 -1.84%. Mother said there would be days like this but God said He’d be with us through them all. Can we give Him some praise? If we can praise Him when the market goes up then we should praise Him when it goes down. He has always always blessed this group!

Dow drops 540 points, Nasdaq falls 2.6% as 10-year yield rises to 2-year high

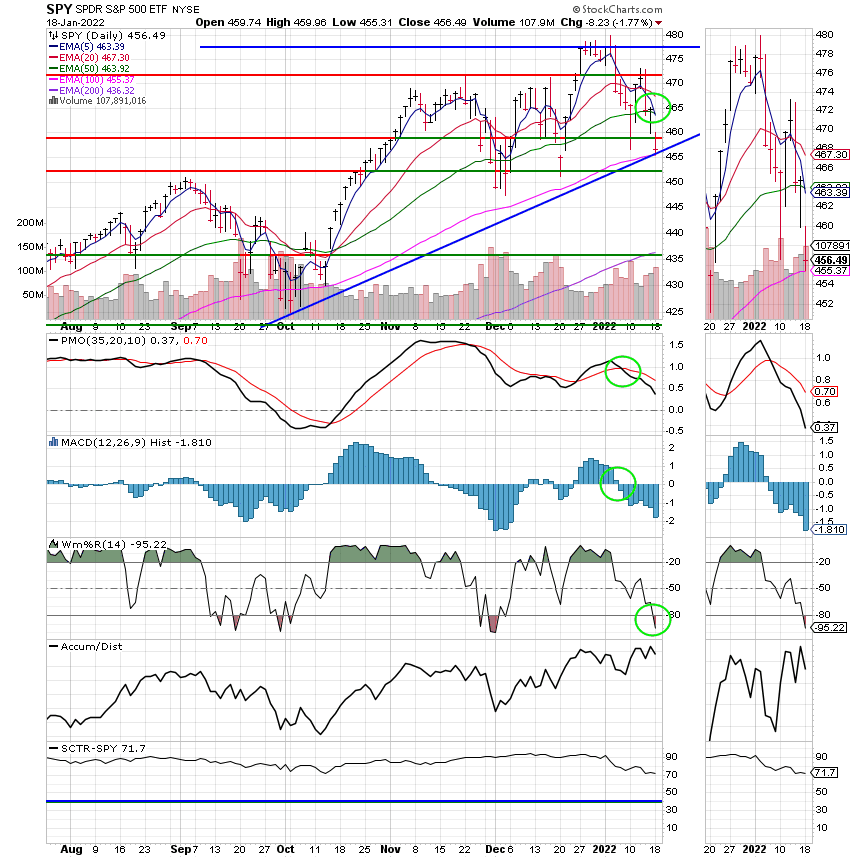

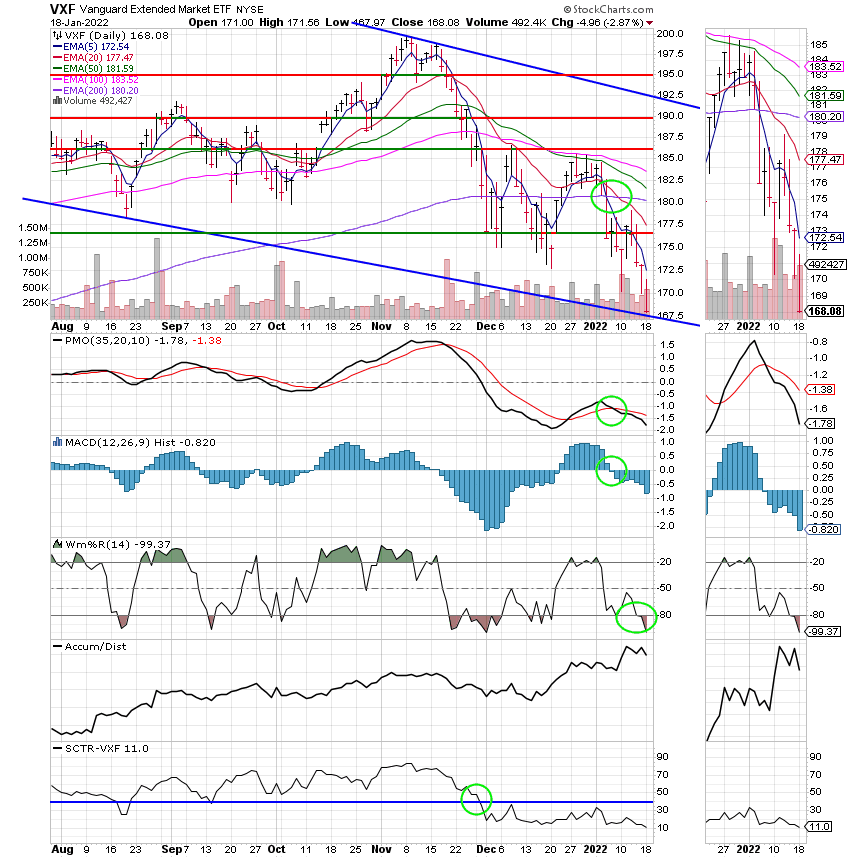

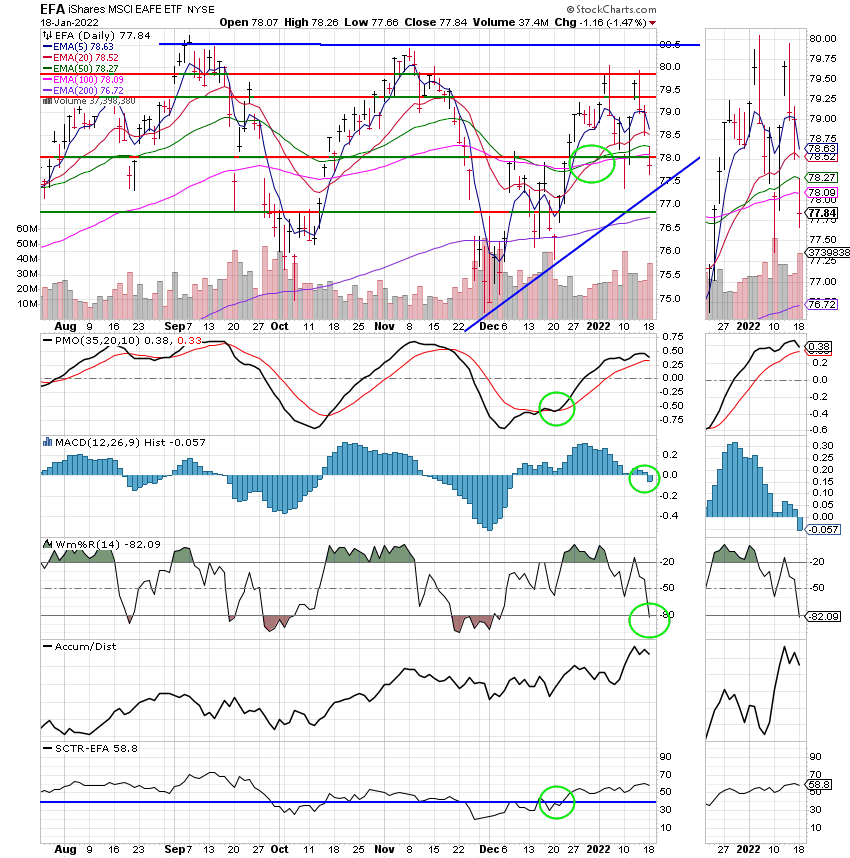

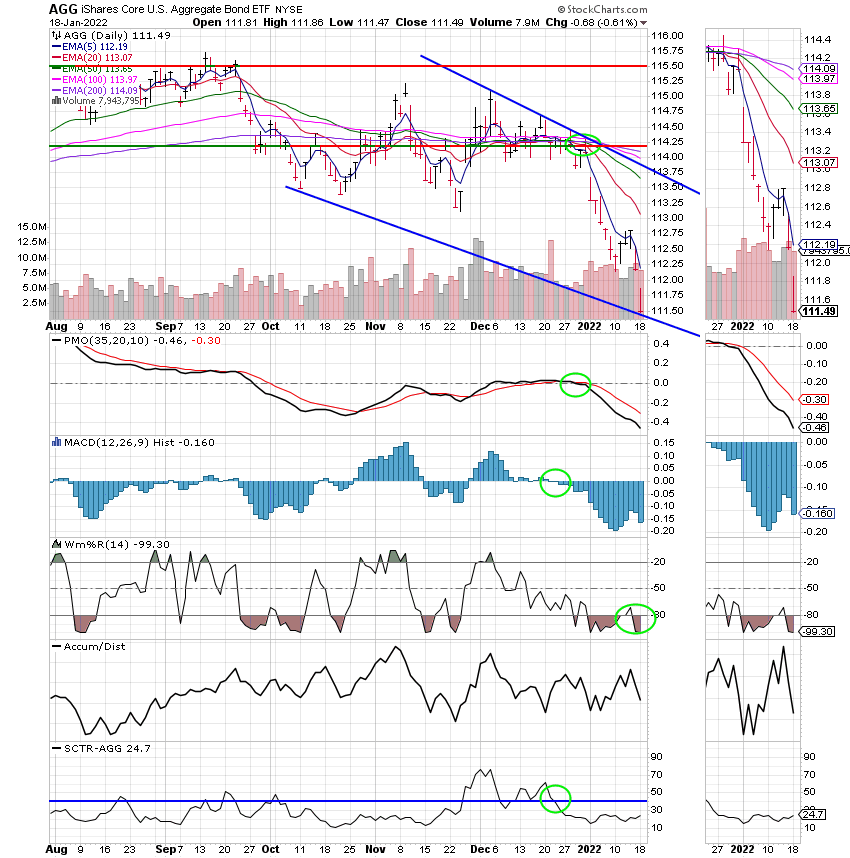

The days action left us with the following signals: C-Hold, S-Sell, I-Hold, F-Sell. We are currently invested at 100/C. Our allocation is now -2.11% for the year not including the days results. Here are the latest posted results:

| 01/14/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7465 | 20.5224 | 70.4269 | 78.9942 | 39.4062 |

| $ Change | 0.0007 | -0.1096 | 0.0593 | -0.1357 | -0.2014 |

| % Change day | +0.00% | -0.53% | +0.08% | -0.17% | -0.51% |

| % Change week | +0.03% | -0.31% | -0.29% | -1.15% | +0.19% |

| % Change month | +0.06% | -1.74% | -2.11% | -5.33% | -0.09% |

| % Change year | +0.06% | -1.74% | -2.11% | -5.33% | -0.09% |

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

It’s going to be a tough year, but we’re up for it! That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.